United Airlines held its earnings call this morning. The airline’s stock price jumped with release of their performance for the second quarter and during the call.

Since earnings beat estimates it was a more upbeat call than many of United’s recent run-ins with the investor community. It also largely focused on how they plan to drive earnings growth despite potential geopolitical and fuel price challenges.

- Flight attendant integration will happen in October. United and Continental merged 8 years ago but they’re still not operating as a single airline. Ex-Continental flight attendants largely fly ex-Continental routes and planes, and vice versa. That means the wrong planes fly the wrong routes relative to demand. They say they’ve finally got their act together on this.

- United says they’re recovering 75% of higher fuel costs in higher revenues, though this isn’t attributable to higher fares across the board but they suggest it’s more high yield premium traffic. Corporate revenue up “double digits” year-over-year. Atlantic revenue up 7.9%. This is related to the argument American makes about why they don’t hedge fuel, that fares go up when fuel costs go up so they’re best able to handle the change (and also that they don’t have a strong trading capability).

- United was #1 in ‘D0’ — pushing back exactly on time — during the past quarter, squeaking ahead of Delta, though they’re roughly flat year-over-year. This is a priority that came to the airline with Scott Kirby, who believes the most important element of success for an airline is on-time operations, and that departing on time is the most controllable thing an airline can do to arrive on time. (Airlines basically give up control of their planes from push back to arrival, turning that over to the government, so they throw up their hands at the rest.)

- United continues to scale back from aggressive growth targets. They outlined aggressive expansion plans in January and Wall Street freaked out. They scaled back from top line growth projections of 6% back to 5.5% in April and now to 5%.

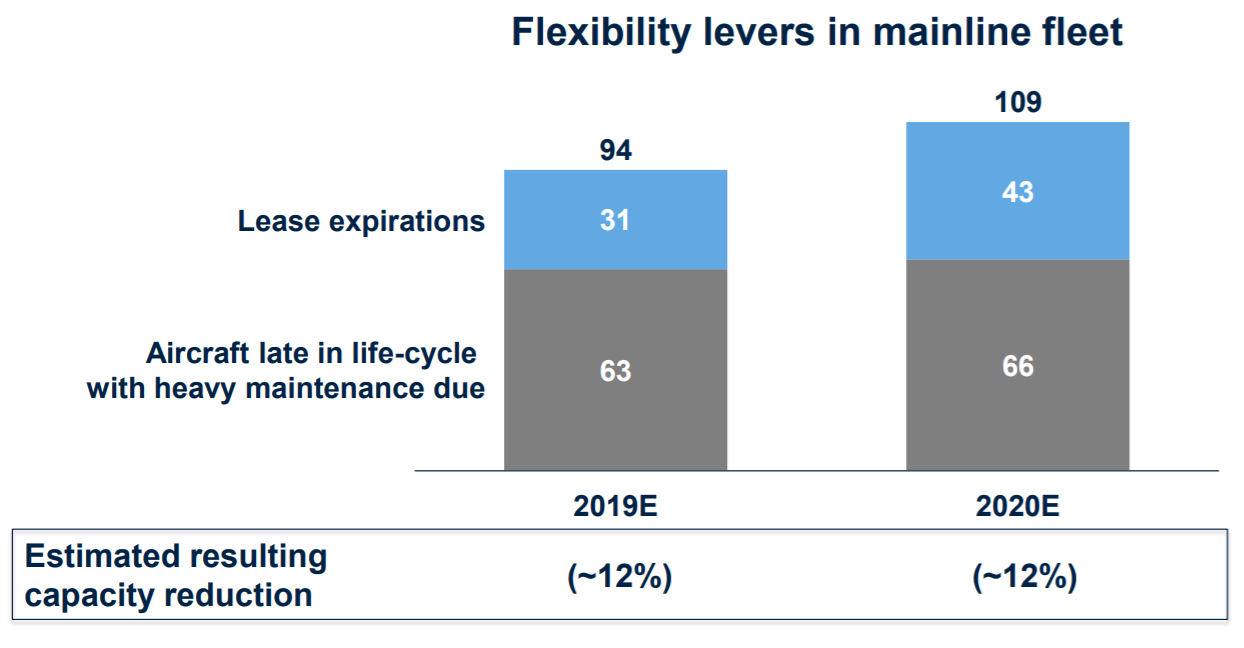

- They’re flexible to shrink if the world blows up. United emphasized that they can scale back the airline in the event of much higher fuel costs, a recession, or a trade war, by giving back leased aircraft. Highlighting for investors the ability to shrink the airline works at cross-purposes from trying to convince pilots that allowing regional seat growth (outsourced flying) means more mainline flying too and more union pilot jobs. That was a non-starter from the get go but it’s something that Scott Kirby has talked about in the past.

- United will restore some capacity to Guam. Demand has recovered and they are going to schedule widebodies flying Guam – Tokyo instead of 737s.

- Will rebank its Denver hub in early 2019. Shorter connections turn into shorter travel times, which customers like and shorter trips show up higher in search displays. That all generates revenue. But when operations melt down a ‘banked hub’ where planes come in, passengers change gates, and then planes take off again all at similar times can become a disaster — no gates for planes to arrive at, more missed connections. And it means extra staff to handle peak times who are paid during the lulls too. United believes banking their Chicago and Houston hubs has been successful.

- Chase co-brand credit card acquisitions are up year-over-year. While they highlight the new benefits of the card, what’s different is that flight attendants started marketing cards inflight during the third quarter last year, a new channel for the airline. Andrew Nocella shares they experienced “record low attrition” (members cancelling the card), 10% card growth, and a 3% increase in spend (which strikes me as surprisingly low given 10% cardmember growth).

Hunter Keay asked the most skeptical question, that we’ve seen the market get excited about United finally getting its act together “and then something happens.” So he wanted to know why believe it this time? Indeed United has underperformed in many ways for 30 years. The airline says what’s different is their focus on earnings per share and also that employees are happier. To me that’s very different than hearing them say they’re focused on delivering the best possible product, at the best price, and winning customer business.

Sounds like not a lot of good news.

When will Scott Kirby be fired?

Thanks Gary- I feel like you offer a unique perspective compared to most travel blogs because of your experience in the finance world. Once you get used to things like earnings calls you can read between the lines to get the real story, but it takes experience and understanding of what is being said.

Actually @RF – this was a very good earnings call, and shares are up. They’re doing well. No firing for Scott Kirby.

Too bad it wasn’t worse. Was looking forward to seeing Scott Kirby at the unemployment office.

All the US airlines products are VERY weak with inconsistent, products , high fees , inconsistent service and constant service cuts in the Cabin. This will never end. The “soft” product will only get worse , and worse. The airlines can’t find a way to properly advertise better products and make them profitable and when they do, they can’t help themselves with the Bait and switch. Corporate greed at the airlines = to or worse than banks

IMO the only surprise is the success of the co-branded card. personally I think the CSP and CSR are the better play for most travelers, but I guess there are enough non-elites on UA that find value in the Explorer card perks (mainly free baggage and Group 2 boarding). Of course the higher fee UC card is a no brainer for frequent travelers who want club access.

Would think the market is well saturated after two decades (incl. predecessor bank) but I guess not or maybe just a lot of churners.

Although it is not material, I am curious if hedging fuel is much less important as a larger portion of the fleet becomes more fuel efficient, modern aircraft.

Did they cover load factor?

Also, United Credit Card = Free Luggage. United seems cost competitive enough with Delta/AA/SWA to justify holding the card and getting the bonus miles.