How much are miles worth by airline, hotel and credit card program? Miles used to be thought to be worth 2 cents. I think that conventional wisdom developed out of the idea that a cross country flight cost about $500… or 25,000 miles. 20 years ago that was generally true, and award availability wasn’t really a problem either.

That was long before:

- Airline alliances opened up huge possibilities for miles.

- Mileage programs increased the cost of many awards.

- Awards became tougher to get with flights full.

Plus the 2 cent number probably wasn’t ever a true value of miles to begin with.

Many different folks have taken a stab at how much miles are worth. For this post I’m not going to give you a single number. I’m going to share my own rough and ready number for several different programs. And I’m going to explain how I think about the value of miles — why they are different for different people, and for different circumstances of how you plan to use them.

I haven’t published updated valuations in over a year so it seemed like a good time to look at the value of miles. Plenty has changed affect the value of the underlying currencies since I looked at this last. For instance,

- Awards on American Airlines flights have gotten even tougher to book (availability)

- United’s routing rules have tightened up

- Several Delta award chart devaluations and then increasing the price of partner awards… a lot

- Singapore Airlines no longer gives a 15% discount for booking online, and raised the price of Singapore-only saver awards, while eliminating fuel surcharges

- Citi Prestige’s ability to redeem points for American Airlines tickets at a premium goes away in late July

- Marriott points now transfer back and forth to Starwood (1:3), and Virgin America points move to Alaska (1:1.3)

How to Think About How Much are Miles Worth

Here’s how to think about how much are miles worth by airline, hotel and credit card program.

It depends on how you redeem them. What value are you going to get for your points? The important thing here is not to use the retail price of a ticket you’re getting, since

- with premium cabin rewards you might not have been willing to spend that much cash.

- Frequent flyer tickets aren’t necessarily worth as much as a paid ticket. They don’t earn miles. They may not be upgradeable. And you can’t necessarily just pick whatever flight you want, you have to be flexible and worry about award availability.

It depends on when you’re going to redeem them. You don’t earn a rate of return on miles and points like you might with cash in a bank or investment account. And you need to discount to present value if you’re going to use the points later. Plus there’s substantial risk of devaluation with many points currencies.

It depends on how many you already have. The value of points at the margin is different than an overall average value. As you approach having enough points for an award, the marginal value of a few more points goes up substantially — since those extra points are what make the award possible. On the other hand, once you have more points than you’ll redeem in the near-term the value of additional points falls since you may not ever use them, or may not use them under current award charts.

The value of a mile is the amount at which you are indifferent to holding miles versus cash.

If a mile is ‘worth’ 2 cents you should be equally happy with a mile or two pennies, if you’re offered a mile at a price of 1.9 cents you would be a buyer — you’d consider yourself to be earning a 5% margin.

Put another way, when we put a charge on a credit card, that doesn’t earn any bonuses (it earns 1 mile per dollar spent), we’re effectively buying that mile for 2 cents since the opportunity cost is putting the charge on a 2% cash back card. You’re revealing a preference through your behavior that you believe the mile is worth two cents.

Here Are the Valuations

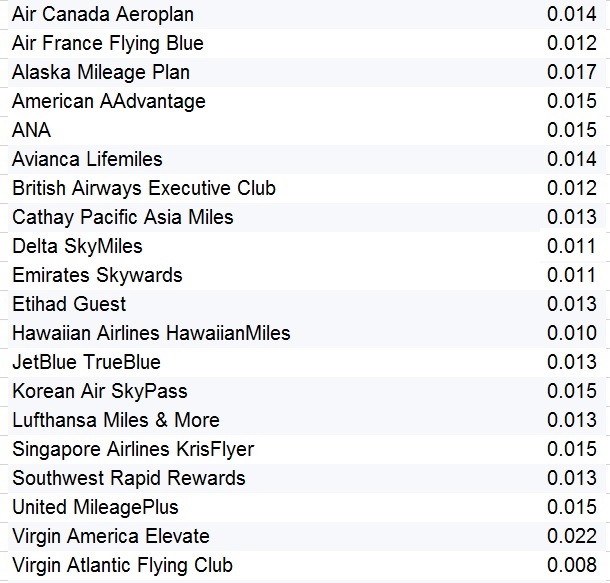

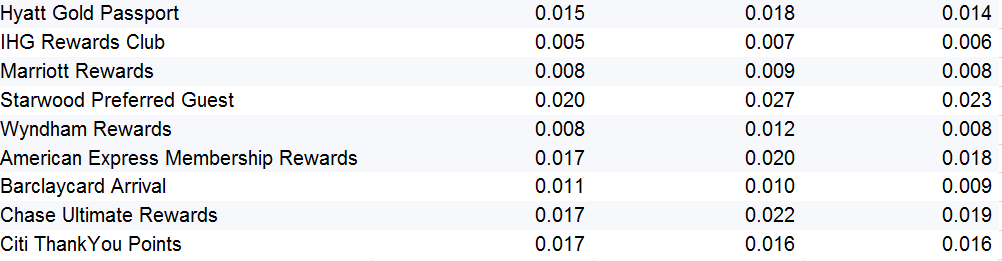

Airline Frequent Flyer Miles:

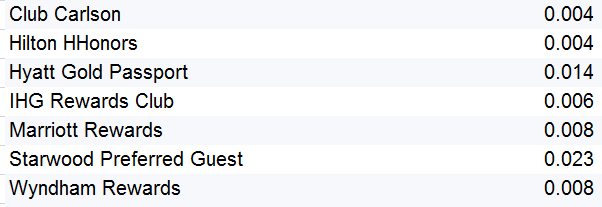

Hotel Points:

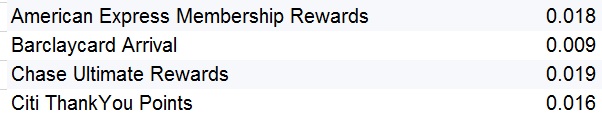

Bank Points:

The most valuable points, at the top of my currency list, are transferrable points. That means Starwood, American Express, and Chase points. You can transfer those into a variety of programs. Earning those gives you tremendous flexibility and optionality.

I value Chase points higher than Amex points because of their specific partners, such as United (no fuel surcharges) and Korean (great first class availability, great value award chart) as well as Hyatt (the only really good value hotel transfer partner). I love Citi points but their best partners are duplicated elsewhere (Singapore, Air France, Etihad).

You’ll see I don’t value a Barclaycard point at a full penny, even though you can redeem points for one cent towards airfare and the Arrival+ card even gives you a 5% rebate on those redemptions. That’s a function of the discounts I take relative to cash, and for currency risk (they’ve devalued before).

A single Virgin America Elevate point is the most valuable airline mile, but their points-earning and redemption tables are somewhat deflated. At this point the value is driven by transfers to Alaska Airlines at 1-to-1.3.

How to Use These Valuations

Since valuation here is the amount at which you are indifferent to holding miles versus cash this figure is useful for:

- Comparing when to spend miles or cash. Should I spend 50,000 miles for an award ticket or $700?

- Comparing when to spend on airline’s miles versus another for the same award. Should I spend 25,000 United miles or 35,000 Delta miles?

- Comparing the value of different credit card signup bonuses. Is an 80,000 point offer from Marriott better than a 75,000 point offer from Hilton? In fact, I view a 50,000 point offer from Chase Sapphire Preferred better than both (and that’s without the 5000 extra points for adding an authorized user to the account).

- Determining which hotel chain offers the better value reward when you’re considering staying at two different hotels. Should you spend 12,000 Starwood points or 35,000 Hilton points?

- Deciding whether to buy points when there’s a big bonus promotion.

- Figuring out how much extra you might be willing to spend to earn points through a bonus promotion, or figure out whether a hotel promotion should influence your decision about where to stay

But since the value of miles isn’t precise I won’t actually pay 1.5 cents for an American mile. I want to accumulate American miles when they’re substantially less costly than 1.5 cents apiece. And I know I am clearly not a buyer at 2.5 cents.

In practice these are fairly blunt tools that tell me “1 cent a point for American miles is a really good deal” but that I’m not going to spend 2 cents unless there’s a very specific scenario — like a few points at the margin to top off an account for an award I’ve put on hold — where it makes sense (and in that scenario, my valuation of each point is higher since they’re helping me to save with a real redemption).

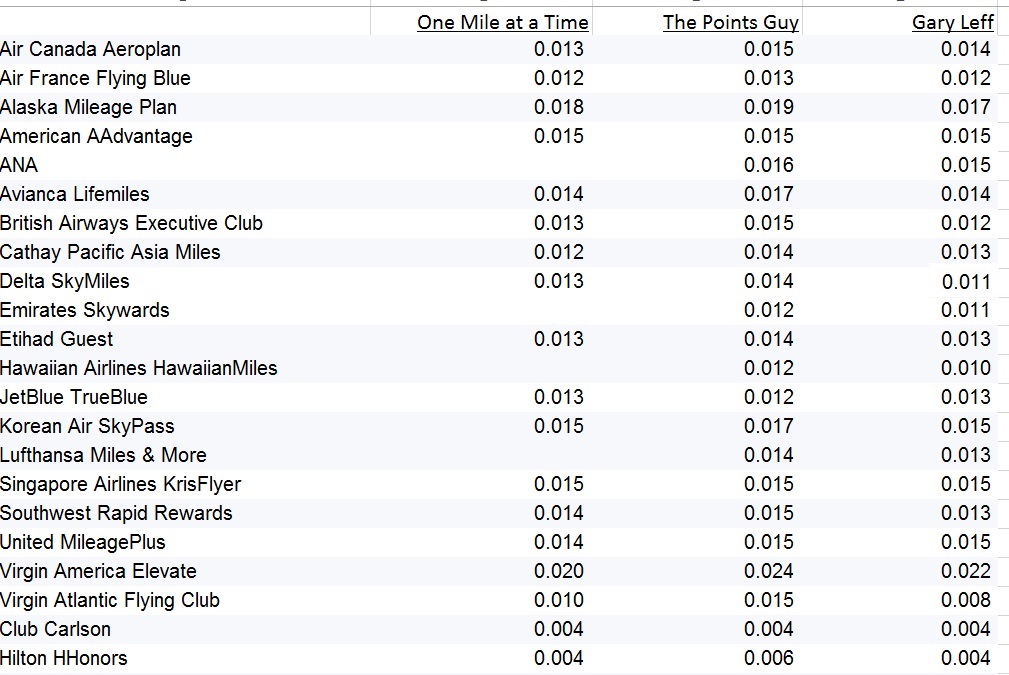

How My Valuations Compare to Others

I thought it would be interesting to compare side-by-side how One Mile at a Time and how The Points Guy value miles in comparison to my valuations.

How Do You Value Your Miles?

What is your value of miles and points by airline, hotel and credit card program? How much are miles worth?

Let me know if you think I’m off base on any of my valuations and make your case between me, Lucky, and Brian Kelly for whose valuations are most reasonable.

@Sam is DEAD ON. The valuation of these miles depends so much on perceived value, which is based almost entirely on retail price. Also, many of them assume saver availability, which is getting very tough to come by.

Also @Gary, Singapore undergoes at minimum 15% devaluation since your last exercise and you dropped the points valuation by .001 cents. Come on.

To me the value of anything is the amount I would pay to acquire it or the amount I would receive if I sold it. Too bad there is no market (that I know of) for points and miles. That would eliminate all doubt.

There is a lot of hard work and thought in the charts of points values. I do not see how these calculations are made, however. Even if the charts are not a measure of absolute value for everyone they are very helpful in making a relative ranking among programs.

Since the issuers of these points and miles can devalue or eliminate them at any time for any reason without notice, putting any real value on them seems suspect.

“”…in coming up WITH the listed …”

“… do a number OF paired dummy…” etc…

Get DISQUS with the ability to edit comments like some other BA blogs!

“…in coming up WITH the listed …”

“… do a number OF paired dummy…” etc…

Get DISQUS with the ability to edit comments like some other BA blogs!

“…in coming up WITH the listed …”; “… do a number OF paired dummy…” etc…

The ability to edit comments would be nice

Thought comments were not posting because I was not seeing them so I posted slight variants, then I remembered this weird feature (should be fixed too) of starting a new comments page while leaving the commenter on the prior page.

Please delete one of the triplicates and this one. Thx.

@Sean the scope of our disagreement — to which you say “come on” — is that I valued SQ miles at $0.016 before, and $0.015 now while the 15% reduction you call for would be $0.014. So our difference is 1/10th of 1 cent.

However it’s Singapore-only awards that have devalued by 15%, there’s not been a change to other awards. So I disagree with you here… I don’t think the entire program has been devalued by 15%, just one of the award types. Hence the reduction in value I chose.

@Chris, I didn’t see anyone else responding to you, so I’ll take a crack at it. The reason transferrable points are more valuable is that you have the chance to use them to create more awards in ideal scenarios. Gary developed the idea that the next points become worth much more when they approach the level needed for a given award. Say you’re short 5,000 Singapore miles for an award (or 8,000 Aeroplan miles, or 6,000 United miles, 11,000 Flying Blue, or whatever). You can strategically target those transferrable points to the right program at the right time to maximize your opportunity to get the highest value awards and, secondarily, to avoid maintaining unusable leftover balances in accounts. For example, not long ago I saw a possible good value redemption for the exact date and destination I wanted, but I was short on points I needed in that program. I was able to transfer the exact number of MR points needed, getting excellent value from those points, and leaving me with a zero balance in the airline program afterwards. On that day my MR points were worth far more to me than points in any non transferable program could have been. Now it’s true that many people always transfer points to the same partner without regard to strategic choice and timing, and in that case they are worth no more than the value of the points of that partner.

Gary, you value a lot of these airline points at 1.5 cents or less. Because Sapphire Reserve cardholders can book flights with Chase points at 1.5 cents through the Chase travel portal and earn status/points on those bookings, as a general rule, and assuming no other higher value use for the Chase points, are a lot of these rewards programs essentially terrible deals to transfer points into? (With the understanding that specific flights in these programs may yield a higher value than the average)

@Dan that doesn’t mean I won’t get more than 1.5 cents per point in value from my points, in fact I’ll only redeem those airline miles when I do. As I explain above, this valuation is the point at which I’m indifferent between holding cash and holding miles.

Gary, call me naive but I still hold to the miles until I can cash them for the equivalent of 2 cts a mile (certainly on domestic flights)

Exception is when cashing for expensive trip for the family, then might go for 1.5 cts or when clearing an account with small leftover balance

Just cashed 15,000 avios for 2x domestic flights that would have cost total 180 usd….but wanted to clear the last miles on BA

Also just managed to get 4 tickets saver award economy on AA to singapore and returning from japan, so cashed at about 1.3 cts, and only had to “compromise” on the outbound route (yvr to dfw to nrt to sin) as opposed to yvr-nrt-sin but again, raided the AA account of 300k as dumped AA for this year onwards

Great article and happy it assures me of my strategy of switching to alaska

As based in YVR can take alaska almost anywhere domestic, or aeromexico going south for work or alaska + latam also going south connecting in LAX or DFW

Gary I also think people need to consider how much it cost them to acquire the miles when placing value

If all the miles someone gets are for travel paid by employer, then they are in my opinion more valuable than for example chase, tat you need to spend money to get them, even if it is money you would spend anyway…

tks for article

Should your valuations of starwood and Marriott points follow the 1:3 ratio? Right now it’s off a tad even though it’s free to transfer back and forth. I personally value SPG at 2.1 and Marriott at .07. Ish.

There are so many functions that you cannot find in excel that impact the value of a point. The route or destination and is it available, the ease of earning, the ease of redemption.

British points as an example if you want to fly lax to Hawaii in non summer months is available is a great value at 25k points and is easy to redeem. But if you always use the sweet spot to calculate value of a point like it seems tpg does then a significant number of people are disappointed at redemption time.

I switched to valuing hotel points over airline points about 10 years ago. I find them easier to earn and simpler to redeem. Also hotels still treat travelers with respect unlike the airlines. Plus the value of a point is fairly consistent in a range.

I used to play every angel for airline points. But then the bottom fell out and the availability dried up on routes I wanted to travel and the games just became exhausting instead of fun. I dread earning most airline points these days so I apply a negative value especially to the big 3. Simple programs like southwest are so much more attractive to me these days.

Gary what about the fact that several of the programs have flexibility in allowing free or cheap cancellations that otherwise don’t exist on certain fair classes of paid tickets?

All of this nonsense aside, the valuations are important ***to me*** as a guidepost: I certainly won’t redeem my points for LESS than the posted “value” of the points, and — obviously — want to redeem them (and often do) for more . . . sometimes significantly more.

In the FWIW Mode, my wife and I are traveling to Europe this Fall. So far, I’m saved $8.5k by burning some 435,000 points. Whether it’s Starwood, Hilton, Virgin America, Alaska, JetBlue, Citi, Chase, or Amex points, the combined average valuation of the points I used worked out to be 1.4¢. The weighted average of the value I received is double that. Actual valuations ranged from 1.1¢ (with Hilton) to 15.5¢ (with Virgin). So far, so good . . . and that doesn’t even include the money saved with 4th Night Free benefits through Citi Prestige . . . .

Hmm… general trend is that TPG has the highest valuation. Either he’s that much better at maximizing value… or he overinflates their value to promote his links. “Get $2K value by clicking this link!” Almost every blogger overvalues these points. It’s hard to calculate the cost of (lost) flexibility in award bookings rather than just paying cash. Also, I see nobody ever accounts for miles not earned by paying cash.

I think you also need to calculate how you earn your miles. Getting triple from Chase Sapphire Reserve for travel means these miles are worth more as you accumulate faster than a 1$ to 1 mile, Having a few cards and being careful what card I use for the transaction has increased the value of a mile if comparing to a 1 to 1 ratio.

Gary, this is a great article. Thanks for taking the time and providing this information. Hopefully, you’ve had a chance to try Opies BBQ in Spicewood now that you’re an Austinite. Kristy is the owner, tell her Miles and Andy sent you.

Hi Gary

Declaring that I work for AccorHotels, I would be keen to understand what you would value Le Club AccorHotels points at given it is a revenue based program with 2000 points being valued at Euro40 when redeeming in Hotels

I just got over 5c value for 5 nights at the Sheraton Salzburg. I am here in Europe on tickets i got for over 3c value. Business class for 2, from Hawaii to Amsterdam on Delta for 70,000 ea and from London to a small town in the western US on American for 62,500 ea. Value well over $4000.

Since I’ve had good luck with redemptions, I hold out for fairly high value. For instance, there was a recent sale so i got a RT to London for $2400 plus a few hundred in repositioning. I paid that instead of using points. (Plus I want the MQM’s.)

That said, now that I have built my points balance up quite a bit (especially now that we FINALLY got approved for CSR and are earning 3x on all travel), i am using my 3% cash back card instead of Freedom at 1.5x UR. There are only so many times you can use points at a very high value. So it’s a balance.

So I guess the new Southwest promotion to buy the max 84,000 (60,000 + 24,000 bonus) for $1,650 is no bargain since that equates to $0.019643/point. Thanks for your info!

Cindi Anderson said, “I just got over 5c value for 5 nights at the Sheraton Salzburg.”

But Cindi, would you have really spent $600/night (12,000 x 0.05) to stay there?

The other half of how to value FF miles that Gary only lightly alluded to is really “How much cash would I be willing to spend for this redemption?”

For example, I cannot fathom valuing SPG points at 2.3 cents per point, because I cringe at spending more than about $70 for any given hotel and absolutely refuse (as in, I’ll stay outside the city or change my plans entirely) to spend more than $100 per night (yes, I’m a budget traveler–it allows me to travel more and not go into bankruptcy). So to me, that Category 5 redemption of 12,000 points per night is worth at most $100 per night…making that redemption worth 0.83 cents per point. I very rarely find Starriott/Hyatt/Hilton/IHG rates below those figures, not to mention award redemption opportunities that are in line with my budget, hence why I really don’t participate in those programs (aside from IHG when a particularly lucrative Accelerate promo comes along) and instead focus my stays on Choice and Wyndham.

When it comes to air travel, my comfort level for spending cash hovers around the $375 round trip mark (less is ideal, of course, but above that point I start looking at either redeeming miles or changing my plans). That pegs my valuation of most of the domestic legacy FF programs to around 1.5 cents per mile. Assuming (as on Alaska) that a typical transcon round-trip earns about 6,000 miles worth about $90, that actually lowers the value to about 1.15 cents per point (I usually round up to 1.2).

My point is that you can only value a particular redemption at what you’d be willing to spend for it in cash, and that sort of serves as a guide to how much you actually value miles. If you’ve done well in life and are happy to spend $300 a night on a hotel, more power to you, and go ahead and value your redemption accordingly. But I’m certainly not willing to spend $20,000 on an international first-class ticket–heck, I’m not even willing to spend $5,000 for it or even $2,000 for a J ticket, so I have no right to say that I value my miles at 14 cents apiece because I redeemed them for a ticket worth $20,000.

@jackal —>. First of all, you’re replying to a comment made in June of LAST YEAR — relating to an article posted in APRIL of LAST YEAR…19 months ago. That was before the Marriott/Starwood merger. The value “assigned” by Marriott to SPG’s Starpoints was 2.7¢/point, or 3x the value of Marriott Rewards points, and “Marriwood” converted each Starpoint into 3 Marriott points (0.9¢ x 3 = 2.7¢).

Secondly, while under the old SPG system, I’ll admit I didn’t quite make Cindi Anderson’s 5¢/point redemption, I have received up to 4.2¢/point when redeeming my Starpoints for free nights at SPG properties…HOWEVER, as I write this, I am sitting on the couch in my 1,600 square foot suite at the Westin Canal Place in New Orleans, overlooking the Mississippi River…I reserved a room at this hotel with Starpoints @ 10,000 points/night for four nights (11/7-11/2018). When we arrived, we were upgraded to this suite. If I had to pay cash for this suite, it would have cost a total of $4,418.12. And you are correct, I *never* would have paid for this room, but that honestly doesn’t matter — I’m here. Thus, the redemption value I received for my 40,000 points comes to 11¢/point (versus the stated value of 2.7¢ each). Even without the upgrade, my redemption value was 4.0¢/point — nearly 150% of the stated value.

Now, as to not spending more than $75-100/night…if you can find rooms for that price where I live, and in a hotel you’d actually want to stay in, more power to you. Even a Motel 6 (which is at least clean, and they’ll leave the lights on for you) is more than $100…and the same goes for airfare — hard to find a flight to Europe or Asia for <$350 r/t (incl. taxes and fees). It's not totally impossible, I suppose, but on such a long-haul flight, I prefer a more comfortable seat.

I wouldn't pay $20k to fly anywhere, regardless of class or destination in travel, and there aren't many people who would. (Certainly there are some, but I think even you'd agree that those individuals are few and far between.). In regard to international travel, I do not pay cash for F or J, period. I will pay cash for PE or for Y, if the redemption rate is poor, but in the past — let's say 18 years (the length of time I've been with my wife) — But I have received redemption values of up to $1.17/point¹ on VX flying in F from SFO-JFK; on the return leg, I received a value of just under 50¢/point² flying Mint on jetBlue. Internationally in J, I've earned of up to 3.9¢/point on my redemptions…

_______________

¹ Admittedly that outsized value includes a sign-up bonus from a credit card, but even without that, the redemption rate came to 4.1¢/point, IIRC.

² That rate was made possible by jetBlue matching my point total on VX (well, up to 75k, anyway). Without those points, I wouldn't have flown in Mint…indeed, probably wouldn't have flown jetBlue, period, but would have redeemed more points to fly VX…

jackal Actually yes, in that case I would have paid $600. Sometimes we like suites and that’s what it costs in an expensive city. But your point is good. I usually use $4000 RT as my cash amount for a business class ticket to Europe when calculating my points value, even though the flight often prices out at over $10,000. Because I’d never pay more than $4000.

Unfortunately I have previously purchased a lot of IHG points at half a cent. However when I try to use them at different places that I want to stay in, the best room rates are always better than paying that amount in points.

Eg: This week I tried Cartagena for November. Intercontinental $123, or 35,000 points ($175), or Holiday Inn Express $73, or 25,000 points ($125). And you can’t choose the room or bed size.

I feel ripped off every time I try to use my IHG points.

How can you value them at 1/2 a cent?