Via Reddit and also posted by US Credit Card Guide:

A source working for AmEx told us that, AmEx built a new team: Rewards Abuse Team. The following methods should stop working any longer thanks to this team:

Use MPX to get air credit.

Buy products to reach minimum spending, get the sign-up bonus, and then return the products.But she added that airline GC should continue to work for air credit.

Frequent flyer programs all have corporate security, and so does American Express. I’m not sure whether this is a ‘new team’ and even if it is whether that means a new charge. We’ve certainly seen reports of accounts being frozen and investigated when using targeted links that weren’t intended for public use, and we’ve seen points clawed back from those accounts when violating American Express terms to achieve bonuses (such as meeting minimum spend with gift cards).

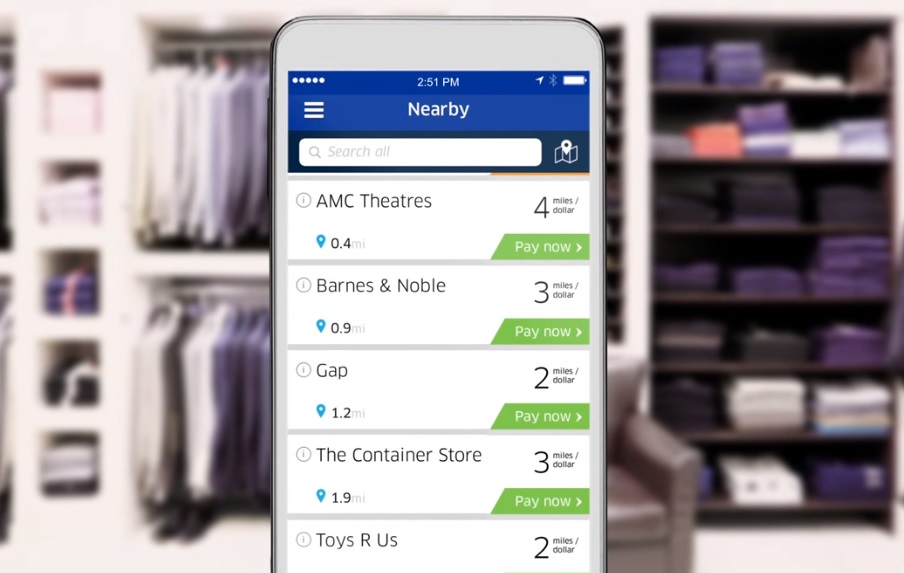

I’m not sure this rumor, if true, changes very much other than perhaps that the MileagePlus X shopping app won’t earn based on airfare spend any longer.

My biggest fear from a new dedicated team is that they expand their purview like any bureaucracy. Years ago Delta’s Revenue Protection Unit was going after mileage runners.

Flyertalk members worked to come up with ‘legitimate’ reasons for adding extra connections to their itineraries other than simply earning more miles.

I’m having an affair with someone in XXXXX (insert city 1), but I told my spouse I was on business in YYYYY (insert city 2). And when they ask why your layover is only 25 minutes in XXXXXXX, you can tell them “that’s all the time I need.”

I’m pulling a heist in XXX and there’s no extradition treaty with YYY.

I lost my wallet in XXXXX last week and needed to check the airport lost and found to see if it’s there.

I’m buying a lottery ticket in XXX on the outbound and picking up my winnings on the return.

The [Crown Room Club, now Sky Club] in place XXX does not have my favourite beer. So I would like to grab one in YYY on my way to ZZZ.

I’m actually spending the weekend in ZZZ, but I’m flying [Continental] there since I can upgrade even the lowest fares.

I need the connections to stretch my legs and avoid deep vein thrombosis.

Those pretzels in the Philadelphia airport concourse are worth the extra stop.

I am auditioning an escort service in one of the Laptop Lanes and they have a free booth open in city AAA on my way to BBB. I only need 10 minutes in a private booth.

they are always looking for ways to limit points but at the same time I just got two targeted offers for PRG and Plat for 50k points each. So there is always a balance the banks will have in trying to get back good customers and limiting number of churns.

Lol love that excerpt!!

LMAOL

Is this really the best use of resources at AMEX? They need to be stepping up their rewards game, having lost the millennial mass affluent demographic to Chase Sapphire.

@Jason agreed. If they are only going after people who are massive abusers that is one thing. If they are going to try to nickel and dime customers that would be quite another thing.

Rewards Abuse Team = RAT. Wonder if it was purposeful?

MEGA LOL