I receive compensation for content and many links on this blog. Citibank is an advertising partner of this site, as is American Express, Chase, Barclays and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

Credit cards are big business. So figuring out how to deliver benefits most relevant to potentially high value consumers is big business too.

People usually forget about their credit card benefits beyond the most obvious ones — rewards, priority boarding, lounge access.

But when flights cancel I don’t worry about getting the airline to put me in a hotel, one I probably wouldn’t want to stay in anyway, I’ve had great success just sending the bill to my credit card. And I’ve sent the bill to repair the cracked screen on my phone to my Chase Sapphire Preferred Card as well. It was a new phone and I was stupid.

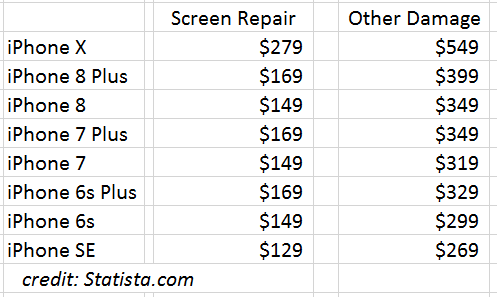

After those precious first few months though you’re either on your own or you’re paying for overpriced insurance with high deductibles from your cell phone provider. And the costs of a damaged phone add up. Here are average iPhone repair prices.

You can shift this risk onto your credit card provider too. Here’s the cell phone protection benefit that comes from paying your bill with the Ink Business Preferred℠ Credit Card (and by the way you earn 3 points per dollar paying your cell phone with the card, too):

Get up to $600 per claim in cell phone protection against covered theft or damage for you and your employees listed on your monthly cell phone bill when you pay it with your Chase Ink Business Preferred credit card. Maximum of 3 claims in a 12 month period with a $100 deductible per claim.

Credit: Tyler Love via Wikimedia Commons

Here’s the benefit that comes with the new Uber Visa: “stolen and damaged cell phones as well as involuntary and accidental parting of your cell phone.” The coverage is secondary to other insurance you may have and will provide up to $600 in coverage after a $25 deductible. There’s a maximum of 2 claims and $1200 in reimbursements per 12 months.

It pays to be strategic about the card you use to pay your cell phone bill, just like you’re strategic about which card to use to pay for airline tickets for both best protection and best rewards, and like you’re strategic about which card to use dining out.

What if I have the old Chase Ink Business Plus that gets you 5% back? Does that have the same coverage as the Preffered?

Gary, if I bought my phone with a different credit card, but pay my monthly bills with the Ink Business Preferred or the new Uber Visa, will I still be eligible for that $600 coverage?

Gary, is this limited only to the Business Preferred version of the Ink? I ask because I just had a screen on a new Samsung phone crack, and I pay the monthly bill on my Ink Bold (the one that gets 5x points on that category).

Gary, when I last checked few months ago, these benefits only applied is the phone was owned out right. If it was being paid for over an installment plan or on a lease, the claim was not eligible with this insurance. Has this changed? Do you have a different reading of the T’s and C’s?

I’ve said it before. I’ll say it again. $600 doesn’t cover a $1,200 phone.

stvr

Check out the repair cost, should fall below the max benefit. Theft or lost is obviously not going to get you there. Those are more rare. View the difference as a larger deductible or purchase separate coverage to reinsure.

I recently talked to Chase about this benefit. The Ink Preferred is the only card in the Chase portfolio that offers this benefit. According to the CSR, the benefit is in effect when you pay your monthly cell phone bill on that card. It doesn’t matter if you bought the phone outright or are making payments. It also doesn’t matter if you bought the phone outright with another card as long as you’re paying your monthly cell phone bill with the Chase Ink Preferred card. The Chase Ink Plus card does not offer this benefit.

Wells Fargo, regardless of the love lost lately, does provide this benefit with a $25 deductible on their Visa card. That’s the only reason I have the card, and it has come in handy with two smashed phones over the past six years or so.