The cities where air service are growing and where it’s shrinking should come as no surprise.

There are cities which made sense as hubs but once the arilines maintaining operations there merged those hub operations were pulled down. In the midst of a merger airlines always say they’re committed to all of the major cities they operate in — but those obligatory statements should never be given greater weight than the underlying economics of the cities and route network that a combined airline will operate.

Per the latest issue of Airline Weekly:

- Neither Cincinnati nor Memphis are among Delta’s top 10 airports any longer in number of seats offered. The former hubs lag both Orlando and Boston.

- Cleveland is no longer among United’s top 10 airports. The former hub lags Seattle, Boston, and Las Vegas.

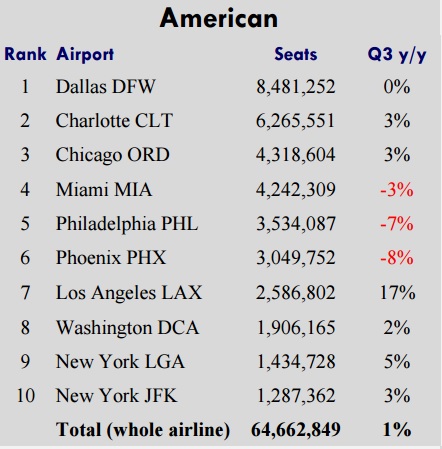

- Operations at American’s Philadephia (legacy US Airways) and Phoenix (legacy American West) hubs are shrinking, down 7% and 8% year-over-year, respectively.

- Atlanta, the former home base of AirTran, is now only Southwest’s eighth biggest airport.

Where service is growing, and where it’s remaining steady, should be no surprise as well. American’s biggest year-over-year growth is in Los Angeles. Delta’s is in Seattle.

Southwest is growing most in Denver and Oakland. Their biggest airport is Chicago-Midway, and contrary to my impression they haven’t shrunk there. Instead they’re treading water.

United is shrinking most, unsurprisingly, in Houston. Because, energy.

And JetBlue — which has built up an operation in San Juan, a city that used to be a hub for American Airlines, is now shrinking there as well. No surprise.

Growing – and contracting – air service is often a good barometer for overall economics in a region.

Very interesting post

I’m surprised at how much AA seats are moving through CLT compared to PHL. I would have assumed the numbers would reversed. I never CLT as being as big as PHL in routes.

PHX will for sure be dehub in a few years.

Gary – why not post the tables for UAL/DAL/SWA similar to what you did for AA? Thanks.

I guess I am glad that NY and Chicago are growing at least slightly for AA. Even before the slaughter of the AAdvantage program I was thinking about shifting allegiance just because it feels like everytime I fly AA they want to take me 2 to 3 hours out of my way to connect in the old confederacy. 5 of their top 7 service cities are in the southern half of the country. Of the top 10 AA cities, 2/3rds of the seats are in the south.

If you have the data for UA and Delta, I’d love to see that too.

Ho hum, business as usual. PHX doesn’t need to be a hub for AA. They are far better served by their legacy AA hubs.

I’d love to see the data for DELTA.

I’m guessing Gary doesn’t post data for the others because Airline Weekly is a paid subscription. I’m actually surprised he posted AA’s data – I’d assume that violates the terms of agreement for his AW subscription.