Airlines have historically been able to offer outsized value to consumers through their frequent flyer programs. Instead of merely offering a rebate on spending, where points are a modest currency that can be used to buy tickets at retail,

- Airline seats that go out empty can never be resold. As a result the incremental cost of carrying a passenger is about $30. But the retail value of that seat may be hundreds of dollars.

- It’s that spread that lets an airline give consumers a real value, they buy the inventory cheap and make it available to frequent flyers.

- Frequent flyer programs are also the largest buyer of seats from the airline, so they’re getting a ‘volume discount’.

The existence of seats that would otherwise go unsold, which can be liquidated through a frequent flyer program, creates a huge opportunity. Programs can avoid giving that same seats at a discount to paying passengers especially who are having their tickets purchased by a third party (usually an employer).

Programs don’t just make seats available they expect to go unsold, they may avoid offering some of that excess capacity to frequent flyers so that program members need flexibility to use their points at the saver level, further ensuring that members don’t spend points when they’d otherwise pay cash.

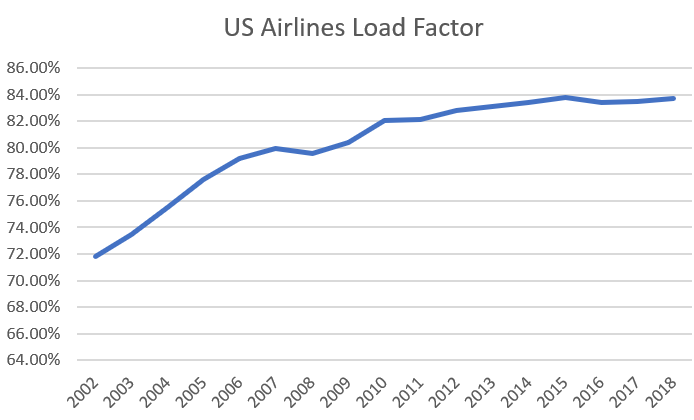

A problem arises, however, when there just aren’t many unsold seats. With airline consolidation and capacity discipline, load factors are at historic highs.

While there may be about 16% of seats going unoccupied,

- Some routes rarely see an empty seat, while certain undesirable flights go out half empty. While there may be seats available on average they aren’t likely where members want to go.

- With less excess capacity it’s harder to anticipate in advance which flights will have empty seats. Making award space available in advance carries a higher risk of trading off with paying passengers.

Airlines have to figure out how to satisfy member redemption demands. If the redemption experience is unsatisfying customers will get off the treadmill — and stop engaging with the program. For US airlines in particular that means stopping their spending on the airline’s co-brand credit card, which in the case of Delta, United, and American such spending drives 10 figures in annual value each.

They may charge members more points and spend more money to buy seats from the airline that do trade off with seats that would be purchased by passengers. They’re generally trying to get customers to use their points on seats that would have been sold — but sold cheaply. And they do this by tying the price in points to the price revenue management has determined they can get for the seat in cash.

- Delta and now United have eliminated published award charts

- They’re free to opaquely vary their pricing, hoping consumers won’t notice as they drive more towards average value rather than outsized value

- American has been making more award seats available when fares are especially low, both on a connecting basis (married segments) and on low fare routes during off periods.

That actually costs the program more money, think $100 instead of $30. But it also means providing less value per point, less reward for engaging in the program, to members because there’s no longer the same kind of leverage in spending frequent flyer miles.

What airlines are trying to do is spend incrementally more on redemptions in order to avoid chasing customers away.

At the same time they’re trying to hold down costs. What I’ve argued for some time though is that — given how much competition there is from banks offering their own proprietary rewards currencies that in many cases transfer to a choice of airline frequent flyer miles or can be used to buy travel directly — airlines are going to have to sacrifice margins to continue to keep customers.

Why spend money on an airline card whose points earn around a penny apiece instead of collecting a straight 2% cash back? The only way to retain the business is for the airline to continue offering superior value.

Frequent flyer programs are in some sense a victim of their underlying airline’s successes in holding down growth to sell the seats they’re offering. Originally started as a way to fill seats, if there aren’t excess seats to fill the model breaks down. And airlines are slow to realize that the era of truly outsized margins goes away with it.

Airline frequent flyer programs are the most successful marketing innovation in history, because they capture member imagination and offer the possibility of experiencing travel customers wouldn’t otherwise be able to afford. Pursuing non-transparent pricing and average value is a strategy for destroying the leverage in the programs that drives their success. A straight rebate (even when designed opaquely) puts a program on par with the sandwich shop punch card and at a disadvantage to cash that earns at a higher rate (and carries less devaluation risk).

The phrase “outsize value” sounds like industry apologist talk. The value is not outsize from a neutral or pro-consumer perspective; rather it’s more akin to differential utility value, where the airline wants to maximize the airline’s utility value gotten from the consumers’ mileage earning and redemption and where the consumers want to maximize the consumers’ utility value gotten from the consumers’ mileage earning and redemption. In other words, the value is not necessarily outsize, it’s just a difference in value with each side trying to maximize their own gain from being in business with each other over whatever time frame a party chooses to consider as being relevant to their valuation decisions.

I have 320k miles with United. I’ll burn those and I’m done. I don’t mind hunting for saver space, but I need to know how much spacer space will cost me. I’ve been flying AS more and will continue with that.

Maybe Subway will buy AA! Punch card flights for everyone!

Let me be the first to comment, just sent you a personal message how I plan to eliminate my Delta card, the point value is not there. I stopped spending on my American Airlines cards because of decreased point value. I have been chasing after United miles giving a significant amount of spend there and now it seems like that may have to change also. That is sad because I was able t count on United for close in awards of ok value, not great but ok. I hope they don’t mess it up too much, at least with chase I do have other transfer partners but United could lose almost 90K in yearly spend on my credit card if they mess this up.

The airlines and hotels have gotten greedy and find customers too easy to replace. Until airline shareholders get burned by the greedy ways of their airline management teams, the beating of the FFP customers will continue and get worse since only highly acute pressure on shareholders and their exploitative management teams from potentially awful financial results in the very near term will put a bit of a brake on the beatings of the airline and hotel loyalty program customers.

Post makes no sense and is rubbish! People will continue to travel. In SF, we have to use united because there are so many non stops regardless of frequent flier program. United sucks, all around. They don’t care about customers and only their bottom line.

First the airlines went revenue based. Now they eliminate award charts. For the vast, vast majority, putting $50,000 in annual spend, at one point per dollar, on a credit card to get two standard domestic awards is nuts. Who can afford to fly for free anymore?

Collision and Collusion sound similar. It’s all shiesty stuff if you ask me.

If U.S. airlines want to treat miles as currency, there should be regulation and oversight to protect consumers.

Airlines sell a huge amount of miles with a high breakage proportion based on the dreams that a set number of miles lets you go somewhere. Destroying that will be a disaster for them in the medium to long term.

@Blue — “Airlines sell a huge amount of miles with a high breakage proportion based on the dreams that a set number of miles lets you go somewhere. Destroying that will be a disaster for them in the medium to long term.”

Well, it hasn’t been a “disaster” for WN or DL, and it won’t be a disaster for UA (or AA, when they join them). What would be bad for the programs if it typical customers can’t find anything to redeem for and lose interest. But the variable awards actually give MORE choices. Heck, in the past year, I’ve redeemed for at least 5 trips (all coach) that I could not or would not have redeemed for on a fixed chart. Like 10,000 mile transatlantic tickets, 7000 miles Caribbean awards and 5000 mile transcons. I suspect these are the type of rewards that make more customers happy than 140,000 international premium class redemptions. Just because gamers don’t like it doesn’t mean it will be unpopular.

Well said. The allure of frequent flier programs is the dream of aspirational travel. I thought that the idea was supposed to be to foment loyalty, not destroy it.

The explanation is much simpler: when you “hyperinflate” your currency (aka miles) away, people no longer want to collect nor use it.

It means it will also become increasingly difficult to sell billions of that currency/miles for real dollars.

For those that think consumers are stupid, remember this: “You can fool all the people some of the time and some of the people all the time, but you cannot fool all the people all the time.”

Most programs are inflated by all the CC hocus pocus.

The most sustainable FF program will be the one that has 0 CC transfer partners. Devaluations are not needed as earnings are not being inflated. I am still looking for a down to earth *A program that earns miles by flying and nothing else.

@chopsticks WN earns less than their competitors off their mileage program. Delta nets less than American does.

Said it many times before, so won’t repeat with examples explaining why excessive industry concentration, aka cartelization/oligopoly, accounts for the same type of progressively anti-consumer actions seem recently with FFB rewards programs as we’ve seen virtually everywhere else over the past decade since meaningful competition began disappearing from the airline industry.

Unless the tide changes and consumers begin to demand more value for their hard earned money (across the board in many sectors of our economy, but especially airlines) instead of allowing themselves to continue being conned by their corporate overlords that it’s perfectly OK to be screwed with ever shrinking products that cost more and more – or in this example, frequent flier rewards that are becoming increasingly worthless and useless, this will continue until the airlines kill the proverbial “goose that laid the golden (frequently flier rewards/ benefit) eggs.”

Or when we wake up and stop allowing ourselves to be relentlessly cheated, screwed and abused by corporations who now view customer relationships as a mostly one-way street where they get away with whatever they want without facing any consequences for their selfishness, greed and arrogance.

That, and/or breaking up the deepening toxic airline industry oligopoly would surely lead to a better and fairer value proposition for consumers than we’re seeing now – and have been for a while.

If they want to rid themselves of an award chart fine then they should go with JetBlues model. where each pt has a set value. Doubt theyd do that so when a EWR-MIA tkt is $49 they will want 12,500.

I recently cashed in some JetBlue pts for a roundtrip JFK-LAX it was 11,600 roundtrip! My trip this Tues is 15,600. Cant even get a 1 way on DL or UA for that

Nope UA.DL etc are Greedy SOs and will want to charge a mountain of miles when fares are high and keep a min amount when fares are extremely low

Im happy I moved my travels to JetBlue and fly UA when the fare is right , was a 1K for 14 yrs with UA, but saw once the merger was gonna happen that its best to simply walk away even with being a IMM member and so I did and never looked back.

Feel for all those who swore an alligance to UA instead of to their own pockets as I did

And UA will make out like a bandit just as DL has, for the masses are simply sheep.

I needed to make a tkt for an Oct trip and saw fares way way thru the sky, so for $1000 less I booked Comfort class (Premium Economy) on Aeroflot via SVO and wont have to suffer in E+ on UAs 787-10 with its ever smaller lavs and seat size

Airlines should just go to a %-of-future-ticket rebate model already, with premium tickets earning more of a rebate on the next ticket bought than cheaper tickets. Customers would be incentivized to buy up, airlines would sell more higher-priced tickets, customers would earn tangible rewards (which would be limited to their next purchase)… and then the airlines could freely collude on pricing.

@Gary — And that’s because of the credit card revenue, right? So for “chart elimination” to be negative for the airline that does it, we’d have to see folks ditching the credit cards because they don’t think the programs are still rewarding enough. Do you really think that will happen? I don’t. I do think it MIGHT happen if all the one-way domestic rewards were suddenly 20,000 miles all the time. I don’t think the average customer cares about “a chart” as much as the folks “playing the Game” care.

To be honest, until consumers massively vote with their wallets, airlines won’t feel the pinch. Credit card companies are paying airlines 1.5 to 2 cents per mile (or more, when you include multi-million dollar re-up payments and such). They all know the airlines, like Delta, are then turning around and allowing redemptions for far less cost — particularly once you consider breakage. But what can they do? Negotiating power is limited. If Amex doesn’t pay up to renew Delta’s co-brand, or Chase for United, there are MANY other card issuers that would love to get in on the action. Of course, as we learned with the Costco cobranded card, Amex finally said “no” when it’s own margins were pushed so low. They lost it and all the spend that went with it. Do that too many times and all your card partners just walk away to Chase or Citi. So as long as the cards keep selling and uninformed consumers keep signing up and spending with dreams of a Hawaiian vacation, the amounts that the issuers pay to the airlines will keep going up. (It would surprise no one to learn that many of the decision makers at issuers like BofA and Chase are fairly uninformed themselves about the value of miles and points — so they’re not negotiating from an informed consumers’ perspective either.) And now they lock themselves up to 5-10 year deals. With that kind of time, airlines can do whatever the heck they want with their mileage programs.

John says: “Who can afford to fly for free anymore?” Bingo!

Chopsticks said: “we’d have to see folks ditching the credit cards because they don’t think the programs are still rewarding enough. Do you really think that will happen? I don’t.” I think we do. Instead of putting spend on the United Card, people are putting spend on the Sapphire Reserve Card. This gives them the ability to redeem on United. However, on the Reserve Card, one can purchase tickets using points as 1.5 cents. That means that people will not even transfer points into the United miles, if miles value is less than 1.5 cents.

I think the airlines are playing with fire by devaluing their Frequent Flyer programs. Companies go out of business when they run out of cash rather than when they lose money. The big three Airlines has always been able to raise a lot of cash quickly and cheaply by selling miles to banks. If the suckers, I mean the consumers do not want the miles, then the banks will not buy miles anymore. In a sudden downturn, to quote the Ghostbusters: “Who are they going call?…” Well, not the Banks. Maybe the airlines could try raising money on the Junk market, high interest and all.

Gary — At times you’re like the ‘Geraldo’ of travel blogs; and at other times, you’re like Ben Bernanke. This is one of the latter moments, great article.

“A straight rebate (even when designed opaquely) puts a program on par with the sandwich shop punch card and at a disadvantage to cash that earns at a higher rate (and carries less devaluation risk).” Darn straight. When the no-fee Citi Double Cash card gives 2% back, and the no-fee Chase Freedom Unlimited gives 3% cash | 3 UR points back (the first year), why would any rational consumer pay $95 per year for an airline card that gives one airline mile per dollar spent on most purchases? (Okay, the free checked bag and priority boarding on airline cards probably makes sense for some people, but still…)

I love the points game as it has afforded me 3 international business class redemptions in 8 months (1 saver award on Lufthansa and 2 mileage upgrades on American from premium economy to business although economy to business would have been the same amount of miles).

However let’s be honest here: everyone complaining is complaining that they will be able to take advantage of Airline Mileage Programs less. They see less benefit of the rewards program when the rewards program is supposed to be a bonus. The meat and potatoes of commercial aviation is to transport people who pay cash for tickets. Rewards programs provide value to customers but also come at a great cost to airlines. There is a marketing benefit that fills seats and generates some revenue but also decreases cash spending. It has put pressure on airlines who already tend to suffer from ridiculous Union and labor demands. Would you rather airlines go bancrupt again instead of righting these programs?

The problem with the points game is too many people have now become familiar with it not just frequent flyers who bring in a lot of revenue. Banks are responsible for this with their transferable points although banks themselves feel pressure from this as anything more than 1 point per dollar is unprofitable without interest being paid on charges (swipe fees that banks keep are from 1.5-1.8%. Overhead is expensive).

The ones who get shafted with these changes are people who currently hold these points. All newly earned points are done so with knowledge of these changes and of course there is still value and there will still be seats that will be sold with or without rewards programs.

I hope the rewards system continues for my own benefit. I do fear a Jetblue system where every point is uniformly valued compared to the cash fare. There is a benefit to knowing exactly what a point will be worth and that if a seat is avaliable for cash it can be booked with points. We’d just lose the outsize value. In theory if all airlines got rid of rewards programs fares would drop especially for business class and international first class flyers. I’ll travel as much as I can and not hoard points. The rewards game both from airlines and credit cards are fairly new. They have been around for the past 30 years but have only become well known and avaliable to most in the last 20 years. Who knows what will happen.

I think we can all agree that we can vote with our wallets on this, and are doing so by cancelling the airline cards in favor of cash back cards where it makes sense. However, we are EDUCATED thanks to blog’s like Gary’s.

As an AA EP I am obviously on a large number of flights. On every flight the flight attendants make a pitch for the credit cards and state that the sign up bonus is “equal to 2 tickets to “name your exotic destination”. I’m shocked at the number of people who grab the applications, not knowing that 50k miles is not going to get them squat anymore.

If someone has complete flexibility and is willing to travel out of season or on low demand dates then that may be possible. But, they are pitching something as a fixed rate that is actually a rare find (the reality is that on American flights to Hawaii Friday to Friday during Thanksgiving week are 90k each way in COACH, which is much higher than their highest published level on the award chart).

As long as people are uneducated on the realities, the pitch is compelling and consumers are willing to bite without doing their research, then I think this cycle will continue, unfortunately.

@Ron: Check out Aegean.

@chopsticks we’ve recently seen consumers stop spending on credit cards as a result of reducing the value proposition, eg spend volume is way down on the marriott (spg) amex cards

The issue isn’t now–it’s 3-5 years from now. How many average consumers are going to wig out when they’ve been accumulating AA miles for four years and when they go to cash in their hard won miles find out that the Delta massive cost expansion is at work?

It is all about supply and demand. There is a big demand for cash seats compared to supply, so the flights are more full. Fewer seats for awards. The catch is, as Gary notes, that airlines make a lot of their credit cards, so if those become less valuable, that may hurt another source of revenue. We shall see how it turns out over time. As for me, for some time I have been putting most of my spend on Amex Plat and Chase SP, and just transfer points to the airline where I need them, when I need them. I still have the UA club and AA club cards, but will be dropping the AA one, mainly because they will be restricting club access to flying AA later this year.

Excellent piece. Thank you, Mr. Gary.

You know when you see increased credit card bonuses that a devaluation is imminent. They have already accounted internally for the increased amount of miles…

Looks like it’s time for me to burn my remaining UA miles and drop my MileagePlus card. It will be transferable bank points or 2% cash back cards for me going forward. The game’s no longer worth the effort to play.

@Gary, you clearly see what is going on, I see what is going on, but the average flyer does not and really doesn’t know any better. Getting 2 cents cash back per dollar spent is a better deal than getting one SkyPeso per dollar. But until the average DL Amex cardholder realizes this, things won’t change. I think if say, Capital One began a major advertising campaign that directly attacked theBig 3 major airlines’ loyalty credit cards, (“Why get only one point per dollar, when with Capital One you get real cash, 2 cents per dollar that you can spend anywhere?”) things would change and probably quickly. I think it would be good fertile ground for Capital One to try to expand its business share into the Big 3 loyalty credit cards. That would shake things up in a hurry.

To all who suggest people will stop getting the airline co-branded credit card: our system of getting long haul international premium rewards only works because people are using their points for the least benefit by booking economy and for destinations that have low cash fares. We here live in an echo chamber and assume that everyone is adept at the points game and current news and changes to programs because it is provided online. Most people don’t take the time to research much of anything (medicine and medical care, finance and of course credit cards and rewards) even though the first page of a search engine takes only seconds to get an answer.

@Gary – You’re right on the money, as usual. You got me into this fun, crazy and smart game of collecting FF miles years ago and I was able to put my United Miles collected throughout a years for an aspiration international business class ticket. The cost at the time was 90K and the product was a 747 (with a seat on the upper deck!) and it truly changed my life — travel was the experience that broadened my mind and gave me a hobby to fill some of those (slower) times in life. Working towards those tickets keep the average individual (me) willing to invest time and money AND LOYALTY into a particular airline and its program and it saddens me greatly that United has to fall by the wayside (much like Delta did, my initial follow-up SkyTeam earning program). If an airline can’t give me the courtesy of telling me what I’m saving up to earn, why save? If it’s a complete guessing game, then shouldn’t I just spend those dollars on the lotto? If you can’t give me a chart to work towards to — a goal for being part of the program — then why bother? I remember the old Coke Rewards programs (and the like) where they cut out the ability to earn airline miles and subsequently replaced it with drawings. I don’t want to “chance” into a trip, I want to work towards it. It makes it much more fulfilling once you see home plate in sight. Sad…and little angry…that UA won’t be getting my loyalty for flights, mileage collection/collecting, etc.

Let’s have some new entrants in this market. Let new airlines in to compete and give consumers a choice.

RF,

New entrants into the passenger airline service market tend to not have very rewarding loyalty programs of their own. And new entrants to a market that is dominated and subject to discipline from the industry cartel kingpins don’t necessarily have a long enough life to put up a real and lasting challenge to the dominant players in an oligopolistic marketplace.

When there were five or six major US airlines that were part of the big 3 airline alliances or seeking to be, the FFP game was more competitive. We are unlikely to get back to that kind of more competitive US marketplace as a result of airline programs.

@Gary: “Originally started as a way to fill seats, …”

The original purpose was to generate loyalty.

“if there aren’t excess seats to fill the model breaks down.”

The FF program still generates loyalty.

The programs were at war with themselves when they DID publish fixed mileage award charts. That created a situation where the terms of trade on FF miles were especially favorable when fares were high. Each mile could have a value of several cents in those cases. In order to prevent the FF program cannibalising cash fares the airlines had to introduce quantity rationing. You could never find a flight near the time/date you wanted to go. By not publishing an award chart FF fares adjust with cash fares. You get the Southwest situation where miles are just an alternative to cash, with a dynamic value. The FF program is no longer at war with itself.

Hence the absence of quantity rationing on Southwest. Cash fare goes up…FF points required go up, etc. Interestingly, the program still retains loyalty value.

The evidence is out: airlines who spend money on their product (Delta) or on their customers (Southwest, no fee for bags, which most people have when traveling) at the cost of having crappy frequent flyer programs (Delta = SkyPesos; Southwest = never leave the US) do well financially.

Airlines overspent on their programs and are getting little to nothing in return.

To play devil’s advocate a little bit, dynamic pricing produces a more economically efficient model. While consumers love having predictable (and low) prices, this behavior leads to a shortage of supply (which is why many would-be points users can’t find saver tickets on popular routes). Dynamic pricing does a far better job at helping frequent flier programs deliver on their program by ensuring inventory is available. In that way, I prefer Delta’s program over American and (formerly) United (although the sky-high prices can be lamentable–however deals still can be found and if I want the trip badly enough I can pay the miles or pay cash). I find programs like American’s that promise potential but fail to deliver on inventory to be dispiriting. In their own way, they undermine confidence in the program because you can’t guarantee that something will be available.

When programs moving to dynamic pricing talk about giving their members more options, it’s not a lie. The reduction of outsize value opportunities is of course the tradeoff, but you can usually count on something being available. If it’s an acceptable price, buy it. If not, don’t. Outsize value sounds great, but if my choices are to fly in first class to somewhere I have no interest in going or spend a few hours in coach (or after paying a little extra, premium or otherwise elevated economy) and go where I actually want to go when I want to go, without paying cash, then I choose that.

As you suggested towards the end of the your article, cash back cards are the true danger to airline loyalty programs. In an age where tens of millions of dollars are generated by airline cobranded cards, it’s foolish to drive the value of points down too low. Delta’s drive to cause each mile to be worth 1 cent each is insane given that their own cards return 1 mile for almost every purchase. Fortunately, there are still ways too get far above that (I got around 2.8 cents per point on my trip to Europe last year). The constant erasure of consumer purchasing power driven by ceaseless devaluations will only push people away from airline credit cards towards cash back cards. Airlines may not feel like that’s a problem now when record numbers of seats are being sold, but there will come a day when consumers have had enough and move to cash back cards. Then, the next time a recession hits, credit will be more difficult to obtain (which means fewer airline cobranded cards will be reopened regardless of whether airlines attempt to restore value to their frequent flier programs), and consumers won’t be sending money to airlines when the airlines actually need it. It’s shortsighted on the airlines’ part.

Additionally, the constant erosion of frequent flier program currency values will eventually start to look like the hotel credit card arena. It’s no accident that hotels have to heap perks like top-tier status on their cards to get consumers to sign up for and retain their cards. Hotel cards, now that SPG has departed, have arguably already crossed the threshold where cash back cards provide a greater return. Eventually airlines will have to start giving away similar perks as the value proposition of their cobranded cards diminishes. In turn, as was heard by many Marriott platinum holders during the transition, when everyone has status, no one does.

I know my post is a bit unfocused, but the general thoughts I have are that dynamic pricing brings its own version of predictability to frequent flier programs, and the problem with frequent flier programs in the age of dynamic pricing is not the lack of transparency, it’s the lack of investment in the program. In other words, if airlines invested more money in their frequent flier programs, the value of their currencies could be higher per point/mile. The fact of the matter is that they’ve chosen not to make that investment. Time will tell whether that’s a mistake. However, from a consumer’s perspective, dynamic pricing is not, by itself, the problem.

You hit the nail on the head with this! Unfortunately, by the path these programs are taking, when they eventually realize this, they will have already lost the loyalty.