I receive compensation for content and many links on this blog. Citibank is an advertising partner of this site, as is American Express, Chase, Barclays and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

Over the summer United offered to sell miles for 1.88 cents apiece, I believe for the first time. What’s interesting is that selling miles cheap was the US Airways strategy that came over to American Airlines, and now that former US Airways and American President Scott Kirby is United’s President they’re doing it too.

He knows that the airline is in control of their cost of redemption, and that any miles sold above that cost generates profit.

Even as customers shy away from earning traditional airline miles in the face of competition from proprietary bank currencies and devaluations (United devalued again November 1) they can still sell miles at a profit if they drop the price low enough. They sacrifice margins for volume.

United is offering a ‘mystery discount’ you have to provide your MileagePlus number in order to see.

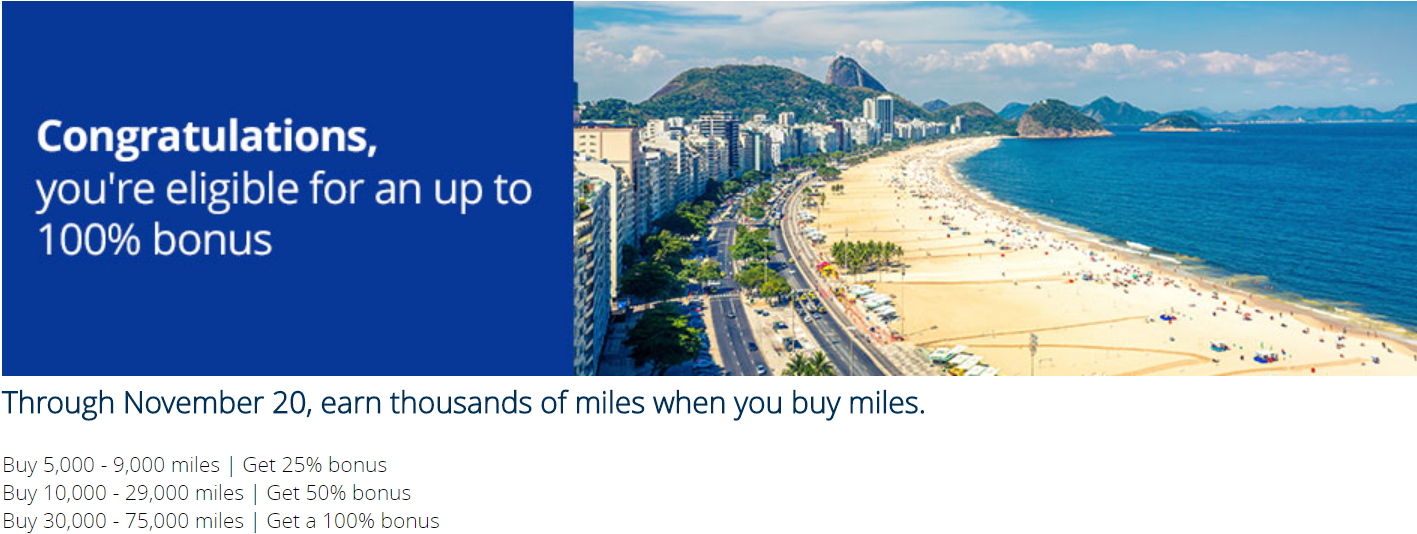

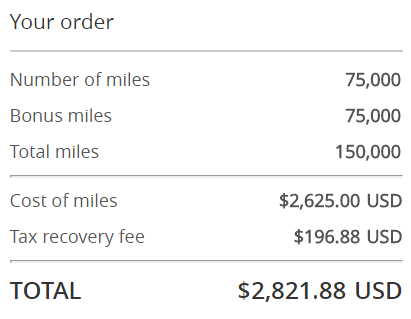

My offer is a tiered bonus, nearly the same as what was offered over the summer, up to a 100% bonus on purchased miles. Buying 30,000 or more miles gets that 100% bonus and a price including tax of under 1.9 cents.

They’ll let you buy up to 75,000 miles, receiving 150,000:

Remember of course that you may be able to get back the taxes from the IRS as well.

United sells miles via Points.com. That means you won’t get reimbursed for the purchase as a travel credit. And it actually means that Points is taking a cut of the purchase price. (They may also be guaranteeing some minimum sales to United, buying in bulk and reselling at a profit.) United itself is earning meaningfully less than 1.88 cents apiece through this arrangement.

While 1.88 cents is more than United miles are worth the offer can work for you to top off an account, or even buying from zero if you were going to book one of the unique values.

Why would anyone buy United points when they are almost useless? The problem with United is 1) close-in booking fees 2) devaluation after devaluation 3) no award seats available. Anyone who plays the United FF points game just gets a Beating.

On the other hand Chase has a strong program whereby you get a minimum of 1.5 points, up to 5 points. Then multiply that by a minimum redemption factor of 1.5 cents per point and it’s easy to see that Chase is giving United a Beating, and dragging their sorry carcass out of the points game.

United may have been selling miles this summer for the same discount but the miles are now worth less after 11-1-17 obviously. I find better award space on United than on AA but still not sure it’s worth it to buy these.

No point. I’d be interested at about 1 cpm. Just about all the carriers have so devalued their miles that, apart from credit card signup bonuses, there’s no real reason to go after those currencies directly. Go for cash back and/or transferrable points that can be moved where needed when a good redemption comes open.

@Alan. Or you could be a 1K/GS -pay no booking/change fees -have amazing availability (I’ve booked 5 bclass round trips this year on miles for my wife) -and I have to disagree on devaluations….the last one was the first in a very long time and it was pretty minor. AA and Delta are the two I would never buy (and I have status on all 3+ Alaska).

Although selling miles at a discount is better than full price it is just too expensive compared to what you can just purchase flights for. I value United miles currently at about 1.1 CPM, and that is where I would be a buyer.

Actually, I agree with Greg on this. If they are selling miles at about 1 cent per mile, I might buy.

For example, suppose I want to fly round trip in business on a partner airlines to Southeast Asia (say JFK-Bangkok (BKK)). It is 180,000 miles round trip after the devaluation. 1.88 cents/mile * 180,000 = $3,384. Round trip business on Finnair in Business JFK-HEL-BKK from 11-27-17 to 12-11-17 is $3,076 (less) according to Google Flights. Turkish Airways business JFK-IST-BKK is also less at $3,299. However, to be honest, I would probably fly Eva Air premium economy (with seat pitch of 38″ and width of 19.5″) JFK-TPE-BKK for $1,400 instead. Seriously bad price for the points given the devaluations!

@Seeing the World. I agree that I would not purchase AA miles at that price either. However, IF AA miles were priced at 1.88 cents, round trip business JFK-BKK on partner airlines would be 140,000 miles x 1.88 cents = $2,632. I find wide availability on Cathay Pacific and some availability on Japan Air with AA miles. I would probably still fly Eva Air at $1,400 if I was spending my own money. However, currently, I am trying to use up my AA miles before another devaluation.

The problem with airline management is that they do not we flyers know how to use pocket calculators.

This doesn’t make a lot of sense now since people can currently buy United miles for 1.13 – 1.3 cents each through the other Choice Hotels and United promotions, at least through November 12.

http://www.travelingformiles.com/deal-buy-united-miles-just-1-13-cents/