Aimia is the parent coming of Aeroplan, the frequent flyer program spun off by Air Canada. They also have investments in other loyalty programs like Air Miles Middle East and Aeromexico’s Club Premier.

The company lost about 80% of its value when Air Canada announced last year that they were going to launch their own new program and sever ties with Aeroplan when the 15 year agreement between the two parties ends in mid-2020.

Aeroplan has been working on what it will look like as a standalone loyalty program with new single airline partner two years from now. Meanwhile, Air Canada and Aeroplan’s financial institution partners made a bid to buy the Aeroplan frequent flyer program. This would,

- Give Air Canada all of its members right away, something Air Canada would need to spend a lot of money on to acquire independently

- Take important competition off the table, Air Canada and Aeroplan would have to compete aggressively for member participation if they co-exist separately

- Keep Visa from losing charge volume to Mastercard (Mastercard could win the standalone Air Canada business

- Keep the Air Canada business for CIBC and TB banks, which view an Air Canada co-brand as worth more than an Aeroplan-without-Air Canada co-brand.

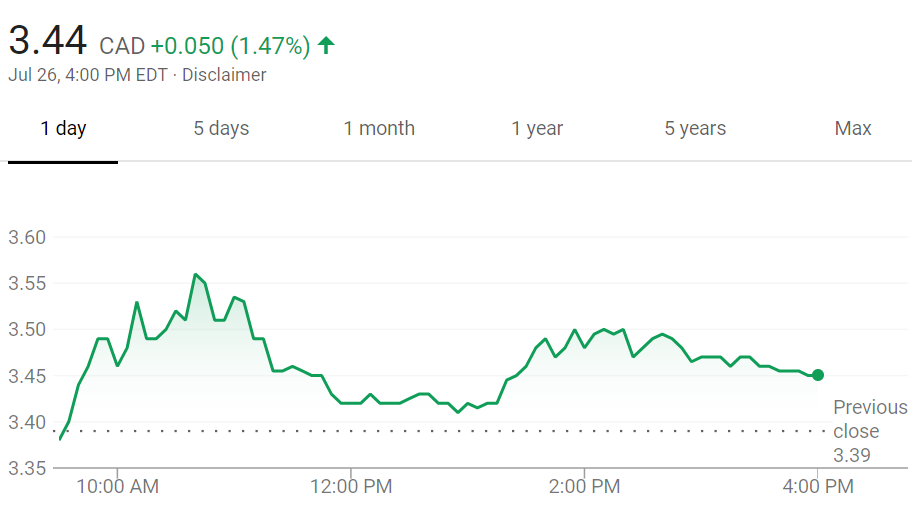

The market liked the deal, with shares jumping on the announcement and staying significantly elevated.

The net effect though is that the company that owns the Aeroplan frequent flyer program became a lot less valuable without the Air Canada relationship. So Air Canada was able to come in and offer to buy the program at a massive discount.

So let’s everyone get in on this game, shall we?

Aeromexico which is in some sense a vassal of Delta these days doesn’t own their own frequent flyer program in its entirety. Aimia owns nearly 49%.

- So Aeromexico informed Aimia that they aren’t going to continue the Club Premier relationship when their contract ends

- But they’d love to buy Club Premier.

Copyright: noratm / 123RF Stock Photo

Except the deal is rather cheeky for three reasons.

- They’re only offering $180 million for the near-49% stake in a 3 million member loyalty program generating $77 million in annual earnings.

- Declaring an intention not to continue an exclusive relationship with Club Premier is a knee slapper since the exclusive deal still has 12 years left to run. It doesn’t expire until 2030. So this wasn’t a serious claim.

- Aimia says this offer had already been made and rejected, so offering it publicly was always a non-starter.

The market, by the way, laughed off the termination that’s supposed to happen in 2030.

To be sure if Aimia doesn’t sell Aeroplan, they do need cash. They’ve been selling assets to raise cash. Their future income stream sans Air Canada will be lower but they have $2 billion in accrued points liability to redeem.

However the last thing Aimia needs to do if they sell Aeroplan is to unload Club Premier. They will no longer have significant cash needs. Aimia immediately rejected the offer.

In some measure though this helps Aimia because it reminds the market they hold significant assets in addition to just Aeroplan. So contra One Mile at a Time who asks “Was Aeromexico following Air Canada’s offer so closely because they figured that Aimia would be more likely to unload a lot of their assets at once, or…?” I wonder if the previously-rejected offer was made public at Aimia’s request.