Starwood was being shopped aggressively for over 6 months, and Marriott wound up the high bidder in the eyes of the Starwood board. There was likely interest from foreign purchasers. Definite interest from Hyatt. Possible interest from IHG and Wyndham.

On the one hand, when the Marriott acquisition was announced, it seemed like they were buying Starwood on the cheap.

SkyCity Marriott, Hong Kong Airport

On the other hand, aided by strong investment counsel, Starwood wasn’t able to find a higher bidder. It’s hard to imagine that other hoteliers thought Starwood was worth more than Marriott is paying.

Now a consortium led by Chinese insurer Anbang has made an offer that’s about 20% higher than the current value of the Marriott deal, excluding the disposition of Starwood’s timeshare business (whose spinoff continues in the same manner under either arrangement).

Surely Anbang is overpaying. As a consumer I think that’s great. And it’s funny in a way, turning political narratives on their heads, for consumers to be excited by a large asset purchase by a Chinese company. They ride in as white knights.

Marriott says they will counter. It costs nothing to say that of course. Starwood cannot formally accept the higher bid until March 28 giving Marriott a chance to revise the deal. But the Anbang offer is:

- all cash

- 20% higher

Marriott has the advantage of a $400 million breakup fee, or ~ $2.37 a share based on 168.76 million outstanding Starwood shares. And arguably the Marriott deal contains $200 million in synergies.

It’s unclear to me whether Starwood pays the breakup fee and then Anbang’s consortium receives something worth $400 million less, or that $400 million in effect is a reduction in the value of the deal received by shareholders. The full deal terms haven’t been publicly released that I’m aware of.

But Marriott would need to go from ~ $63 in stock and $2 cash to at least something like $74 in cash in any counteroffer to be serious. And there’s only 10 days to put together that kind of financing.

This will be expensive if Marriott still wants in. They presumably already bid about as much as they were willing to at the time the transaction was announced in November.

If nothing else, Marriott’s managers are smart business people. They shouldn’t get pulled into a bidding war in which they’d overpay. So they’re probably wise to walk away.

Buying foreign assets is a way of diversify out of the Chinese Yuan. Even if they’re overpaying, with multiple bidders likely willing to pay $12 billion for Starwood the company’s short-term downside is almost certainly less than 10%. Nonetheless Anbang is likely overpaying, especially considering it doesn’t really complement their existing businesses.

On the other hand, the Anbang deal would also save the Starwood American Express card — so it should benefit American Express stock, and could help American Express’ Chairman hold onto the company.

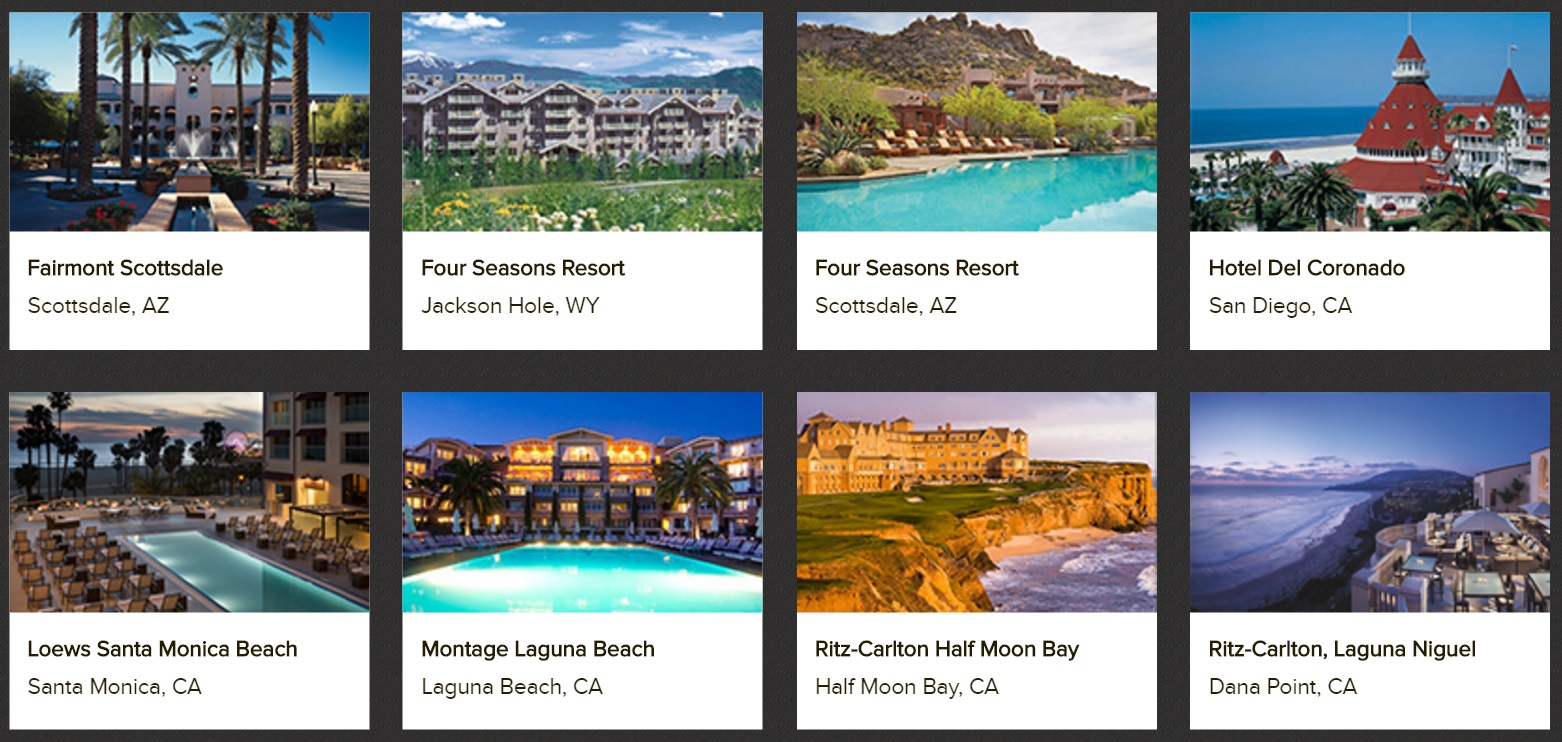

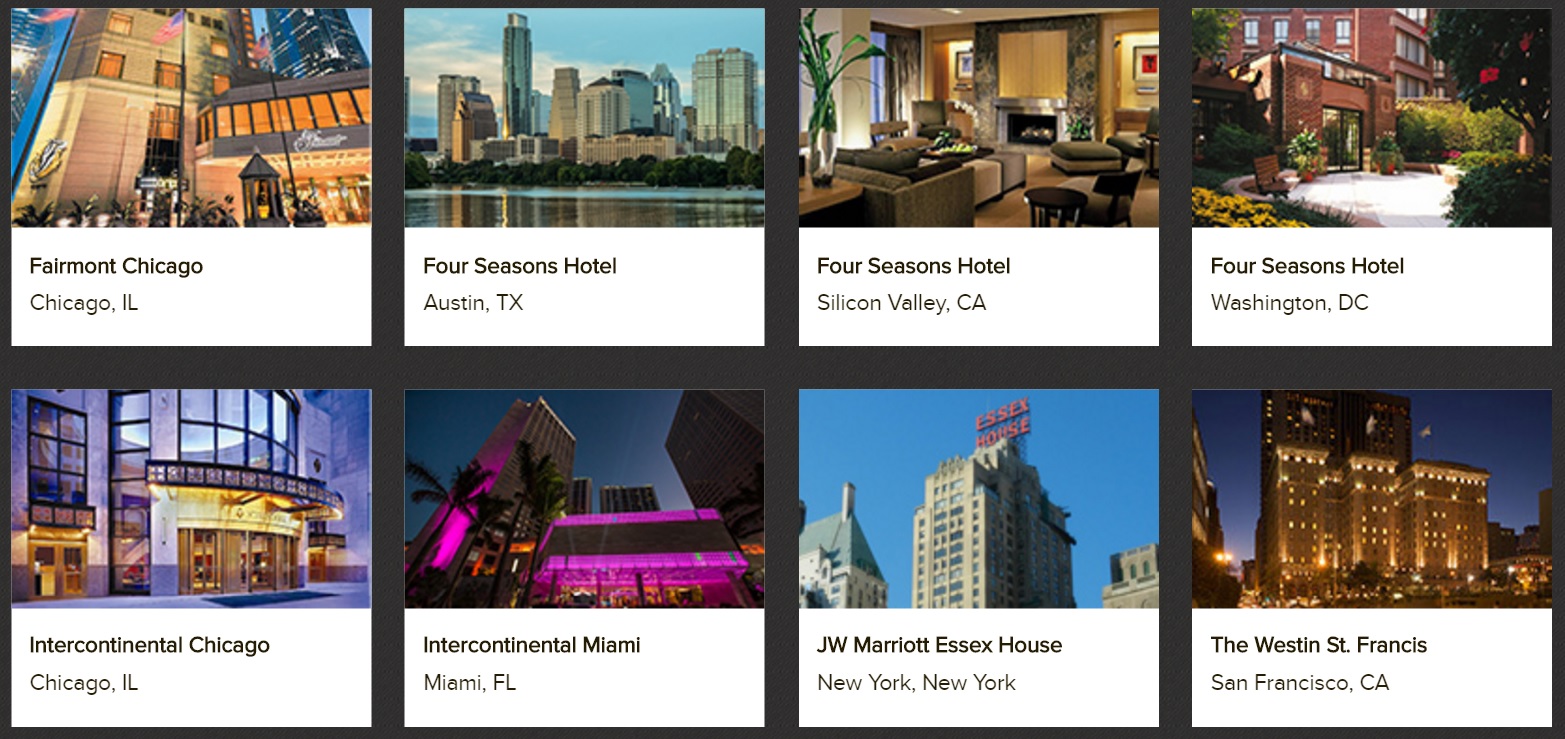

It will also be interesting to see the ultimate disposition over time of hotel properties the insurer has acquired in the US (like the Waldorf Astoria in New York, which has a long-term management contract with Hilton) and is in the process of acquiring:

Nonetheless, for Mariott, the question is: is it worth paying 20% more, and taking on debt, to do a deal that may have been about as expensive as they were willing to pull the trigger on just a few months ago? My guess is that they are smart enough not to.

Thank the Chinese! I was worried SPG wouldve been dragged into the sh!thole of Mariott management and splurged on a few st regis stays soon after perhaps now I can build up some SPG points again.

Underlying premise of this article is absurd. Namely that Marriott bid its max price that they think Starwoods was worth originally. From that absurdity, there is no logic to the article.

Current HOT price(@$80) seems to indicate a higher bid forthcoming from somewhere.

@Geoff – Anbang is offering $78 and shareholders also get over $5.50 for the Vistana spinoff. So that’s over $83. Shares are trading at a discount to that because the deal isn’t done yet. I don’t think you can read in that the market believes Marriott will top it.

@Mike I didn’t say they bid the absolute maximum, but given that there was pretty active shopping and lots of folks looking and the best Starwood could do was Marriott’s offer, Marriott’s offer is likely about the top end of what the company was worth — not 20% more than Marriott’s offer.

Typically, Starwood would make the investor group pay the $400M break-up fee directly to Marriott as a condition to entering into an agreement with them. In any event, however paid, it would not reduce the amount to be paid to Starwood’s shareholders.

Gary, forgot about spinoff. My bad.

@Neil – I’m suggesting that we only know how deal terms are described, and the increased $2 a share offer on the part of Anbang could represent the investor group paying the fee. Not saying it does, and that Starwood investors get less than the full $76. Just that in early reporting I’m not aware of enough details behind the offer yet.

These two blog posts back to back seem kind of inconsistent, no? At least the headlines do.

@Larry Starwood has determined that the Anbang offer is superior. So the presumption now is a deal with Anbang, Starwood can’t move forward with the Marriott deal. Marriott has a 10-day period in which they can counter but they would be foolish to. They’d have to pay 20% more and take on debt, likely substantially overpaying for a pyrrhic victory.

@Larry and Gary: The first article’s headline should have been “The Starwood-Marriott Deal is Mostly Dead”

There’s a big difference between mostly dead and all dead!

@Gary – I was just saying, as a deal guy, Starwood wouldn’t put a number in the announcement that would then have the break-up fee deducted from it. I agree there’s probably nothing that says that, but I’m 100% confident that the payment to shareholders from the Anbang offer on the table would be $78 (plus the timeshare spin-off consideration).

It will be interesting to see what kind of blood they try to squeeze out of SPG points. Anbang may have bought SPG customers with large SPG point balances some more time from a devaluation that would take place if Starwood were acquired by another hotel company, but Anbang may end up pulling a Blackstone-Hilton type move and I remember what that has meant for Hilton HHonors customers with large point balances.

@nsx at Flyertalk = Miracle Max?

https://youtu.be/7qVlNiAYshQ

@GUWonder there are absolutely no guarantees about the future with the Chinese acquisition of Starwood!

My only simple point is that there’s more upside for SPG members staying independent than there is as part of Marriott.

That’s not the same as saying ‘SPG cannot or will no devalue in the future’.

I don’t think Marriott needs to top or even match Anbang’s offer for the Starwood board to conclude that it is superior. There are potentially important factors relating to the ongoing operation of the business that could arguably make Marriott’s offer mother attractive. I hope not. Either way Starwood execs will reap a windfall from change-in-control provisions in their incentive plans and retention bonuses likely to be doled out after the merger.

Cash is King!!! Good luck for Marriott in finding that much cash in only 5 days. If I were them I would not even lose my weekend over this. Done deal. Let the Chinese have it and move on.

@Santastico they have 10 days, I expect them to counter, but with a deal that’s less attractive but that they will say is more attractive

@john Starwood accepting a lesser offer because of some belief about future value is something their lawyers can try to paper of course but it is pretty close to abdicating their fiduciary responsibility to shareholders. I’m not saying it can’t happen but i’d bet against it.

Gary — you mention a “bidding” war in your post. Do you have enough of an understanding of the Marriott/Starwood agreement to know whether that’s actually possible. My read of the letter that Startwood sent to employees is that this really isn’t a possibility. Marriott has something more akin to a right of first refusal. Starwood went out and got the best deal it cold get, and now Marriott has to decide whether or not to propose something that is the same or better, and if it does, the deal closes on those new terms. I don’t think there is any opportunity for the new consortium to come back and say, “fine, we’ll give $1 more in cash.” Now, they may still have time to up their offer if they get concerned that Marriott is prepared to match and for all we know there may even be some other suitor out there who still has time to put forward a greater offer that Marriott would then have to match by March 28 — without knowing the agreement’s time line for competing offers it’s hard to really know for sure. But my guess is that this was written in a way that all offers have to be in by a particular date, and then Marriott gets a one time shot at matching at which point the deal closes.

Whether or not any proposal that Marriott comes forward with is the same or better is probably going to be a complicated question unless they simply match the consortium’s offer. I also think it’s an interesting question you raise whether Marriott could offer a lower offer than the consortium and still claim it is the same or superior on the ground that it excuses the $400 million payment. So, could they come back (assuming your numbers are right) and offer $75.63 on the ground that this is economically the same offer?

Gary: nit in the article (“5” should be “10”):

But Marriott would need to go from ~ $63 in stock and $2 cash to at least something like $74 in cash in any counteroffer to be serious. And there’s only 5 days to put together that kind of financing.

Wasn’t the primary reason Starwood was on the market because it was thought to be too small? If so, an acquisition by Anbang seems to leave Starwood in the same boat. A Marriott acquisition could be viewed as providing the scale required to maximize the value of the business. It will be interesting how this plays out. As a SPG guy, I’d prefer Anbang, but even then there are no guarantees on the future direction of its program.

@Gary: Trust me. It is all about money and SPG shareholders couldn’t care less who buys Starwood as long as they make the best return on their investment. The company I work is going through a very similar situation and as I said before “cash is king”. Some people are saying that Marriott has to offer at least $74 in cash for their offer be serious. Why would a shareholder take $4 less? It is all about the money.

@Santastico that is EXACTLY what I’ve been saying.

E.g. http://viewfromthewing.com/2016/03/15/will-chinese-insurer-anbang-save-starwood-marriott-heres-happens-next/

“NWA‘s “Gangsta Gangsta” pretty much summed up the decision tree here, Starwood’s life ain’t nothin but money. The only question for Starwood’s board comes down to how real the Anbang offer is and whether Marriott raises their offer.”

Anbang is offering $78. Marriott is closer to $65.

My prediction is that Marriott may counter, but not at $78, they will wave their hands about how great a combination Marriott and Starwood will be for future value. But they won’t match or beat the price. And so the deal will be done with Anbang.

Could Marriott match? Sure, though I think they’re too savvy and also too conservative to do it.

Could Starwood’s board recommend something other than highest price? Sure, and lawyers can paper it, yadda yadda.

Both of those things are relative longshots.

@john – the primary reason Starwood was on the market was because of slow growth, not absolute size.

@Larry

1. there isn’t talk of Marriott literally matching as much as countering.

2. If Marriott came back at $78 cash Starwood would certainly take that.

3. But any time before the shareholders vote on the deal, Anbang could still come back.

There’s a $400m breakup fee. The deal isn’t done until the shareholders vote to approve. And the shareholders will vote for the offer that puts the most money in their accounts.

All Marriott has to offer is something in the range of $4-10 more per share of Starwood stock. As it stands, the deal is valued around $69 per share. So then add around $4-10 to make the deal more attractive to Starwood. Whether or not you agree with their loyalty programs, Marriott is the better partner for Starwood.

Love people on message boards deciding M&A deals are “cheap” or “expensive” without citing a single valuation method. 13x EV/Ebitda? 21x Price/Free Cash Flow? Anyone?

And a lot of commenters have misunderstood the trade-off between all cash deals and cash+equity… Neither one is “king”. A seller (in this case Starwood) could reasonably decide that an all cash offer is inferior to cash+equity if they believe the synergies are reasonable…

Potential deal synergies are often overstated, but are they in this case? I’m no expert in the Lodging Sector so I don’t have a grasp on how much they’re projecting based on higher RevPar or on the cost side, but to say that cash deals are always better than equity deals in a strategic acquisition is simply not true.

And any revised Marriott wouldn’t necessarily have to MATCH the AnBang bid due to the $400m optout ($2.38/share)

Marriott was willing to pay what IHG and Wyndham were not. Can they construct models to suggest it’s going to be worth 20% more than they already agreed to pay? Sure. Is it more likely than not those models will turn out to be correct rather than overvaluing the asset? Are they giving away much of the upside of the deal?

But I’ve written that there’s both the $400m kill fee and $200m in stated synergies that don’t require Marriott to match.

Still, cash is going to be more attractive not just to Starwood’s board but to Starwood’s shareholders. Marriott is going to need to come up with more cash.

My own bet here is that they would be overpaying, that they are both smart and conversative enough to be willing to walk away.

There’s a long and proud history of Asian companies overpaying for Western assets. The Chinese have recently added their names to the list, taking a bath, for example, in oil assets purchased when crude was over $100/barrel.

I have no idea what Starwood is actually worth, but it wouldn’t be a bit surprised in a Chinese insurance company was willing to pay a dumb price.

That would be a real shame if Chinese buys Starwood,

What is happening, the Chinese are buying United States

The Chinese will probably run it into the ground or convert everything to condos like they are doing with the Waldorf Astoria.

This is good news. Ill take my chances with the Chinese owning SPG over Marriott. With Marriott the program would be definitely diluted and devalued. If they want to compete in the US market it would not make sense for them to hurt the existing SPG business.

@robertw, I’m in total agreement. Had been lamenting SPG’s takeover by Marriott…thinking we were a year or two away from the end of any meaningful program. Now it’s has if SPG has a second life. Here’s to hoping Marriott walks away.

All I can say to SPG loyalty members is be careful what you wish for, you just might get it. There is no way that a company badly overpay in a takeover, then leaves the asset exactly as it was. They will find a way to at least try to make more money out of SPG and just as with Hilton and Blackstone, an overly generous (by industry standards) loyalty program will be among the targets. Odd that the old saying about the devil you know and the devil you don’t, has been turned on its head by SPG loyalists.

If Anbang closes Starwood maybe they in turn now buy Hyatt or even Mariott….

Usually when a business buys another business and pays a premium for it, the buyer has a clear idea of how it intends to run the business to make its acquisition payoff. So what is Anbang’s plan to address the reason(s) that Starwood was on the market in the first place? The Chinese are communists, but they believe in getting a return on their investments. If Anbang is in fact overpaying, that would seem to mean it will soon be looking for ways to change the Starwood business to make its investment profitable or it may be putting the business back on the market.

Considering that list of hotels that Anbang is already purchasing, it appears that Starwood would be a better match to those properties versus the Marriott properties. I never thought Starwood and Marriott were a good match. But, the Chinese could turn super thrifty and really change SPG into a less costly to operate program. I think one would be wise to guess that SPG would be cut down by either buyer.

@Marcus — Anbang goes after companies that put themselves up for sale. They are not in the hostile takeover business, and wisely so because the US and other international regulators would turn hostile against them fast.

Blackstone Group had floated the idea that they were looking for a buyer for the Waldorf-Astoria NYC, and Starwood, of course, had been whorish about their intention to sell…

@Farnorthtrader: “…just as with Hilton and Blackstone, an overly generous (by industry standards) loyalty program will be among the targets”

Got any evidence to support that claim? As far as I know, Anbang has done nothing to change how the HHonors program is implemented at WA NYC. If anything, they have pumped even more money into renovating the iconic building, and who knows, they might even insist that WA NYC start offering free breakfast like both WAs in China — WA Beijing and WA Shanghai on the Bund — that offer an astonishing full free breakfast to HH Diamonds.