I receive compensation for content and many links on this blog. Citibank is an advertising partner of this site, as is American Express, Chase, Barclays and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

Ink Business Preferred℠ Credit Card

This is a great premium card, with a big signup bonus and strong points-earning. It’s a $95 annual fee card, not a $450 annual fee card. And many of you can get a business card in fact you probably should.

The Ink Business Preferred℠ Credit Card comes with an 80,000 Point Signup Bonus.

- Spend $5000 on your new card within 3 months and you’ll get 80,000 points. As you’ll see below, that can even be enough for a roundtrip business class award ticket between the US and Europe. (Chase points are super valuable because they transfer directly to a variety of airlines and hotels.)

The card earns 3 Points Per Dollar on Travel and on Shipping and Advertising on Social Media and Search Engines.

- Chase points are one of the most valuable currencies and you’ll earn 3 points per dollar on travel — that’s airlines, hotels, rental cars, tolls, even Uber.

As a result this displaces, for instance, a Citi Prestige Card which generously provides 3 points per dollar on air and hotel spend — because a Chase point is more valuable overall than a Citi point thanks to its transfer partners.

You can earn these bonus points on up to $150,000 spend in bonus categories. Previously Chase’s business cards capped category bonus spend at $25,000 or $50,000 in a year.

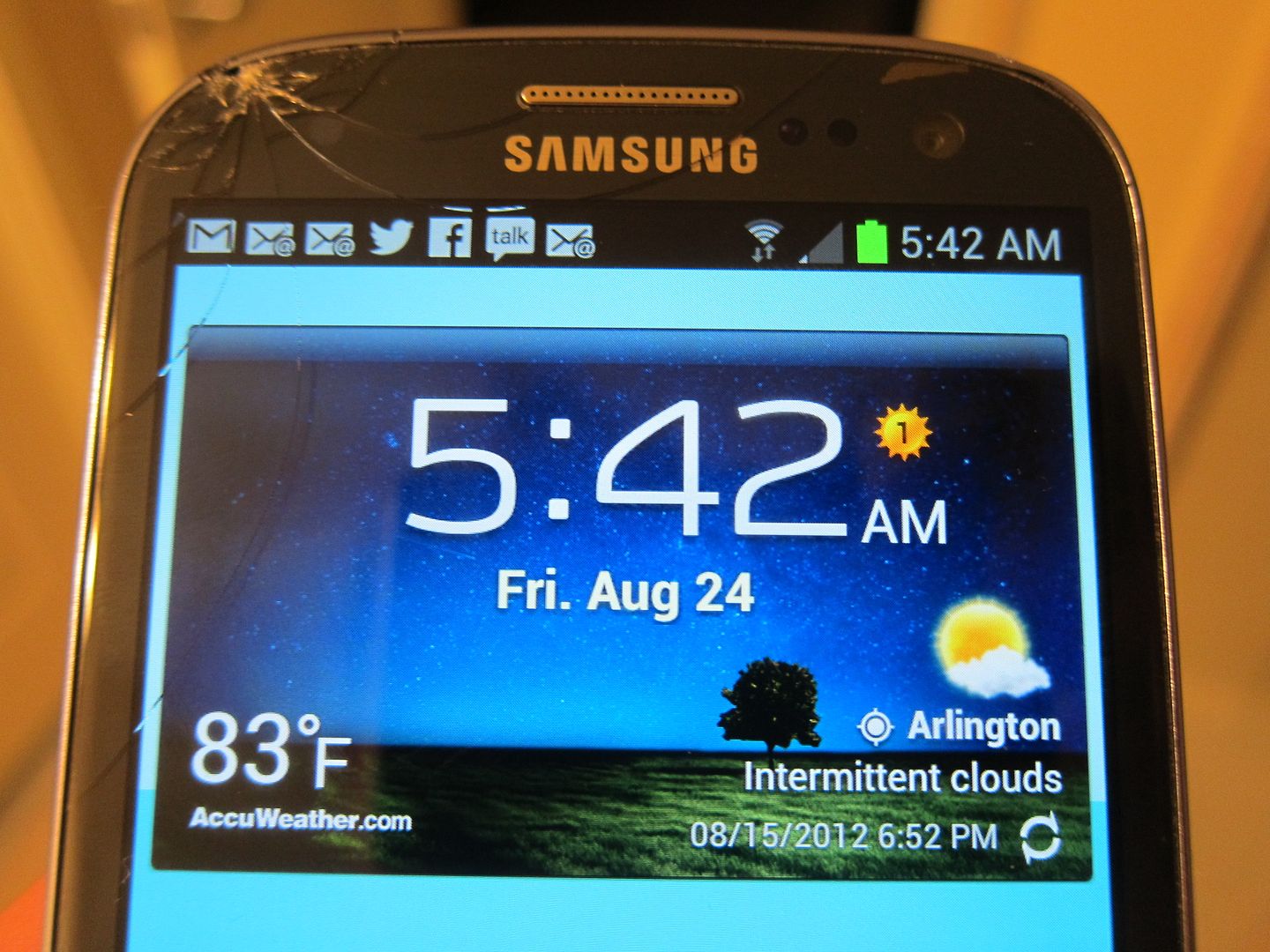

You get a pretty remarkable benefit, one I wish I had in the past, in $600 protection against theft or damage for your cell phone.

Get up to $600 per claim in cell phone protection against covered theft or damage for you and your employees listed on your monthly cell phone bill when you pay it with your Chase Ink Business Preferred credit card. Maximum of 3 claims in a 12 month period with a $100 deductible per claim.

This benefit though is significant, since it’s real ongoing cost savings as well: those of you who pay to insure your phone against damage could consider pocketing cash savings every month if you paid your bill with this card.

Points transfer to:

- Airlines: United, Korean, British Airways, Singapore, Air France KLM, Southwest, Virgin Atlantic

- Hotels: Hyatt, IHG, Marriott, Ritz-Carlton

Park Hyatt Aviara

“5/24 limits” apply to the card. That’s not a surprise, there are cards that Chase won’t give to most people who have had 5 or more new cards within the last 24 months.

Ink Business Preferred℠ Credit Card

Gary- Do you know if you are eligible for this card if you’ve had the chase ink product, but not the chase ink “preferred” product before? Wasn’t sure if it is considered a completely new card or just a modification of the previous. Thanks

Yesterday I applied for the card on a referral. I had no business credit cards to this point. The online portal told me to wait 30 days for an answer. I called Chase and was told they couldn’t do anything about it. I called back and was sent to a biz rep, who checked on it. After an hour of really strange questions, probing about estimated revenue for 2017 AND 2018, what my ‘company’ actually did, I was finally approved for $5k credit line. But it took over an hour in total and was MUCH more probing than expected. Once I was approved they weren’t happy to transfer me to a regular CSR to have the card expedited rather than waiting 10 days. It’s clear that the Credit Card division at Chase is under pressure to perform…

@Ryan S – It is a completely different product. If you have past Inks but not preferred you can still get this. However, 5/24 is applicable.

Clearly it’s the preferred card for Russian Oligarchs. With the utmost sincerity, I will be directing everybody to procure and use this card for all their fake news advertising on facebook, twitter and google. Thank you for your contribution. Let us know the next time you are in Moscow.

Спасибо

Does a business card still fall under the 5/24?

Gary: You wrote: “As you’ll see below, that can even be enough for a roundtrip business class award ticket between the US and Europe. (Chase points are super valuable because they transfer directly to a variety of airlines and hotels.)”.

I didn’t see anything below that explained how I could get a business class r/t with 80,000 Chase points. Would really like to know.

Retired Lawyer – transfer to Korean for Skyteam business class to Europe

I currently have the Ink Cash card, having previously PCd from the Ink Plus card. Providing I am under 5/24, will Chase let me have two different Ink cards simultaneously, and will I still be eligible for the 80K bonus?

@Retired Lawyer that’s the Korean Air price for Skyteam business class US-Europe

https://www.koreanair.com/global/en/skypass/redeem/skyteam-awards/skyteam-bonus-north-america.html

@Barbara this card is subject to 5/24, but business cards from some issuers don’t report on your credit so don’t ‘count’ towards the 5

I have 4 new credit cards including one very popular one with lots of travel rewards on it. 🙂