I receive compensation for content and many links on this blog. Citibank is an advertising partner of this site, as is American Express, Chase, Barclays and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

The Citi Prestige card is pretty awesome.

You get a $250 airfare credit, which makes the $450 annual fee go down much easier — this can be used directly for the purchase of airline tickets, no need to mess around with gift cards.

You get points that transfer to a variety of airline frequent flyer programs.

The card’s points can be redeemed for paid travel, including at a strong 1.6 cents apiece on American Airlines.

Earning is triple points on air and hotels, and double points on restaurants and entertainment.

You get American Airlines lounge access when flying American, and a Priority Pass Select membership for Alaska Airlines lounges and lounges around the world — including free guest access.

You also get a fee credit for Global Entry or TSA PreCheck, no foreign transaction fees, and even free rounds of golf (seriously!).

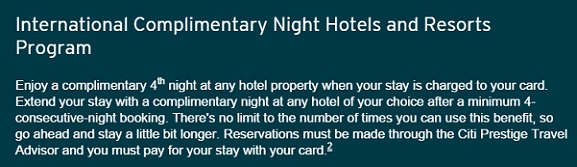

Another benefit that I haven’t covered is that the card comes with 4th night free on hotel bookings. And this isn’t for a limited set of hotels, this is for any hotel.

- You have to book through the Citi Prestige Concierge

- Your rate will be equal to or less than the best flexible rate available through the property itself. (Net net you may wind up paying a little more than a prepaid or AAA rate for the first three nights.)

- These stays earn full points and stay credit.

- You pay at checkout with your Citi Prestige card and then receive a statement credit for the 4th night of the stay.

This is fantastic for stays where the rate goes up on the 4th night of a stay.

And this is fantastic where you’re going to stay 3 nights at the best flexible rate anyway, just tack on a 4th night and earn additional stay or night credit towards status and promotions and additional points without coming out of pocket any additional money. It’s the perfect mattress run.

On a 4-night stay you may not save as much as 25% compared to what you’d pay without the program, e.g. you may be able to save almost as much with a corporate rate code, but this is definitely a great deal on any four night stay and you can use the benefit as often as you like. This alone could make the card worthwhile for cardmembers who stay at hotels regularly for more than a couple of nights at a time.

And since you can use this even at luxury properties, you can get huge savings if you book the kinds of rooms that are $400, $800, or what have you per night.

I was told by a rep while trying to book a stay that the benefit may not extend for 2016. Is that accurate?

You do a wonderful job with your blog, same as Lucky, but the credit card affiliate links thing is getting out of hand. I have had the Prestige card for a long time and was always curious why travel bloggers never talked about the card. I know understand. I am fine bloggers benefiting from the links, but not to the point of losing their integrity. When you rank the cards it really has to be because you believe that is the best card, not because the affiliate links. It is amazing that you guys are promoting Prestige so hard these days, when less than a year ago it had better benefits and barely got mentioned.

@Nic Seriously!

These promotional posts for the Citi Prestige on some the most prominent travel blogs is obviously a coordinated campaign by Citi. You guys really expect us to believe that you all just happened to start making multiple posts per week about the same card at the same time? It’s getting out of hand. I haven’t read all the posts on here about this card to see if Gary says admits or denies anything in the comments but Lucky actually tried to claim in the comments of one of his posts on the Prestige card that this flurry of posts about the card was just because he only now just noticed how great the benefits are. :roll eyes:

@Mike – I wrote about Citi Prestige before, but frankly the much smaller bonuses or much bigger spend requirements kept it a bit niche. Once it went to 50k signup bonus the card got more exciting and I started paying more attention to it. Nothing coordinated with Citi, no increase in benefit to me from folks signing up for the card either.

@Ryan I haven’t heard that though of course ANY benefit can change and 2016 is a decent way off.

Hi Gary,

The Prestige terms and conditions seem to contradict the idea that the paid rate quoted by Wagonlit will be equal to or lower than a “flex” rate. They specifically state that “Rates provided will be equal to or lower than the lowest publicly-available fare at the hotel’s official website.” If a pre-paid fare is listed, it should count.

Furthermore, the same t and c contemplates, “if the cardmember books a special ‘prepaid’ rate this may require payment in full, at the time of booking.” It specifically means to include pre-paid rates and there is nothing at all about the rate being offered being equal to a flex rate.

Do you think I’m missing something? Thanks!

Gary you are not that naive, the benefits on these card were too good for you to not have heard about it before. Free international companion ticket, 15% discount on flights, airline credit, flight points, etc. It is a total PAY TO PLAY scheme.

@Nic but they only just recently added transfers to airline miles, and began building out additional partners. You liked the card before, that’s cool, I never paid much attention to it until it became a points-transfer card. I wrote about it occasionally and paid much more attention once the signup bonus increased. Now it seems to me a really great product.

You can accuse me of whatever you like but as I say there’s no greater benefit to me now than there was before if someone signs up. So the only difference is the bonus, product details, and point values.

i am not sure why everyone castigates Gary and the other bloggers for trying to make a buck. Clearly this is not a charitable endeavor. As long as the information is accurate we are surely capapable of making our own independent evaluation of whether the benefits are worthwhile or not,I hpo

@EVERYONE: This criticism of affiliate blogs and suspicions of coordinated campaigns is starting to remind me of the financial crisis .I just can’t decide if Gary is being accused of being Hank Paulson or Tim Geithner working behind the scenes on behalf of their big-money interests.

I’m surprised that in all this affiliate marketing bashing no one who has the card actually confirmed whether this benefit plays out as Gary mentioned or not. Will my 2500 a night suite count when I book it? What about end on end bookings?

Gary needs to get paid, it’s clear that these credit card affiliates do that for him. I’ve learned to take them with a grain of salt on how exciting the offer is, but am learning about benefits and don’t doubt their veracity.

wow, as a student, I must say that whatever citi prestige had as benefits in the past, it didn’t really capture my attention at all or suites me, but whatever benefits it has now really benefits to the general crowd in my opinion, and thanks to @Gary Leff I will be applying for this card to save one night hotel at paris with my mom, and I must say this card has really become something that I would pay attention to. I don’t care how much money or whatever Gary might or might not make out of this, but I do know one thing: Citi bank is really jumping into the rewards world, following Chase’s footstep and I am gladly benefiting from it

This is a big joke, right? I believe that there may be something to the allegation that the latest flurry of posts on the Citi Prestige card is a reflection of a campaign by Citi to push this card rather than travel bloggers suddenly seeing the light and realizing what a great card the Citi Prestige is.

The reason pushing this 4th night free benefit is a joke is that no serious player of the mile/point game, by which I mean someone who patronizes and has top elite status with one of the major hotel loyalty programs, would use this card to pay for their hotel, especially at $400 or $800 per night. For instance, as HHonors Diamond who pays for my revenue stays with the AMEX Surpass, I typically earn 32 points/$. You can compute how many points I would leave on the table if I used the Citi Prestige rather than my HH AMEX Surpass to pay for my stays. Heck, I could just extend a 4-night stay to a fifth night and get it for free!

Anyone who would falls for this purported “benefit” of the Citi Prestige has no clue about how to play the mile/point game. Unfortunately for them, bloggers who are supposed to provide them with the best info to enable them to choose wisely seem to be in cahoots with the credit cards companies and are pushing, not the best cards, but those cards that the issuers wish to promote aggressively at any given moment.

Thank you for posting this. This is timely as the hefty $450 annual fee for the Citi AA Executive has come up and it is time to cancel that one & get this Citi Prestige card.

Any experiences out there for people calling to switch the cards and getting the sign up bonus for the Citi Prestige one?

Thanks again.

@DCS

No need to belittle people, friend. That’s particularly true when they are badly outplaying you in the value game.

Hhonors points are worth about a half a cent each. So while you’re chasing huge numbers of them, your 32/$ yields you about 16% off.

When you throw in that there are many incredible hotels in the world that aren’t part of a points program and the fact that you can structure your trip so that an expensive Saturday night is free after paying for cheap weekday nights, I’m getting twice the value with my prestige card you are with your CZ status.

1st, I think people need to understand that this is a business for these bloggers. All things being equal they will promote a card that pays them over a non paying card. I know I would.

2nd, if someone knew about this card and it’s great benefits years ago they should have wrote a post about it and “sell it” so others would have chime’d in on it and the post would have gained traction.

3rd, the value I get from these bloggers are great. I just started this hobby and am greatfull for the opertunity to allow me and my family to travel again for little money. It’s been 3 years since we have and I feel terrible that my kids had to hear about other families traveling while we did not, so thank you for helping me change that.

Now on to my personal experience with the 4th night free.

Last month I booked an all inclusive hotel in Jamica for 4 nights. I used the service of tingo.com since they price guarantee if rates drop.

Few days ago my card arrived and I was able to book the same room at the same rate I got on tingo. There was no AAA discounts, or other promo codes (the rate was an online special).

I canceled the room at tingo, and went fed with Citi. The swap saved me $500+ for the night and went twd my initial spending amount.

Bad news is the process sucks. Calling the number on the back makes you enter a ton of info. Dial the direct number and ask them to connect you to the travel department. Do NOT go through the email crap, takes way too long.

So week one the card paid for itself on 1 trip. Plus I sighed up for the go pass (forgot the name) and will get the $100 credit. And looking fwd to the $250 airline credit and free lounge access when I didn’t have.

So if you ask me, these posts on this card could not have come at a better time. BTW Citi mailed me an offer for 100k points for $5k spending in 3 months. I called them and begged them to honor it. They said they will after I emailed a scanned copy of the mailer.

Time will tell…

(Sorry for any bad grammar, on my cell)

@Joel — When you start by throwing around the mindless schtick about HHonors points being worth half cent, it is clear that you are clueless and would be too much in over your head to even know who has outplayed whom “in the value game.”

See if you can get this:

According to bloggers HH points are worth 0.4 cent each. However, they are totally clueless about the fact their valuations a meaningless because they do not take into account the earning side of things! For example, one earns 6 times more HH points a clip than one does SPG points (valued at 2.2 cents) or 3 times more HH points than one does Hyatt GP points (valued at 1.4 cents)….

….which means that HH points are equivalent to 0.4 * 6 = 2.4 cents (vs. the bloggers 2.2) and 0.4 * 3 = 1.2 cents (vs. the bloggers’ 1.4 cents). See? No difference at all, and that is why you should not get in a debate that you are poorly equipped to participate

G’day 😉

….which means that HH points are equivalent to 0.4 * 6 = 2.4 cents in terms of SPG points (vs. the bloggers 2.2 cents) and 0.4 * 3 = 1.2 cents in terms of Hyatt GP points (vs. the bloggers’ 1.4 cents). See? No difference at all, and that is why you should not get in a debate that you are poorly equipped to participate.

@DCS

Your ironic ad hominem aside, you should really give the prestige a shot.

To use your Starwood example, if I book an SPG room using my Prestige, I get two SPG points per dollar for the stay and three Thank You points per dollar for hotel spending. If each SPG points is worth 2.2 cents and each Thank You Point is worth 1.6 cents you get ((2.2*2)+(1.6*3))=9.2%.

Since the free night is a statement credit, you also get your 9.2% on the amount that’s rebated. If you’re getting a pricier night as the free night, you can get about a 33% bonus this way, taking your points value to 13.3% or so. That’s very near your 16% you’re getting with your status.

But you also get a free night. That’s about another 30%.

The Hhonors clearly has value, but it’s strongly inferior for a four night stay.

@Joel — Ad hominens go to folks who start a comment with baseless assertions or conclusions.

If you are happy with the Citi Prestige so be it. The rule thumb is that one must go for a scenario which is likely to be a winner most of the time. Translation: one needs to have a co-branded card for every loyalty program that one patronizes because such cards almost always earn the most/mile points, without any caveats. Travel bloggers, on the other hand, must push cards, all kinds of cards, to earn a living. I don’t know about you but I see in there a conflict of interest large enough to make their recommendations highly suspect.

Follow a blogger’s recommendation at your own peril!

A couple of points to make:

The Citi Prestige card is awesome. You’ll make way more from it than you spend in the annual fee. TY Points suck, but the benefits are so good that it’s worth having the card and never using it.

I blog and am purposefully not leaving my link here to keep this opinion agnostic. I don’t know Gary and he doesn’t know me. But, given what the various credit cards pay, I can safely tell you that there are MUCH better cards to pump if you are only in it for the commissions.

This card is a pain in the neck to use on a day-to-day basis because the stripe is on the front of the card, and it is a black stripe on a black card. No clerk can ever find it and it’s a pain to explain.

Thanks,

Mike

@Gaspipe1 – very cool. I love when someone posts a real scenario.

@DCS – The joke must be on you. You sound like you are jumping around freaking out – this is a BLOG, it is not a billboard in your front yard, you never have to come here again to read it. REALLY. It seems to me most people in this game have ALL the cards. The “one must” and “one needs” is really neither here nor there. Who cares? Settle down and have a cup of tea.