I receive compensation for content and many links on this blog. Citibank is an advertising partner of this site, as is American Express, Chase, Barclays and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

American AAdvantage sent out an email today marketing their mileage partner BankDirect, which offers American Airlines miles-earning checking and other financial products.

I’ve been a BankDirect checking customer since July 2003. They’ve increased signup bonuses since then, but capped mileage-earning multiple times and also imposed a $12 monthly fee on their checking account that you can’t avoid by holding a sufficient balance of funds with them.

As a result it isn’t as lucrative as it once was. But that’s because the checking account business isn’t as lucrative (post-Durbin Amendment they’re not making good money on debit card transactions any longer, and holding deposits alone isn’t profitable with interest rates so low).

The BankDirect Value Proposition

Some will view this as an investment account that pays a rate of return in miles rather than money (and which doesn’t report earnings to the IRS).

BankDirect awards 100 American Airlines miles per every $1000 average balance every month. Depositing $50,000 at the bank generates 60,000 miles per year (they only award 100 miles per $1000 on the first $50,000 in your checking account, earning is just 25 miles per $1000 above that). If you value those miles at 1.5 cents apiece that’s a $900 return, minus $144 in monthly fees, or a net of $756. If your rate of return on that cash would otherwise be less than 2.5% you’re probably coming out ahead (depending on your marginal tax rate of course).

I view it as a checking account that offers miles, which is how it’s intended. If you aren’t keeping $10,000 or more in your checking account on average though (and earning 1000 miles a month) then it’s probably not worth paying a $12 monthly fee. I’ve long had big business expense reimbursements such as from work travel. As a result I’ll be holding short-term funds in my checking account until I pay off my credit cards. And so there’s enough float on which I’ll earn miles to justify keeping the account.

I’ve found the bank to be helpful. They provide your first order of 50 checks free, a free debit card, and they not only do not charge out of network ATM withdrawal fees but they will reimburse up to $2.50 per withdrawal you make from an out of network ATM four times per month.

For an online bank they’re not super-technological. In fact they just rolled out their first mobile app mere weeks ago.

The BankDirect Signup Bonus

This won’t sound super-impressive when you can earn 50,000 American Airlines miles for a new Citibank checking account, but they’re offering 21,000 miles to new accountholders:

- 1000 miles for opening your account

- 10,000 miles for direct deposit for 6 consecutive statement cycles with a minimum of $2000 per month

- 5000 miles for using billpay to a minimum of 3 different payees totaling at least $500 a month for 6 consecutive statement cycles

- 5000 miles for using the debit card at least 12 times totaling at least $500.00 per month for 6 consecutive statement cycles

You’re going to need to keep your account, therefore, a minimum of 7 months to see the full miles post (miles generally post around the 7th of the month following the month in which they were earned). That’s 7 months of $12 fees.

Of course in the meantime you’re earning miles each month based on your average account balance. A $50,000 deposit earns 5000 miles per month (or 35,000 miles in those 7 months, worth far more than the monthly fees).

Bear in mind that two checking accounts – Citi and BankDirect – can earn you enough miles for a one-way first class to Europe or Asia, or business class to the Maldives.

Cathay Pacific First Class

Referral Program

If you are referred by an existing BankDirect accountholder you get an additional 1000 miles, and the person who refers you gets 1000 miles as well. The rules say that a referrer can earn a maximum of 10,000 miles through the program, however I earned several times that much before they stopped allowing me to earn miles referring new accounts.

If you are a BankDirect accountholder and would like to refer a reader so that you both get 1000 miles when they open their account, feel free to leave your email address in the comments so that you might be contacted.

Other Account Types

BankDirect offers a Mileage Money Market account which earns 50 miles per $1000 dollars (rather than 100 for the checking account) on the first $50,000 and then 25 miles per $1000 dollars after that.

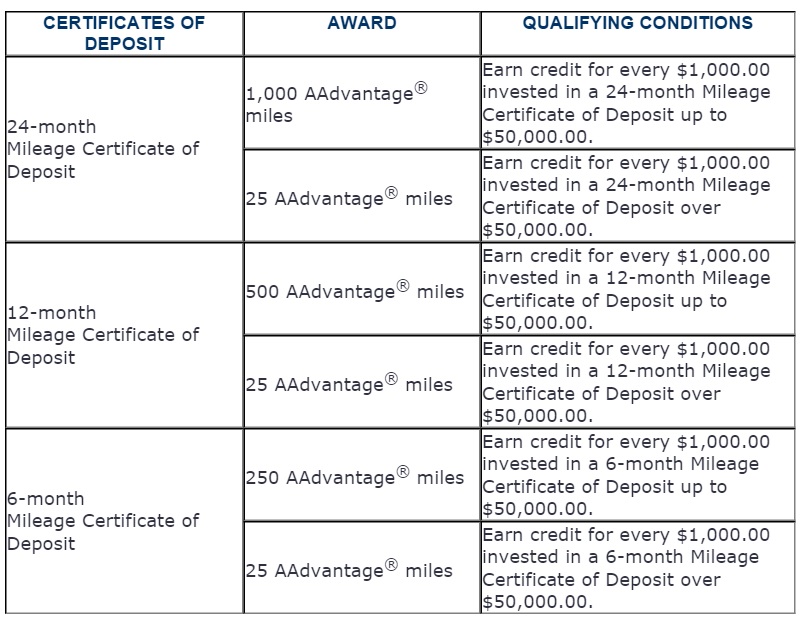

They offer mileage-earning CDs as well.

I have not taken them up on either of these.

Additional Financial Institutions Offering You Miles

Other checking account products earn miles for signup, but I don’t know any others that reward you on an ongoing basis for the balances you keep in your account. In addition to Citibank, UFB Direct devalued their earning this year and offers an American Airlines mileage-earning debit card that gives 1 mile per $3 in spending, not to exceed 120,000 miles per year.

The big mileage earning comes from Fidelity.

Fidelity offers up to 50,000 miles from your choice of American, United, or Delta with a deposit of $100,000. You used to be able to ‘cycle’ the same money in and out to get up to that $100,000 mile threshold, but it no longer seems to be possible.

With each of these offers, Fidelity will give you up to 50,000 miles based on the amount you deposit into your account within 90 days of opening.

- 15,000 miles for a $25,000 deposit

- 25,000 miles for a $50,000 deposit

- 50,000 miles for a $100,000 deposit

And while Fidelity doesn’t give you an ongoing bonus for your balance the way that BankDirect does, some folks have been able to earn one bonus per 12 month period (getting the 50,000 mile offer with one airline and then repeating with a different airline). These three mileage-earning bonus offers have not, to date, been 1099’d that I’m aware of.

Does Fidelity offer these bonuses for retirement accounts (401K, etc)? Does anybody offer bonuses for tax advantaged retirement accounts?

Hey,

Thank you for the summary on this Bank, I was not aware.

If possible please confirm whether there is any fee for international ATM withdrawals; You state “they do not charge out of network ATM withdrawal fees…” but I wonder if I could use their debit card also when traveling outside the USA.

Thank you,

PB

I’ve had a BankDirect checking account that I cancelled earlier this year and I was wondering how often you can sign up to get the 21K in bonus miles. I know Chase bank has it that you can only get a signup bonus once a year. I might consider signing for BankDirect again in the coming year.

Quick correction. The Fidelity offer must be funded within 60 days of account opening. “New accounts or deposits into existing accounts must be funded within 60 days of registration.”

I’ve been a Bamkdirect customer for about 3 years and love the 60,000 AA miles I get per year. If you decide to sign up please use me as a referrer – we each get 1000 AA miles:

joel dot gilgoff at gmail.com

@Joel,

Leech. What did you contribute to this post?

If you need a BankDirect referral for an extra 1,000 miles then please email me

grewal.sukhbir.singh@gmail.com

Thanks.

@farnorthtrader

Hubby and I have the Fidelity accounts and they are straight up brokerage accounts, not retirement accounts.

Does the Citibank checking account offer still incur a 1099?

If we have an existing Fidelity account, is there anyway to still get the airline bonus offer?

My wife and I have taken advantage of the Fidelity airline mileage account 4 times. The key is to open accounts as sole owners not joint accounts. You can open an account in each of your names about once every 9 months.

The money in the account can be used for any investment. I’m quite conservative so I used the money to buy a 9 month CD rather than invest in the stock market.