I receive compensation for content and many links on this blog. Citibank is an advertising partner of this site, as is American Express, Chase, Barclays and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

Upside is the new travel booking site from Priceline founder Jay Walker. It’s finally launched with its full functionality. They raised $50 million on a $200 million valuation even before they were fully operational. Because a new idea on how to deliver value to consumers from the guy who created Name Your Own Price bidding is a big deal in the travel world.

I interviewed Jay about the new site and about his Priceline days over the summer.

It’s also a widely misunderstood site. There are leisure travelers who will sometimes get value out of it, but the real payoff is for self-managed business travelers.

The idea is that if you’re a business traveler, you book what’s most convenient to you within company guidelines because your employer is footing the bill. But with some economic reason that benefits you, you’re willing to make trade-offs.

Maybe you’ll fly in the night before if it saves more than the cost of a hotel night and they’ll give you $100 in your pocket to do it. Maybe you’ll stay at a hotel a mile away from the conference if it’s cheaper and they’ll give you $150 in your pocket to do it. Upside asks the question, how much is your flexibility worth if there’s upside to you? Are you willing to book a less expensive itinerary if you put money in your own pocket to do it?

If you’re a leisure traveler, booking on your own, you’d want to:

- Price flights separately, and hotels separately, and see how Upside’s pricing compares

- In fact, you probably want to compare their packages to travel packages on other sites. On average Upside might even save you a little, but it’s unlikely to be yuge.

That’s why their market isn’t leisure travelers. It’s business travelers who save money compared to what they could have booked, and get much of the savings rebated to them in the form of gift cards.

Doctor of Credit looked at this purely from the perspective of lowest price and found,

[T]he flight is $16 more expensive than using another third party and the hotel is $45 more expensive than using another third party. This is more than offset by the $88 package savings discount and the $100 gift card.

Right now is the best time to try the site, since they’ve only just launched in all of their markets. They’re offering a guaranteed minimum $150 Amazon gift card with bookings through February 28 using promo code UPSIDE150.

And they’ll even top that — they gave me promo code VFTW that guarantees a minimum $200 rebate in gift cards on all purchases through February 28. Enter it here. Right now I think it’s fair to say they’re ‘over-indexed’ to get buzz going at launch, so definitely look to see if it makes sense to take advantage of their marketing budget.

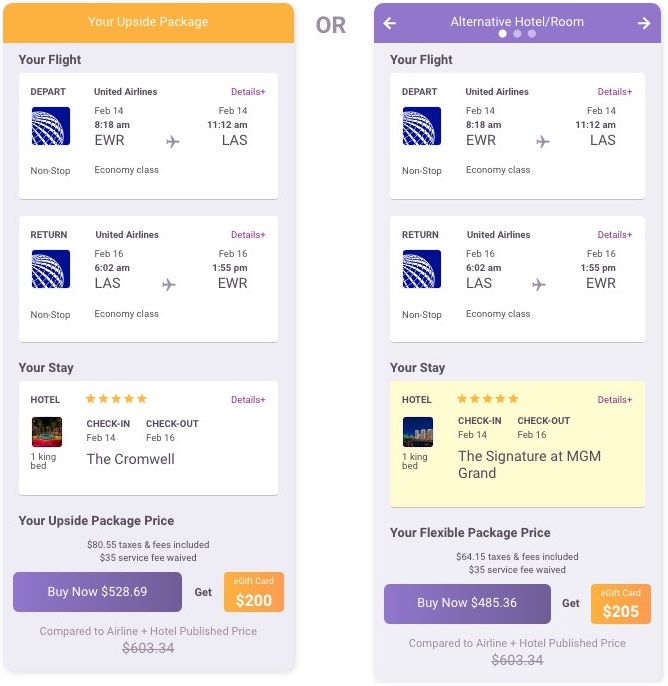

Here’s a 2 night Vegas air and hotel package departing New York in a few weeks. You can do a $485 package and get more than $200 back in gift cards.

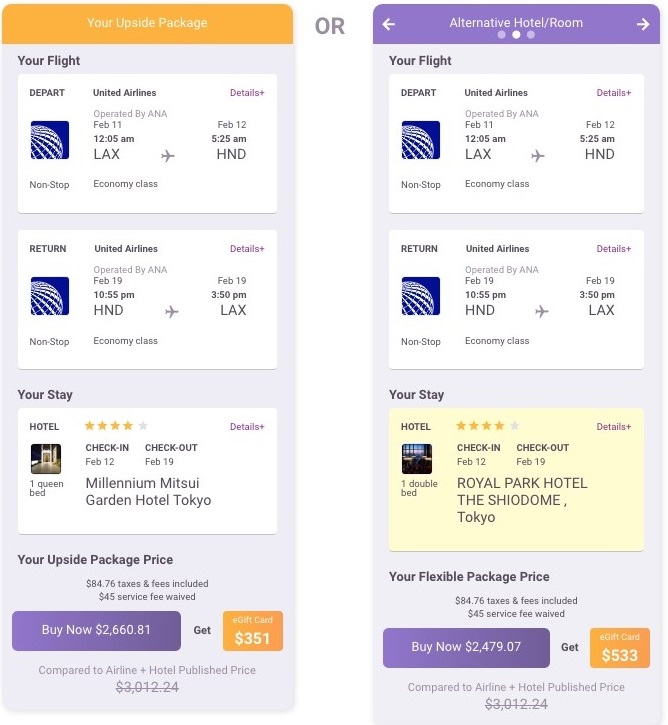

The biggest money is going to be in international business class, but even so here’s an economy itinerary (poor soul, working for a company that requires transpacific travel to be booked in coach!) that nets over $500 in gift cards back.

As long as you’re not spending more than the trip your employer will pay for this works out great for the business traveler. And while they’re guaranteeing a minimum $200 per trip, it’s worth comparing.

Just be sure to sign up with promo code VFTW for the minimum $200 payout.

New account sign-ups appear to be broken.

What does the bill say? I would think it would say you got gift cards, which would cause an issue with expenses?

Do you earn airmiles on trips booked through this new site?

OK got through the sign-up bug but available flight options to/from points outside the U.S. appear to be unavailable or patchy. Some foreign airports missing from the database. All issues reported to their Tech Support. Not ready for prime time IMHO.

Roundtrips only and no multi-city

I tried to make reservation for 2 but no option to enter 2 travelers. Did I miss something?

What happens if they issue more than $600 in gift card to an individual in a calendar year? Will they automatically issue a 1099-MISC to the person?

Site only supports ex-US RTs. The service isn’t flexible yet as I hoped it would be.

Your previous (paid though not disclosed) recommendation of HotelOne, which turned out to be terrible, means I’m going to skip on this. Unless you’re telling us you’re not getting paid per signup?

How is this not unethical? If I discovered one of my employees using this site they would be let go immediately.

You make a valid point @Tom, but what if the price through Upside is the same or even less than can be booked for elsewhere. Is it still unethical if the company saves and the employee earns a gift card? I’m not taking a side, just asking the question as it’s interesting.

Might be an interesting question for the NYT Ethicist:

https://www.nytimes.com/column/the-ethicist

Anything preventing you from booking a flight/hotel package and skipping the hotel?

I’m less cynical and more wary of this setup.

My company uses Concur and we are explicitly directed to book all travel reservations through them.

I totally get the concept, but if I understand it correctly I’m running the transaction through Upside, not Concur right?

My company is broadly much less strict than most in the industry with travel. Again, not being skeptical just trying to understand because as much buzz as I keep hearing about this service I have to believe I’m not understanding he process. Is there a step I’m missing where Corporations have signed onto this game plan?

Because I have to believe mine will be sending out an announcement soon making sure all employees are crystal-clear this is not an acceptable avenue for booking business travel.

I want this to work, and I want to take advantage of it. But I’m struggling to see the opening where I can participate without risking certain termination.

@Jeff It’s not designed for employees who work for companies that use products such as Concur. It does not, and like will not ever work with Concur. You must book directly with Upside. From the Upside FAQ:

“Currently Upside does not offer corporate accounts. All Upside accounts are created and controlled by the individual traveler. And, if your company already has corporate discounts with certain airlines or hotels, Upside is currently unable to incorporate those discounts into our system.”

Basically it’s (primarily) designed for business travelers who have the flexibility to book travel on their own. If you’re company requires you to book through Concur, then you are not their target demographic.

@Tim I challenge you to find a post where there’s a financial benefit to me that’s undisclosed, and I have never done a sponsored post.

If a company allows business, direct, or otherwise expensive forms of travel they’re doing it for a reason. It allows their employees to be better rested, work more, and generally perform better.

This is taking money out of businesses pockets and putting into employees’ while harming the performance of those employees, and thus the businesses.

As another commenter said, I would immediately fire any employee that used such a service. Deeply unethical, I hope it folds sooner rather than later.

I think a point made early in the article is the key one. It is misunderstood. It is directed to the self-managed business traveler who has guidelines to work under, but sets up his or her own travel within those. I could not use the site for my work, but my sister could for hers. I still don’t get the mechanism, though. Is the idea that they present her with a more expensive option that fits within her guidelines, but she actually takes a less expensive option that they find for her? How does that generate a gift card? What do they do – take her credit card payment based on the more expensive option and receipt her for that for expense purposes, but she actually flies and stays the less expensive option and gets a gift card for part of the difference? So she’s basically lying to her employer about her actual expenses, but with Upside as the go-between to cover it up? Will Upside find her a new job when her employer finds out? I must be missing something here.

@DaveS The basic idea is that there is a fair amount of “fat” (i.e. commission) when booking package deals. Most of this fat comes from the hotel end but there is also some from the air side, especially when you’re talking about flights that are lightly loaded that the carrier is likely going to need to drop the price on eventually to move seats. Because the air and hotel is packaged together, neither side is worried about undercutting their public pricing, hence they are free to discount to move seats/rooms.

The model is fairly straightforward… Only offer flights/hotels where there is enough fat on the commission end to more than make up for the gift card that is offered to the traveler. In some cases those could be perfectly acceptable to the traveler, whereas in other cases, the hotel might be less desirable and/or the flights less convenient. It is left to the traveler to decide what compromises (if any) he/she is willing to take in order to maximize their earnings.

So it’s not like they’re just offering the same itinerary that the traveler would have booked themselves at a higher price, but rather one which they can discount heavily to earn enough commission to compensate for the amount of the gift card they are purchasing for the traveler (which they may be purchasing at a discount).

As to how employers would view it, I would assume that would vary widely, and probably would have an impact on whether Upside can survive. It certainly won’t be right for all travelers/employers, and even the worry that it could raise alarms might be enough to keep folks away for fear of jeopardizing their jobs. Time will tell.

Gary, getting burned by you on HotelOne means I’m not signing up for any more services you push. It also caused me to stop clicking on your affiliate links and just go straight to the credit card site.

I won’t call it a scam but it’s pretty danged sketchy.

Just 2 examples:

LGB-LAS: airfare over $100 higher than other OTAs or direct for SAME flights.

FLL-JAX: airfare over $100 higher than other OTAs or direct for SAME flights AND the SAME hotel over $40 higher per night.

Would have a 3-fer except the international example kept timing out.

Not sure what their market is but CERTAIN it is not for ME!

#Sad

@gringoloco I saw a similar instance on the site’s prices being more than other OTA or direct pricing, but when checking out the ‘package price’ drops to the same as purchasing separately and direct. I saw lgb to las for $58 and a hotel for $40 so ~100 total. but through upside it showed $80 and $50 respectively, but the package during checkout came to the same $100. Not sure how it would work for travelers that have to fill out an expense report, but for a leisure traveler or small business owner, it could still work.

@Jay: not my experience checking actual dates over the next 90 days. Not once did I see the them ever get close…

Obviously this is a YMMV situation. For my needs, it’s a NO GO (and sorry to have wasted my time!).

Am I missing something? I don’t understand why some say this is unethical. To met it’s the same as getting points for going through a shopping portal or getting points on a personal credit card for reimbursable purchases. Of course I wouldn’t want an employee to do it if it was more expensive than a trip would be otherwise.