Yesterday American Airlines Chairman and CEO Doug Parker spoke at the J.P. Morgan Aviation, Transportation and Industrials Conference and it was… strange.

The crux of his talk was that American is worthwhile as a long-term investment, returning to his ongoing theme that investors should take a ‘leap of faith’ which of course isn’t what investors think they should generally be doing.

He introduced the talk saying that “the subtitle that I didn’t” use was “why you [investors] care more about next month’s RASM than we do.”

- He claims that investors are buying and holding, that at merger 44% of shares were held by long term investors (probably mostly index funds) and now it’s 80%. Of course at merger, and with American’s bankruptcy, a lot of investment was naturally speculative. Will the merger happen? Will equity holders receive anything, and how much, coming out of bankruptcy?

- And ironically he emphasizes how his own compensation is 100% tied to share price and how other top executives are largely paid in equity as well as an argument that the airline is focused on long term value rather than short-term movements in price.

Parker thinks that the goal is no longer holding down costs, but doing a better job producing revenue per unit of cost by having best product. Yet American seems to copy Delta without offering as good an airline operation.

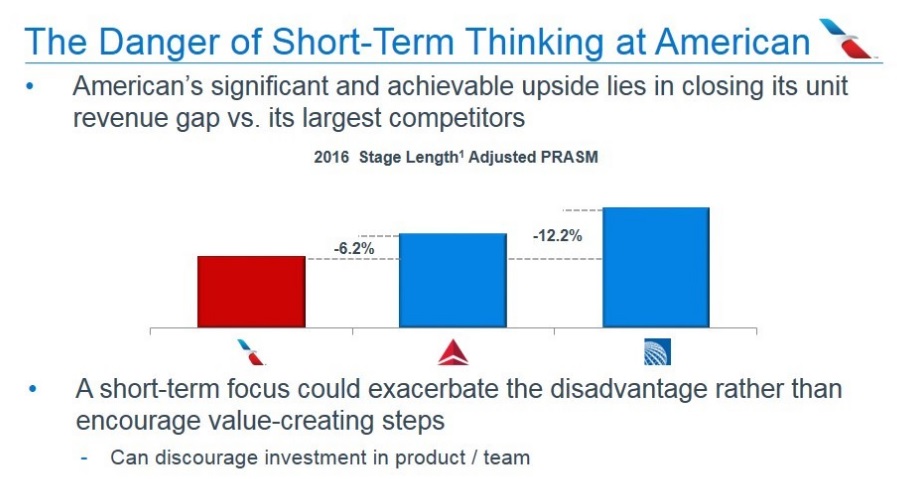

Several times he seemed to keep getting lost in his talk. And discussing American’s revenue disadvantage against competitors, Parker oddly digresses that he thinks the numbers are wrong and that “maybe we over-adjust.”

Still if the key insight is having the best product to earn revenue, and their earnings are lower than competitors, yet Parker seems to think they have the best product because they’ve spent the most on new planes and given employees big raises (38% average pay increase).

Parker talks about capital expenditures on aircraft leading to more investment than competitors, though of course much of that was done by previous management that legacy US Airways leadership was mostly stuck with (and of course they’ve put off some of that investment). They’ve added 395 aircraft and retired 391 aircraft since the merger.

Ultimately he argues that American’s stock is undervalued — that they’re making $3 billion a year over time after taxes, with a $21 billion valuation, that’s 7 times earnings but the average price/earnings multiple of the S&P 500 over time is closer to 20 times earnings.

What he seems to fail to understand, that I argued last summer, is you don’t get even average price-earnings ratios without expectation of growing revenue. Parker already suggested that the airline’s fleet isn’t growing, so where does future growth come from? And it’s a heavy lift even to get to flat earnings, you have to believe both in long-term $50 a barrel oil and that airlines won’t compete away margins.

The talk arguing that American Airlines is a long term play ends with John Maynard Keynes’ quote that ‘in the long run we’re all dead.’ So there’s that.

Maybe Doug should have just mentioned that Snapchat’s market cap is higher than AAs.

I like AAs 3 billion in profits more than Snaps sigificant growth potential, horrible financials and indeterminate plan to even stem their loses.

Is Parker drinking again?

He wants his(AA’s) multiple closer to the S&P’s?? Bwaaaaaaaaaa Haaaaaaaaaaaaaa haaaaaaaaa.

ALK Is the highest @14X, Delta is about 8X. He runs an inferior airline.

Airlines simply always trade at a p/e far below the general market. Why? Low return on invested capital, very little topline growth, huge fixed costs etc…

Someone needed to tackle him during his rant.

Sounds like it was an odd speech especially from DP who I respect quite a bit for what he’s done. I don’t think it should come as a suprise that American’s revenue per unit is lower. Just look at where their hubs are compared to their competitors: American really only have one true Fortress hub in CLT, and maybe in some part DFW (Although Southwest as well as low costs have cut into that quite a bit). Their other markets: MIA, ORD, PHL, NYC, LAX, DC are all competitive markets. Compare that to the number of Fortress Hubs or Focus cities that DL (ATL, MSP, DTW, CVG, SLC) and UA (DEN, HOU, SFO, Guam) have and its clear they can’t demand a price premium without growing into other markets where they don’t have a huge presence, but can command a price premium like DL has been able to do. That sort of goes against what the “New AA” has been pushing for, but its hard to tell if that was Scott Kirby was the main driver behind that since he’s a straight numbers guy or whether it was DP. Bottom line though is that I’m skeptical they can match DL without looking at Secondary markets and growing those like DL has done. RDU is a great example of what DL has done. Other cities that I guess you could argue have that potential combo of high biz travel and fast growing would be XNA, SAT, AUS, IND to name a few.

I guess the Berkshire Hathaways, Vanguards, Blackrocks, Fidelities, and State Streets of the world have it all wrong and Gary the credit card peddler and AA kvetcher has it all right.

Every company wants more revenue, but look at the state of the industry Gary and the pricing environment all U.S. carriers have faced since Mid-2014. I mean I thought you were an astute and financially savvy individual.

@Andy CLT, DFW, and MIA are fortress hubs.

@Josh G – Vanguard is investing as an index fund, Parker even conceded that in his talk, index funds invest as a proportion of the company to the relevant portion of the market that the company represents.

I certainly don’t claim to be a savvier investor than Warren Buffet, but Buffet didn’t get on stage and endorse the stranger claims Doug Parker was making either. This post isn’t a recommendation to bet against American Airlines stock, it’s highlighting some rather odd comments Parker made in support of the stock.

Josh G’s comments are the best, his lack of reading comprehension never fails him!

@Andy. Uhm, where you have been the last 10 years? DL pulled out of CVG and MEM massively (WN just announced they moving in). IAH/HOU has WN running international flights now out of HOU. DEN now has a large WN presence in addition to F9 and UA. UA doesn’t even have 40% of SFO any more. I could go on about how worthless hubs at SLC.

Why is everyone thinking Buffett is a genius all of a sudden when it comes to airline stocks? I mean, the man is investing in US Airways, now American Airlines, for the third time, and the previous two times didn’t work out so well–think bankruptcy, twice.

Airlines have not been good businesses since deregulation. In a few years we will be back to normal. Already we see the budget carriers and the majors looking more and more like each other and copying each other’s every move. Soon we will be back to the 2000’s and watching them slit their own throats.

Is Parker drinking again?

Looks like he picked a bad week to start sniffing glue.

Sorry, Gary, but the speech wasn’t “strange.” It was a manifesto as to why you should invest in American Airlines, which was the exact reason Parker was speaking to investors yesterday. And they ate it up: just look at AAL’s stock chart as he gave his speech: it took off like a rocket.

Parker was telling the assembled crowd not to look at his stock as a trading vehicle, but as a long-term investment. This is something very foreign to most Wall Street money managers, who tend to view airline stocks as trading vehicles and not blue-chip investments. Yet, Parker is clearly the visionary — yes, VISIONARY — who put the sector on the path to long term, sustainable profitability. With Scott Kirby as his (former) sidekick, he is responsible for EVERY major legacy airline merger in the sector since 9/11. Those mergers led to the highly profitable USA airline industry that we see today.

Investors who have bet on Parker since 9/11 have made extraordinary financial returns. He’s now telling investors that there will be more such gains, and he’s so confident about this that he’s taking his compensation completely in stock. He’s now counting on AA’s consistent multi-billion annual profits to garner a higher price-to-earnings ratio for the company, which is still extremely low by Wall Street standards. He believes that Wall Street values the company so little because they don’t understand why these profits will be sustainable. Many large investors agree with Parker, including Warren Buffett, who has now bought about 10% of the company.

You can certainly disagree with Parker and, given the unpredictable world we live in, he could certainly be wrong. But he’s now had more than 15-years of being right, so I would suggest the odds are very much in his favor. I hope somebody finds this thread in about 5 years and sees what actually happened.

Here’s a reasonable, objective news report about Parker’s not-very-strange speech.

http://www.dallasnews.com/business/american-airlines/2017/03/15/american-airlines-ceo-tells-investors-thinking-short-term-industry

@iahphx if you talk to financial analysts about the speech they found it strange as well, especially the thrust of his comments along the line that aa plans haven’t worked out the way intended, so shifting plans are what we want to do all along, here are my new goal posts.