I receive compensation for content and many links on this blog. Citibank is an advertising partner of this site, as is American Express, Chase, Barclays and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

Key link: Plastiq special 1.5% bill payment offer

Here’s finally I think a good and super quick and easy way to earn miles paying your rent or mortgage and anything else that you’re currently paying by check or online billpay.

Back in May I wrote about Plastiq, a service that lets you pay bills with a credit card. It’s convenient, you earn miles for the payment, and it costs less than using Paypal.

Last month they ran a special offer of 1.99% fees when paying bills with a MasterCard or American Express.

Not everyone should be ready to jump on a service charging a 2.5% fee, it means you’re buying spend at 2.5 cents per dollar (or paying 2.5 cents per mile if there are no bonuses involved). So even though that’s cheaper than competing services, it’s a niche play .. worth doing if you need a boost to meet minimum spend on a credit card, but not something to use every day. At 1.99% the points you earn should be worth more than the cost.

Now they have an even better short-term offer.

- Both new and existing users can get a 1.5% fee when paying any new business (a business they haven’t paid before) with a MasterCard.

- You can get that fee on any transactions scheduled to that business (or new businesses) by September 30. (Recurring payments to the business – like a landlord or mortgage company – scheduled by September 30 will still have the rate applied to them even if they’re over a year out.)

This is a huge offer that makes sense to me for:

- Meeting minimum spend requirements for a signup bonus.

- Spending enough on a card to earn a spending threshold.

- Everyday spend, if you have the right card or if you need to top off for the right award. At 1.5% even an airline co-branded MasterCard probably makes sense.

Even at 1 mile per dollar (unbonused spend) you can buy as many miles at 1.5 cents apiece as you have bills — or even can prepay bills.

What Bills Can You Pay With Plastiq?

Plastiq will let you pay an US or Canada business or person for any amount. The only restriction is that the payment has to be for a good or service. You can pay an individual person, for instance, if they’re your landlord and you’re paying them rent or if they are your contractor or landscaper.

Just don’t try to pay yourself, a spouse, or another person just to send money (a “peer to peer transfer”), that’s not allowed, and I’ve seen reports of some individuals receiving payment being asked for documentation that there was a bona fide good or service involved for which they’re being paid. It’s not like the ‘good old days’ where you could send $5000 to your spouse for free with Google Wallet, and they could send you the same back.

While you can pay bills with credit cards issued outside the US and Canada, payment recipients need to be in either of those countries.

They don’t allow payments to credit card companies, either (so you can’t pay your credit card bill with a credit card) and no “trust/retirement accounts” either.

How to Pay a Bill With Plastiq

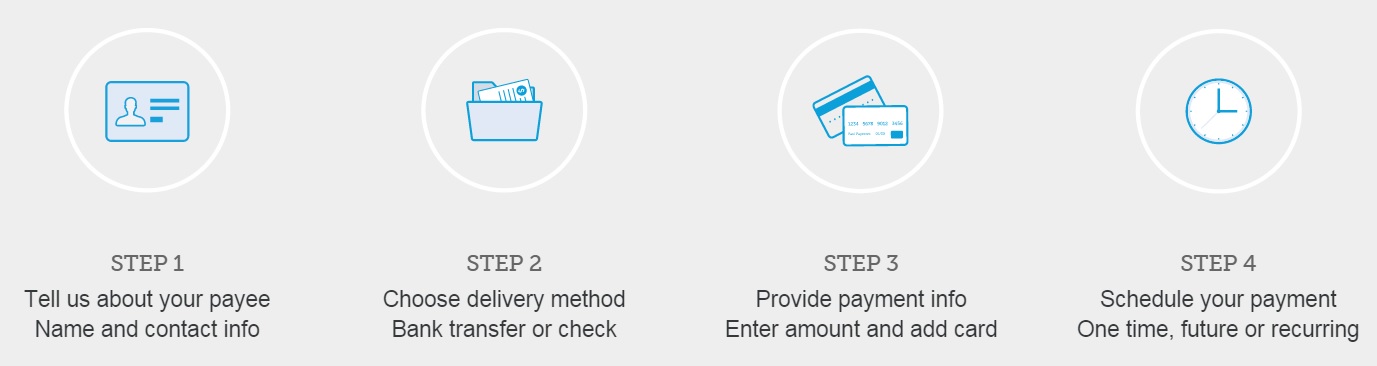

You’ll create an account and then verify your email address. Then:

You can specify any recipient of funds you want to pay using your credit card. And you can specify whether they get a check or an electronic ACH transfer (provided you have their banking information).

That’s it.

Frequently Asked Questions

Will this code as a purchase or cash advance?

I have not heard of any payments coding as a cash advance. Plastiq does flag one possible instance:

For the vast majority of payments, these are not coded as cash advances. The instances that are are if you’re paying specific Canadian merchants with a Visa card. If you are doing this, please email support@plastiq.com to determine if it will fall under this

Can you pay bills with a gift card or debit card?

Yes.

I heard it can take awhile to pay someone.

That’s not a question. But some transactions get flagged and require additional information. This is especially true if you’re paying an individual. Say your landlord is a person not a company, they may contact you wanting a copy of your lease. They aren’t a peer-to-peer payments service and are coding transactions as purchases, they need to keep their paperwork good to continue being able to process bill payments like this, and at low rates. And process could take a few days once you provide the documentation they’re looking for. I don’t advise paying bills, especially the first time with a business, close to the due date. Remember that even if you aren’t paying an individual, as long as you aren’t giving them electronic transfer information, they’re mailing a check.

Multiple Benefits to the Service, But it’s Fine to Use Because We Want the Rewards

The landing page even highlights Act Now & Rack Up Rewards, so this isn’t something where exposure is going to ‘kill the deal’, I’ve spoken with one of Plastiq’s founders who understands that using their service helps cardholders earn rewards and that’s a strong motivator.

It’s an easy way for folks outside the US to pay US vendors. It can be convenient to pay a bill by credit card close to the due date, but at the beginning of a credit card billing cycle (and thus have nearly 60 days to actually pay).

And I love retaining chargeback ability when paying by credit card versus having to pay a merchant via billpay or by check — I rarely ever need to file a dispute, but it’s great knowing that I’ve paid by credit card and could do so if necessary.

Sign Up Now and Schedule Payments By September 30

Note that I receive $5 if you sign up whether you use the service or not. (Update: that was from a previous Plastiq promotion, there is no benefit to me at this time.)

This 1.5% discounted rate for paying bills via credit card isn’t available through the ‘general’ Plastiq website, in order to get it you need to sign up with the special offer link.

I’ve talked with the folks at Plastiq and they tell me that if you’ve already created an account with them you can still have the offer provided you know about it and use the link.

Key link: Plastiq special new member offer

Skeptical on the chargeback ability. I suspect the way this looks is that your agreement is with Plastiq for them to mail a check to your vendor, not with the vendor itself. So as long as Plastiq fulfilled that, I doubt you would win a chargeback even if the vendor didn’t fulfill their side of the equation.

Does Plastiq send a check to a landlord if you use them? I ask because my landlord (like most) charge a fee for credit card payments, so while the 1.5% here is nice, if my landlord is still going to charge their fee it wouldn’t be worth it.

@ Gary — Too bad the 1.5% is for MC only. I need to generate some big spend on AMEX. Oh well, even with extra $350 in fees for on the $35k I plan to spend, using Plastiq is still worth it to me. Here’s hoping for an AMEX promo soon!

The link still says 2.5% fee.

I would not say this is super cheap – maybe 0.5% for that designation

Made 2 payments through them last month, both payments were very late. I personally wouldn’t use them again unless you are ok with late payments.

@Jr price a payment through the link paying via mastercard

@Thomas yes, exactly

Too many reports of unreliable service with this company.

Is this a one-time play for a single payment before September 30? Or do you get the 1.5% for all scheduled recurring payments in the future that are created for a merchant before the end of the month. Like a car payment, for example.

Too bad it is just Mastercard; there are very few Mastercards in the rewards game and even fewer that offer anything for big spending. The only ones that I know of are the American Airlines Executive (for extra elite qualifying miles, which are no good to me) and Virgin Atlantic for a half price companion redemption, which is also no good to me. I am left with deciding whether I want to spend 1.5 cents apiece for Ultimate Rewards Points or Thank You Points or American Airlines miles. All of these are marginal at best.

@ No name — Yes, they are VERY slow, so this should definitely not be used for last-minute bill payments.

Bank of America visa treats plastic as a cash advance — had a service charge of ten dollars on my one dollar plastiq payment, and another ten dollars on the plastiq two cent fee.

In Canada tdbank, all,visa but one MasterCard treat it as a cash advance , as does Royal bank visa. For almost a year plastiq stopped accepting any visa , accepting only MasterCard and Amex.

I have never had a payment processed late.

My wife signed up on gary’s link and it worked like a charm. 1.5% fee on MC. We just got our Premier Citi MC and needed to meet the $3500 spending for 60,000 points. This will take care of it.

No payments to credit card companies. But what if your mortgage company also issues credit cards (i.e., Chase)?

Mortgages are ok. I paid citimortgage last month

Got the email confirmation on the 1.5% using MC. Thanks Gary!

I used it to pay Wells Fargo mortgage last month. It is slow but worked.

Sent it on the 24th. They actually mailed the check on the 31st. and arrived/cashed by Wells Fargo on the 4th. (after the 6th, Wells Fargo would have charged me a late fee)

This time I will be sending it on the 19th so it gets there before the 1st.

I plan to use this to get to my 40k spend threshold for the 10k EQM on Barclays AA Silver.

isnt there a fee free for 6 months using mastercard on plastiq out there somewhere? or is that closed

I have wf mortgage and they have a 15 day grace period and late fee on the 16th.

I signed up when they had the promo. I managed to do one bill pay and then all of a sudden the promo was over and the rate was back to 2.5% and there was no email or notice sent to me about the impending end of the promo. They said oh we told all the blogs that promo was ending. Funny how not one blog I read mentioned the plastiq promo ending and even better yet how Plastiq thought that telling blogs the deal was ending was sufficient notice to their actual customers. Waiting on a rent payment to go through now. Hopefully it doesn’t get tied up.

This sounds good to me. I got the AA World Elite thinking my new truck purchase would get me 40K spend this year. By year’s end with just flown miles I’ll need about 40 thousand more EQM to get to lifetime Plat. After 5 years of ExPlat, falling to Gold, while not the end of the world, is certainly noticeable. The auto dealer won’t go for me putting over $3000 on my CC, even if I paid the fee. This should work!

@Coldagglutanin – that was for utility payments only

Hi everyone,

Just wanted to answer questions and offer clarification:

1. You don’t need to register, or have registered, through a referral link. This promotion applies to everyone!

2. We recommend submitting payments 10 business days before they are due to ensure timely arrival.

3. Does Plastiq send a check to a landlord if you use them? I ask because my landlord (like most) charge a fee for credit card payments, so while the 1.5% here is nice, if my landlord is still going to charge their fee it wouldn’t be worth it.

Yes, you can send a check and there will be no cost to the landlord.

4. Is this a one-time play for a single payment before September 30? Or do you get the 1.5% for all scheduled recurring payments in the future that are created for a merchant before the end of the month. Like a car payment, for example.

If you schedule the recurring payments during the promotional period then you will receive that rate for all those scheduled payments.

5. Bank of America visa treats plastic as a cash advance — had a service charge of ten dollars on my one dollar plastiq payment, and another ten dollars on the plastiq two cent fee.

This should not be happening as long as your making payments within the US. Please email support@plastiq.com ASAP if you are charged a cash advance and are making payments within the US.

If you have any questions or issues, please email support@plastiq.com or chat us in the app (available Monday to Friday, 8 a.m. to 6 p.m. PT).

Best,

Rebecca from Plastiq

Hi, I’m planning to pay my tax due on Sept 30 , do you think it will get credited on time?

There’s a 5% penalty if late.

Thanks!

@JR i don’t see why a payment now wouldn’t be postmarked before end of month

@Gary – Even going through the sign up link you have mentioned, plastiq.com on the account creation page shows 2.5%. Do you know if once the account is created it will change and apply the promotional offer?

@Nitin – bingo.