I receive compensation for content and many links on this blog. Citibank is an advertising partner of this site, as is American Express, Chase, Barclays and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

Customers with the J.P. Morgan Select card are going to be transitioned to the Chase Sapphire Preferred Card. They won’t get the Sapphire Preferred’s signup bonus of 50,000 points after spending $4000 on the card within 3 months of their new account, so will probably be wishing they had simply signed up for the card themselves directly. (HT: Allan H. who is not to be confused with Alan H.)

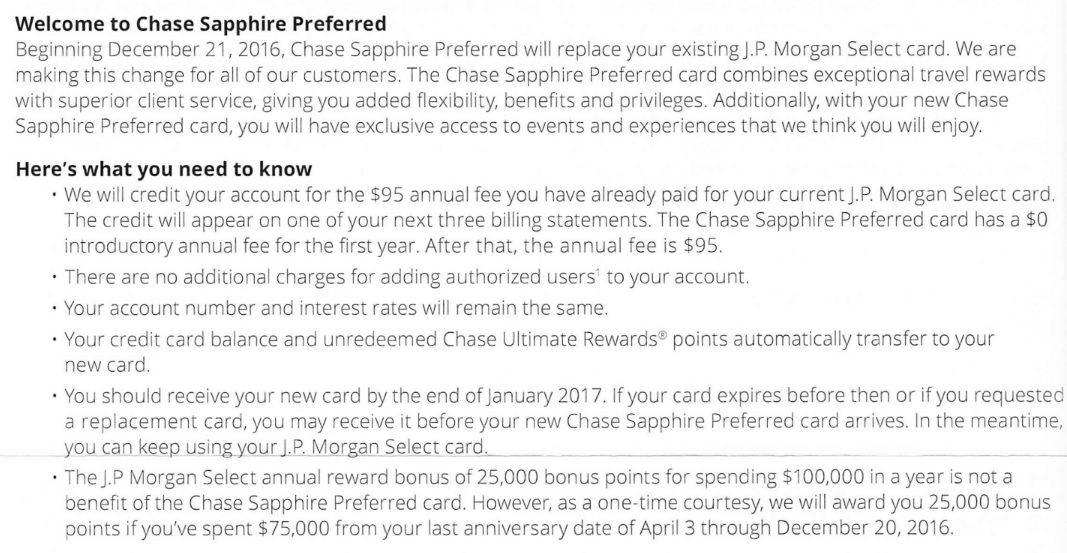

Here’s the notice that went to cardmembers:

Too bad, from a purely aesthetic standpoint the JP Morgan Select card is I think really quite tastefully designed, a better looking card than even the Sapphire Preferred. Although I do much like the design of Chase Sapphire Preferred Card which is much heavier and attractive in its own right, here’s mine:

In 2012 I offered a comparison between the two cards for Conde’ Nast Traveler.

The JP Morgan Select card was earlier with an EMV chip, and earlier offering primary rental car collision coverage. Of course Chase Sapphire Preferred now comes with both. JP Morgan Select didn’t have a signup bonus, but offered 25,000 bonus points every year after $100,000 spend on the card.

You haven’t been able to apply for it as a standalone product in several years, so this doesn’t surprise me at all.

The card is also given to Palladium (and perhaps to JP Morgan Reserve?) cardholders as a ‘low profile’ version of their heavy metal cards. President Obama uses one. Presumably these customers get to keep their plastic JP Morgan Select cards, which have the same account number of their other more expensive products. It’s just those who had it as a standalone lose it.

Oddly I received a similar letter, even though I closed my JPMorgan Select account way back in 2011 or 2012. (Though the letter did reference the fact that my account is closed.)

I want JP Morgan reserve. I hope they allow chase private client to get one soon.