The co-brand credit card business changed when Citibank stole Costco from American Express. It was the biggest most expensive deal in history, and it set off a chain reaction. American Express agreed to pay Delta over $2 billion a year for its business to lock in the partnership.

That set a benchmark for the United. American managed to put together something with two banks to claw their way up to similar levels (Citi after all was tapped out). Southwest and Starwood re-upped at record levels.

American Express would only let go of the Costco business when there was no way to make a profit at the numbers Citi was talking about. It’s the perfect example of winner’s curse. Everyone knows what the business is worth, the one who wins the auction is the one that overpays.

Citi got a huge portfolio — over 11 million American Express cards across more than 7 million accounts. But they didn’t get the same card exclusivity Amex had, Costco will accept any Visa — even those of competitors.

Copyright jetcityimage / 123RF Stock Photo

Citi was never going to make money with the accounts it bought from American Express. And they paid a big premium to service those and issue new cards. The only way to make the deal work was to grow at a fast pace. But they didn’t get the changeover done until last June.

And you have to be a Costco member to get the Costco card but over a year later they still haven’t made it possible to complete both tasks via the online card application.

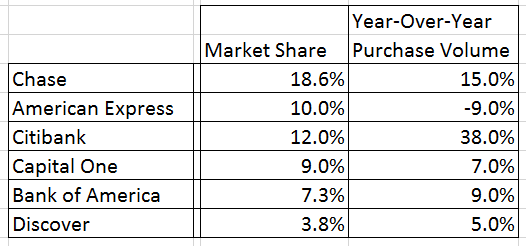

Citi’s credit card purchase volume is up and their market share now exceed’s Amex’s.

However the Costco deal hasn’t made Citi’s credit card business an engine of growth.

The bank said that it had $1.2 billion in losses at its consumer lending business in North America, mostly driven up by unpaid credit-card balances. Worse, the bank put aside another $500 million in its loan-loss reserve account mostly for cards, an acknowledgement that improvement in the segment could be further off than expected. Overall, revenue in the card business was down just 1 percent.

…Its biggest move came a year ago when it undercut American Express Co. and took over Costco Wholesale Corp.’s card business. Citi executives have warned that the expansion would boost costs and losses for a time. But they have repeatedly said that investors would see an improvement starting in the second half of 2017. In the third quarter, at least, the payoff wasn’t evident. Credit-card loans were up just 1 percent from the quarter before. Credit-card margins, as a percentage of loans, dropped to 7.3 percent, down from 8.7 percent a year ago. And credit-card losses were up 36 percent, to $611 million, from a year ago.

Couldn’t happen to a nicer bunch.

and they literally pissed off the entire Costco user base by winning the business. There doesn’t seem to be any incremental win for the customer, just Costco itself and (given this article) no one else 🙁

I wonder when credit card issuers wise up and refuse to overpay for a co-brand contract.

@funkright: I wouldn’t agree that they pissed off the entire Costco user base. I’m happy getting to use Visa cards at Costco, especially because Chase ran a 5% Freedom deal for a few quarters and I can get 2.5% cashback to Citi’s 2% with my USAA card. There weren’t any AMEX deals that were nearly as good.

When does the deal up for renewal?

@Bill – I do wonder if Chase runs those 5x at Warehouse quarterly promos just to mess with Citi and take away $1500 of spend from a large amount of the base.

AMEX didn’t have exclusivity either. I used a non Costco AMEX card for over fifteen years.

@SomeDutchGuy amex had exclusivity with Costco. They still got the business, whether you used the Costco Amex or any other Amex. Citi paid for the Costco deal but gets nothing if you use a non-Citi Visa card.

@Lamar, you’re right. I see the difference.

Well. I used my Citi Aadvantage Amex card at Costco during the Amex era.

Don’t know if they belong to citi or Amex…..

The next recession will be very painful for both credit card issuers and airlines. I can’t wait!

Does Citibank expect us to believe they are losing money on their credit card portfolio because customers are carrying a balance? Or is it because customers are paying off their balances?

Costco just needs to make sure their customers are happy and can afford to pay their cards off, or else Citi is going to collect their 1 to 2% per month from Costcos customers that could otherwise be spent at their store. And if the card gets maxed out, Costco may lose a customer.

On that note, Sam’s Club offers discounts on memberships and a variety of payment options.

@Leef33

IMO – Sam’s Club isn’t really the same as Costco. Costco sells quality stuff. Sam’s Club isn’t much more than big boxes of Walmart products.

“…when Citibank STOLE Costco from Amex”. (Capitals are mine for emphasis).

They didn’t “steal”…Citi got / won / secured / etc… the business. Stealing is taking something without paying. If anything, some – including you Garry – would say that Citibank over-paid…so hardly ‘stealing’!

With Amazon and Walmart increasing share, the days of paying a membership fee to shop are limited. Costco will need to change their business model otherwise they will be Amazon-ified!

Over the last 10 years Costco sales have approximately doubled while WalMart was up 35%. It looks like they don’t have much to worry about with them. I’ll give you Amazon. Their sales went up about 10X in the last 10 years.

I use my Citi Costco card when I shop there, unless a bonus is running on a Chase card. If Costco weren’t 2 miles from my home I’d be there a lot less often, as I currently sit I do pretty well with the executive acct rebate, and gas rebates. But that’s it. And I’m not tied to the Citi card, which is great!