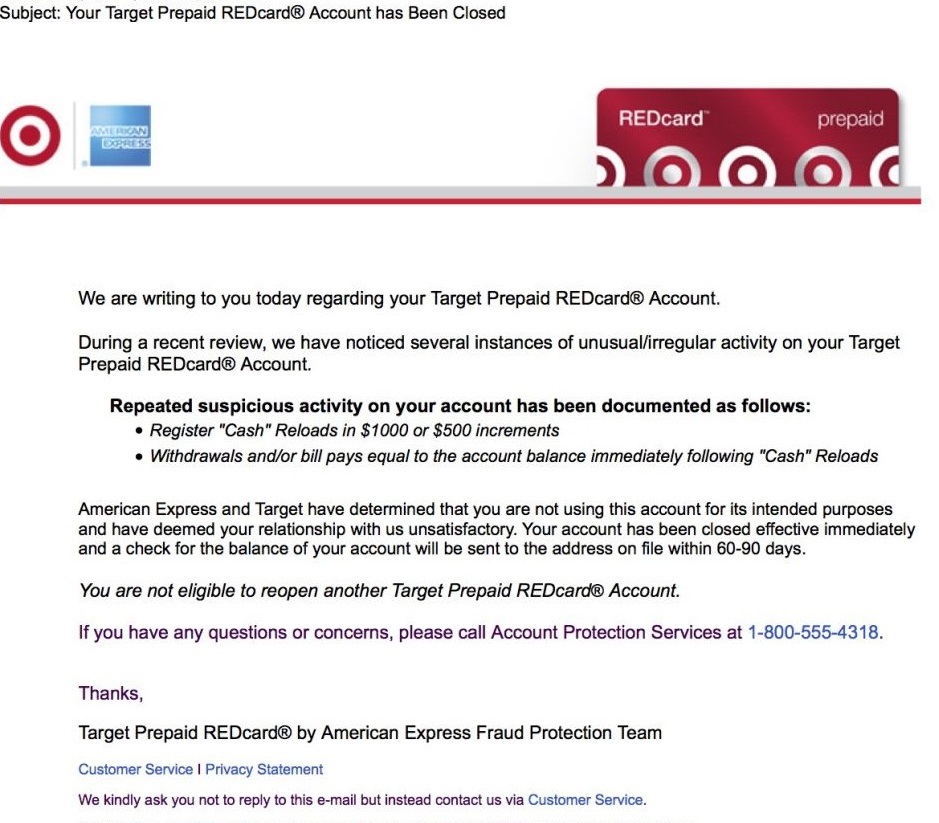

Reader J. who asked not to be further identified forwarded this email that he received, shutting down his Redcard account. (It’s often referred to colloquially as ‘Redbird’ rather than its proper Redcard name because of its similarities to the American Express Bluebird cards co-branded with Walmart.)

American Express apparently decided they didn’t like his loading the card at a Target register using a credit card (to earn miles and meet minimum spend requirements) and then immediately pulling the funds off the card.

Click to enlarge:

Has anyone else received a similar message?

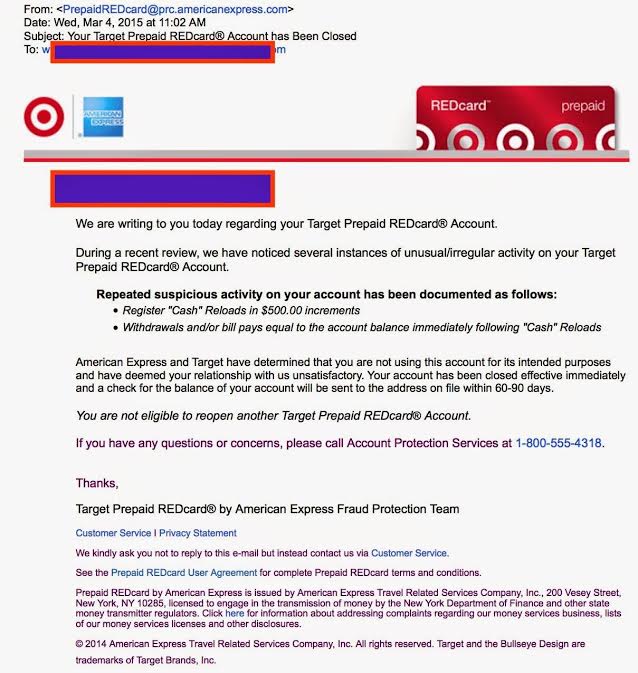

Update: another reader sent in the letter they received:

Update 2: There are a bunch of people out there who feed misinformation about deals, to confuse people into not taking advantage of them. I find it shameful.

And it’s entirely possible that’s the case here. It does seem strange that the letters are so specific, and name specific amounts, that doesn’t seem like what American Express would do.

But if it’s a hoax, it’s an elaborate one, with several different emails being produced and sent from multiple email accounts and multiple names being used to comment from to bolster the claim this is happening.

I’m not sure it should change anyone’s behavior either way (other than perhaps to load and unload in different amounts, and certainly as a reminder never to put more money on cards like this than you can afford to have held for 2-3 months before you recover it).

On each of my trips to Target to load the card, I always make sure to buy $10-$40 worth of merchandise I needed anyways. I hope that’s enough to shield from a similar email.

Looks like the identical load amounts was an issue, why not make $700, $800 and $1000 instead

What happens with the money in the account?

@FlyerM, you’re $10 purchase is not being transacted at the same time as the load. The $1000 load is it’s own swipe and is just as sketchy to them whether you buy paper towels or not.

[We] “have deemed your relationship with us unsatisfactory.” It sounds like a polite but firm divorce filing!

Kudos to the author of that classic expression of restrained rage.

I agree with FlyerM… I live very close to a Target so I theoretically could go and hit the maximum of 5000 per month of Manufactured spending.. but I don’t.. just so I would avoid this type of email.

I only reload when I am at Target to buy something, which is 3 to 4 times a month. I load about $650 before I buy $20 to $50 worth of stuff. Then I pay my bill in smaller odd payments like $272 or $315.. not $600. That’s just asking for trouble from fraud detectors.

I was told at target in Brooklyn that policy is to no longer accept credit cards or gift cards with pin numbers to load cards. Only bank debit. Anyone else having similar experiences?

Or was he loading with REAL cash???

Wow, that’s scary! I guess do random amounts ($846.75), use the redcard at Target for some purchases, wait a week, then pay off the card in another random amount ($837.50).

I received the same shutdown notice, but it was a little bit different. It specifically called out my $750 loads

not good

Good for them. The whole concept of manufactured spend is fundamentally dishonest.

AJ, reread the letter it states what is happening to his money..

This is typical for Amex, people where having Blue Bird accounts closed because people would load them and the same day drain them with a payment to the CC company. This is why I wait 2-3 days before making my payments, never had an issue, while others have had their accounts closed.

@AJ – letter says balance will be mailed in the form of a check in 60-90 days

I just got done with a bunch of loads, hopefully I don’t get that message. Ugh.

Arcanum, I think you may be lost.

In full disclosure I try to use my card on occasion for small target purchases in hopes to keep a “satisfactory” relationship. Plus I let the funds float for a bit (2wks+/-) before using bill pay. So far I max the daily limit on the 1st and 15th or so of each month. Needless to say, but I’m nervous. Given precedence, we should all be especially mindful to not let balances exceed our comfort zone to be delayed by 2-3 months

So far there is ONE report of this. Why is everyone so concerned? Thousands of people do this same thing with RedBird/BlueBird/Serve every month. There has to be more to this story that we don’t know.

Juno,

Could you clarify your sentence :

“Then I pay my bill in smaller odd payments like $272 or $315.. not $600. “

@PainCorp actually we have several reports. There’s the one sent to me, there’s one report on Flyertalk, and there are folks above in the comments mentioning same.

I agree with PainCorp….even if you add the ones to the one he mentions that is now 3 or 4…out of the how many thousands?!?!? I’m not buying it, and most people should know that Amex will not give you an exact reason for closing your account on paper, you have to call in, and even then you will still get the run around.

@Arcanum: Agree 100%. Smacks of money laundering.

So far all of the reports seem to mention withdrawing immediately and/or in the same amount as the loads. This definitely reads like an AML concern rather than a revenue concern, although denying them any swipe fees or float revenue doesn’t help keep the product alive for very long.

I’ve updated the post with another letter forwarded by a different reader.

@Darth Chocolate, please let me know how you define money laundering?

FWIW there’s a thread about this on FlyerTalk. Trouble is, the OP there has been caught lying about MS at least twice, presumably to scare people away from the hobby.

Actually, I misstated something. It wasn’t in the amount of the loads, it was the “account balance.” So I assume that means they were emptying the entire account regularly.

First IANAL, this is my opinion so take it FWIW.

I am not accusing anyone of anything illegal, but when someone deposits money anywhere and then immediately withdraws it, it appears to banks and regulators that they are hiding something.

To a regulator, it may appear that this behavior is being used to fund something nefarious, say drug buys for resale. But they don’t care; they are suspicious. If your job is to find illegal activity, everything looks like illegal activity.

Granted, it looks worse with cash deposits, but any transfer may alert the financial institutions that something is happening they may not want a regulator to question them about.

All you have to do to get the attention of regulators is to engage in legal activity the government does not like. I would suggest you Google “Operation Chokepoint”.

Did any of the people who own the affected accounts try to call AMEX or Target to see if this was for real?

And Gary, why the moderation all of a sudden? What did I do besides agree with someone?

Well, that certainly isn’t very surprising, since the $$ is ‘swept’ out almost as soon as it’s put in by CC spend.

I use Redcard, the same way I used BB via CC Spend with VRs. The many bills we all have to pay that can’t be paid easily with a CC, make the Redcard and nice way to get the points & miles we all crave. Mortgage, insurances, rents, maintenance fees, power bills, Taxes, boy do I get taxes, just to name a few. No need to sweep $$ to my checking accounts with all those to pay.

Perhaps a good solution would be for AM-EX to charge a fee to sweep money to a checking or savings account. I think a 5 to 10% fee would slow down that practice. Or perhaps a 60 day waiting period to withdrawn funds via the sweep.

I, for one, wouldn’t mind seeing that put into place to save Redcard CC loads. Maybe then, it won’t go the way of BB.

@peck – I’m well aware that lots of people lie about deals to get folks not to take advantage. I suppose it’s possible that a cabal is trolling me sending me fake letters. That’s why I asked for others’ experiences.

@Darth Chocolate, I do not know why your comments went into a moderation queue but I approved them as soon as I saw them

Suscribe

Key phrase: “immediately following ‘cash’ reloads.”

Thanks. Maybe it’s because I am posting from China using a VPN.

I remember from the numerous blogs writing about RB at this point cc loads at the register fall under “cash” reloads; so “cash” is used loosely.

FT is full of such trolls and assholes who like to mislead people so that they can hoard all the deals and do all the MS themselves

The phone number in the e-mail doesn’t work.

@David, I don’t billpay round numbers like $500 or $600. If I load $650 using my Chase card and bought $50 worth of stuff, I don’t go immediately online and send $600 to pay off the Chase card. I would send $228 to pay off my Barclay card and few days later send $335 to pay off my Chase and always keep some money on the Target Redcard account. I am not sure if that stops the alarm from going off but it works for me. Loading $1000 and then paying $1000 immediately that same day would set off an alarm with any bank i would imagine.

Oh yes, people loading their cards while picking up their milk and TP are downright evil, lol.

We know from recent history that the banks are squeaky clean.

Please.

Darth, money laundering usually involves cash. People who manufacture spend leave a paper trail that’s easy to follow (and to rule out illegal activity).

Claims of potential money laundering are sometimes used as an excuse for banning unprofitable activity. For instance, some stores won’t let you buy gift cards using credit cards. If they were really concerned about money laundering, they’d disallow buying gift cards with cash.

I agree that MS LOOKS like money laundering. I actually think that’s why we run into problems–not that most businesses are trying to stop US, but are trying to prevent money laundering. I know for a fact that’s the problem at WM money center, b/c more than one manager has told me that. I do not think there is anything unethical (much less illegal) about MS, in moderation.

As for practices, I always try to pay bills from BB if I can, and on occasion transfer 1k or so to my bank acct. I may start changing the amount around, in light of this, though I would think a transfer into a bank acct. is what it is, and the amount shouldn’t be the issue. It’s cool or it is not, and since it’s one of the BB options, I assume it’s okay with Amex. (I have not used Redbird, so can’t speak to it.)

As for anyone who would post lies in order to stop others from doing what the liars are doing themselves, that reminds me of the ones who get all mad every time someone posts any sort of “how to.” I call it “we got ours, you can’t have yours” mentality (also known as GOP), and it is just plain old selfishness. Plain and simple.

Best strategy leads your business at profitable stage. Decision make by American Express to shutting down red bird account is very good if it has not get enough demand. American express implemented some new strategy and give solution how to again build red bird. And earn revenue for this great business.

http://www.travellingareas.com/top-ten-asian-countries-to-visit/“>Top Ten Asian Countries to Visit

Ha Ha … This is going to be fun these next couple of years.

I love spy movie/ thrillers. Just not sure anymore who’s playing which role or if you’re all being typecast .

Haben Sie Ihren Verstand verloren? Έχετε χάσει τα μυαλά σας;

Always the most fun to plug the maniac variable into the equation.

When they forwarded you the emails, was it a photo of the email with their information blacked out or was it the original email in raw form?

For those that are creating hoax emails, AmEx and Target invest a lot in building and protecting their brand. They are liti-happy and I’m sure they’re working on identifying individuals involved with this hoax and pursuing legal action against them.

Will this be renamed “viewfrombehindbards?” LOL

The thing I find oddest about the emails (or alleged emails) is the quotation marks around the word “Cash.” While MSers call it a “cash” reload, would AMEX do so?