I receive compensation for content and many links on this blog. Citibank is an advertising partner of this site, as is American Express, Chase, Barclays and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

Ink Business Preferred℠ Credit Card

The introduction of the Ink Business Preferred℠ Credit Card is a big deal. It’s an 80,000 point signup bonus card (after $5000 spend within 3 months) that has a $95 annual fee. Many cards with bonuses like this are premium cards at much higher price point.

The card earns 3 points a dollar on the first $150,000 spend on travel, telecommunications, shipping and advertising on social-media and search engines. So that’s really broad triple points earning. It’s great for folks who advertise a lot on Google or Facebook. It’s great for people who spend on shipping. (Of course the big signup bonus makes it great for most everyone.)

Ink Business Preferred℠ Credit Card points transfer to:

- Airlines: United, Southwest, Korean, British Airways, Singapore, Air France KLM, Virgin Atlantic

- Hotels: Hyatt, Ritz-Carlton, Marriott, IHG Rewards Club

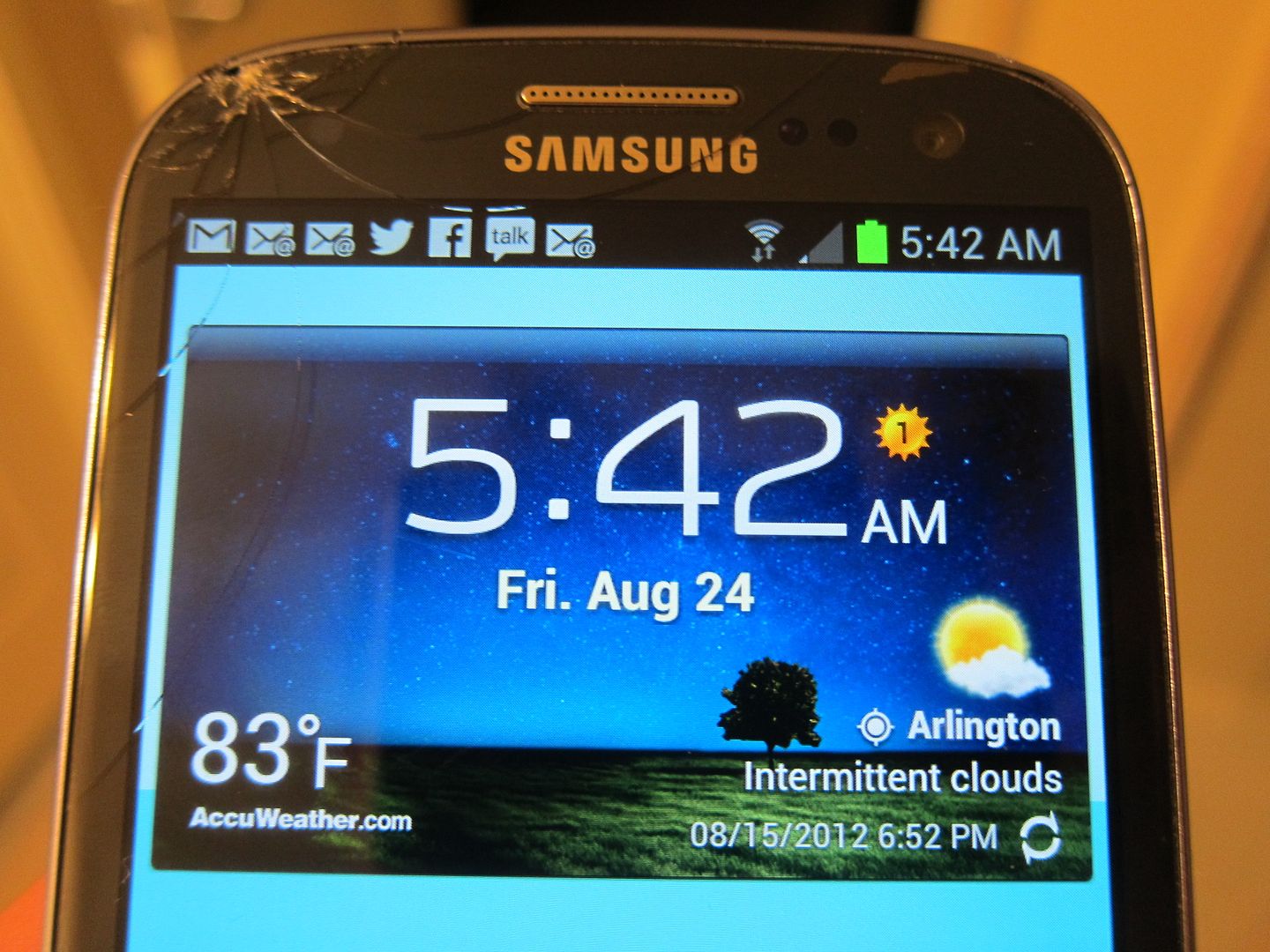

Here’s a benefit I had overlooked and is probably worth quite a lot to many people: $600 protection against theft or damage for your cell phone.

Get up to $600 per claim in cell phone protection against covered theft or damage for you and your employees listed on your monthly cell phone bill when you pay it with your Chase Ink Business Preferred credit card. Maximum of 3 claims in a 12 month period with a $100 deductible per claim.

Now, I got my cell phone’s cracked screen covered when I paid for it with my Chase Sapphire Preferred Card — but that was purchase protection, cracked the screen shortly after I purchased the phone.

This benefit though is significant, since it’s real ongoing cost savings as well: those of you who pay to insure your phone against damage could consider pocketing cash savings every month if you paid your bill with this card.

Ink Business Preferred℠ Credit Card

with three kids on my phone account, that’s enough of an inducement, thks Gary.

do we know if Chase still has a five card in two maximum?

Nice find! I also have three kids and two adults in insurance plan. Does the current Ink Plus offer this too?

As someone with a more expensive phone (iPhone 7 Plus 256gb not on contract) I did the math and this is a worse value than paying AT&T $8 a month for insurance.

Phone = $950 (not including tax)

AT&T insurance = $96/yr, $150 deductible (if no claim for 12 months, $200 if no claim for 6 months), no limit to phone value (deductible takes into account higher value phone) = $246/year for a new (not refurbished) phone in case of total loss.

Ink Preferred = $95/year (after first year, and since I have the ink cash and the CSR it would be pointless to keep this past the first year EXCEPT for this benefit), $100 deductible, $600 total phone value = $450 first year, $545 each subsequent year.

All this is just to say, do your research. It’s a no-brainer to pay your bill with the card just to keep your options open, unless the 2 extra points per dollar (ink cash or plus or bold) are worth more to you than that ‘option’. And for people with more than one phone on their account, (and phones of lower value) and less likelihood of loss/damage (I travel a lot and not always to super safe places) this is probably a better option since it doesn’t involve a constant outlay of money. Just crunch the numbers first.

Thanks! This is a big benefit. If only 5/24 was suspended !

Oh wow! I hadn’t read much about the new Ink and didn’t realize social media was a bonus category! That’s much better than the AMEX options for social media.

I don’t see anything in the offer about current Ink Bold or Ink Plus cardholders being excluded from the signup bonus, whether it’s been more than 24 months or not since getting a previous bonus, or a lifetime ban. Any take on this?