I receive compensation for content and many links on this blog. Citibank is an advertising partner of this site, as is American Express, Chase, Barclays and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

Ink Business Preferred℠ Credit Card

The introduction of the Ink Business Preferred℠ Credit Card is a big deal. It’s an 80,000 point signup bonus card (after $5000 spend within 3 months) that has a $95 annual fee. Many cards with bonuses like this are premium cards at much higher price point.

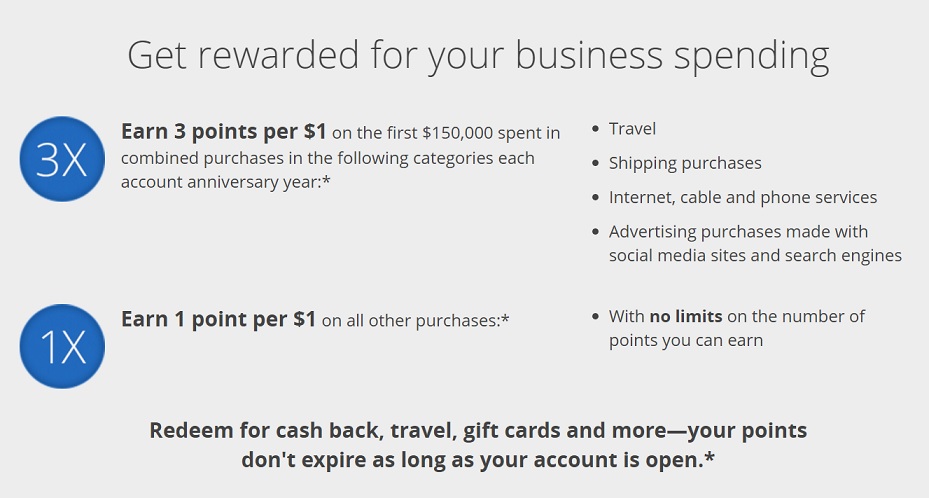

The card earns 3 points a dollar on the first $150,000 spend on travel, telecommunications, shipping and advertising on social-media and search engines. So that’s really broad triple points earning. It’s great for folks who advertise a lot on Goole or Facebook. It’s great for people who spend on shipping. But it no longer has a 5 points per dollar earning category.

Since the card launched we learned three things:

- You cannot upgrade another Ink card to the Ink Business Preferred℠ Credit Card at this time, though that option may be available in the future. I have a hard time imagining a scenario when you’d want to because you’d give up the card’s signup bonus and that’s one of its best features, and you’d give up 5 points per dollar earning from your existing Ink as well.

- “5/24 limits” apply to the card. That’s not a surprise, there are cards that Chase won’t give to some people who have had 5 or more new cards within the last 24 months. This doesn’t apply to everyone, but it does apply to many (Here’s what you need to know about 5/24 and remember that 5/24 doesn’t apply to Ritz-Carlton Rewards® Credit Card so if you’re excluded from Ink Business Preferred you can still get the Ritz card and its 3 complimentary Ritz-Carlton nights).

- You can get more than one Ink Business Preferred Card if you have more than one business. Chase won’t approve this for everyone, of course, they’ll consider how much credit they wish to extend to you. But they don’t limit you to one card if you have multiple businesses.

Ink Business Preferred℠ Credit Card points transfer to:

- Airlines: United, Southwest, Korean, British Airways, Singapore, Air France KLM, Virgin Atlantic

- Hotels: Hyatt, Ritz-Carlton, Marriott, IHG Rewards Club

Park Hyatt Aviara

Ink Business Preferred℠ Credit Card

So you’re telling me my ink plus does not get anymore 5x on phone bill? What???

Is the 150,000 in a calendar year or the application year?

So good post and amazing information you shared about it.

Can you get multiple ink cards if you only have one business?

80000 RS Its business card is help full for every one i love it