I receive compensation for content and many links on this blog. Citibank is an advertising partner of this site, as is American Express, Chase, Barclays and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

Plastiq is a great way to turn bills you have to pay (even rent or mortgage) into miles, albeit for a fee. Right now there’s a promotion with discount rates for paying rent or mortgage with a MasterCard or American Express.

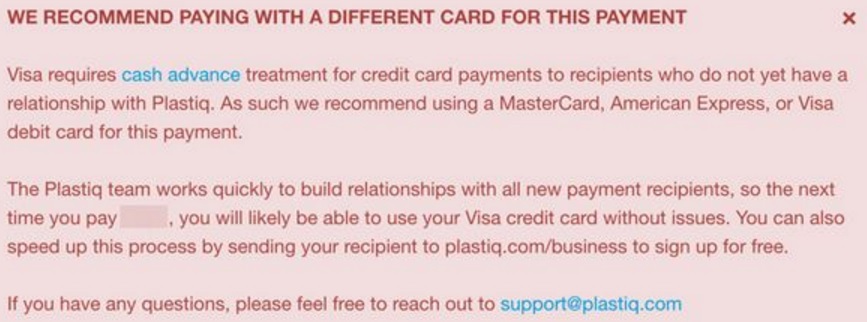

This week there was a bit of a stir when bill payment service Plastiq — which charges your credit card and mails checks for you — started warning customers that Visa may classify charges with them as a cash advance.

For instance Doctor of Credit, Million Mile Secrets, and Point Me to the Plane — as well as others — are covering this.

I spoke to Plastiq to find out what was going on.

- Anyone that has been paid via Plastiq before is fine to pay with a Visa.

- Plastiq can set up a relationship with anyone new you want to pay, and then it won’t process as a cash advance (just email them).

- It’s not all Visa cards that are coding as a cash advance, it’s actually a limited problem they’re working to resolve, but they’ve giving a warning broadly ‘just in case’.

- If you don’t get the warning you can be confident your situation won’t involve a cash advance (for instance because they’ve paid the recipient before, etc).

I’m not certain which issuer is the prime culprit here, or how they’re able to overcome the issue by having an established relationship paying someone but that seems to be the case.

If you do want to pay someone new that Plastiq hasn’t paid before — and you don’t want to get the recipient to set up a relationship with Plastiq first — just pay them first with a MasterCard or American Express, even a small amount, that gives Plastiq a sufficient relationship with that recipient. And then you’ll be able to pay with Visa subsequently and not risk a cash advance.

Gary since you seem to have a relationship with Plastiq can you persuade them to allow loan payments that are same as cash payments to be processed. They won’t do it because i assume they do not want you to pay credit cards with credit cards and I get that. However, the you purchase a large ticket item and choose a 12-24 month same as cash deal you do not earn points but you get the extended terms. I prefer to pay with a gift card I purchase from office supply with 5* points and earn and save. Again I understand their concern but damn, I can pay a bank equity line of credit, not much different.

I’ve had issues with the card changing the payee name several times. It will start out correctly “Plastiq Wells Fargo” then the next day in pending status it will be some random apartment building. It’s very strange but my points have still posted , so far, regardless of how the card issuer codes it. Very annoying though.

@Leonard I’m not actually familiar with this issue, for instance they allow mortgage payments, what payments (what payee?) aren’t they allowing?

Plastiq’s fees don’t make sense for me. For example, $10,000 in Vanilla Visa gift cards costs $100 in activation fees and another $16 in US money order fees at the post office. 1.16% total cost. Substantially less than Plastiq’s fees and I can use my Amex at CVS unlike Plastiq. If Plastiq ever can get their fees down to 1% and add all card types, then I will be happy to use their service regularly.

I just sent them an email last night about this very issue. I tried to pay three different bills using a Visa and got the same error message. I can see where the site might have value in helping to build up point balances, but Visa is a pretty major player to have issues with. Plus, I’m hoping they tweak the site a bit. It’d be nice to assign nicknames to the cards, use the zip+4 zip codes and have more categories.

Two I have tried. Synchrony (spelling ). This is the GE or once owned GE finance program. I have a same as cash sleep number account with them. I bought the mattress with 24 months to pay. Wanted to earn points by paying it off with gift cards, I also had a Sony same as cash card with them . The other is Wells Fargo. They also run several same as cash programs.

So , do I understand.

I have a brand new chase credit card. I have paid the same company through plastic before , using a personal chase visa credit card, and not my new business Visa card .should I be ok?

JANUARY 2017 Update!

Okay, so I also feel like I wasted a good opportunity – I JUST got my Chase Sapphire Reserve card, and then saw this same Cash Advance warning for my Visa card.

I chatted with Plastiq’s customer support, and they also repeated what we now know – first use a non-VISA card to make the first payment. Once this new recipient successfully accepts the payment, then the VISA card should go through.

Because I was freaking out on how to make my $4k payment in under 3 months (because you have three months to satisfy this spending amount from when you’re APPROVED, not when you receive the card!) – I was curious to see what warning message would pop if I put my Chase Sapphire PREFERRED card.

No warning message popped up. Weird.

I hit up the customer service reps via chat, they said “oh it’ll be rejected” – but I still didn’t see a warning message.

I then switched the payment card back to my RESERVE card – and voila – the warning message disappeared!

I submitted the payment SUCCESSFULLY, and Plastiq’s customer support verified it did NOT go through as a Cash Advance – and it was a successful transaction from their end.

I have no idea why this happened? Maybe because I have been using my PREFERRED card for a while, so Visa was like “okay we can trust him?” – and then that made my RESERVE card okay too? Who knows, who cares – it went through WITHOUT a hitch!

WARNING – be sure to call Chase Sapphire and tell them to reduce/remove your cash advance to avoid any potential situation where Plastiq will charge it as a Cash Advance. I did this BEFORE I successfully submitted the RESERVE payment via Plastiq.

Good luck – and let me know – did inputting your PREFERRED then switching payment between that and your RESERVE card solve your problem too? Curious….

Free $400 dollars

https://try.plastiq.com/658796

Sign up using this link and get $400 fee free dollars after your first transaction of $20. Hurry, ends April 18th:

https://try.plastiq.com/658796