I receive compensation for content and many links on this blog. Citibank is an advertising partner of this site, as is American Express, Chase, Barclays and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

FICO scores (versus VantageScore) are used in 90% of credit decisions. FICO is used in mortgages, which is precisely what I care about my credit score for. I’m not marginal for an auto loan.

Most of the time I don’t worry about my credit score. Pay bills on time and for the most part most people will be fine. But credit scores do matter for the big stuff, and when the score is marginal it can make the difference between approval and denial for rewards credit cards.

Here are the credit scores you need to get approved for several rewards cards.

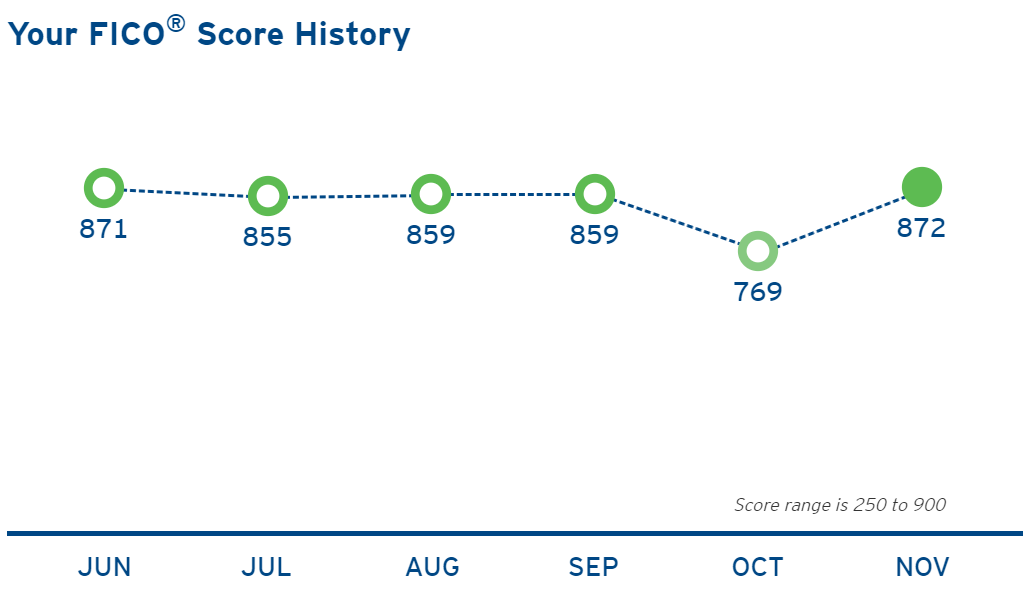

Since I write about credit cards and credit scores I often feel like I should share with you my own, walk the walk as it were. So here’s what Citibank shows as my FICO® Bankcard Score 8.

However that’s a big change from where it was a month earlier.

I had laid off lots of new credit applications, and putting big spend on monthly bills, for a few months because I was in the mortgage market. I’ve always taken extra care before buying a place (I still own my first condo in Northern Virginia from years ago and keep it as a rental property) or re-financing.

Applying for cards can temporarily depress your credit score. Spending a lot on your cards relative to your available credit card lower your score. When you go for a mortgage having a score of 760 or higher matters. On the other hand having more available credit that you use responsibly can improve your score, and having accounts for long periods of time can too. So contra the advice of Dave Ramsey wannabes credit cards aren’t inherently ‘bad for your score’. They can help it and clearly my score is good despite playing at rewards cards for two decades.

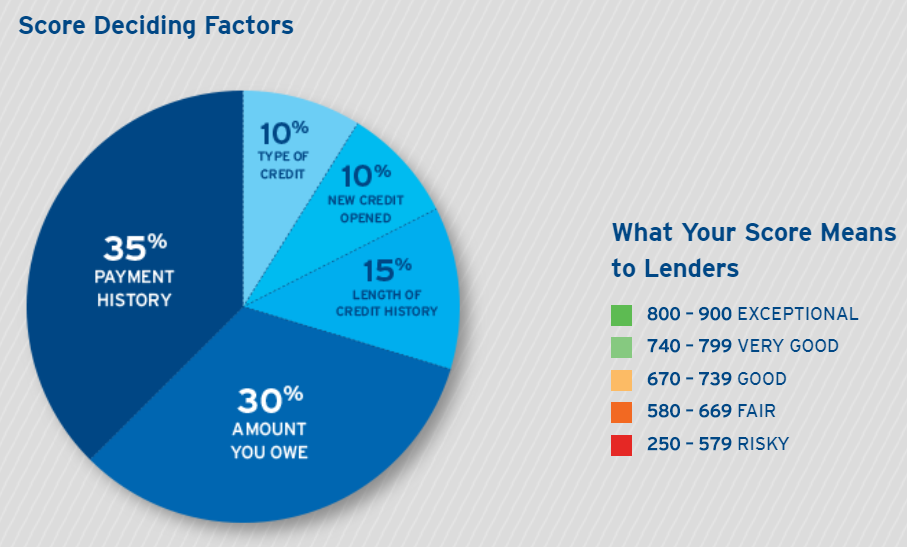

As I say the most important thing for a good credit score is paying your bills on time. And I do that. But balances carried — not just the balances not paid off but your balances reported with your statement — matter too.

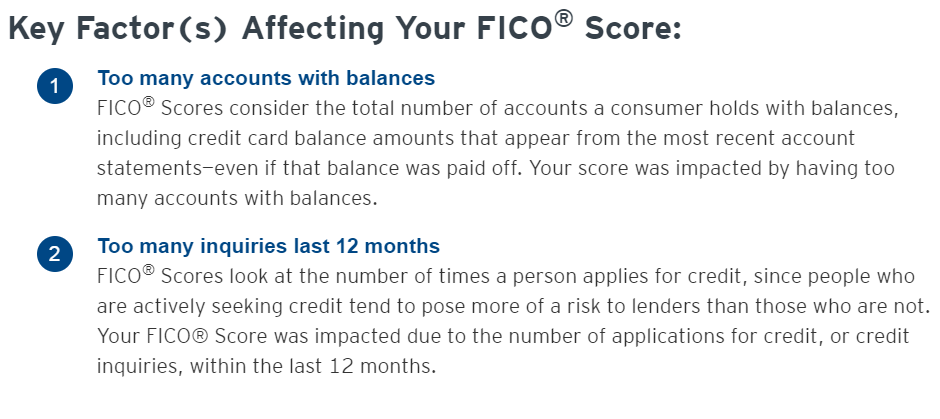

Once I finished up the mortgage I pushed a tremendous amount of spending through my cards, a lot of pent up demand for miles on my part. And I didn’t pay off the cards prior to statement close, so I was using a very high percentage of my available credit. That pushed down my score dramatically. But I paid off the cards, and in fact I paid off the balances on those cards prior to statement close the following month. My score recovered quickly.

In my case what’s holding down my score? (If you can call this score somehow held down, though it isn’t perfect.)

I’m pretty sure I will always have ‘too many inquiries in the last 12 months’. But in spite of that I keep a strong score, probably stronger than I should — put another way I’m wasting my good credit score, I should be doing more with it.

so your using industry specific scoring rather than basic scoring model which only goes to 850?

You are also missing one of the biggest contributors to score. INSTALLMENT DEBT.

This is why wealthy folks who pay their bills have crappy credit scores. No installed debt payment activity- car loan- mortgage etc.

This is the biggest fallacy of Fico scoring – it’s NOT an indicator of risk only a history lesson.

There are plenty of wealthy people with perfect credit for decades- even owning 6 figures of bank issuers debt and still get turned down for a 10-20k card app.

Even worse this erroneous risk calculation means these folks pay higher car and home owners insurance rates.

The Fico formula is fake math and bad science.

@Paul (December 9, 2017 at 4:37 pm) is spot on – Warren Buffett has mentioned in the past that his credit score is roughly in the 700’s.

Given that different cards offer free score checks every month, I sometimes wonder why the differences between banks are so much. For example, Amex & Chase use Experian, every time I check the score it is the same for both, currently over 800, but my Citi score is always significantly less. Obviously Citi is not using Experian, but I never thought there would be such a large difference. Any ideas?

Why did Gary take a big hit? My theory is the algorithm sees a sudden surge in spending and fears the customer is positioning for a bankruptcy filing.

Too long of a story but my two Credit Karma scores differ by 95 points.

Really glad you’re posting this. Many thanks.

This score thing’s been driving me nuts …:

Whatever I do, pay off ALL charges BEFORE statement time, stay below 5% expense on both overall credit and each individual card’s credit limit, the score still keeps bouncing around without reason.

It doesn’t make sense AT ALL, I can’t figure out why it happens, and it p’s me off big time.

Feels like the bureaus have gotten super nervous and stingy.

My mother could not get a fidelity credit card because everything was in my deceased fathers name. As a result she doesn’t have a low score she has no credit score. She has an eight figure account at fidelity.

Mark, I don’t know about FICO because I can’t see the scores updating quickly like I can with CreditKarma which uses the other score. But every time there is a balance owed on the date the bank reports, my score drops a LOT. This is true even with 2% utilization. This is true even if the charge isn’t due yet. So when I am trying to keep my score as high as possible, I pay balances before they are even posted to the account (when they are still pending charges). Not for every small charge but I keep the total balance below $1000 or so. I have heard this isn’t supposed to happen, but it definitely does. During these times if I check FICO it’s higher so maybe they don’t do that.

My big mistake was canceling old cards over the years. And recently I cancelled Capital One because they wouldn’t credit my annual fee if I downgraded, and that took me from excellent to very good for the first time. But the good news is it started climbing back up right away and was back into excellent in a few months. The best thing people can do is get no fee cards and hold them forever.

How accurate are calculators? I tried this calculator https://www.futufan.com/whats-my-fico-credit-score-free-estimator/ it shows my credit score to be 540 to 600. I’m not sure because on my last annual credit report it was below 540. Been making payments on time for a while now but not sure if it is increased or not.

Is there a way for me to convert VantageScore to fico score?