When I bought a condo in 2006 I earned six figures in United miles for being referred to a realtor. Basically they were rebating a bit more than half their commission in the form of United miles.

There are opportunities to earn miles for mortgages as well, and for using a moving company. Big dollars are involved in real estate, so big miles are too.

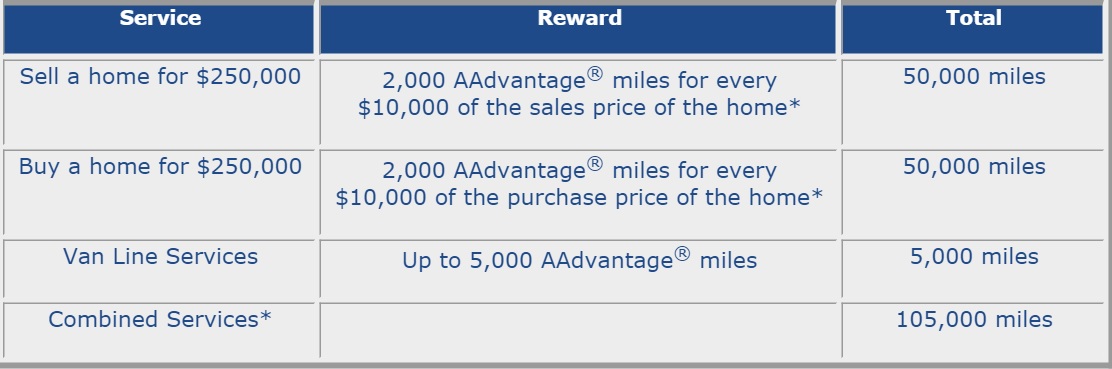

American Home Miles will give you American AAdvantage miles for the real estate transaction, miles for working with them on your mortgage, and miles for using the moving company they refer you to. In each case they’re rebating a portion of commission.

Miles from Home will give you American AAdvantage miles for real estate transactions and mover referrals. They don’t do miles for mortgages.

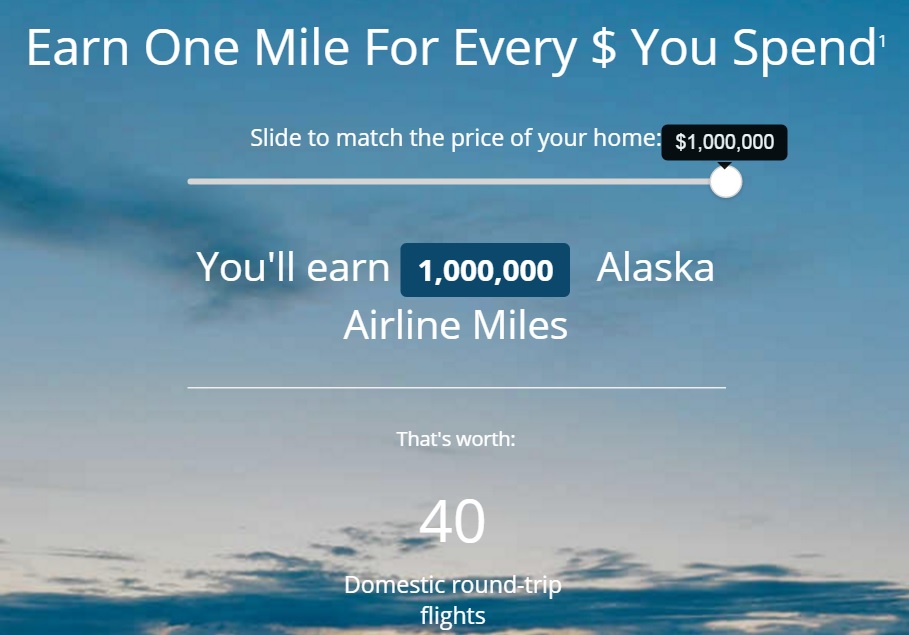

You can also earn 1 Alaska mile per dollar spent on real estate through FlyHomes.

Apparently this has been out for several weeks but I just saw for the first time 25,000 miles for a Quicken Loans home loan.

Here are the terms and conditions:

Offer valid on new applications received between 06/29/2016 and 06/28/2017. This offer is only available to clients who call the dedicated benefit phone number or go through the dedicated benefit website. Client will receive a credit of 25,000 MileagePlus award miles within 6-8 weeks of their closing with Quicken Loans. Quicken Loans is not responsible for the provision of, or the failure to provide, this promotional offer.

I find it fascinating that they say “Quicken Loans is not responsible for the provision of, or the failure to provide, this promotional offer” when:

- They’re the ones making the offer and inducing you to initiate the process with them

- They almost certainly are responsible, through an agreement with MileagePlus, for ensuring that eligible recipients do indeed get their miles.

Companies tend to put whatever they wish into terms and conditions and almost nobody reads them. These sorts of things aren’t always enforceable but it costs them little to try.

Disappointing to not see the word ‘interest’ mentioned in here at all. The loan offers can be good if and only if it is the best rate and fees that one can get. A small change in interest, even 1/100th of a percent, on a 30 year, 200k loan will instantly negate the 25k miles one could get. Additionally, even slightly higher fees can quickly negate these offers.

Obviously you’re going to compare interest rates and pick the best loan. In general you won’t pay higher rates to get miles, this is marketing expense the way any mortgage company is going to advertise.