American Airlines filed updated fleet projections with the SEC today.

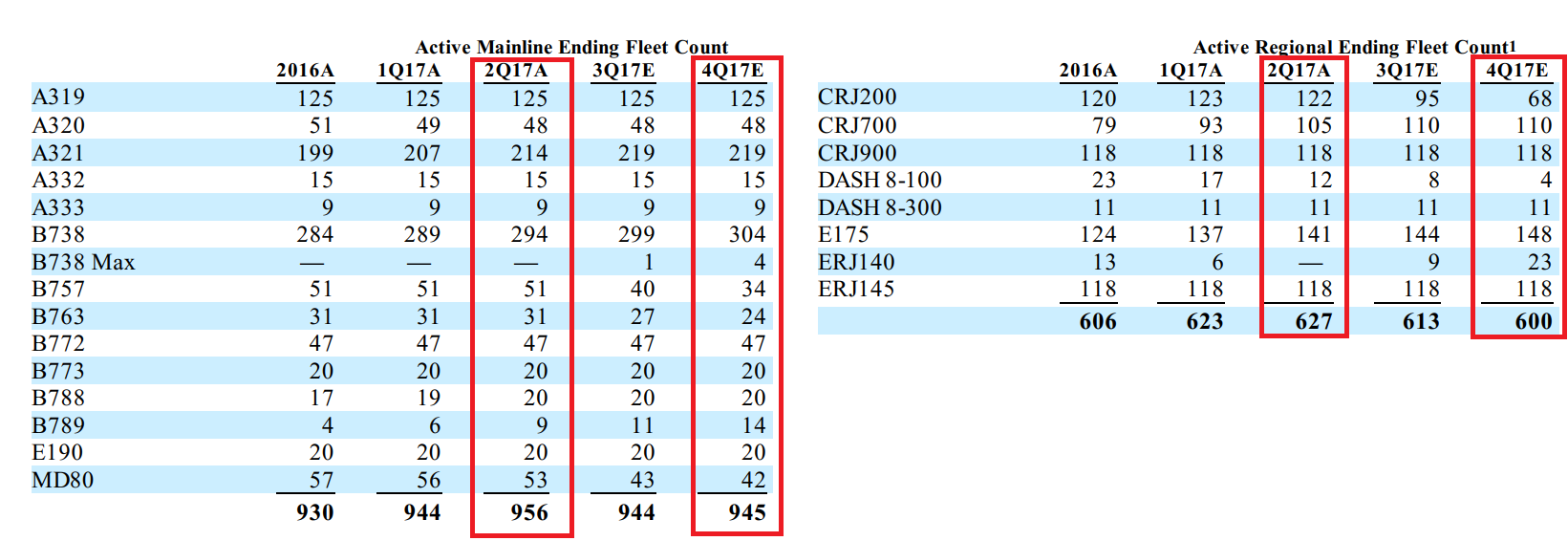

They show, quarter-by-quarter, the size of each aircraft family in their fleet. I’ve highlighted aircraft totals as of June 30th and also where they project to end 2017. You can click to enlarge:

Year-over-year American should take delivery of 57 new mainline planes — 20 Airbus A321s, 20 Boeing 787-800s, 4 Boeing 737 MAXs, 3 Boeing 787-8s and 10 Boeing 787-9s.

American Airlines Boeing 787-8

The 737 MAX aircraft will be equipped with fast ViaSat satellite internet — but standard coach seats with 30 inches of pitch, the distance from seat back to seat back. That’s one less inch than coach flyers are used to (but not the 29 inch pitch in a few rows that American had earlier threatened).

However the mainline fleet only grows by 15 planes (or 1.6%) year over year due to retirement of 3 Airbus A320s, 17 Boeing 757s, 7 Boeing 767-300s, and 15 MD80s.

The retirement of American’s old MD80s is bittersweet. On the one hand their premium seat-heavy which makes for a good chance of upgrades. On the other many flyers experience mechanical delays at a higher rate with these planes which also suffer from the oldest installations of inflight internet (which are therefore generally the slowest) and power ports which require adapters. For most parking these planes in the desert can’t come quickly enough.

In addition to changes in the mainline fleet year-over-year the regional fleet should shrink by 6 (1%) — though by 27 between end of June and end of December — as a result of cutting the fleet of CRJ200s in half (to shouts of joy from frequent flyers who will endure fewer 50 seat regional jets without first class, extra legroom coach, internet, or seat power). They’re also reducing the count of Dash 8 turboprops and few will miss those.

In the same filing American Airlines disclosed that they still have “approximately $10.5 billion of federal net operating losses (NOLs) and $3.7 billion of state NOLs” — they discharged many obligations in bankruptcy but managed to keep their historical losses nonetheless and use those to write off income against taxes. As a result they expect “to recognize a provision for income taxes in 2017 at an effective rate of approximately 38 percent, which will be substantially non-cash.” (emphasis mine).

In other words American Airlines is making billions of dollars of profit and not paying taxes, but they continue to insist only their foreign competitors are subsidized. Oops.

A few thoughts on your tax comment:

1. All corporate taxpayers have the ability to carry over NOLs – up to 20 years. This is not specific to the airlines.

2. While debts may have been forgiven, they could have recognized cancellation of debt income – or they were debts that never resulted in a current deduction (for example, the pension amounts are amounts due and were accrued for financial purposes but never deducted for tax until paid – since not paid, no deduction.

3. Most of the losses were generated by costs and fees paid to advisors that were income to such advisors and subject to tax. Some of those are also generated by wage payments to employees and subject to tax. Those are deductible items and the tax law allows such symmetry.

4. 38% is an average tax rate for US taxpayers (35% fed, plus state and some foreign).

5. Financial accounting rules required that they book a benefit for the losses (which were recorded in prior years – even though they did not get cash in those years) and record an expense for income – even though there may not be a cash tax payment.

What they have done is correct within corporate tax law and under financial accounting standards. .

Is it bad that I actually think that the turbo props are some of the coolest planes out there? Who knows.

@Jim “What they have done is correct within corporate tax law and under financial accounting standards” ABSOLUTELY. But it’s no less a subsidy. And they carried forward these NOLs through bankruptcy while discharging other obligations. [As Delta, United, and US Airways did with pensions.]

@jim thanks for the tax lesson, but it doesn’t rebut any of Gary’s points.

I’m going to miss the MD80 for the 2 side with no middle. Great for couples.

My thoughts…. I am happy that the CR2s are shrinking and that number will continue to shrink through Feb 2018 I believe. Plus Skywest/Expressjet wants to get rid of their CR2s and AA has handful of them, so this is positive (I suspect on a macro level most will be replaced with Envoy E175s).

Not too excited about E140s coming back, but they are still better than the CR2s.

I am a little concerned about the Dash retirement… Some markets will lose flights and those have been fantastic for short hop flights like MDT-PHL where it would be too costly to operate a 50 seater for a short flight. I think the retirement of the Dashs is bad news in general and wouldn’t view this one as a positive.

Overall, I agree this plan is more positive than negative

“What they have done is correct within corporate tax law and under financial accounting standards.” doesn’t in ANY way negate (or even *slightly* diminish) Gary’s excellent perspective on this issue.

149 wide body planes, wow.

I hope we can start to really see some expanded non-stop destinations in Europe with those frames.

@Econometrics – while 149 is impressive, unfortunately the frames are not exactly utilized as efficiently (i.e. Significant DFW-Asia ops) as they could be…

UA will end the 4Q with roughly 175 frames (excluding 757s which UA has more than AA) and their international route network is much more comprehensive primarily thanks to a relatively efficient connecting+O/D hub network. SFO for TPAC ops and EWR for Europe ops, IAH for LATAM ops with IAD/ORD/LAX focusing more on O/D traffic with some connecting support.

AA’s JFK hub is unfortunately weak domestically despite having many EU destinations which limits flow of connecting traffic. LAX is constrained and does not have the same domestic connecting network that UA has in SFO which forces AA to also have significant Asia/Europe operations from DFW and spreading connecting EU ops thin among ORD/MIA/CLT/PHL/DFW which limits the number of turns a given aircraft can deliver.

I do wish AA had a more efficient international network, but as long as JFK (slots), PHL (airfield), LAX (multitude of issues) and ORD (gates) are constrained they are pretty much stuck with a relatively fragmented international hub operation. DFW is the only hub right now that has virtually unlimited room to support growth with the necessary O/D support. Until then, AA will need to serve the same destination from multiple airports to provide the appropriate connecting coverage and cherry pick which hub for destinations that can only support one flight (i.e. PHL-LIS, JFK-ZRH, DFW-ICN, etc.)

<>

Not “their” but “they’re,” the contraction for “they are.”

‘On the one hand their premium seat-heavy’

“They’re” not “their.”

You don’t mention the lack of seat-back screens on the MAX. Have they come to their sense and are actually putting her in (as in a modern fleet)?

I’ll miss the MD 80s. They are like getting in your grandma’s old Buick wagon. Big old plush leather with leg room. So what, you don’t have any 8-tracks to play and the doors squeak a bit. It’s worth it. Heck Grandma even let’s you sit up front fairly often and you can make fun of your naive brothers and sisters stuck 3 across in the rear jump seat.

@Adam – nope.

U people need to Get Over the Seatback Video BS already….. If You need it so badly fly Delta or JetBlue….. the whining is ridiculous. it’s Transportation for damn sakes!