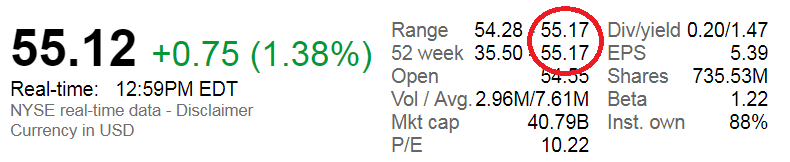

Delta’s stock set a new 52 week high today.

In fact it’s a new all-time high for the stock.

That’s not surprising. Passenger revenue per available seat mile is up year-over-year. Their operating margins are growing to 18%. Their planes are full. Delta is doing well, and better than their direct competitors.

At the same time, Delta’s market cap is slightly below its 2015 high when oil prices were under $40 a barrel. The discrepancy is explained by share buybacks in the interim, the company’s share price is higher but isn’t quite as valuable because share buybacks drive down the denominator.

Copyright: idealphotographer

Nonetheless the airline’s financial realities and stock market performance are inconsistent with a claim that competition from the much-smaller Mideast airlines Emirates, Etihad, and Qatar constitute an existential threat to their business.

Ted Reed is all over the media making Delta’s case againstthe Gulf carriers. It seems like the market doesn’t believe it.

@Delta shares hit an all-time high Thursday. Now analysts see margin and PRASM gains over @AmericanAir and @united https://t.co/sw5YiYHcjk

— tedreed (@tedreednc) July 7, 2017

Isn't the market telling us something about the lack of threat from the Gulf carriers? https://t.co/qjAbv0Xb7A

— gary leff (@garyleff) July 7, 2017

Reed responds that “Trans-atlantic is not the most important piece for U.S. carriers.”

Either Emirates, Etihad, and Qatar are a threat to Delta’s business or they aren’t. If it’s even close to the existential threat that Delta executives claim, that should be priced into the the market’s valuation of their future prospects. If it doesn’t matter, then the controversy is a tempest in a teapot.

At the very least, critics of the Gulf carriers have to explain why the stock market doesn’t appear to see validity in their position.

With the caveat that I don’t actually believe this, it could be that the market is already pricing in an expectation of regulatory rents from restricting the ME3 in some way.

@gary – you’re smarter than this. DL can certainly argue that certain routes are affected by Gulf carriers and yet still be a very efficient operation that has high value. And I agree with @corey – what’s not to say that current pricing already has uncertainty baked in.

Gary — Your point rests on the false premise that DL cannot have a record valuation and be hampered in its growth. DL would say that its market cap (and profit metrics) would be even higher if not for the alleged unfair competition.

Their value is at a record high, their business isn’t in jeopardy which is the claim that Delta makes e.g. in their video. Their value is growing. And it even grew after the electronics ban was lifted on the 3 airlines.

My claim is NOT that the airline would have no value, or wouldn’t even be valuable. On the contrary, the market clearly suggests that Delta is a very valuable company DESPITE competition.

But the market also doesn’t appear to believe that the Gulf carriers are an existential threat to Delta’s business. Their margins, employment, and share price (reflective of FUTURE value) are at truly historic highs.

The answer is that Wall Street is smart money. Smart money knows the me3 are blatantly flouting trade agreements and will be thwarted, especially now since trumps election, which the street understands is an issue he is well in tune with. It really is that simple. The view that delta and the US carriers are just whiners is a view only held by those in the blogosphere who don’t have access to top management, top economists, and policy analysts.

@Rob do you really think I don’t have access to top economists and policy analysts?

@Rob think carefully before answering Gary’s question.

As a former I-banker…Gary let’s stop talking market cap since it is a poor measure of corporate value. Enterprise value is the figure that needs to be quoted. Marker cap is an irrelevant statistic.

@Gary, No offense intended, I’m sure you have great access. I just mean sell side analysts spend a week with management several times a year sitting in on 8 meetings a day while Fidelity, Wellington, Steve cohen and Lee Cooperman and portfolio managers attack them from every angle of any issue that could affect the stock over the coming months. If journalists are writing stories about it, it’s been in the stock for months that’s all I meant.

@Rob I was making a specific reference to policy analysts and economists, it just happens to be what I do for a living. Sitting with upper management several times a week is a different matter. But that’s beside the point. As is @arrek’s discussion of enterprise value versus market cap above, here what’s relevant is the general market’s take on the future value of the company not what the company is worth today, and record share price is a proxy. The market clearly doesn’t see an existential threat to Delta’s business, and Delta has a problem explaining that away.

@Gary. I agree the market doesn’t see an existential threat given the stock price, But I disagree about the reason. I think it is because it expects the abuses to be countered since Trump is very focused on closing exploitative trade imbalances, not because gulf subsidies are not harmful or ok. You can see from the history of steel stocks how the market reacts to dumping it does not expect to be countered.

@Rob what evidence do you have that the market ‘thinks’ this — when the Obama administration explicitly declined to act, when it’s a far higher priority to cooperate with the UAE and Qatar on fighting ISIS, and when the US already misstepped emboldening Saudi Arabia to isolated Qatar and we’re hardly in a position to push Qatar further..?

The US airlines have obviously overstated the risk from the Middle East airlines. It’s called hyperbole. Individuals, groups, corporations, etc. ALWAYS do it to get attention. Adam probably used hyperbole on Eve. And there are good reasons to do so. Look at how much trouble the US airlines have had convincing Washington to do something about the openskies violations of the ME3. Had Delta just said “Guys, these guys are breaking the rules and we’re losing some money,” do you think that would have been MORE effective?

The reality is that the ME3 subsidies are absurd and outrageous, and that it does cost the US airlines a lot of money. It’s also reality to note that the ME3 do not threaten the existence of the US airlines. The Middle East is very far away from the USA and not very convenient for the vast majority of international travel to and from America. That doesn’t mean that they should be allowed to break the rules. Your right to free luxury travel does not Trump US corporate and labor interests. If you’re an employee or shareholder of a US airline, you should be able to expect your government to do something when foreign governments massively subsidize your competition and make it impossible to compete. You should not have to write off the India market, for example, so Gary Leff can travel for free in style to the Maldives.

@Gary. Evidence when it comes to explaining stock behavior is always subjective, which is why I stated it as my opinion. But my opinion is essentially based upon the fact that none of these issues are secrets and the street is exceedingly efficient in pricing in non-secrets (and unfortunately many secrets as well).

The “obama didn’t do anything and the stocks were fine” argument ignores the fact that the street realized he wasn’t going to be president forever, realized this issue is unlikely to bankrupt the airlines in the near term and realized near term trading would be more on the benefits of oil price moves on profitability.

Now, can I be certain that is what the market “thinks”? No….but I’ve made a living for 20+ years being called into portfolio managers across the globe who wanted to know what I think the market thinks, so I hope that means I don’t suck at it.

The “we won’t enforce trade agreements bc Qatar and Arab states are too important” argument is valid, but only to a point. We have not been happy with qatars funding of Muslim brotherhood for quite a while and have been wrestling with how best to make this point. I posted reference to a good article about this a few months ago on Lucky’s blog, which sort of foreshadowed the move their neighbors just made against Qatar. I will post the link if I can find it.

This was the thread I was referring to back in April addressing your points about U.S. relationship with Qatar:

http://viewfromthewing.com/2017/04/24/qatar-airways-san-francisco/