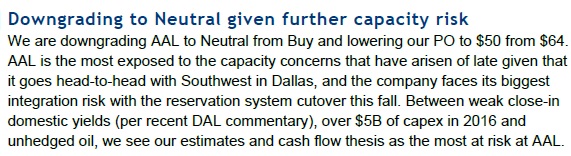

Merrill Lynch has downgraded American Airlines stock to a ‘neutral’ rating just as airline CEO Doug Parker elected to take all his compensation in stock.

Remember that neutral means sell (and sell means build a shelter and accumulate canned goods and bullets). Historically an investment firm wouldn’t rate a sell (or likely even neutral, since ‘buy’ is considered neutral) if they hoped to get business from that firm in the future.

I think that airline stocks generally have had a good run, and there’s more downside risk than upside at this point. That’s true for the US industry as a whole rather than for American in particular.

It’s also true that they’ve already given up much of the gains from the past year. So this may be Merrill just shutting the proverbial barn door. Remember, the factors they see (and I see) aren’t secret or proprietary, so they may already be priced into the stock.

Of course I am not a professional investor, I invest predominantly in low cost, broad-based stock index funds. So what do I know? Then again Parker went all-in on his airline’s stock, and he’s an airline CEO not an investor (though presumably at least someone with insider knowledge).

Nonetheless, it’s reasonable to see the industry as a whole underpeform the market.

- While we no longer face $100 oil, fuel costs are up of late, and there may be greater risk of increases than likelihood of decreases although much of this depends on Chinese consumption.

- Airlines have practiced capacity discipline over the past several years but with profits up and costs down are beginning to get more aggressive. Much of American’s increased capacity just comes from adding seats to existing aircraft, but the industry as a whole is beginning to grow capacity.

- The industry is cyclical, both with commodity prices (fuel) and the economy (demand for business travel). The first quarter showed negative growth. Nonetheless, airlines made money and in their most challenging quarter. Where the economy goes will drive airline profits and determine if they can absorb capacity growth.

- With backward-looking substantial profits, we may see increased friction with labor groups as they demand bigger pay packages.

I think the Merrill report is wrong to lead with the risk of reservation systems-integration. It’s not a zero risk, but:

- They’ve already merged frequent flyer programs, and that went well — doing this in stages is different from the past failed integrations like United/Continental.

- They’re reducing the risks of the reservation system cutover by draining down US Airways reservations before moving data. Running the US Airways operation on the American platform after mid-October isn’t without challenges, but the data migration should work out well.

Goodness knows I don’t give investment advice. I’m unlikely to outperform really smart people who spend all of their time looking for the slightest advantage and who still get killed half the time.

But I’m skeptical that airline stocks will continue their meteoric rise. And other than recognizing there’s some folks who believe United’s operation can only get better starting from a low base and who think that’s not already baked into their share price, I’d guess that the industry would likely tend to move together rather than singling out American’s stock (as we see from the stock price chart above). And if history has taught us anything it’s that airlines are always a strategic short-term play, rather than a long-term investment.

The same comment can be made about any stock. A rough ride in store. Airline stocks as a whole have always been poor investments without perfect timing and luck.

@robertw – my point exactly!

Who cares?

I appreciate miles and points news, but I read enough worthless equity analyst reports at work

The bigger challenge for AA shareholders is no viable plan for the Asian market.

They have the biggest domestic operation, which means the most exposure to Spirit’s margin cutting.

Stock recommendations can also be relative calls. Maybe BAML prefers United to AA and gives ranking as such. Doesn’t necessarily mean AA will do poorly…but, the stock won’t do as well as other airline stocks. I am a former equity research analyst so I have some background in stock ratings.

LOL. Take what stock analysts say and do the opposite. You will come out better than by following them.

If they knew anything, they’d be rich and retired instead of working 7 am-7 pm.

It hardly matters what the reality is once the “wisdom” speaks and starts talking a company down, the herd mentality sets in and it’s a downward spiral based on little or nothing of substance…as we’ve seen every time the interest rate hawks speculate the Fed will start to increase rates….which of course never happens, and won’t until well into next year, if even then. My AA stock doubled, but it may be time to sell just to follow the market, then buy back when there’s a sign of rational recovery. Of course, my AC stock is up 1200%…$2 to $14.

As a professional investor with a specialty in airline stocks, I tell everyone that this is the hardest game in the world, and 99% of people should not buy individual stocks. It’s simply too hard a game unless you are truly an expert — and even experts are often wrong.

That said, you picked a bad analyst report to start writing about airline stocks. There’s not a lot of insight there and — as you seem to appreciate — whatever insight there is, it’s too late to be helpful to investors.

One thing you should appreciate thought is that American Airlines stock is actually cheaper now than it was when oil was $100/barrel — and its profits were about half current levels. This is extremely bizarre because — while stocks sometimes sell-off when anticipated events come to fruition — nobody (except a very small handful of people like myself) expected oil prices to drop to current levels. So, essentially, an unexpected windfall in profitability has caused AAL’s shareholders to lose money!

On a forward price to earnings basis, AAL stock is probably now about the cheapest in the S&P 500, and they have billions of dollars available to buy back the stock. As the more experienced Wall Street airline analysts have noted, there’s really nothing to the current “capacity” concerns, and there aren’t any other particular storm clouds on the horizon. Are airline stocks risky? Absolutely. Are they risky than other individual stocks here? Absolutely not.

I agree with iahphx’s comments.

Fuel is something like 1/3rd of an airlines’ costs and for the foreseeable future, the airlines are going to save billions of dollars/year in fuel costs.

And I guess I’d add, when was the last time you could find the award seat(s) you wanted w/o working for it? When was the last time the flight you were on was not packed to the gills if not oversold? Why are the airlines able to command the same price before the price of oil plummeted-well, sure, there’s consolidation and 4 airlines running the country but maybe there are other reasons to…in any event, I don’t pretend to know what the future holds but I think airline stocks are a great investment at the moment-even w/a really strong dollar and its impact on DAL, UAL, AAL who are exposed to the exchange rate….if I only had any money, I’d be investing in pretty much every major US Carrier and Alaska for good measure…and because their customers actually seem to like them.