British Airways Executive Club is a challenging program already: Fuel surcharges; extremely expensive premium cabin long haul awards; fuel surcharges; few elite benefits that aren’t provided to all oneworld elites of the same tier; fuel surcharges; modest mileage-earning since they eliminated 1 mile per mile flown.

And now we can expect things to get worse. Air France KLM is introducing dynamic pricing for awards June 1.

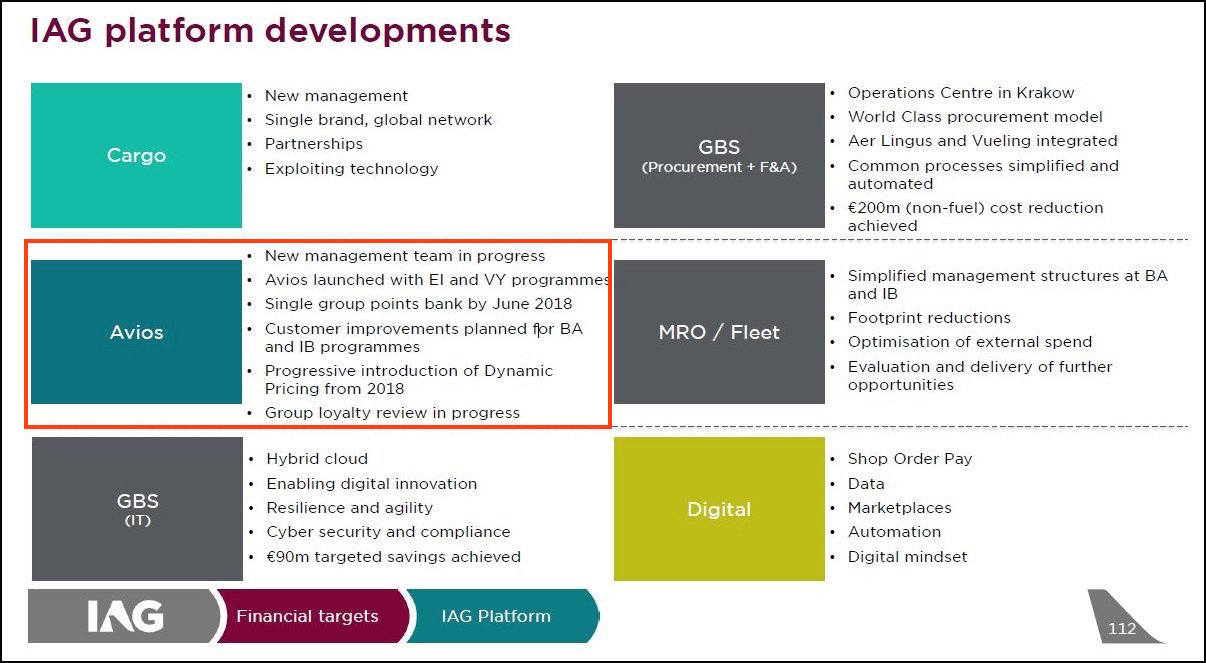

Ultime Llamada points out that in an investor presentation British Airways noted plans to do the same thing next year.

That said Head for Points suggests dynamic pricing might only apply to “last minute bookings” or the introduction of additional inventory or last seat availability based on ticket price (which BA doesn’t offer to most members today).

IAG parent British Airways was supposed to combine all Avios programs onto a single platform in 2017 but that’s been pushed to “by June 2018.” And in 2018 we’ll get ‘dynamic’ pricing of awards.

They’ll frame this for customers as somehow being a benefit — some awards will be more expensive and some will be less expensive. But the awards that will go up in price are the ones that were a good value, that you’d actually want to redeem for. And the ones that go down in price won’t suddenly become a good value.

IAG CEO Willie Walsh told us already — in an earlier investor presentation — why they do things.

As more airlines change their loyalty programs to be revenue-based, they’ll see people abandoning their co-branded credit cards in favor of simple 2% cashback cards, since there will be no advantage accumulating frequent flyer miles. That will ultimately hit their bottom line as they generate so much of their profit today from their loyalty programs.

A quick comment, and a question….

This is why I didn’t focus on BA, when I lost transferability from VX to VS. Originally I thought I’d shift to AF/KLM, but since AS partners with AA and so many foreign carriers, I don’t think overseas will be an issue.

My question has to do with Avios. Between BA and IB, I have some 10k Avios. (Not much in the grand scheme of things, I admit.). Once they’re “moveable,” where do I “park” them: BA, IB, or just let them expire?

Southwest’s revenue-based redemption is consistent with its brand image of simple, straightforward value. For airlines wanting to cultivate a premium brand image this change seems very ill-advised. Literally.

Glad I didn’t take advantage of the recent AMEX > Avios bonus transfer deal.

Tricky, tricky.

Was a loyal BA customer for nearly 20 years. BA used to be a decent airline with good routes in Africa and Europe, where I do most of my business. With the significant changes to accruing tier points and the shift to more revenue-based awards I stopped making BA my preferred airline a couple of years ago and with the new changes I am now avoiding BA completely. Avios points are not worthless but they are not worth my time trying to figure out how to use them.

So does this mean Iberia is also following along?

Article headline not strictly true is it?

BA = robbing BAstards!

I’m giving up gold BAEC as Mr Cruz is like Uncle Willie on a rampage.

If they do this for last minute bookings, probably only a matter of time before they do it for all bookings.

But agree with Evan, the title is very misleading (ie, clickbait)

@Evan – nope, par for the course with Gary’s click-bait headlines!

Why is everyone assuming that “dynamic pricing” of awards necessarily means “revenue based redemptions”? These are (or at least can be) two very separate things.

I’d be interested to compare how much the european airlines make from the ff programs versus the american ones. The US ff programs generate huge wads of cash largely by selling miles to credit card companies. In europe, limits on interchange fees make this unprofitable for banks (this is why US cards are by far the most generous in the world to customers). I would imagine that BA is far more exposed to this than AF/KLM, but I’m curious what the numbers are.

Don’t forget about the fuel surcharges!

Sooo the BA Avios card that you were pushing oh so hard just several weeks ago is no longer going to be a good value? What a shock.

Sco: there’s no reason for “dynamic” unless it’s revenue-based. Since you can price these in pounds/Euros/dollars by definition, a changing Avios price is directly tied to cash price. You could potentially only base the dynamics only on which routes see more redeemed awards instead of monetary purchases, but that hasn’t been implemented anywhere in the world that I am aware of.

I don’t think it’s correct to categorise BAEC as a “challenging” program. Shorthaul redemptions have always been the sweet spot, and continue to be so.

While prices and fuel surcharges for long haul redemptions are ridiculous, flights within Europe are (and have long been) incredibly good value. In essence every time I fly BA/OW in any paid cabin to Asia or the US and credit to Executive Club I earn a free round trip within Europe, which is not a bad deal. Availability for shorthaul redemptions is usually pretty good, too, as is upgrade availability for long-haul flights.

Elite tiers are easier to earn than on Cathay Pacific (although CX have just backed down and started to award more tier points in each cabin to bring themselves closer to BA), and arguably provide better benefits than equivalent tiers on AA (hello, flagship lounge access for domestic AA flights). Overall they do a reasonably good job of recognising their Silver and Gold tier members.

Having said that if they do away with the good value shorthaul redemptions they will cripple the program, so this dynamic pricing is very concerning.

PowerPoint presentations can make it look like management’s got it covered but don’t tell you shit.

Award redemptions have been “revenue based” to some extent for years. “Dynamic pricing” is just further segmentation of the market. Price is the ultimate market segmenter.

Crap. So much for Avios.