At the outset of an employee forum last week American Airlines President Robert Isom declared, “we’re planning the airline in a world where oil be at $75 a barrel forever.”

After the US Airways merger the airline was hugely profitable, so were other US airlines, as the price of fuel plummeted. Share prices didn’t really reflect a new reality, recognizing that opportunities to continue to grow profitability seemed limited and indeed it wasn’t clear that profitability levels could be maintained.

While American’s CEO Doug Parker declared in September that the airline would never lose money again, that their stock would hit $60 by November 2018, and that their buybacks in the high $30s a share represented one of the great opportunities of all time, he likely didn’t anticipate that today the airline’s stock would hover in.. the $30s.

He doubled down on his $60 a share bet in a March presentation. Fuel prices seem to be getting in the way.

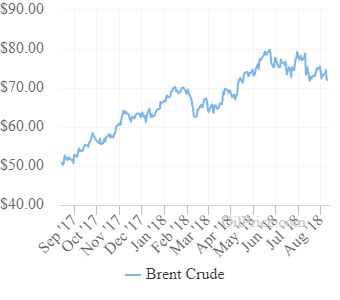

Here’s how Brent Crude oil pricing has shot up over the past year:

American is reducing flying such as Chicago – Beijing and, Isom says, also Latin American where demand is down in places like Brazil, and they’re continuing to fly older narrowbodies longer and deferring aircraft deliveries.

And they can’t afford to lose customers to Delta because of their stringent basic economy fares any longer. Basic economy was supposed to be a billion dollar idea but turned out, in Isom’s words, to be “not as much as we thought it would be.” That’s why they’re removing the worst restriction from basic economy fares next month.

He acknowledges that Delta was offering a better product in Basic Economy than American, but “that product wasn’t seeing enough visibility from our customers, so we’re removing the bag restriction. We’re really lining up basically where Delta was.”

Since basic economy fares won’t be as uncompetitive going forward we’re going to see basic economy fares offered on more flights. American has simply not been offering them as broadly, knowing they would lose business as customers chose a better value elsewhere.

Premium economy, common configuration of aircraft, revenue management system issues, re-launch of Main Cabin Extra “we have a laundry list” worth $3 billion in revenue.

The “prospects for growth at American are more rich than anywhere” according to Isom. American is growing less than industry average this year, and probably “a lot less than the industry in 2019.” They’re growing in Dallas and Charlotte as they get more gates at the two airports. He says the 15 gates they’re getting at these airports comes “at about the price of one or two gates that it would cost to add at JFK.”

American gets 8 gates at DFW in 2019 and then 7 gates at Charlotte in 2020. They expect the regional gates at Washington National to open in 2021.

And he views their opportunity to add flying to these hubs are profitable, though it’s not clear how the new regional concourse will translate into the right to add flights at the slot-restricted airport.

I’m such a seller of AA. They have management that lived thru the most positive business environment EVER for airlines. Upswing economy under Obama + his indifference in allowing mergers. IE OIL = $30 and 5 airlines vs 12. It’s not rocket science people. Oil can probably be at $100 relative to actual demand before airline profits hit previous negative levels.

Disclaimer that I’ve made decent money trading airline stocks over the last 10 years. But I really believe that a monkey could have made money running these airlines and at the same time…kept a positive brand image. Telling people that 30″ seats and pay $30 for a bag is an “upgrade” is a blatant lie. But that’s airline CEO’s. Look at their total compensation over the last 10 years…..if you were making that would you really care..especially if Jonny Kettle kept paying it?

I met Doug at a FF event a few years ago…Kirby was there as well. They are Honda car salesmen who somehow ended up selling Bentley’s Not sure how else to describe it.

While I wanted to American to be successful for decades when I was their customer

I didn’t want them to behave like criminals to do so.

Have no empathy for a company that has a rotten CEO with no heart and no concern for his customers experience.He has destroyed CRM and customer value. @ American

They drove decades loyal customers out the doors by the millions and when it gets tough out there

I hope they bleed due to their own greediness

Perhaps only then can they possibly reflect why screwing customers and making their mile currency unusable by reasonable expectations isn’t a good idea for short term profits

Anyone who believes that commodity like oil will never change in price is gullible. I have a bridge I can sell you……

“We’re the most near-sighted and incompetent management group by far – so we’ve left a lot more opportunities on the table – so with a laundry list like that to work on, our future is so much brighter…”

“Anyone who believes that commodity like oil will never change in price is gullible. I have a bridge I can sell you……”

Of course he’s not saying that. What he’s saying is that it would be irresponsible to make strategic plans on the assumption that oil prices drop back down to the levels seen over the last couple years. That is, they need to assume that the current high oil prices are the new normal. (I’m in an industry affected by oil prices and we’re doing our planning on the exact same assumption.)

As a former EP that did not meet revenue requirements, I have been helping American make a profit by not flying them. After all, they do not what customers like me. 0 miles in 2018. Cool huh.