When Delta re-upped its co-brand card agreement it set a bar that other airlines have tried to chase with their own bank issuer arrangements. American Express was willing to back the truck up to Virginia Avenue since it was set to lose its Costco cobrand and desperately needed to lock in its next-largest co-brand deal. (Shortly thereafter they re-upped their next largest, Starwood, as well.)

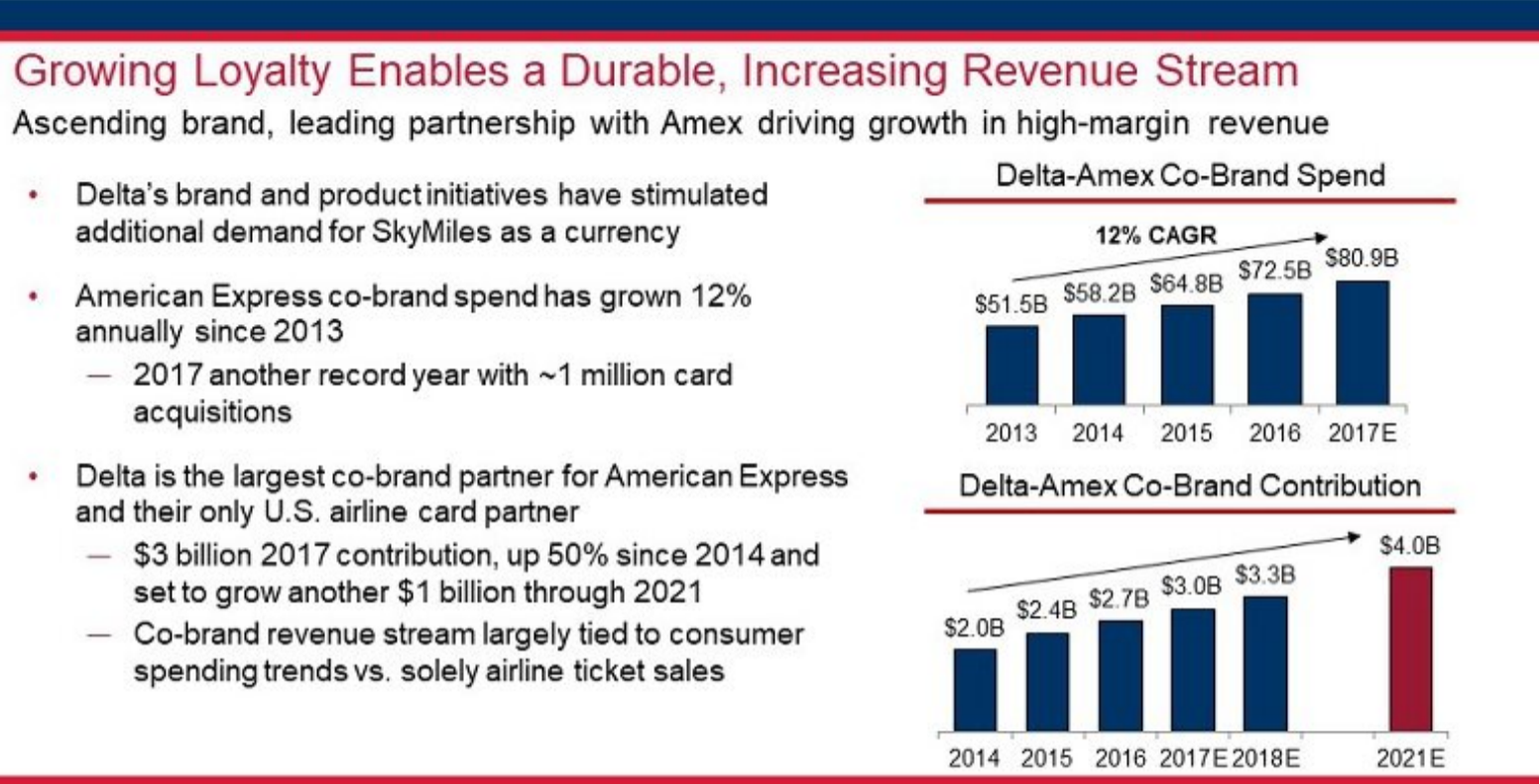

Revenue from American Express has continued to grow as spend on their products has grown. As Delta shared this week at is Investor Day 2017 revenue from American Express will total $3 billion. And they’re projecting out continued straight-line growth.

That leaves sophisticated observers scratching their heads. SkyMiles isn’t a very good program, why does it accrue so much consumer spend?

Along certain margins value certainly matters, but in a perfectly rational world consumers might sign up for the card for its benefits like early boarding and free checked bags but wouldn’t put any spend on the card (unless trying to waive minimum spend requirements for Delta elite status) after earning its signup bonus.

That’s because even if you want SkyMiles Delta’s co-brand cards aren’t the best way to earn those miles. Other American Express Membership Rewards cards earn points faster than the Delta cards do. Whether it’s double points on the first $50,000 in spend, 5 points per dollar on airfare, a 50% bonus on all spend when using the card 30 times in a month, or other category bonuses the suite of Membership Rewards cards reward spend better and still let you transfer to Delta plus offer the flexibility to move points elsewhere as well.

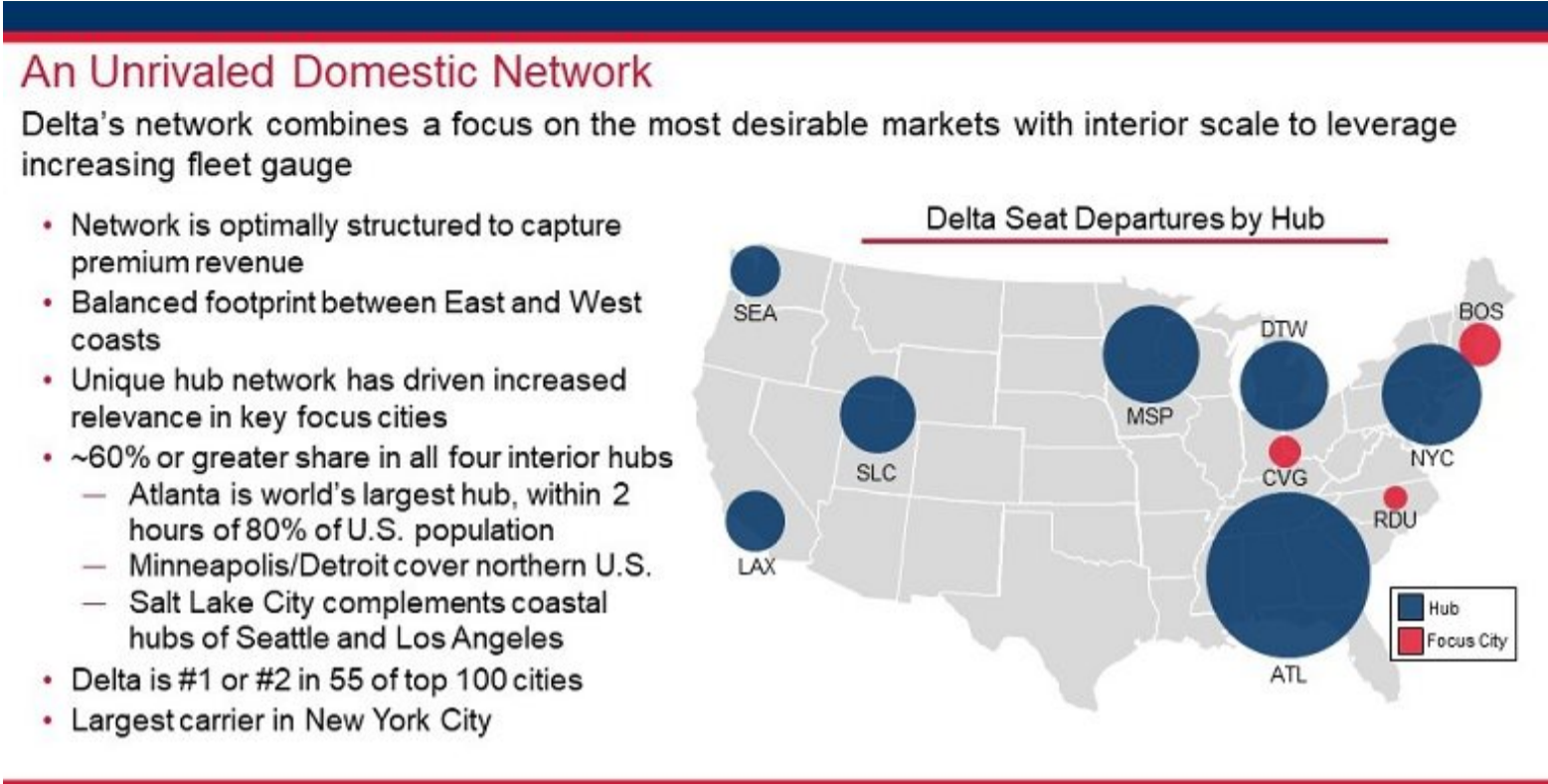

Yet Delta’s brand is ascendant because of its airline operation, and in many markets it faces little competition. Delta owns the Southeast via its Atlanta hub. It owns the Upper Midwest as well, Northwest executives used to say “it’s cold, it’s dark, no one wants to go there but it’s all ours.” It’s won New York, at least lower Manhattan, Midtown East, and anywhere where New Jersey is a pain to get to.

And most consumers don’t get beyond their airline co-brand. That said, I’d be skeptical about the projection of straight-line growth in the near-term given increased competition from banks themselves — and over time remember of course that the amount payment networks charge to process purchases (which is what supports paying consumers to incentivize use of a particular card) could fall in the face of new technology.

I got 2 Delta cards for the 130K bonus. After I burn those miles on a partner trip, I’m going to Burn Delta. They are complete hypocrites. After crying like little babies over ME3, they put in a big order with AirBus. They DO NOT support American jobs, so I will not support Delta.

Delta is dead as far as i’m concerned.

It’s not really that much of a mystery, the growing revenue for a not so great program is likely just due to that nebulous concept called “Goodwill” that sits on every company’s balance sheet but nobody really knows what it means.

Goodwill is what makes my brother and his wife put every dime of their hundreds of thousands of dollars of personal and business spend on their Delta Amex cards. And when I ask them why? They say, “for the points!”

When I try to explain they can get more and better points on other cards, it always boils down to his wife having gotten a sweet points redemption to Europe on Delta 20 years ago and that has stuck in her mind all of these years to the point where it is steering millions of spend over the last 2 decades to their Delta Amex card.

All it means is that lots of people are foolish. Putting spend on any airline co-brand card has become a bad move for almost everyone due to the massive devaluations all of these programs have experienced. I understand getting a card for the signup bonus, and possibly keeping it for the other benefits, but using such a card to actually spend money is almost always counter productive. You’re effectively paying 2 cents a mile for those miles (since you could get a cashback card for that), and the miles are barely worth more than a penny.

MQMs and the MQD waiver are valuable (even if Skypesos are not). I reach those milestones with Delta Reserve card first, and then coast to MQD requirement for Diamond by flying on China Eastern or other airlines where $2k spend on a round trip Business class ticket to Asia earns $5k-6k in Delta’s MQDs as a result of a % of distance formula that still applies to Delta’s non-European partners.

First, as for the comment on “American jobs”, you are aware that the Airbus jets Delta purchased are being assembled in Mobile, right?

Second, there are reasons people use credit cards other than points. SkyMiles is obviously a heavily devalued program – no doubt about that. But for those of use that have either moved on from caring solely about redeemable miles (or never did), Delta (and therefore the Delta Amex cards) offer substantial additional value. If you value a solid airline operation and want to maximize elite benefits, you might spend on the Delta Amex to either obtain additional MQMs or to satisfy the MQD requirement via spend. Unlike with AA and UA, the ability to rollover MQMs incentivizes continued spend on applicable Delta Amex cards (assuming you haven’t met the annual MQM cap) even after your desired status is achieved.

As Gary suggested, I view the card as a $95/year free DL luggage pass for my husband and me.

FWIW, cancelled my Delta Plat yesterday because annual fee was due and there was nary a hint of retention effort. Well at least I got my companion certificate first 😉

” It’s won New York, at least lower Manhattan, Midtown East, and anywhere where New Jersey is a pain to get to.”

Gotta stop you right there. From WTC, LGA and EWR could potentially be equal travel time while JFK is the furthest, so there’s hardly any distinct advantage for say someone at the Goldman Sachs HQ to pick DL just because of airport proximity. (I just checked it on Google Maps – from GS HQ it’s 15.3mi to EWR and 15.5mi to LGA, so EWR is indeed the closest airport out of all 3)

That’s the same mentality that allows UA to run more SFO-NYC services than DL and AA *combined*

Gotta love those DL lies.

https://www.panynj.gov/airports/pdf-traffic/REG_SEPT_2017.pdf

The *official* PANYNJ report shows DL as #2 in NYC, but they’re quite worthless since they don’t fly a single NY-East Asia nonstop at all.

I have the co-branded AmEx for MQM, MQD, and SkyClub access (Reserve Card). The SkyPesos are just a tiny “bonus”.

AMEX needs the DL partnership so that big spenders with high annual fee premium cards can transfer points to DL. DL needs to fill seats and points provide a nearly captive market. AMEX customer service reflects well on DL.

And the Platinum DL card includes companion pass for paid fare.

Is it $3B per year or for 3 years?

$3B per year…I didn’t notice the graphic.

Gary, you mention yourself that Delta “won” in New York, which is one of the few competitive big airline markets in the country. Why didn’t Delta’s poor mileage program hurt it more there? Simple – people who actually spend money and time on planes prefer Delta due to operations. It’s a better airline.

Hi Gary – is there a minimum spend on amex plat unaffiliated used 30 times to get 50% bonus ? Wow did not know that

Also to Roman’s post Dec

14, how do you book on China Eastern Plz ? As per your comment thanks so much Gary!

@ninamscccslp – no, amex plat earns 5x on air, blue business plus earns 2x on everything for first 50k spend, and everyday preferred earns 50% bonus on points earned each cycle you use it 30 or more times for purchases.

@ninamscccslp, first I like to take a look at itaSoftware “Matrix Airfare Search” matrix.itasoftware.com It is a free service and you can search by fare class, cabin type and airline alliance and it has a few useful features (including the detailed fare break down). You cannot purchase tickets on Matrix Airfare Search but it will re-direct you to portals where you can. Then, for China Eastern specifically, I use http://www.hop2.com if native http://us.ceair.com/en/booking.html is not cooperating.

To illustrate the point consider this real example: even though it is just 3 days away, right now you can still purchase a BUSINESS class (comparable to Delta One) ticket on China Eastern for Dec 31- Jan 9, 2018 (if MQDs/MQMs are important – this itinerary may result in 50% earn for 2017 and 50% earn for 2018 as it departs on Dec 31 and returns in Jan, further for flights departing in 2017 there is an older chart that is slightly less beneficial for “I” fare class on China Eastern, the new chart becomes effective Jan 1, 2018): NYC – Shanghai – Tokyo – Shanghai – NYC (booking class “i”) for $2,279.06 and earn 6,808 MQD (that’s approx x3 your USD spend, including taxes) and approx. 25,530 MQMs and 54,564 Skypesos (which, other redemption options aside, essentially is a $500 credit on future Delta-issued travel). I have seen sub-$2k roundtrip fares to other parts of Asia and since MQDs are calculated as a percentage of distance flown based on booking class (“I” gets 40%, you can confirm it here: https://www.delta.com/content/www/en_US/skymiles/how-to-earn-miles/airline-partners.html ), the further you fly, the more you earn. Alternative solution can be premium coach ticket with 30% of distance flown MQD earn – up to you and your preference.

I had a hunch that there were some opportunities in arbitrage via partners when Delta moved to $15k MQD requirement for Diamond. I put together a table of all Delta partners, and MQM/MQD/Skymiles earn for each fare class and went shopping!