How much are miles worth by airline, hotel and credit card program? Miles used to be thought to be worth 2 cents. I think that conventional wisdom developed out of the idea that a cross country flight cost about $500… or 25,000 miles. 20 years ago that was generally true, and award availability wasn’t really a problem either.

That was long before:

- Airline alliances opened up huge possibilities for miles.

- Mileage programs increased the cost of many awards.

- Awards became tougher to get with flights full.

Plus the 2 cent number probably wasn’t ever a true value of miles to begin with.

Many different folks have taken a stab at how much miles are worth. For this post I’m not going to give you a single number. I’m going to share my own rough and ready number for several different programs. And I’m going to explain how I think about the value of miles — why they are different for different people, and for different circumstances of how you plan to use them.

I haven’t published updated valuations in over a year so it seemed like a good time to look at the value of miles. Plenty has changed affect the value of the underlying currencies since I looked at this last. For instance,

- Awards on American Airlines flights have gotten even tougher to book (availability)

- United’s routing rules have tightened up

- Several Delta award chart devaluations and then increasing the price of partner awards… a lot

- Singapore Airlines no longer gives a 15% discount for booking online, and raised the price of Singapore-only saver awards, while eliminating fuel surcharges

- Citi Prestige’s ability to redeem points for American Airlines tickets at a premium goes away in late July

- Marriott points now transfer back and forth to Starwood (1:3), and Virgin America points move to Alaska (1:1.3)

How to Think About How Much are Miles Worth

Here’s how to think about how much are miles worth by airline, hotel and credit card program.

It depends on how you redeem them. What value are you going to get for your points? The important thing here is not to use the retail price of a ticket you’re getting, since

- with premium cabin rewards you might not have been willing to spend that much cash.

- Frequent flyer tickets aren’t necessarily worth as much as a paid ticket. They don’t earn miles. They may not be upgradeable. And you can’t necessarily just pick whatever flight you want, you have to be flexible and worry about award availability.

It depends on when you’re going to redeem them. You don’t earn a rate of return on miles and points like you might with cash in a bank or investment account. And you need to discount to present value if you’re going to use the points later. Plus there’s substantial risk of devaluation with many points currencies.

It depends on how many you already have. The value of points at the margin is different than an overall average value. As you approach having enough points for an award, the marginal value of a few more points goes up substantially — since those extra points are what make the award possible. On the other hand, once you have more points than you’ll redeem in the near-term the value of additional points falls since you may not ever use them, or may not use them under current award charts.

The value of a mile is the amount at which you are indifferent to holding miles versus cash.

If a mile is ‘worth’ 2 cents you should be equally happy with a mile or two pennies, if you’re offered a mile at a price of 1.9 cents you would be a buyer — you’d consider yourself to be earning a 5% margin.

Put another way, when we put a charge on a credit card, that doesn’t earn any bonuses (it earns 1 mile per dollar spent), we’re effectively buying that mile for 2 cents since the opportunity cost is putting the charge on a 2% cash back card. You’re revealing a preference through your behavior that you believe the mile is worth two cents.

Here Are the Valuations

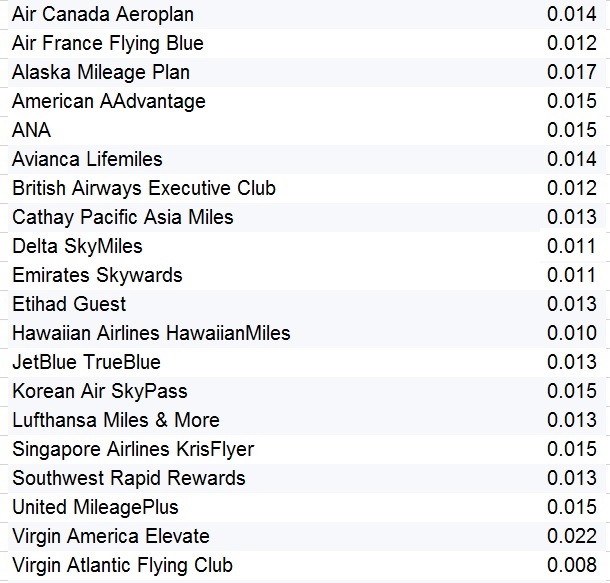

Airline Frequent Flyer Miles:

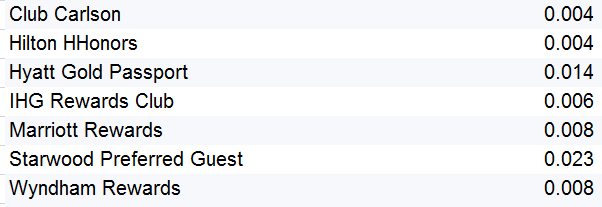

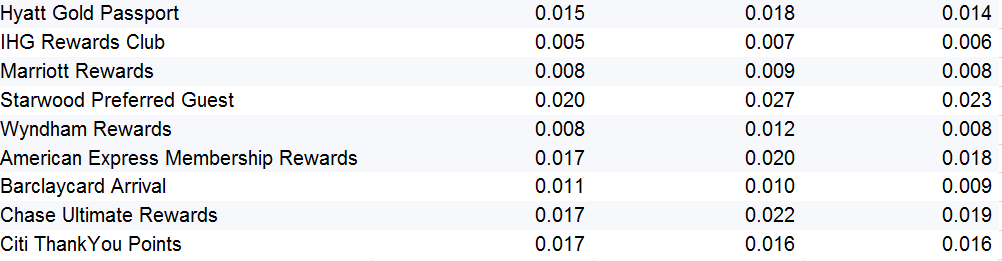

Hotel Points:

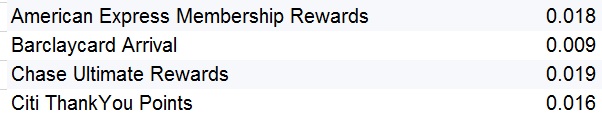

Bank Points:

The most valuable points, at the top of my currency list, are transferrable points. That means Starwood, American Express, and Chase points. You can transfer those into a variety of programs. Earning those gives you tremendous flexibility and optionality.

I value Chase points higher than Amex points because of their specific partners, such as United (no fuel surcharges) and Korean (great first class availability, great value award chart) as well as Hyatt (the only really good value hotel transfer partner). I love Citi points but their best partners are duplicated elsewhere (Singapore, Air France, Etihad).

You’ll see I don’t value a Barclaycard point at a full penny, even though you can redeem points for one cent towards airfare and the Arrival+ card even gives you a 5% rebate on those redemptions. That’s a function of the discounts I take relative to cash, and for currency risk (they’ve devalued before).

A single Virgin America Elevate point is the most valuable airline mile, but their points-earning and redemption tables are somewhat deflated. At this point the value is driven by transfers to Alaska Airlines at 1-to-1.3.

How to Use These Valuations

Since valuation here is the amount at which you are indifferent to holding miles versus cash this figure is useful for:

- Comparing when to spend miles or cash. Should I spend 50,000 miles for an award ticket or $700?

- Comparing when to spend on airline’s miles versus another for the same award. Should I spend 25,000 United miles or 35,000 Delta miles?

- Comparing the value of different credit card signup bonuses. Is an 80,000 point offer from Marriott better than a 75,000 point offer from Hilton? In fact, I view a 50,000 point offer from Chase Sapphire Preferred better than both (and that’s without the 5000 extra points for adding an authorized user to the account).

- Determining which hotel chain offers the better value reward when you’re considering staying at two different hotels. Should you spend 12,000 Starwood points or 35,000 Hilton points?

- Deciding whether to buy points when there’s a big bonus promotion.

- Figuring out how much extra you might be willing to spend to earn points through a bonus promotion, or figure out whether a hotel promotion should influence your decision about where to stay

But since the value of miles isn’t precise I won’t actually pay 1.5 cents for an American mile. I want to accumulate American miles when they’re substantially less costly than 1.5 cents apiece. And I know I am clearly not a buyer at 2.5 cents.

In practice these are fairly blunt tools that tell me “1 cent a point for American miles is a really good deal” but that I’m not going to spend 2 cents unless there’s a very specific scenario — like a few points at the margin to top off an account for an award I’ve put on hold — where it makes sense (and in that scenario, my valuation of each point is higher since they’re helping me to save with a real redemption).

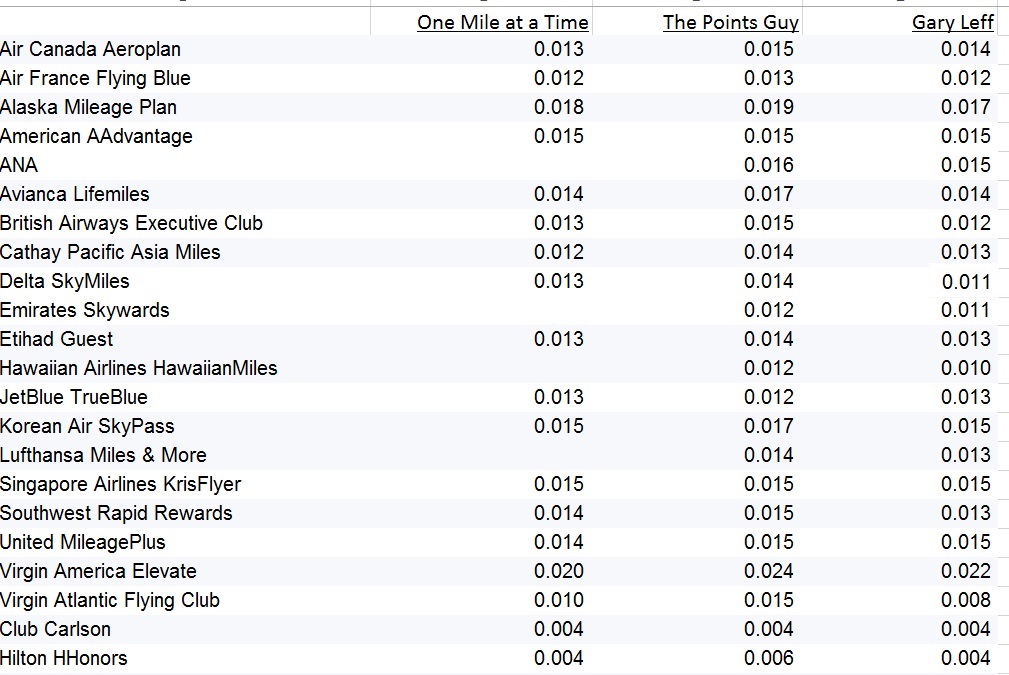

How My Valuations Compare to Others

I thought it would be interesting to compare side-by-side how One Mile at a Time and how The Points Guy value miles in comparison to my valuations.

How Do You Value Your Miles?

What is your value of miles and points by airline, hotel and credit card program? How much are miles worth?

Let me know if you think I’m off base on any of my valuations and make your case between me, Lucky, and Brian Kelly for whose valuations are most reasonable.

So true about the value at the margin vs. overall value. I know you get outsize value out of premium redemptions (but harder and harder, and less options) , as do I, but if it wasn’t for signup bonuses on cards, it seems like more and more of us should just focus on a 2% cash rebate card.

It seems like your valuations for airline miles decreased, so shouldn’t the SPG points? 2.3 seems a touch high if the premium over a Hyatt point is due to transferability of the miles.

Seems like AX points have a floor of .02 if you have the Business Platinum card, no?

@Richard – I disagree for several reasons.

1. Points you can use on paid airfare aren’t as valuable as cash

2. American Express can change the rules

3. Amex Travel doesn’t always see all flights online, if you call you’re paying a phone booking fee

4. You have to have all the points up front and get a 50% rebate, that’s not the same as using each point at 2 cents of value

@beachfan Delta and American decreased for instance but I wasn’t ever valuing Starpoints based on those transfers (and certainly not on United, since that was 1:2). If I value Marriott points at $.0075 each (rounds up in the spreadsheet to 0.008) then a Starpoint is worth 3 Marriott points, or $0.0225. I get that ought to round down but $0.0075 is not precise either.

Your Hyatt point valuation seems low considering that you typically don’t have to pay taxes or resort fees when redeeming points for rewards.

I’m a big fan of Southwest, but I dont’ fly internationally that much. I value their points because I like to get to 110K/yr for their companion pass. So, that’s my #1 priority (and they are expanding internationally). Furthermore, with 2 kids in college I can use my points to speculatively book multiple flights to and from and then cancel when they know their schedule. No charge to do so even if you’re not an elite with them.

@ Gary

Thanks. In the days when American was worth 1.8 cents per mile, then it seemed like it tied in to the airline transfer.

Great post Gary. I tend to agree for the most part with your value. Thanks for comparing with others, especially as the Points Guy is way off in several programs.

Its unfortunate that miles have devalued, and I might argue that all the points are worth slightly less then your values as well, because the points you are holding MAY devalue again before you actually get to redeem them. Knowing they are moving downward in the future should be a slight lower value calculation perhaps.

As an example, I had been holding onto Delta points to redeem for a Virgin Atlantic flight just this week. The flight came up on Tuesday this week and when I went to book, the Delta changed its Virgin redemption from 140K to 170K

Probably the most accurate and gives a good picture of the state of airline miles. If TPG wants to trade me 1 United mile for each 1.1 Delta mile I’d gladly take that offer.

I also think that UR points are significantly more valuable than MR and TY but I have difficulty poking specific holes in the valuations based on how they could theoretically be used. That’s just not how I end up redeeming them – as you said, values are personal.

I argue that miles and points have no value at all until you redeem them.

The valuations shown here can be a starting point, but the ‘value’ of miles and points is relatively meaningless, irrespective of a redemption value. There is only ‘potential value’.

You and Lucky and Brian may use your Hyatt or Hilton points for the Maldives and get a relatively high valuation for your travel. I have never considered using my points for resorts in Maldives, so it does not matter to me if there is great points value there. I have no interest in going there.

My hotel travel comes down to which promotions are currently available and comparing the cost of a hotel night and points I can earn with a paid stay to the cost for a hotel reward.

On my current trip in the Lithuania, I was able to redeem 13,500 Club Carlson points for a Business Class room in Kaunas Lithuania with a 141 EUR room rate. My redemption value is over $0.010/point compared to your .004/point. The last time I made a Club Carlson redemption at .004 was Oslo, Norway in 2013.

In January, when Club Carlson had the 50,000 bonus points offer for 8 nights, I earned 70,000 points for $470 with hotel stays in Amsterdam, Prague and Wroclaw. I earned 70,000 Club Carlson points at .00672 per point, while staying 8 nights in hotels I needed for my trip.

The redemption cost for those hotel nights would have been 176,000 Amsterdam Park Plaza Vondelpark, 56,000 Radisson Blu Wroclaw, Poland and 56,000 points Park Inn Prague for 288,000 points. By your valuations = $1,152.00 in Club Carlson points value.

On my current trip to Europe, I redeemed 43,500 Club Carlson points for 3 hotel nights in Lithuania. So far, I stayed 11 hotel nights with Club Carlson in past 10 weeks for $470 and I still have another 26,500 Club Carlson points to redeem from points earned during those stays.

The comparison I make for the value of my points is to other lodging options available for the place and dates I travel without regard to hotel points. There are plenty of Airbnb or local independent hotel options. Loyalty programs save me time by automatically narrowing down my field of options. I always consider other options, but generally I find the better value playing the loyalty cards.

Wyndham Rewards – Daily Getaways are selling 15,000 Wyndham Rewards points next week for $175. I doubt they will sell out at that price. Only TPG shows a value of $12/1,000 points ($180/15,000).

For me, that price is still a good deal. I stayed at the 5-star Ramada Vilnius earlier this week for 3,000 points + 62EUR when room rates were 141 EUR. There are far cheaper options in Vilnius, Lithuania, but I had been to the Ramada Vilnius hotel before and knew it was a great value. I saved $84 with my 3,000 points. And it would have been hard to find a comparable location and room quality for 62 EUR or even 98 EUR in Vilnius for that date. My next Wyndham hotel stay this week will earn 3,000 points for $60, with a net result of buying 3 hotel nights I need for this trip in the Baltic countries at high rated hotels for a total $126. I will get back the 3,000 points I redeemed for Ramada Vilnius on my next low cost hotel stay.

Hotel points and frequent flyer miles have no value to me until I redeem them.

I know that from experience having lost upwards of 500,000 frequent flyer miles over the past 20 years when programs went out of business or miles expired before I redeemed my accumulated miles.

I think one of the key aspects is that value can change based on status. Avios arr worth more to a EC Gold member with a joker, Aeroplan miles are definitely worth more to a SE, same for for UA GS and many more I’m sure.

I would love to sell my point for these prices. If only they weren’t a product of your imagination.

Are the banks paying the Points Guy to produce such high valuations?

Where do you put Qatar airways privilege club miles?

If in fact you believe these are accurate valuations, then most people would be better off using a 2%+ cash back card for their everyday non-bonus spending. The exception would appear to be SPG Amex, but of course Amex is not accepted everywhere.

The charts are also useful for determining which program to credit, particularly in situations where you don’t have elite status bonuses. For example, I had a recent OW flight on Cathay that I could credit to BA or AA (I don’t have a CX account) – the chart suggests that AA was the better choice.

I found it difficult to spend my Citi Thank You points at a value > 1 cent on hotels in Asia. First of all, when you book through the Thank You portal the prices are inflated 20-30% or more over the booking.com price and airfare was often even more inflated for Vietnam Air and others. Secondly, it’s often unclear which room you’ll get since the names do not coincide with the hotels’ website room names. Thirdly, on more than one occasion I arrived at a hotel with my printed Thank You reservation and they had no reservation for me and no idea who Thank You was. Citi Thank You books through multiple unnamed consolidators and middlemen and it takes forever to straighten out and they won’t tell you who they deal with to actually make the reservation so I look like an idiot telling the hotel that I don’t know if it was getaroom or expedia or some other 4th or 5th party. On the flip-side, I did get a lot of really cheap rooms in SE Asia for free with Thank You points, but at a valuation of less than a cent.

Awesome post, Gary. Especially love the comparison between you, OMAAT, and Points Guy, who is either high or being paid off by all the CC companies etc. Although the value of points is clearly debatable, I would typically use this chart and go with whoever has the LOWEST value for each, so as to avoid overestimating what one’s points are worth.

Another big problem with holding pts vs cash, is that you cannot do anything with the points while you are holding them, like earn interest on them or invest them.

Actually, Gary, now that you’ve (conveniently) posted what all three sites considered values, I just use an average of all three . . .

I agree with most of what you’ve said above, ESPECIALLY with the advantages that come with transferable points. But just toss in my own 2¢ (or 1.33 Kris Flyer miles), the value of SPG Starpoints seems high — ONLY in that they are impossible to transfer and retain value, even with the 5k bonus one gets with every 20k transfer; the value is probably spot on when redeemed at Starwood.

@Boraxo “If in fact you believe these are accurate valuations, then most people would be better off using a 2%+ cash back card for their everyday non-bonus spending.”

I’ve made this case explicitly many times.

@Ben O – I haven’t put as much thought into Qmiles as I should

@ABC if there was a legal market in points, the points would have a greater value

@ryan definitely the value of miles changes in a number of circumstances, as I suggest in the post

@Ric Garrido “I argue that miles and points have no value at all until you redeem them.”

That’s no different than saying US dollars have no value until you spend them.

Points are a (private) currency. They’re a store of value and a medium of exchange, though even more likely to depreciate than dollars and which have limits on what you can exchange for.

@beachfan oh I still think SPG points have value in points transfers, and this helps drive overall value (basically another way to get to same value), for instance from partners like JAL and Aegean

AA miles are not worth 0.015 ; not even close. Maybe for the rare Cathay redemption, but that’s about it. AA has virtually no saver awards; and most partners require ridiculous surcharges. I’m so fed up with AA availability. It’s worse than any other airline; period!

You are like the stock analysts. make a big show about the research but the price target ends up being only a dollar or two up or down from the rest of the analysts.

@Gary Leff, I doubt that. Most would sell them cheaper. There are billions of unused points. The average point holders would be happy to just trade them for flexible cash rather than book an award trip.

@Jason “AA has virtually no saver awards; and most partners require ridiculous surcharges.”

True AA saver availability is terrible, though that’s not where I want to use my AAdvantage miles. The ONLY partner with ridiculous surcharges is British Airways (not most), though there’s very modest surcharges on Iberia (again not most). I get phenomenal value out of Etihad and Qatar redemptions, Qantas Mideast-Australia, JAL, Cathay and Malaysia intra-Asia, etc.

@ Ric

The redemption part of the points is a “sell” price.

The valuation is the “carrying value of the assett”

It is also a “buy” guidepost – not at that point (because of a cash preference) but maybe 5% or 10% below that.

Gary, maybe it would be simpler to set the “buy” price as 5% below the valuation, and then folks might understand it. (Of course, that’s also a simplification due to the differing value at the margin).

Buy low, sell high.

@Credit I think in some cases there are clear divergences, in those cases where there aren’t it’s a pretty good indication that the values are.. right.

@ABC There’s no way I would sell my Virgin Atlantic miles for less than 0.8 cents apiece etc etc

@beachfan I sort of assumed it was enough (pehaps not!) to include a section on how to use these valuations, I wrote:

“But since the value of miles isn’t precise I won’t actually pay 1.5 cents for an American mile. I want to accumulate American miles when they’re substantially less costly than 1.5 cents apiece. And I know I am clearly not a buyer at 2.5 cents.

In practice these are fairly blunt tools that tell me “1 cent a point for American miles is a really good deal” but that I’m not going to spend 2 cents unless there’s a very specific scenario — like a few points at the margin to top off an account for an award I’ve put on hold — where it makes sense (and in that scenario, my valuation of each point is higher since they’re helping me to save with a real redemption).”

You forgot Best Western Rewards!

@stvr there are a lot of programs not listed!

@Credit —-> So, maybe, you expecting one point to be worth $1.28?

The problem for me in saying to use a 2% cash back card for non bonused spending is that it just adds up so slowly. It seems I’m always clearing one enrollment bonus or another, so I put non bonused spending there most of the time. To get, say, $100 worth of travel with Barclay Arrival, in round numbers I need to spend $5,000. But that amount of spend will instead clear the bonus on my new SPG card for points worth $920 by your valuations (35,000 point bonus plus 5,000 more on the spend). Yes, some credit card companies aren’t as generous with new applications as they used to be, but it seems there’s always something out there. Even if I’m between enrollment bonuses, it seems to me that in that case using the CSP gets me points that I can often use at the margin to leverage accounts for specific awards when I need them. As you note, it’s how one personally uses the points that determines the real value. I appreciate the relative valuations as a starting point.

While I sincerely appreciate the effort people like Gary put into their work, I find this valuation discussion of little practical use to me. I think the value of the points differs dramatically by end use and so the more useful analysis would be to show some measure of typical variation by major uses.

I think many of us would agree, for example, that you can get much higher valuation if you use your points for an international long haul business class flight vs. using them for a domestic economy award. Whether someone would pay the miles for the business award (but would pay for economy) seems to me irrelevant. The fact is that a mile applied to a long-haul business award is worth a certain number of cents, and that is its true value in that end use. A mile applied to a typical economy award is worth a certain number of cents and that is the point’s true value in that end use.

So I would suggest, from a methodological perspective, that the blogosphere discuss what the appropriate “market segments” are, e.g., first class, business, premium economy, region to region, etc.) and estimate separate values. THIS would be instructive because that would help me target where I can, specifically, get the most for my miles–in other words where the true sweet spots are. Trying to boil this all down to one number per type of point obscures these valuable distinctions just like saying that the “average” temperature was 65 degrees when the high was 85 and the low was 45.

Personally, of the more than a million miles my wife and I have spent over the last two years or so, probably 80% we have spent on long haul business class awards in part because they seem to have the greatest ‘”rate of return” on our miles. We also have taken several BA/Aer Lingus Boston to Dublin “sweet spot:” trips. I would love to have more information so I could more readily take a more nuanced approach to all of our future decisions.

Beyond this, I also personally would love to see a website that, at any particular moment, could crosswalk actual ticket/room cost, airline/hotel award chart cost/availability, and purchase costs through portals,( e.g., Chase at 1.5 cents with the Sapphire Reserve), to get an instant picture of how I could optimize my miles for a specific use I want, in real time, to put them to.

It’s hard for me to wrap my head around transferable points being worth more than airline miles since that’s what you would be transferring to. Could you delve into why valuing them higher than what they would become makes sense?

The only thing that is sort of “right” in this post are the listed estimates of the AVERAGE REDEMPTION values points, if one understand that they are just that AVERAGE ESTIMATES. A close second in ‘accuracy’ is that the listed values can be useful toward estimating the relative values of redemptions WITHIN a loyalty program. Almost every other claimed utility of the listed values is wrong or misguided.

For instance, the following claimed usefulness of the listed values would be wrong if applied to hotels in different chains with different loyalty points currencies [it is unclear if “hotel chain” below refers to different companies or programs or simply to a hotel brand within a chain, which is sometimes referred to as a ‘chain”. I am assuming the former]:

— Determining which hotel chain offers the better value reward when you’re considering staying at two different hotels.

The listed values are average REDEMPTION values for each program. They will tell you NOTHING about the relative redemption values ACROSS programs because each program awards different number of points per cent spent, meaning that award costs per point are also different ACROSS programs. A cent may be a cent, but a point is not a point because different programs award different numbers of points per cent spent. Therefore, values of loyalty points in CENTS per POINT are like the value of PURCHASES in different currencies. They cannot be compared directly. The “value” of a purchase in Australian dollars (i.e., the redemption value of an Australian dollar for that purchase) cannot be compared to that of the same purchase in US dollars without using an exchange rate because, even though the two currencies are called ‘dollar’, they are different currencies. Likewise, all points currencies may be called “points”, but they are different currencies, so that the redemption value of a starpoint cannot be compared to that of WoH point or any other points currency without using a “points currency exchange rate” , which is their relative EARN rates.

Without an understanding of preceding trivial concept and taking it into account, claims about what the listed values tell you about the relative values of redemptions across hotel loyalty programs are all wrong.

The situation is different for the FF programs of the 3 big US airlines, which now award roughly the same number of REDEEMABLE miles per CENT spent…

G’day

Last minute change bungled: “The only thing that is sort of “right” in this post are the listed estimates of the AVERAGE REDEMPTION values OF points, if one understandS that they are just that: AVERAGE ESTIMATES.”

One thing I think nearly everyone gets wrong when trying to value points is that they take inflated costs of first / business class flights where they are getting 4 or 5 cents a point and try to attribute that to their points having that value.

If someone offered you a seven hour one way first class flight or five thousand dollars which would you take? If you would always take the five thousand dollars (like most of us) how can you possibly pretend that your points are really worth 4 or 5 cents? At a certain price point you will probably opt for the flight and that’s where you find out what points are really worth in terms of value.

This one of the main reasons that despite AMEX points being worth 1.9 cents a point, I value them much less considering the only thing you can actually get more than a cent of value for using AMEX points is expensive airfare I would never pay for myself.

BTW, It was easy to predict that Marriott would use a 3:1 MR points:SPG points transfer ratio because it was the ratio that yielded, WITHIN each program, the SAME “purchasing power” for points transferred in either direction. On average, one earns 3x MR points a pop than one earns starpoints from various activities, which makes the factor of 3 the SPG-MR “conversion factor” or “exchange rate”.

Incidentally, it looks like only TPG’s estimates got the 3:1 ratio exactly, although I believe that their values of 2.7cpp for SPG and 0.9cpp for MR points are way too high. The most rigorous estimate of the value of starpoints I have seen, based on computing the average redemption value across all hotel categories using REAL numbers, got a value of 2.4cpp, which is closer to the average of 2.3cpp based on the three values listed above than to 2.9cpp. Also, the average value for MR points based on the three listed values is 0.8cpp, which is lower than TPG’s 0.9cpp.

The 3:1 transfer ratio clearly agrees better with the “best” estimate I have seen of 2.4cpp for starpoints and the mean of 0.8cpp for MR based on the 3 values listed:

2.4 cpp for starpoints: 0.8cpp for MR points == 3:1

It was no accident that Marriott used that ratio, which I predicted they’d use before it was announced, based on the same considerations as in my preceding post. Rocket science loyalty “math” ain’t… 😉

G’day!

This is why my first card of choice for “unbonused” spend is SPG and then if no AMEX an Alaska Visa. These valuations are most handy to me when deciding to pay or redeem

@DCS wants to change the subject to earning rates. That misses the point. This isn’t a list of “what’s the best program” it’s a value PER POINT so that you can compare, say, if Hilton wants 30,000 points for a room and Starwood wants 10,000 which is the better deal/cheaper price? [in that case, Hilton would be].

Of course @DCS wasn’t happy with a presentation that met exactly this criticism, changed topics to one which is normalized with earning.

http://viewfromthewing.com/2017/03/12/simple-model-ranking-hotel-programs/

DCS, you evade and evade, you change the topic when you see things that conflict with your priors… 😉

Sorry – The TGP’s estimate is 2.7cpp and not 2.9cpp, which is still much higher than the mean value of 2.3cpp based on the 3 listed values…

@Gary — I did not change the subject to earning rates. With claims about the utility of the listed valuations like this one…

— “Determining which hotel chain offers the better value reward when you’re considering staying at two different hotels.”

…YOU went THERE without accounting for EARN rates as you should have and, as a result, made wrong claims…

I have expounded ad nauseam on that nearly universal mistake in travel blogopshere and will just let my reiteration of those views above speak for itself…

ROTFLMAO!

@Gary — You did not just link to that roundly and soundly repudiated “simple modeling” of yours!!!

G’DAY!

Great post Gary. Really logical, well laid out methodology and great points. I especially enjoyed the reference to utility theory (each incremental point is less valuable than the last). This makes me rethink the decision to burn at maybe less than ideal rate vs saving for an optimal redemption.

I wish I would have saw it earlier to get in on the discusssion, but I’m currently enjoying a 10cpp redemption…well not really, since that violates several of your valuation rules!

These posts are why I still find it worthwhile to sift through your anti-Trump and big three bashing posts to find nuggets of wisdom 😉

Good piece, Gary. You’ must have enjoyed econ courses in college. 🙂

Get a grip! There is no magic at all in coming up the listed AVERAGE valuations.

Go online to each program’s website, do a number paired dummy bookings in cash and then in points or miles, compute the ratios of the costs of the bookings in cash to their costs in points, compute the mean or AVERAGE value of those ratios and, voila, you get the AVERAGE redemption values that bloggers peddle and make their own as if based on some deep understand of “utility theory.” LOL. How does one quantify each of these so-called determinants of the “value” of points?

— It depends on how you redeem them.

— It depends on when you’re going to redeem them.

— It depends on how many you already have.

— “It depends on transferability”

Is each of those worth a1/1000th of a penny? “Transferability” is great except that when starpoints, e.g., are transferred to miles, they lose about half the average value they have as a hotel points currency…etc..etc..

There is no magic involved at all. It is all very trivial. You could come up with “better” values if you use a much larger sample of paired dummy bookings…

Rocket science loyalty “math” ain’t…

G’day!