Amazing Wall Street Journal piece on the Marshall Islands getting cut off from the world banking system.

First Hawaiian bank, owned by a French banking group, is pulling out of its relationship with domestic banking there due to regulatory risk even though there’s no indication of money laundering. This makes cashing paychecks from the US military base problematic.

Western Union has one branch in the capital, which may leave residents taking a trip hundreds of miles by boat or air to receive funds from the rest of the world.

On the Marshall Islands–a chain of volcanic islands in the middle of the Pacific Ocean, population 53,066—the only homegrown bank can’t issue credit cards, doesn’t have any ATMs and sends well-worn dollar bills between its island branches by boat.

..Ebeye’s only venue for international transfers has been a MoneyGram branch tied to the domestic bank. During tax season, there can be a line of 100 people outside, says Ramanty Chong Gum, a 34-year-old high school math teacher on Ebeye. The MoneyGram already restricts the number of transactions for each customer; with First Hawaiian’s exit, that channel will be cut off altogether.

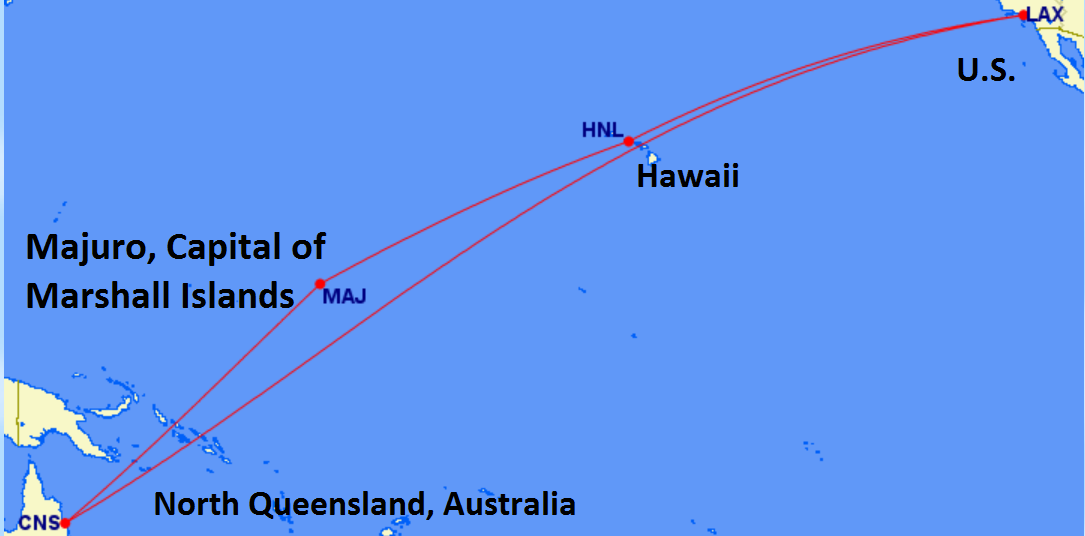

Marshall Islands, Halfway Between Hawaii and Northeastern Australia

The US military base has a Bank of America, but that’s open to military personnel only. Servicemembers will take locals’ debit cards and PINs onto the base and withdraw cash for them, supplementing their incomes by charging a fee for the service.

United Airlines is the only carrier offering flights between the Marshall Islands and the mainland US. They fly four times weekly to Honolulu (United also flies to Micronesia and operates service within the Marshall Islands itself). However residents of Marshall Islands cannot get credit cards from a domestic bank and United no longer accepts cash for buy on board.

Honolulu – Majuro, the capital of the Marshall Islands, is a 4 hour 50 minute flight. United’s four-segment island hopper between Majuro to Guam takes over eight hours.

United’s Island Hopper Arriving in Chuuk, credit: United

Ironically pushing the island out of the banking system pushes everyone to cash, which is worse for money laundering. International institutions are working to “help the Bank of the Marshall Islands get in compliance with” international rules directly. And “the Marshall Islands announced it would launch a cryptocurrency” as a workaround.

(HT: Marginal Revolution)

Weird choice of headline. They certainly can eat things they bring on board themselves, and obviously an inability to purchase buy on board food on s plane is breathtakingly trivial in the context of the larger problems caused by the banking situation.

I am going to the Marshall Islands for the first time on the island hopper soon. I am actually stopping over in Majuro (part of my family lived there 50 years ago). I guess I’ll bring lots of cash.

The Marshall Islands are a foreign country and have historically been on the OECD list of higher risk money (the gray list not the black list) laundering states. I don’t see what is wrong with a US business choosing not to take on that risk.

Furthermore, there are other sovereign Pacific nations that have more access to the US banking system because they chose to add certain provisions to the Compact of Free Association. RMI chose not to.

RMI also has several other banks where you can get dollars – Bank of the Marshall Islands and Bank of Guam. Bank of Guam, a US bank, has credit cards and a mobile app, so I’m not sure how the article can claim RMI is cut off from the US banking system.

Lastly, First Hawaiian Bank IPOed and while BNPP used to own the bank, it now owns less than 50% of it and is reducing its stake. Based on this synopsis, I feel like the WSJ needs to fact check more.

Sandy- Bank of guam issues MasterCard debit cards in Majuro which could be used on board. But they are only on majuro. Residents of Ebeye cannot get a card without traveling to Majuro first and opening an account.

But the real story is what can you buy on the island hopper anyway? They don’t have meals for purchase to begin with. So the real problem is they can’t buy……. beer and wine?

I’m guessing the French owned bank is pulling out of domestic banking because they would rather do business with Iran once sanctions kick back in, nothing to do with money laundering…just a little funding of terrorism is all.

Some huge intl bank just needs to go open a branch there…