United’s Vice President of Financial and CFO – Commercial Jonathan Ireland spoke at the Barclays High Yield Bond & Syndicated Loan Conference yesterday and laid out the airline’s capital investment plans and making an argument that United debt is a good investment.

They’ve paid down significant debt, and Ireland contends they have similar future obligation commitments in line with Delta and far below American (largely because of American’s huge aircraft orders the last several years and into the future, but also because of low pension obligations — remember United moved a bunch of this liability onto the federal government’s Pension Benefit Guaranty Corporation in bankruptcy while legacy American Airlines did not).

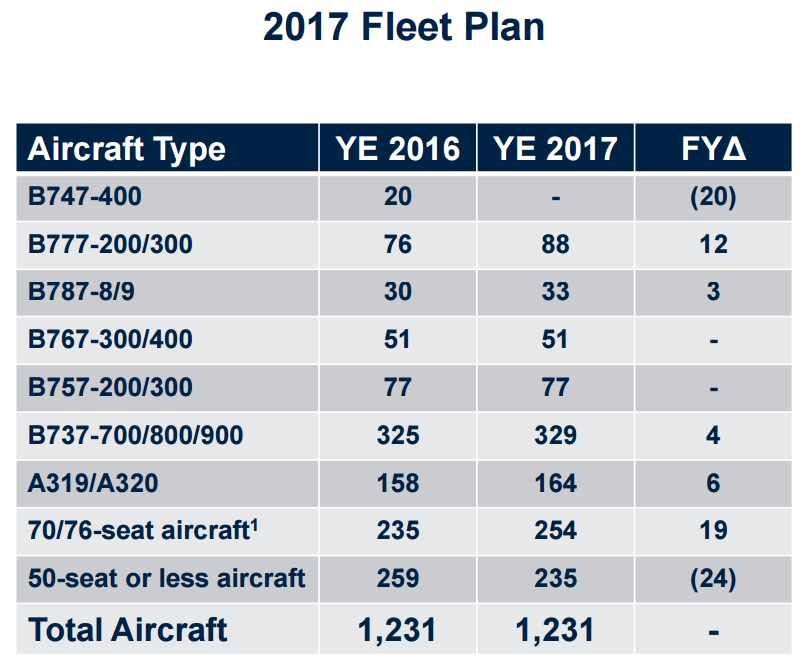

Here’s the United fleet plan he laid out, showing that the airline should end 2017 with the same number of aircraft as 2016:

United is retiring its Boeing 747s, and actively moving flights away from smaller regional jets. Meanwhile they’re taking on Boeing 787s and Boeing 777-300ER aircraft.

United Boeing 777-300ER Economy Class

Investors like to see that United’s fleet isn’t growing which is strange in a way. They want higher revenue per seat, not more seats to sell. US airlines clearly aren’t a growth business, which is also why there’s positive reaction to stock buybacks (bidding up the price of shares from more demand, and improving earnings per share by reducing the denominator). Buybacks communicate that the airline doesn’t have more productive uses for the capital.

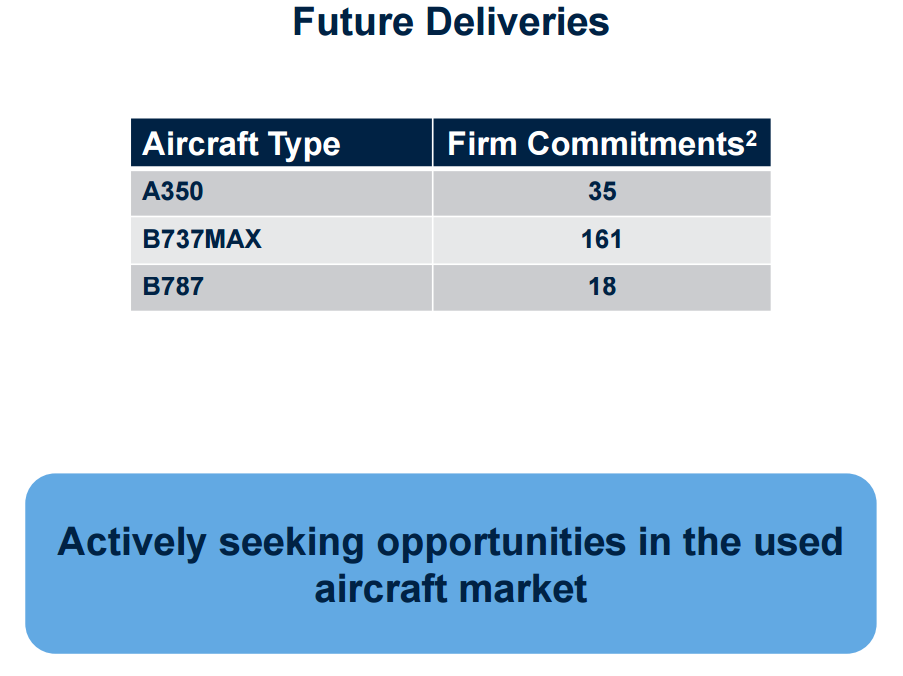

United does have a meaningful order book, some of which will yield growth while much will mean replacement of existing fleet. They’re getting great pricing on their narrowbodies, and signaling an interest in low cost acquisition of used planes rather than more expensive new ones.

“…but also because of low pension obligations — remember United moved a bunch of this liability onto the federal government’s Pension Benefit Guaranty Corporation in bankruptcy…”

Yup, no government subsidies at all. Ever.

“Buybacks communicate that the airline doesn’t have more productive uses for the capital.”

You mean:

Buybacks communicate that the airline doesn’t think investors have more productive uses for the capital.

Yep, they are growing by canceling my pension!

Wouldn’t you be happy to accept a pension funds’ assets and then pay out pennies on the dollar? There’s your ‘subsidy.’ Oh and btw that pennies on the dollar payout is guaranteed, right? Riiiiight.