I receive compensation for content and many links on this blog. Citibank is an advertising partner of this site, as is American Express, Chase, Barclays and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

There’s a card that earns 1.5 American miles on all spend.

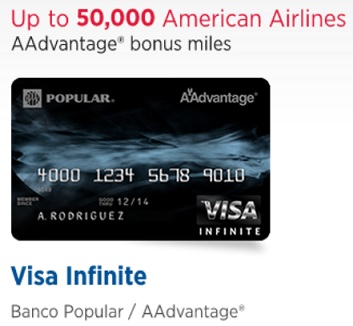

It’s a Banco Popular Visa Infinite, for Puerto Rico residents, and it comes with a signup bonus of up to 50,000 miles:

That’s 37,500 American miles after $3,000 spend within 12 months of card opening and an other 12,500 bonus miles after a whopping $50,000 spend within 12 months.

The card even comes with a Priority Pass membership (not described as the hobbled Priority Pass Select which excludes United Clubs):

Priority PassTM, an exclusive Visa Infinite benefit. The world’s leading independent lounge program provides free membership to access the privacy of over 600 airport VIP lounges worldwide. For more information visit www.prioritypass.com

This strikes me as really attractive for a $195 annual fee card.

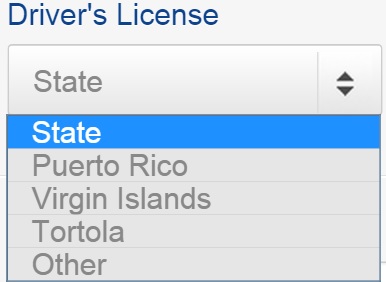

However, the application restricts who can legitimately submit themselves for the card. They ask for a Drivers License from one of the following:

And the only address option is to say you live in Puerto Rico.

Here are the important lessons:

- We should be grateful for the low spend requirements that the Citi® / AAdvantage® Platinum Select® Mastercard and the CitiBusiness® / AAdvantage® Platinum Select® World Mastercard have to earn 50,000 mile bonus offers. (Offers expired)

- Nonetheless, Citibank’s cards could sure be more lucrative for ongoing spend. Remember, the Starwood Preferred Guest American Express Card is actually better for earning American miles than Citibank’s American cards are (since $20,000 spend on a Starwood card lets you transfer to 25,000 miles with several different airlines, not just American).

So while the Banco Popular card seems like a strong offering, there are better options that we’ve got — when it’s an American Airlines signup bonus we’re after, or earning for everyday spend. I’m jealous of the full Priority Pass it appears to have, however.

(HT: MileCards)

I have resisted using the term ‘clickbait’ as you bring out a wealth of information for your readers. But in this case, would ‘For my Puerto Rican readers’ be a more appropriate title? And don’t blame it on making this post before your morning coffee. 😉

Priority Pass sounds intriguing. Can you recommend some other cards that offer the same pass that US residents apply for? Preferably with a low annual fee.

a tease, and click bait. I actually like that you have so many words about credit cards as that is my main interest — how I and my family get to travel at eighty percent off. This is my first time criticizing you. Sufficient for me to use a competitors — either travelisfree or lucky — later this week for chase sapphire preferred.

Ram, I’m not trying to defend Gary terribly much, but I think a lot of Americans live in Puerto Rico for military purposes (including spouses). This may be relevant to them; just another perspective.

how do you get those Amex Everyday points to AA exactly?

@Matt – Maybe I’m misunderstanding, but you realize all 3.7 million people in Puerto Rico are Americans, not just those in the military, right?

The point was not to make people think they could apply but to share that this exists at all which I think tells us something about the economics of these deals (even recognizing that a Visa Infinite card will entail a higher interchange fee). And I wrote it last night.

@Tim in general priority pass with card products get the select version which strip out United access to comply with United’s Chase deal.

@Smartie. Amex points do not transfer to AA (Although with little loss they used to go Amex to Aeroplan to US)

@A dose – two of my favorite blogs! Best, Gary

Argh….one more useless article.

Of course, if you had put the works Puerto Rico in the title, 29,500 of the 30,000 of us who wasted our time clicking and starting to read this would not have bothered. I used to love this blog, but lately it’s almost entirely a waste of time.

“and not just American”

You might want to re-phrase that. To any reader, that means they DO transfer to American.

Interesting one. Wonder why no Visa Infinite in the mainland US. I can’t imagine Puerto Rico is a fundamentally different interchange market.

Sorry to pile on, and I’m usually quick to defend you and enjoy all the credit card bonus info, but come ON. That was a seriously mis-leading title, and very unfair to most of your readers. My time is valuable, and I hate to waste even those 3 minutes. Please don’t do that. Just say “A great card for fans of AA who live in Puerto rico!”

C’mon Gary…. This is click bait and you know it.