A couple of weeks ago many readers took advantage of the deal of the year.

- British Airways ran a premium cabin sale.

- Prices were lower than advertised.

- From more cities than advertised.

- With deals available throughout Europe and not just London as had been advertised.

And the sale was stackable:

- With the AARP $400 business class discount

- With the Chase 10% discount on British Airways tickets

- Or instead of the 10% discount, with using miles to buy down the fare (at 2.5x the usual value of British Airways Avios)

This was an advertised sale, which stacked with other advertised promotions, and wasn’t actually a mistake fare. And yet some people were spending ~ $450 in cash for roundtrip business class to Europe. They had to spend 30,000 Avios to do it, but for travel through the end of January it even earns a 25,000 point bonus either with British Airways or American.

Like I said, in my view deal of the year.

The AARP discount was just renewed through early 2017. It seems to me that they shouldn’t be offering it on discounted “I” fares, but it’s fantastic that they are.

However the question is why BA was running the premium sale in the first place, and why it was available so broadly and at lower than expected prices? There may have been a mistake made at BA, but it also does make some sense in the context of a year-over-year drop in premium traffic that was noted in the British Airways Q3 earnings discussion. BA disproportionately relies on premium traffic, which is sort of ironic given their inferior premium product. (They were once pioneering with lie flat business, but now lag with dense cabins and a comparably poor soft product.)

I’m more of a global pessimist right now than most. No doubt ‘most’ are smarter than I am about the global economy, and so I’m less likely to be right.

But since I believe quite a few controversial things I’ll say that I think China is entering its Great Recession, something the Chinese government had managed to delay for years but finally caught up with them, now there’s a ton of malinvestment to be liquidated and a whole lot less low hanging catchup growth to fuel their economy.

Europe got a Greece deal done but is far from out of the woods. Russia continues to implode.

And this all has implications for the US economy as well. Low fuel prices for the airlines are both a blessing and a curse and we only focus on the blessing. It lowers costs. But fuel prices are low largely because of lower worldwide demand for oil, because of the slumping economy. Airline revenues are falling, but if the economy slows further those revenues will fall further.

All of that makes me think this is the worst possible time for frequent flyer programs to devalue. When the economy is strong, planes are full, and prices are rising an airline doesn’t need to spend as much marketing dollars to fill incremental seats — there really aren’t incremental seats. But as the economy slows, fares are falling (which they are), you need to invest in your marketing engine. Not cut it.

It’s a cautionary tale as American prepares to finalize what they’re going to do with AAdvantage post-integration with US Airways, and something that all programs need to consider. It is a mistake to assume full planes and no need to incentivize or compete for business is a situation that will continue much longer, in fact the facts on the ground may have already shifted.

Unfortunately, though that should be the lesson it may not be. This is very much a herd industry. When Delta was working through the issues of its new, less generous and far less transparent frequent flyer program their planes were full and at increasing prices. Their airline operation was their unique selling proposition. It may have made sense to spend less on marketing through a loyalty program.

- United, which manages by doing what Delta does, followed suit — but United has a different business than Delta does.

- American is now facing these questions (“Do we do what the most admired airline does, because the most admired airline does it?”) when the facts on the ground have changed.

But this is a herd industry, and US Airways was even speculated as a possible first airline to introduce a revenue-based frequent flyer program before Delta but the American merger got in the way.

We’ll see whether they have the vision to respond to different facts with different solutions. And we’ll have a better idea reasonably soon.

Great insightful post. I still do pinch myself occasionally thinking I’ll be reviewing the baby bus to city amongst other things for the rip price of around $645.Just when I was wondering if there was ever going to be one in the sub $1000 range we found which took me to my wedding earlier this year. It was a fantastic sale and i totally agree on the Chinese economy. Cheers Gary.

Still available?

A “herd industry” is a small degree of separation from collusion…

Interesting post. I missed the BA Avios sale until it was too late. Long story that involves being busy, on a cruise ship, etc. etc. I was sad to miss this chance to use some of our Avios and we love going to Europe. I hope the bright spot to be that it may have ate up some of the BA capacity for award seats so that my AA award bookings will be easier to avoid BA over the pond. Maybe I’m a fool for thinking this.

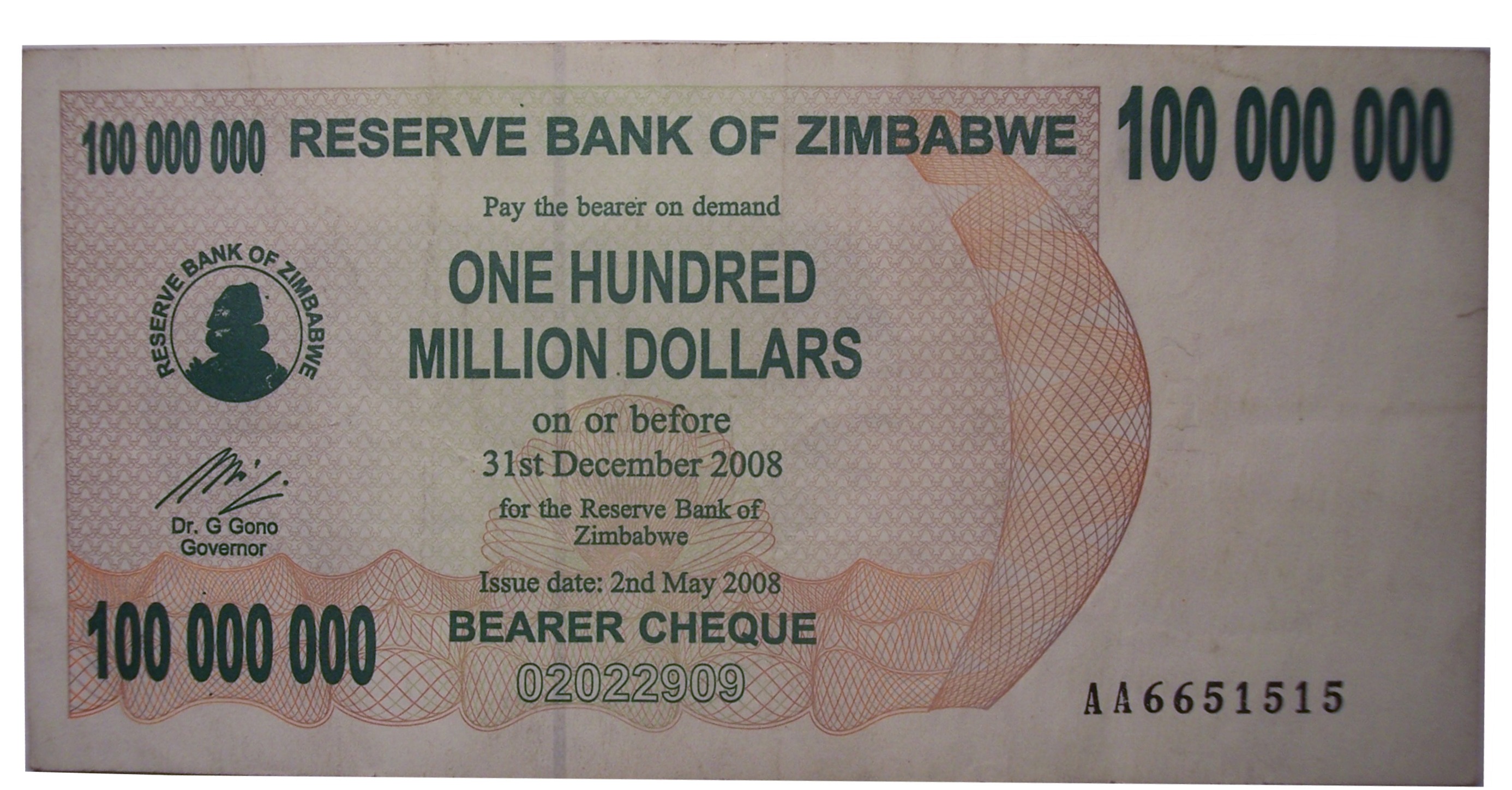

All central bankers are scum. They have been trying to solve a problem that was not monetary to begin with. Prices of assets are too high as related to the incomes. They needed to come down. That was the right thing. When they did, the central banks everything to blow the bubble back up. And now they act like the martyrs. “They have done all they could.” Self righteous jerks. All they did was increase inequality. The world needs 5 years of bitter medicine. Bankruptcies galore. Then start from a clean slate.

Long story short. My last five trips to Europe in business from California have been paid fares under $1800. Good carriers too, Virgin, British, Swiss, Austrian, and Alitalia. I didn’t have to hunt for availability. When those flights went on sale, they were on sale for all departures. How can I justify frequent flier miles, rewards points, and the game when they’re only getting me 1.3 cents a mile.

Well,

The deal of the year was the deal of the year because it involved Avios as part of payment. But the value of those Avios was quite objective – 30,000 Avios reduced the fare $764 dollars or something like that – about 2.6 cents, and a very good use. (I bought 12 tickets for me and my family).

So in this instance, having some Avios in the corral proved quite useful.

Though several years ago I seemed to be able to get TATL business class on some major airline (other than TK) for $2.5K-$3K or so, for the last few years I rarely seem to be able to get low business class fares on the flights I need, mainly to EU capitals. I travel for work, need fairly specific dates and cities, and those just rarely seem to be the ones discounted. The recent BA sale, for example, did not offer much of a discount on either of two flights I needed TATL, despite my being willing to connect through LHR. Just bad luck, I guess. Perhaps it will change back at some point.