Trip delay coverage that comes with many premium credit cards can save you and your family up to $500 this holiday season if things go wrong during your travels. But it requires followup.

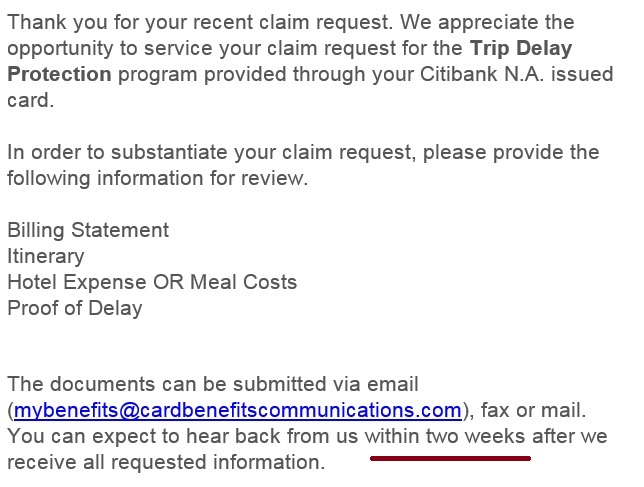

About six months ago I submitted a trip delay claim to my Citi Prestige Card’s coverage. Within minutes of getting off the phone with the rep, I received an email reiterating what they wanted from me to substantiate the claim.

I responded within 20 minutes, and I didn’t hear anything. After the promised two weeks I emailed again. And I followed up a couple more times, but never received a reply. I had it on my list to call Citibank for help, but I hate picking up the phone when I don’t have to and kept putting it off.

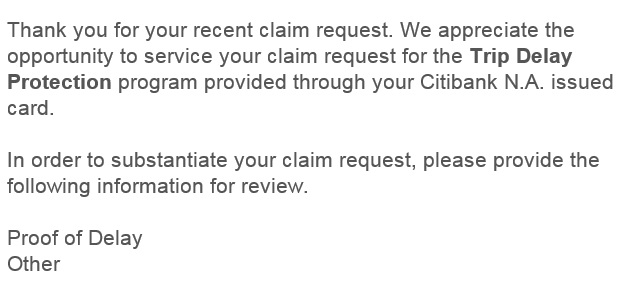

Then out of the blue earlier in the week I heard from them!

So all I needed to do is substantiate the delay and provide them with other and I’d be good!

Only my original claim substantiated the delay, and they didn’t tell me what was insufficient about that documentation. So I replied,

Thank you for your message. Do you realize this claim was submitted 5 months ago?

I have attached proof of delay. [The same information I submitted with my original claim.] If this does not suffice, please tell me specifically what you are looking for.

And please tell me what your request for “OTHER” is comprised of, because the lack of any description makes it impossible to satisfy your request.

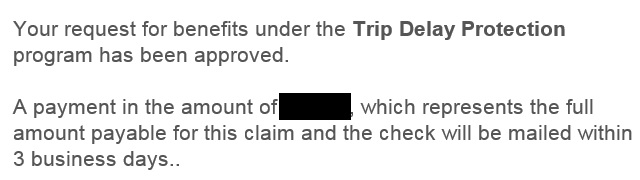

And within a few days I heard back — claim approved!

It was as true four years ago as it is today.

- These companies providing outsourced benefits don’t make money by paying out benefits

- It’s a bureaucratic process

- Most people aren’t super diligent in their jobs, and it’s easier to deny a claim than process one.

So the key to a successful claim is just following up. In my case this time I should have followed up more aggressively, but it still worked out. Just because you get a ‘no’ or are frustrated with silly requests, do not give up.

Just to be clear, it was not an award ticket ? I mostly travel using miles and my understanding is that there is very little that you can do on such reservation. Correct?

Most of these programs (including Citi’s) include award tickets, so long as you charged something (ie, the taxes) to the credit card.

I’ve had pretty good luck with these claims. I always keep my boarding passes and travel documents until the claim is completed. The airline is able to provide the “proof of delay” – if you ask them, they’ll know what you’re talking about and send over a form letter stating the delay/cancellation.

@Daniel if you use like Citi Prestige, even though it’s award ticket, if you paid the taxes using the card, then you are covered.

Same happened to me on citi’s price protection. I sent the documents and everything was “fine”. About 4 weeks later after no response I called again to be told that they needed the documents, I told them I already sent them 1 month ago and they said: send them back. I do and 1 day later claim approved.

My guess is that they voluntarily forget or lose documents to have a percentage of people not going forward with their claims.

On the other hand. Amex has been wonderful in purchase protection claims! It takes them 2 days to deposit the money in your account.

@Gary, it seems that Citi’s Trip Cancellation or Interruption on award tickets is limited on an award ticket to the amount paid in taxes and fees, right? The Trip Delay doesn’t have this limitation?

Also, would you share what constitutes “proof of delay”?

I just finished a nearly-3 months claim process with Citi for a Trip Delay reimbursement. It took about a dozen phone calls, half a dozen e-mails, and a claim filed with CFPB, but Citi finally credited my account.

The claim originated when my flight was delayed for weather, causing me to miss my connection and wait 16 hours for the next flight to my destination. Citi insisted missed connections were not covered by the Trip Delay coverage, even though the policy terms and conditions say no such thing.

Interestingly, I made a claim under identical missed-connection circumstances last month. I never made any phone calls or sent any e-mails, and my claim was approved within 4 weeks.

Any reason why you masked the amount? Is that a secret?

I did two claims for $250, and $120 and both were approved. Nothing secret about that

Is there any difference in trip delay coverage or benefits between Citi ThankYou Premier Card vs Citi Prestige® Card?

I’d say this is the same delay/obstacle game that insurance companies in healthcare use all the time. It certainly pays to remain diligent.

I’d also like to know, what did you used as proof of delay?

Citi prestige is not a high end card of you have to be after them to get the claim approved. Citi is a bank to be used and abused and thrown out like a two bit whore.

@caveman – this works on award tickets too. Our luggage was delayed on an award flight (taxes paid with citi prestige card) and we got $620 back (2 people). The taxes were ~$70 / person. I cannot thing of a year that has gone by where a bag isn’t delayed on some trip, so this is a great benefit in my house.

Same bureaucracy with Citi’s Price Rewind policy. The request was initially rejected because of missing information. Yet, the missing information requested was included in the original submission.

I wish there was a way to compare these benefit claim experiences with Amex platinum

I agree that payment of claims against credit card perks is hit and miss. I claimed a broken tablet under extended warranty and that was paid. But I claimed a “price match” on a laptop which was denied (they kept saying it was a different model even though it was exactly the same model.)

I paid for extra travel insurance through the United site (the added option at the check out point), with insurance issued by Allianz. My connecting 4pm flight was repeatedly delayed until around 10pm when they finally cancelled the flight, due to weather & crew issues, so I had to stay overnight. Allianz refused any reimbursement because the the total delay was less than 24 hours. Such a scam. I highly recommend that nobody buys trip delay insurance from Allianz – it’s a complete waste of money and basically fraudulently marketed. It doesn’t cover what any normal person would interpret as “trip delay”. Thanks for the info on the option of using other cards.

I found @Credit’s choice of words in his analogy to be highly offensive.

One needs to remember that insurance companies are not in business to pay claims. They are in business to make money and paying claims costs them money.

My experience: Chase is SO MUCH BETTER than Citi with these claims, they approve and pay out quickly when you can provide documentation.

Citi (premier) used every excuse to deny, and also pulled the delay/no response tactic. They also have far worse terms for their benefits.

Now that Chase Sapphire Reserve is out with 3x earring on travel, I see no reason to favor Citi anymore especially given your benefits are useless so a slightly better (3 hr vs 6 hr for trip delay) doesn’t matter if they won’t honor.

Happy to re-evaluate my position if Citi wants to address. V1120 at forward.cat

What did you submit as Proof of Delay?

Gary…I’d love to see a post comparing the various insurance benefits of different cards.

Getting “proof of delay” is so much easier to obtain during the trip than afterward. The airline, cruise line, ferry company, whatever, can give you this pretty easily. I have had to obtain this several times over the years for trip delay insurance purposes. Made my life so much easier when filing the claim.

Recently used the Trip Delay benefit as our flight home (from Greece) was cancelled due to an air traffic controller strike. We learned this via an email from the embassy so we called United. We were not able to get on another flight out until 5 days later and from another country. I had booked our original 2 round trip United Award flights and paid the taxes/fees on my United Chase Visa card.

We called Chase before making arrangements to get home to see what was covered and made sure to save all our receipts. First thing, I saved the airline’s webpage showing the airline cancelled our flight for that day which was sufficient for my claim. After returning home, I sent in my statement showing award flights were paid on the card, webpage showing flight was cancelled due to strike, even email from the Embassy notifying us of the strike, and all receipts.

Reasonable transportation, lodging (i booked an apartment but figured it cost similar to a hotel), meals, toiletries etc. Chase covered these expenses. It took a really long time (2 months!) to be finalized (we called often but they said they were backlogged with claims) and they had to translate our (Greek) receipts. Overall, we’re happy with the experience. They paid my entire claim minus $50 for alcohol and tips paid to restaurants (which I expected.) Great benefit to having the card!