On Sunday Lucky at One Mile at a Time wrote about shockingly bad redemptions that American Airlines is offering for peak holiday travel.

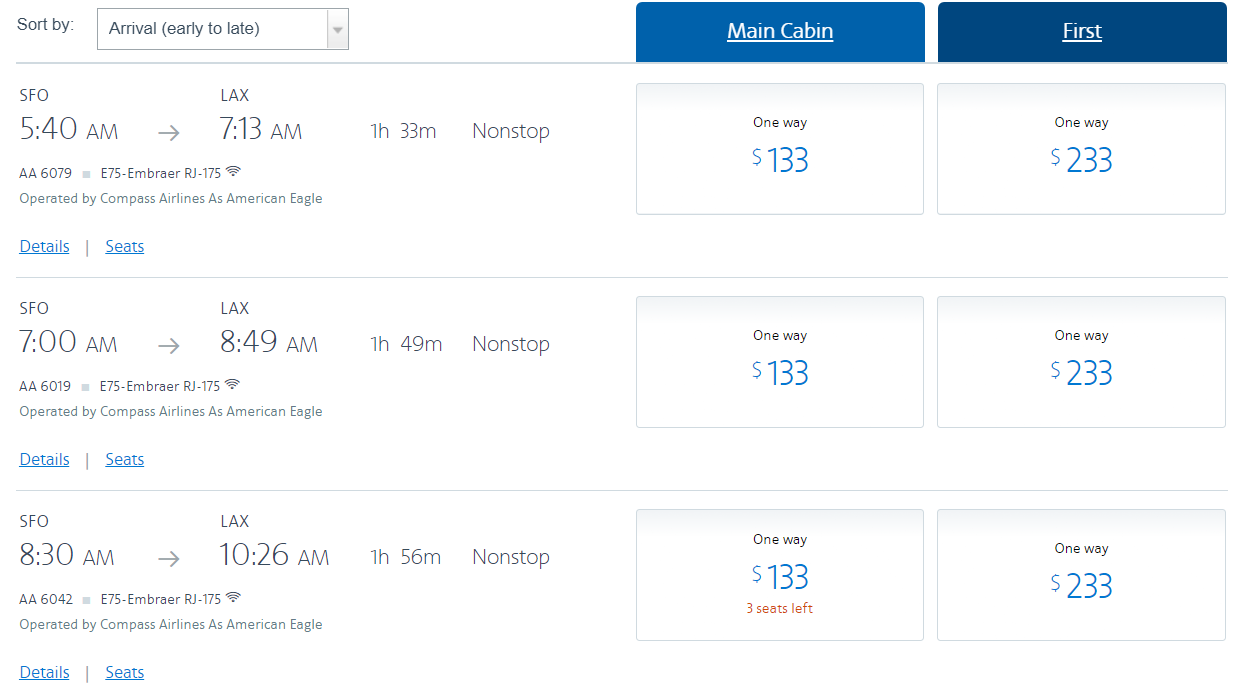

He gives the example of $133 San Francisco – Los Angeles flights that cost 75,000 miles.

Here’s November 26:

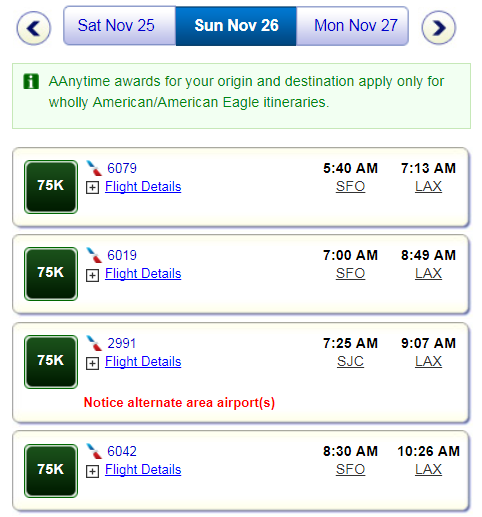

And if you wanted to spend miles it would cost 75,000:

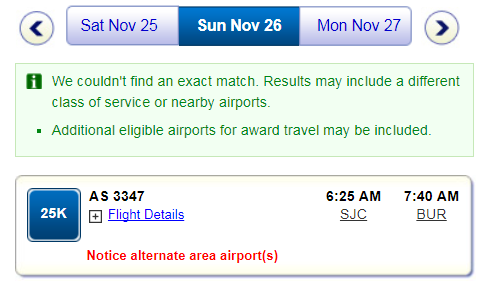

Now, because American and Alaska Airlines are still partners (barely) you could use 25,000 miles for a one way first class award from San Jose to Burbank.

But I’m interested in why American is charging so much. In theory American believes they’ll sell out their flights the Sunday after Thanksgiving (though if that’s true, why are tickets just $133?) so they’re letting you redeem your miles at $0.0017 per mile.

Lucky thinks this is bad management (and I happen to agree),

However, there has to be a balance between trying to provide members with value through AAdvantage and minimizing costs. This is especially true given how many members would love to redeem their miles to see family over the holidays. You know they’d have a positive impression of the program if their miles helped them make that happen.

However the assumptions behind AAdvantage accounting may shed a bit of light here.

Based on data from SEC 10-K filings other than the most recent one (when they started obscuring this data), American sells miles to third party at an average of about 1.23 cents apiece. Presumably banks are paying less, while other partners are paying more.

However they assume this isn’t all for actual transportation. There’s both a marketing component and a transportation component.

- American books ~ 4/5ths of a cent per mile as revenue in exchange for their marketing prowess.

- And books only ~ 1/2 a cent per mile in liability for providing actual future travel.

When American provides miles to passengers flying on their planes they have only been booking about 1/7th of a cent per mile (actually $0.0014) to cover the cost of travel they would have to provide. American’s assumptions are that awards will cost them essentially the value they’re providing San Francisco – Los Angeles at peak time.

At the end of 2016 American had $2.5 billion in total liability on its books for AAdvantage, compared to $4 billion at Delta and $5 billion at United. That’s because American has used an ‘incremental cost’ approach to miles awarded for travel. Delta and United have been using something closer to a fair value approach (booking how much the travel they will provide is worth on the market).

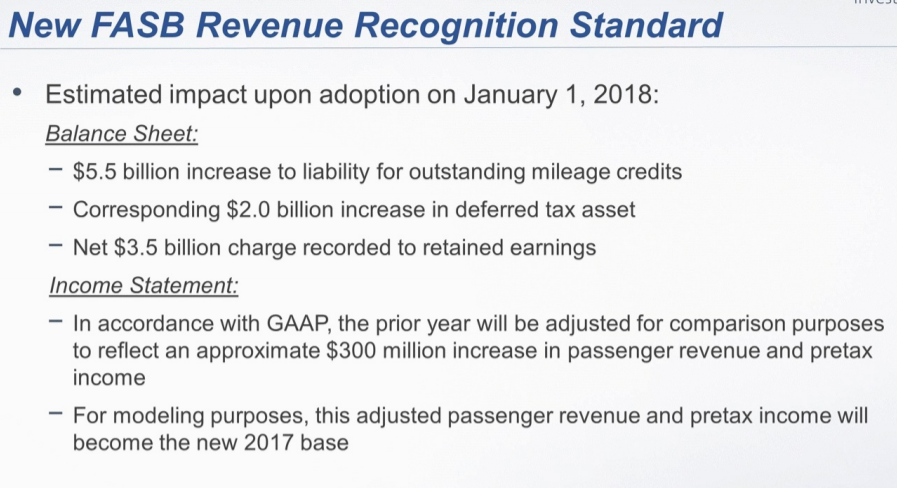

American’s accounting is required to change. They’re required to adopt FASB ASC 606 “Revenue From Contracts With Customers” effective January 1 and instead of accounting for the incremental cost of carrying a passenger when they accrue miles provided for transportation they’ll have to defer the fair value of that transportation.

They are going to record a bigger charge to their financials than I had modeled:

Around the same time they’re making this change — carrying the miles at a higher value on their books — they say that award availability is going to get much better.

I hate to think that a major publicly traded corporation would make business decisions based on accounting rules rather than enterprise value but if that’s what it takes to make our miles worth something again I’ll take it.

Almost makes you wonder if we will see fire sale awards in Q4? Of course it’s not like they are making it easier given awards on QR and EY are challenged lately.

It seems to me like they just use a simpleton method of managing reward inventory. They say ” oh man, the Sunday after Thanksgiving…that’s a busy time…let’s make the anytime award 75,000 on every route no matter loads or price…cuz we smart”. Delta, on the other hand, actually seems to actively manages their inventory. If prices are high and seats are selling mileage tickets cost more. If seats are open and prices low you can get some low mileage rates for tickets. Not every flight is like that, but at least Delta seems to actually use some semblance of supply and demand in managing their inventory versus AA’s blanket pricing based on days.

@Shaun – I think one of the reasons that Delta is “better” at managing the relationship between redemption rate and fare is that they are much further on the spectrum of tying SkyMiles to a rebate program with relatively fixed ranges of value that the miles are worth. It’s a lot easier to incrementally price a redemption when all it takes is a lookup table that translates fare $ or buckets to mileage rates.

It is actually less than that. For an upgrade from Business to First earlier this year I was offered the choice of $500 or 25,000 miles plus $550.

As a consultant for an accounting firm i’ve gotta say i never expected to see ASC 606 make it on to this blog. Kudos.

I’ve booked three business class awards to London on as metal between Aug and next Mar, all as saver awards. The flights normally cost me around $3600 when booked in advance, though ba did recently have a sale where I snagged a few seats at around d $3000.

What was the value of those miles.

I’m sure plenty out there have do better. See how easy it is to cherry pick?

Gary:

If you haven’t worked inside a publicly-traded corporation at the senior management level, you cannot understand how accounting — and the resulting securities disclosures — drives many (if not most) of the business decisions made. Accounting drives securities disclosures — including revenue and earnings per share, which drives stock price, which drives 50% or more of the compensation package for senior management (both stock options and incentive compensation), which drives most senior management decision making.

I guess the obvious solution to this problem is to move to a revenue-based frequent flyer program. I’ve been flying Southwest a fair amount the last couple years (I have a companion pass) and I must say that, for basic domestic travel, revenue-based is better for customers.

@ iahphx

Cant fully agree there at all!

While Southwest displays more available seats and may cost less on average I’d argue that on some rare occasions American award is 12,500 one way saver in coach and Southwest has nothing less than 19 to 25k in coach one way even on Wanna fares

I’d argue its certainly not better all the time with their frequently highly flawed revenue model but I have found some sweet spots like

LGA to SAN for 7,500 miles on Southwest which is like winning the lottery

@DWondermeant, I noticed on the jetway going onto a Southwest flight a couple of months ago a chart comparing average cost of mileage redemptions for round trip domestic flights in the U.S. If I recall correctly, Southwest was low at around 16,000, while American was the highest at around 31,000. The others were in between. Clearly there will be exceptions depending on dates and destinations, but over many redemptions by many people, Southwest is far superior in this respect.

My problem is that for me all Southwest flights go through Phoenix or St. Louis, which are rarely my destination, so always there are connections. American goes to ORD and DFW, which are places I frequently want to be. I prefer Southwest overall, but still find myself on American more than I’d like.

Excellent industry articles like this one are one of the reasons I visit this blog – thanks.

@Retired Lawyer — yes that is my point and I am saying just how sad it is. But as a frequent flyer if it help savailability I will take it.

@iahphx – all depends on the redemption rate of course. Southwest redeems in the ballpark of $.0145 per point, whereas Delta seems to be in the $.011 vicinity.

If most of your point come from CC spend, and most of your travel is domestic, it again points to the $.02 per dollar spend (in travel or cash) cards as being a must for the portfolio, especially as first class is priced better these days.

Only worthwhile redemptions anymore in traditional FF programs are intl biz/1st. Great if you can find those unicorns.

In Q1 2018, I do expect there will be increased mileage ticket space availability at mileage price levels below the most expensive level currently, but I also expect that the mileage pricing for mileage tickets actually redeemed in and flown in 2018 will actually not end up a whole lot better for customers in the aggregate than in 2017.