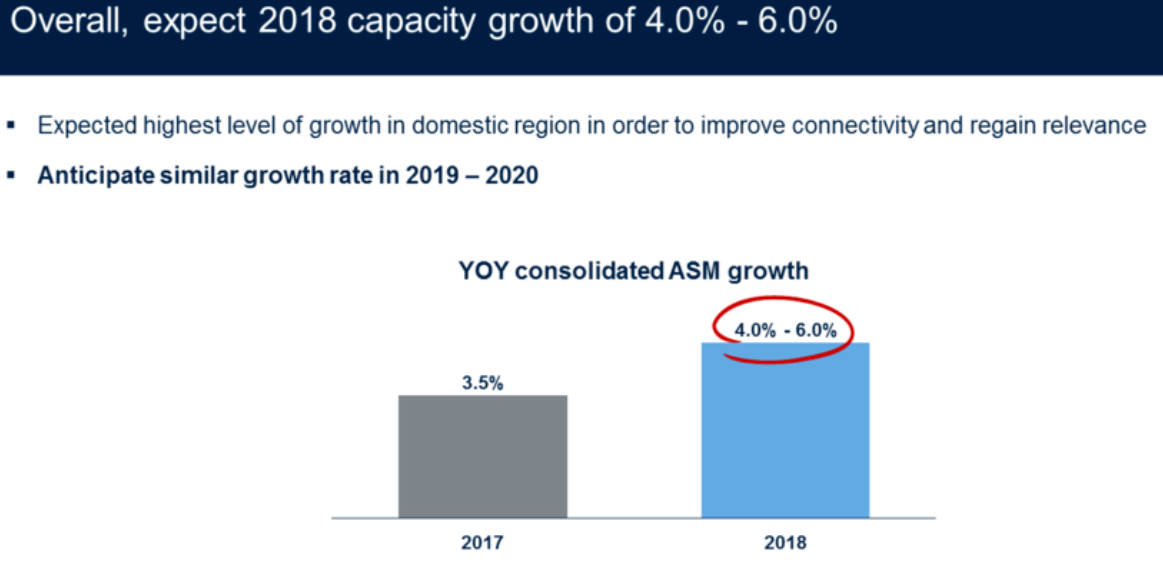

Last night United Airlines President Scott Kirby gave an extended airline economics lecture to investors, explaining how they make more money by building up their hubs. As a result they’re projecting to grow capacity 4% – 6% in 2018 — and continue growing at a similar clip through 2020.

Kirby and the rest of the United team know that growth is unpopular with investors. More seats mean lower prices for the industry. And investors don’t just invest in United, they generally invest across the industry.

So he tried to make the case that they’re really only restoring capacity they used to offer, not growing to some new higher level. But investors so far don’t seem to be buying it.

United shares opened today down sharply.

Kirby may not even be wrong. And though I don’t buy and sell individual stocks on a day trading basis UAL may be sharply oversold, it’s reasonable to think that the price will recover. However the market delivered a sharp message in response.

I actually think share buybacks — United has been taking the bulk of its profits and buying its own stock instead of investing that cash in the future of the airline — signal that a business doesn’t have strong growth prospects. There’s no better business use for the cash than using it to boost earnings per share by reducing the denominator.

So it’s encouraging to see an experienced airline executive betting on growth in domestic markets — which is where Kirby sees United’s growth, while suggesting that over time international growth will mirror GDP growth in scale. (Delta of course takes a different tact towards growth, buying significant stakes in airlines around the world.)

And investors don’t just invest in United, they generally invest across the industry.

Interesting if true. Short-term return to investors generally seems to have an extremely negative impact on long-term company and industry stability. If, instead, investors are arguing against short-term returns from an individual company in favor of longer-term stability of the industry, it would be unusual.

There’s little to see here for the casual observer. Airline investing is VERY volatile and airline shares often move in the short term more on momentum than facts. In this case, Kirby is just trying to fix the mistakes of previous management, which shrunk UA’s domestic hubs when they should have been strengthening them. It’s a bit ironic that “the market” thinks it knows more than Kirby about how he should run his business. It’s a bit like the market thinking it knows better how to run Berkshire Hathaway than Buffett. Kirby is one of the top 3 or 4 most successful airline managers of the past 20 years. If you listen to his detailed investor presentation last night, you can tell he’s no fool.

For customers who like to fly UA, Kirby’s move will mean more seats to second and third tier US cities. For everyone else, you’ll never even notice that ANYTHING happened in the US airline industry. You won’t, for example, be seeing any lower fares.

AAL took a -7.4% dip this morning

DAL -6.62%

LUV -4.23%

JBLU -3.51%

ALK -6.66%

@ptahcha — Your data is valuable information to anyone thinking of “casually” investing in individual stocks. The facts are hard enough to understand, and the psychology is even harder.

I grew up in small markets. Buying plane tickets back home for a college kid was EXPENSIVE. I’ve always wondered why the airlines have taken so long to really exploit the advantages they have there — in many small markets there is little to no competition.