I receive compensation for content and many links on this blog. Citibank is an advertising partner of this site, as is American Express, Chase, Barclays and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

Key link: Plastiq special 1.5% bill payment offer

I’ve written about the different offers from Plastiq to pay bills with your credit card (they chrage your card, mail a check to your payee). My favorite offer is 1.5% fees, which they make possible when you pay via MasterCard.

The last offer — any new payee paid via MasterCard for a 1.5% fee — is over. However, through Tuesday October 13 you can make payment of $500 or more to any vendor (new or existing in your Plastiq account) with a MasterCard for a 1.5% fee.

This means you are buying spend at 1.5 cents per dollar.

You can get that fee on any transactions of $500 or more scheduled to a business (or businesses) by October 13. (Recurring payments to the business – like a landlord or mortgage company – scheduled by October 13 will still have the rate applied to them even if they’re over a year out.

Note that Plastiq now says this is their last currently-planned promotion (the usual cost is 2.5%).

1.5% is a huge offer that makes sense to me for:

- Meeting minimum spend requirements for a signup bonus.

- Spending enough on a card to earn a spending threshold.

- Everyday spend, if you have the right card or if you need to top off for the right award. At 1.5% even an airline co-branded MasterCard probably makes sense.

Even at 1 mile per dollar (unbonused spend) you can buy as many miles at 1.5 cents apiece as you have bills — or even can prepay bills, or schedule out bills into the future.

What Bills Can You Pay With Plastiq?

Plastiq will let you pay an US or Canada business or person for any amount. The only restriction is that the payment has to be for a good or service. You can pay an individual person, for instance, if they’re your landlord and you’re paying them rent or if they are your contractor or landscaper.

Just don’t try to pay yourself, a spouse, or another person just to send money (a “peer to peer transfer”), that’s not allowed, and I’ve seen reports of some individuals receiving payment being asked for documentation that there was a bona fide good or service involved for which they’re being paid. It’s not like the ‘good old days’ where you could send $5000 to your spouse for free with Google Wallet, and they could send you the same back.

While you can pay bills with credit cards issued outside the US and Canada, payment recipients need to be in either of those countries.

They don’t allow payments to credit card companies, either (so you can’t pay your credit card bill with a credit card) and no “trust/retirement accounts” either.

How to Pay a Bill With Plastiq

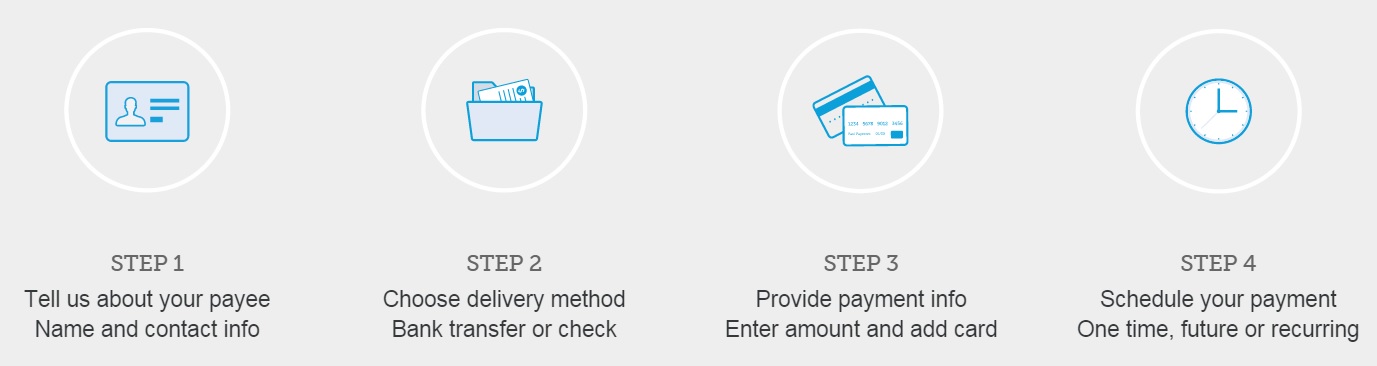

You’ll create an account and then verify your email address. Then:

You can specify any recipient of funds you want to pay using your credit card. And you can specify whether they get a check or an electronic ACH transfer (provided you have their banking information).

That’s it.

Frequently Asked Questions

Will this code as a purchase or cash advance?

I have not heard of any payments coding as a cash advance. Plastiq does flag one possible instance:

For the vast majority of payments, these are not coded as cash advances. The instances that are are if you’re paying specific Canadian merchants with a Visa card. If you are doing this, please email support@plastiq.com to determine if it will fall under this

Can you pay bills with a gift card or debit card?

Yes.

I heard it can take awhile to pay someone.

That’s not a question. But some transactions get flagged and require additional information. This is especially true if you’re paying an individual. Say your landlord is a person not a company, they may contact you wanting a copy of your lease. They aren’t a peer-to-peer payments service and are coding transactions as purchases, they need to keep their paperwork good to continue being able to process bill payments like this, and at low rates. And process could take a few days once you provide the documentation they’re looking for. I don’t advise paying bills, especially the first time with a business, close to the due date. Remember that even if you aren’t paying an individual, as long as you aren’t giving them electronic transfer information, they’re mailing a check.

For avoidance of doubt I will not benefit from your signing up with Plastiq or scheduling bill payments through them.

Key link: Plastiq special 1.5% bill payment offer

Gary, you make a post specifically saying that child-support payments were allowed. I tried to do that, and then I got this back from Plastiq:

“We were able to support child-support payments. However, at this time we are no longer able to do so. The linked blog [VFTW] now shows an update up on top indicating this.

It’s Plastiq’s goal to be able support all your important payments, and I’m sorry we were unable to do so in this case. Let me know if you have any other questions.”

I just don’t really think that this company knows what they are doing.

“A 2.5% fee will be applied to your total.”

Where are you seeing the 1.5% fee?

Has anyone tried paying federal taxes? I am a bit uncomfortable putting my SSN on check which is issued by plastiq and probably doesn’t have lot’s of safeguards.

I tried to purchase furniture using Plastiq from a family member and they said it wasn’t allowed. This site is a joke. You can pay for someone to walk your dog but you can’t buy for used furniture and both would be hard to provide documents for unles the dog walker was a business. If my last payment gets refunded I’m done with that service.