IdeaWorks has put out a new study on airline ancillary fees (.pdf). They rank the airlines earning the most in ancillary fees, and explain where the money comes from.

I’m not going to focus on the ultra low cost carriers around the world although the data there is interesting. Instead my interest is piqued looking at the major US airlines and the contribution of their frequent flyer programs to ‘other income’ at each.

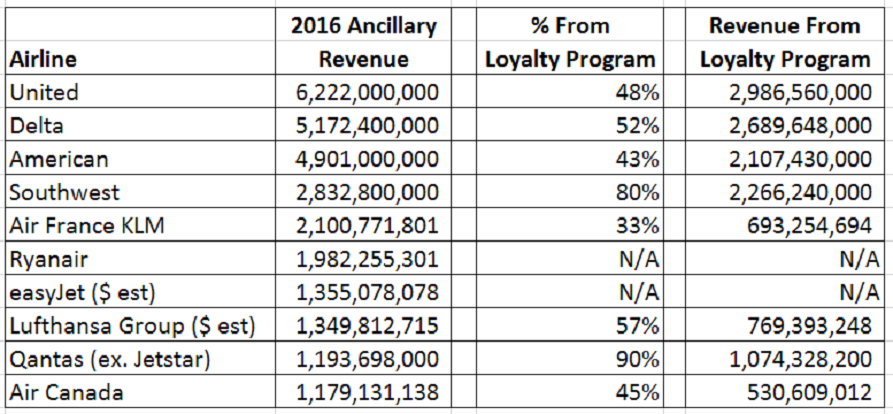

Here are the top 10 airlines earning ancillary revenue, and how much their frequent flyer programs contribute to the total:

We can quibble with what numbers to use here, especially because disclosures across airline financial statements aren’t consistent. For instance $2.1 billion looks to be the total of deferred revenue from the sale of miles at American in 2016. My review of American’s SEC 10-K filing suggests $2.51 billion in total mileage sales.

Nonetheless, working with the IdeaWorks figures yields some interesting results. Remember that most of the revenue from US frequent flyer program mileage sales is coming from their co-brand credit card issuing banks.

- While Delta is the only one of the 3 largest US airlines claiming that their credit card acquisitions are meeting or exceeding expectations, the revenue they’re generating from their frequent flyer program appears to be lower than United and United is disappointed in its results which is why United has begun to pitch card products onboard.

- United may feel some leeway to devalue since they’re earning more than their competitors.

- American’s revenue is lower than competitors. That’s not surprising since last year didn’t include a bump from their new credit card deal although that doesn’t explain the full gap with United. As aggressively as they’re selling miles to banks and even consumers there’s quite reasonably less demand for their miles despite more frequent flyer program members than United and a larger airline overall.

- Perhaps shockingly Southwest appears to be generating more from mileage sales than American. 2016 saw a full year of Southwest’s new credit card deal with Chase.

- With a full year of the new American deal this will reverse. Nonetheless the fact they’re even close is telling. Southwest is punching above its weight because while the program is simple it’s relatively more transparent than peers.

There’s some evidence in these numbers that offering a strong frequent flyer program value proposition is key to earning the most possible revenue from that program. United and Delta have new credit card deals, United has a better program, and it earns more. American should take heed.

Air Canada sees a lot of revenue upside potential in its frequent flyer program which is why it plans to sever ties with Aeroplan in 2020 and start its own.

Air France KLM and other European programs have less potential to earn from local credit card partners due to lower interchange rates in Europe, but that’s also why they’re a partner of US bank transfer programs — to get a piece of the more lucrative US card market. (Lufthansa of course has a US-issued card from Barclaycard.)

While my focus in reading the report was frequent flyer programs, the treatment of Basic Economy fares stuck out as interesting as well.

Branded fares, based upon the “good, better, and best” method of retailing, also contribute to ancillary revenue as shown in the Delta and easyJet examples. The entire fare is not counted as ancillary revenue, but rather the premium above the basic economy fare level is measured. Fees assessed for assigned seating are another method for airlines to boost the bottom line. These fees do tread close to the model defined by low cost carriers; adoption of this practice does pose a risk the perceived quality of global airlines.

Bear in mind that ancillary fees aren’t all profit. Some like frequent flyer programs come with costs associated with them (redemptions). And the accounting can be misleading, since at least some of the revenue included as checked bags might otherwise have been part of airfare if the airline hadn’t unbundled. Indeed checked baggage fees encourage more passengers to carry on bags slowing the boarding process and imposing heavy costs on the airline operation.

A key reason to adopt checked bag fees though is massive tax savings to the airline, federal law encourages checked bag fees rather than including free checked bags in the ticket price since the former is exempt from the 7.5% federal excise tax on domestic airfare.

Qantas is the biggest surprise as they probably earn the most of percentage of total revenue.

Yes – the IdeaWorks numbers are a little funny – but it paints a reasonably close picture for the average reader.

As far as American goes – my figures match yours Gary – in 2016 AA had $2.1b in deferred revenue. And they had $2.51b in third-party mileage sales. They also had an additional $200m in AAdvantage marketing-related payments – which would bring AA up to around $2.7b in FFP revenue.

They also had around $2.13b in income/EBIT recognized from the FFP (excluding around $230m in income recognized from former US Airways deferred mileage sale revenue).

So total 2016 EBIT from the FFP was closer to $2.36b or around 55% of AA’s total GAAP pre-tax earnings.

So I think the IdeaWorks numbers are a little low for AA.

As far as UA is concerned – they’ve been relatively stagnant at around $3b for a couple of years now.

Same with Qantas who are at around AUD$1.5b in annual billings for the FFP. The high percentage in the table attributed to Qantas is reflective of the relatively low-value of non-FFP ancillary revenue for Qantas (that isn’t bundled into ‘Passenger Revenue’). The separate reporting nature of Qantas Frequent Flyer makes FFP easier to account for compared to others.

Of course, your conclusion is correct regardless of the fuzzy math – a strong FFP program and value-proposition is critical if airlines want to continue to enjoy the bonanza that flows from third-party mileage sales.

Tax laws which push airlines to price one way or the other are economic nonsense. Perhaps if the fees were also taxed airlines would return to traditional bundling.

I predict 2017 will be lower for aa. The onboard sales pitch for Barclay card will be trumped by Cutus antichurning policies, which will have more impact in year two than one due tothe 24 month restriction.

Add that to the low perceived value of AA miles and the lack of EQD contribution from Citis cards, and I bet they’ll see less between the two issuers.

It’s the only thing that might influence AAs award ability.

Southwest’s mileage program is moving toward the front of the pack simply by devaluing its points more slowly than other programs. Elite members now have free standby for any earlier flight the same day. True, you can’t use Southwest points to fly free in First or Business class, but very few members of other programs are able to accomplish that either.*

Southwest’s points convert to 1.43 cents of base fare and they avoid most taxes. They also allow full refundability in nonrefundable fare classes, with no locking of the points to one passenger name. For these reasons I value Southwest points at 1.6 to 1.8 cents each, which is highly competitive with other mileage currencies. Southwest is going to win this race by standing still.

*Full disclosure: In the past 2 years I have twice been able to book premium class international awards during very brief (less than a week) windows of wide-open availability which the two airlines never intended to offer. If availability is limited to the equivalent of a flash sale every 2 years, that’s not what I call a reasonable redemption option.

What’s the saying? “The behavior of any large organization can be predicted by assuming it is controlled by a cabal of its enemies”? FFP devaluations — and AA’s recent behavior — certainly suggest this.

@nsx Even more on Southwest, it’s not hard to find flight for point values in the 1.6-1.8 range (I just booked some over 1.8). The added benefit of them being refundable is even better. Compared to American where I basically can’t find any saver flights ever (economy or premium) that don’t involve overnight layovers or other stupid connections, the SW points seem infinitely more valuable. If I were ever to get another airline credit card it would probably be Southwest (I suppose they do have the downside that they can’t offer things like free checked bags, since they already offer those).

” As aggressively as they’re selling miles to banks ”

What banks can you earn AA miles at besides BankDirect?

@Glenn – this refers to banks issuing credit cards, not awarding miles for checking accounts