I receive compensation for content and many links on this blog. Citibank is an advertising partner of this site, as is American Express, Chase, Barclays and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

Cathay Pacific launched its new US credit card back in February. It’s issued by Synchrony Bank — and any mileage-earning credit card not issued by Chase, American Express, or Citibank is worth looking at.

Initially the signup bonus on the card was 25,000 points after $2500 spend within 90 days.

Two months ago they bumped the bonus to 50,000 points after $2500 spend within 90 days. The bounty went up without a concomitant increase in spend required to earn it.

Key details:

- 2 AsiaMiles per dollar spent on CX purchases

- 1.5 AsiaMiles per dollar on dining

- 1.5 AsiaMiles per dollar on foreign transactions

- No foreign transaction fees

- Entry level Green in Marco Polo Club (Cathay Pacific’s elite status program) for one year

- $95 annual fee

Cathay Pacific First Class

Via Doctor of Credit this offer will end October 31. So should you sign up?

The bonus is worth well more than the annual fee. However you’ll earn more miles — even more Cathay Pacific miles — with cards that earn transferable bank points.

There are two unique things about the card:

- The one area where spending is really interesting is the 1.5x for foreign transactions. That’s because while there are cards which can earn 1.5x airline miles on otherwise-unbonused spend, they don’t waive foreign transaction fees. So this may be a great niche card for people who travel internationally a lot (and who are spending on things other than travel or dining because those are well-bonused by other cards waiving foreign transaction fees already). It’s the only product I know that bonuses foreign spend across the board.

- The other interesting feature is access to Cathay’s pay-in elite program.

One caution is that like Singapore Airlines, Asia Miles expire three years after you’ve earned them. You can extend miles for a fee (that isn’t generally worth it). But mere activity in an account doesn’t keep your miles active.

Cathay Pacific’s Marco Polo Club Green Tier

The card comes with Marco Polo Club Green tier for one year (renewing the base Green tier costs $100). This is potentially useful.

- Members can redeem 9000 AsiaMiles per person for Cathay Pacific lounge access while non-MPC members cannot. (You can’t see the page unless you log into your MPC account)

- Green also lets you redeem for extra baggage and extra legroom seats, and comes with priority boarding.

Cathay Pacific Business Class

You Can Top Off an AsiaMiles Account Easily

You can top off an AsiaMiles account by transferring points 1:1 from American Express Membership Rewards and from Citi ThankYou Rewards.

In fact, earning on those cards will in most cases be greater than with the Cathay Pacific card. That’s why the new Cathay Pacific card isn’t going to be the best for most of your spending. You earn more Cathay Pacific miles with American Express or Citibank, and still have the option of transferring points to other airlines of your choice.

Using AsiaMiles

Cathay Pacific has multiple award charts. For simplicity in this post the ones I’ll focus on here are their chart for their own flights (where you fly Cathay Pacific and up to one partner) and their oneworld award chart (for 2 or more oneworld airlines not including Cathay Pacific).

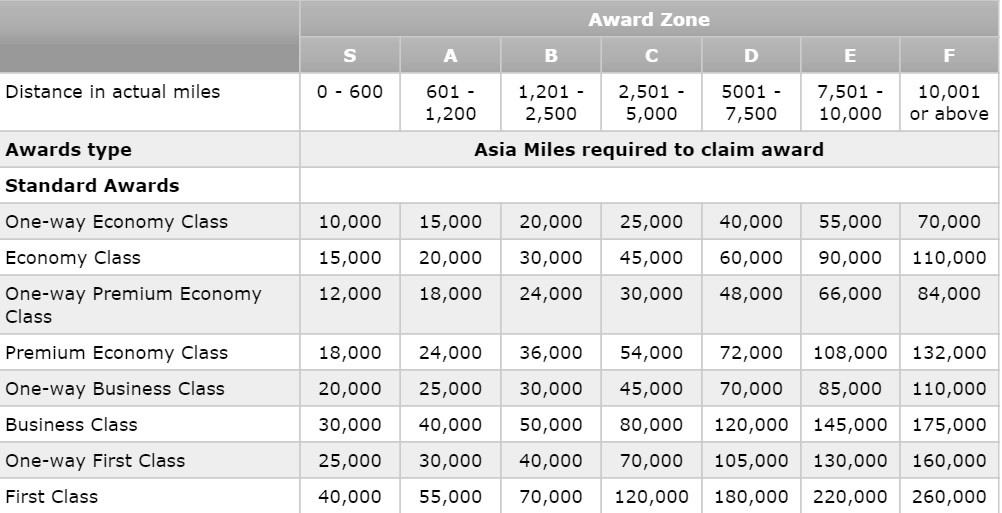

Their award charts are distance-based. Flying on Cathay Pacific, you can include a partner airline to reach the Cathey Pacific international gateway (eg include an American flight to get to New York, Chicago, Los Angeles, etc).

Los Angeles – Hong Kong is under 7500 miles one-way, so costs 120,000 miles roundtrip in business class. One-way awards cost more than half the price of a roundtrip. Since New York, Chicago, and Boston are more than 7500 miles each way to Hong Kong, those roundtrips cost 145,000 miles.

First class long haul gets pretty expensive (though less expensive on some routes than American AAdvantage). Business class remains reasonable. And while AsiaMiles adds fuel surcharges to awards, fuel surcharges to and from Asian destinations Hong Kong and to the North have fallen substantially.

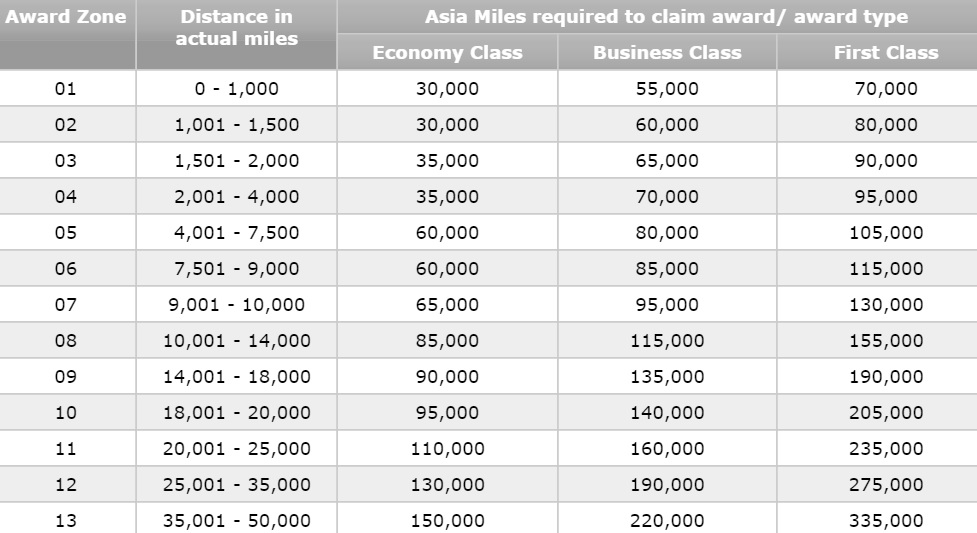

Their oneworld award chart is distance-based as well. This is what you’ll use, for instance, if you want to fly between the US and Europe on oneworld airlines (airberlin, American, British Airways). The longer the trip the more expensive it is, but there are some real values as well.

Business class between New York and London is 6903 miles roundtrip. Fly British Airways one way and American the other direction for just 80,000 miles in business class or 105,000 miles in first class.

You can do up to 10,000 miles of roundtrip flying for 95,000 AsiaMiles in business class or 130,000 in first. This is useful because of their routing rules:

You can make a maximum of five stopovers, two transfers and two open-jaws at either origin, en-route or turnaround point, subject to airline partners’ terms and conditions.

Partners will need to update their mileage-earning charts once American introduces premium economy, so we may see some of these charts renegotiated.

You failed to mention if this card is churnable

Gary – do you know how the mileage would be calculated for sfo-lax-hkg? If calculated sfo-lax and lax-hkg it would be over 7500, but if calculated sfo-hkg it is under. The reason this matters is if availability doesn’t exist from sfo on the nonstop, but lax-hkg is available

Thanks for posting this, Gary. Any sense of whether J or especially F award availability (especially for two seats at a time) is greater using AsiaMiles as opposed to American Advantage miles?