I receive compensation for content and many links on this blog. Citibank is an advertising partner of this site, as is American Express, Chase, Barclays and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

Key link: Plastiq special 1.5% bill payment offer

I’ve written about the different offers from Plastiq to pay bills with your credit card (they chrage your card, mail a check to your payee). My favorite offer is 1.5% fees, which they make possible when you pay via MasterCard.

The last offer 1.5% promotion is over. However, through November 30 at 5pm Pacific you can make any one-time immediate payment (i.e. not prescheduled future payment) with a MasterCard for just a 1.5% fee rather than the usual 2.5% they charge (which is still less than Paypal).

People can pay any bill or invoice to receive this rate – from rent, utilities to even babysitters. This promotion will expire on November 30, 2015 at 5 p.m. PT.

The website doesn’t appear to advertise the lower transaction fee as I write this. However it should calculate correctly as you schedule a payment.

Last month Plastiq said they ran their last promotion for awhile. I’m glad to see that didn’t turn out to be quite correct, as this lets you buy spend/miles at 1.5 cents per dollar. It makes sense for:

- Meeting minimum spend requirements for a signup bonus.

- Spending enough on a card to earn a spending threshold.

- Everyday spend, if you have the right card or if you need to top off for the right award. At 1.5% even an airline co-branded MasterCard probably makes sense.

What Bills Can You Pay With Plastiq?

Plastiq will let you pay an US or Canada business or person for any amount. The only restriction is that the payment has to be for a good or service. You can pay an individual person, for instance, if they’re your landlord and you’re paying them rent or if they are your contractor or landscaper.

Just don’t try to pay yourself, a spouse, or another person just to send money (a “peer to peer transfer”), that’s not allowed, and I’ve seen reports of some individuals receiving payment being asked for documentation that there was a bona fide good or service involved for which they’re being paid.

While you can pay bills with credit cards issued outside the US and Canada, payment recipients need to be in either of those countries.

They don’t allow payments to credit card companies, either (so you can’t pay your credit card bill with a credit card) and no “trust/retirement accounts” either.

How to Pay a Bill With Plastiq

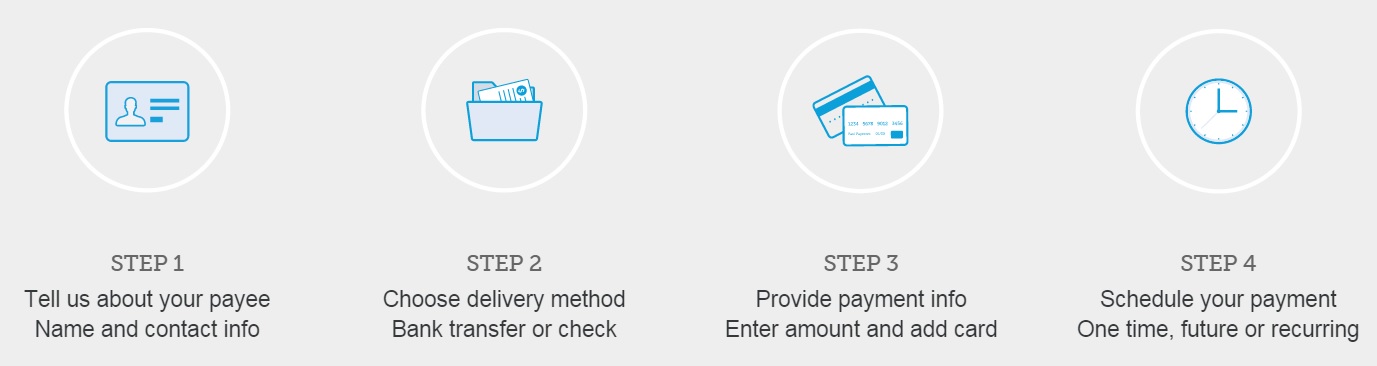

You’ll create an account and then verify your email address. Then:

You can specify any recipient of funds you want to pay using your credit card. And you can specify whether they get a check or an electronic ACH transfer (provided you have their banking information).

That’s it.

Frequently Asked Questions

Will this code as a purchase or cash advance?

I have not heard of any payments coding as a cash advance. Plastiq does flag one possible instance:

For the vast majority of payments, these are not coded as cash advances. The instances that are are if you’re paying specific Canadian merchants with a Visa card. If you are doing this, please email support@plastiq.com to determine if it will fall under this

Can you pay bills with a gift card or debit card?

Yes.

I heard it can take awhile to pay someone.

That’s not a question. But some transactions get flagged and require additional information. This is especially true if you’re paying an individual. Say your landlord is a person not a company, they may contact you wanting a copy of your lease. They aren’t a peer-to-peer payments service and are coding transactions as purchases, they need to keep their paperwork good to continue being able to process bill payments like this, and at low rates. And process could take a few days once you provide the documentation they’re looking for. I don’t advise paying bills, especially the first time with a business, close to the due date. Remember that even if you aren’t paying an individual, as long as you aren’t giving them electronic transfer information, they’re mailing a check.

For avoidance of doubt I will not benefit from your signing up with Plastiq or scheduling bill payments through them.

Key link: Plastiq special 1.5% bill payment offer

MC not working at 1.5% fee so far, also gift card which worked yesterday at 0% now at 2.5%

I used them 3 times, twice was fine and the third was screwed up. The funny thing is, my communication I received from them was always after 6 pm and at least 2 days later. Almost like their employees are really only part-timers working remotely. Everytime I asked the rep to talk to their IT Dept, he ignored me. He kept denying they billed the wrong card and insisted I must have been mistaken. If you’re bills get paid correctly, and the correct cc gets used consider yourself lucky.

He even told me there was no way I could delete a credit card, it had to be done on their end. Almost like he never actually went through the process or knew what a user profile with cards linked looked like. There’s a button with the word delete at the bottom. Wierd and scary folks.

If I am using a $500 gift card (debit card-like), but my payment is for $1200, can I combine 3 gift cards to one payment? Ive logged in and looked around, but can’t figure out how to do that.

@AI that would generate 3 checks, they do not have split tender for a single payment

Can I pay City or Federal taxes with this service?

Tip: you get the 1.5% rate only if you select a one-time payment. Used it with my Citi Double Cash to pay my mortgage. Only made 10 bucks off of the payment after the fee, but I figure why not. Just wanted to try the service.

@travis can i use this service multiple times for the promotion? let’s say i have a mortgage and property taxes due before november 30, could i do both of those using this promotion?