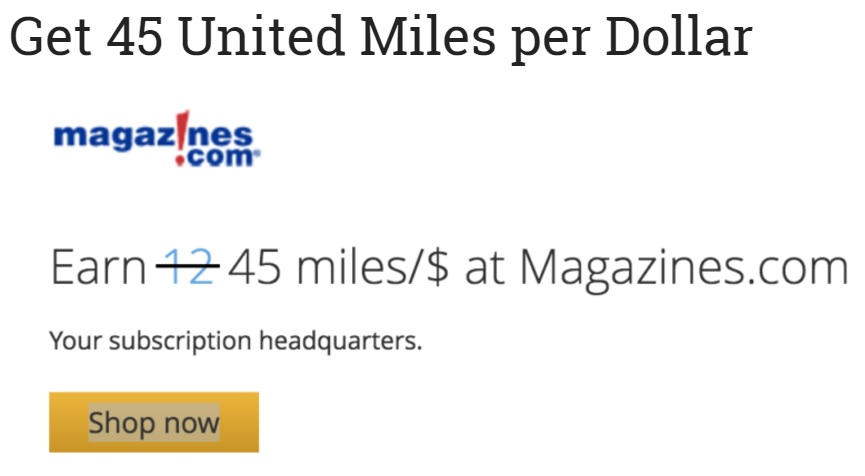

Via Running with Miles, United’s shopping portal is offering 45 MileagePlus miles per dollar for Magazines.com purchases instead of their usual 12 miles per dollar.

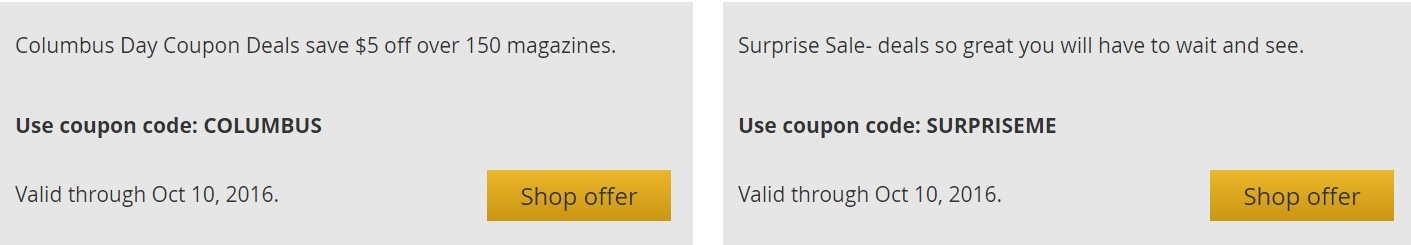

Often coupon codes will interfere with your mileage-earning, but coupons advertised on the mileage portal aren’t supposed to.

This offer won’t last long. 45 miles per dollar means buying miles at $0.022 cents apiece (and it doesn’t include points you’ll earn from your credit card spend).

However here’s an idea to play with, that’s not tax advice let alone advice for anyone’s specific situation but merely something to consider.

Let’s assume you:

- Are in the top income tax bracket (39.6%) and are subject to Obamacare’s 0.9% Medicare surtax.

- Itemize your deductions

- Are already itemizing enough to overcome Pease limits on deductions

- Don’t value the magazines, or don’t value them at 40% of their cost

Mileage rebates aren’t generally considered to be taxable income or to have any value for tax purposes.

Buy and donate the magazine subscriptions to a non-profit, whether a library or other charity, and obtain a tax receipt provided the total of your gifts for the year are $250 or more. The value of your in-kind gift is the market value of what you’re giving.

A $0.022 cents per mile cost, after deducting the amount you’ve paid for the magazines, becomes a net cost to you of $0.0132 cents per mile. I consider United miles to be worth 1.6 cents apiece.

This isn’t as lucrative as reselling items you buy generally but the market for magazine subscriptions is going to be pretty thin. The offer provides the opportunity to think through the cost implications of miles and the US tax code.

I feel bad for ANYONE that desperate to earn miles that would go through all that. ABSOLUTELY pathetic. If you want to donate to a good cause, do so without thinking of yourself . Complete A-holes.

@Ryan,

I think you have not quite seen the point of this post; the intent of the post is not to donate and this is not a sneaky way to gain something while donating. The intent is to buy miles at a cheap price; if it happens that someone benefits from this, then why not.

Well, Ryan, while I cannot speak for everyone, many years my husband and I have had in excess of $30-35 k in medical expenses….we’ve had years we pay $60-75 k in taxes….often times there’s rarely a lot left over for us to make contributions and frankly I feel like I pay enough in taxes that I am not feeling very charitable when I get done with my taxes….call me an “Ahole” all you want, most folks are more likely to give when they can derive “some” benefit from it or there wouldn’t be charity golf tourneys, tennis tourneys, charity balls, celeb photo ops for donations, charity auctions, etc. I have found the points/miles game a fun hobby where I feel like I’m gaining some kind of benefit from the medical/tax bill charges we make in a year along with business purchases I feel like it is getting a bit of a tax break of sorts. It isn’t about being desperate for miles as much as folks are more likely to give when there is a return available than when you just give without one!

Regarding the tax code, it would be nice to see a a post on how to reduce withholding to near zero and make estimated payments to the IRS with a credit card for 1.87% fee.

@ryan seems like you’d rather just buy the magazines (and not earn miles or cashback, etc.) to donate or buy the magazines and then just throw them away? I don’t see how this is bad. I buy some magazines and earn miles. I donate those magazines to a non-profit so they get something they want or need for no cost. Everyone wins, even United and the Magazine company.

@M That is actually easier than you think…..even if you are not self employed, go to your employer and increase your deductions so they take nothing out of your check for Federal and/or state withholding. Go to the irs.gov website and click pay taxes, there are 3 or 4 providers for payments listed, you can pay monthly or quarterly whatever amount you need, pay the 1.87 % fee and when you file at the end of the year, it will have to be manually entered on your return. For those of us who are self employed, it is great for big sign up bonuses, I generally eat up the sign up bonus on a new card to meet spend. But you can do it for your state & fed taxes. Of course, don’t take my word, chec with your Cpa….or do your own research, but you can legally change your deductions to have less taken out of your check or nothing. Make sure you make your monthly or quarterly payments to avoid any penalties.

I’m not sure how this makes sense if you make so much you lose 80% of your itemized deductions.

Does it?

Asking for a FRIEND

Still waiting for the return of the 112.5 miles/$ on magazine spend at Valumags!

Dan,

You refer to a 501(c)(3) getting “something they want or need for no cost”. How am I to know what 501(c)(3) needs Architectural Digest? And what is the cost to me in identifying an organization which wants or needs it?

Yes, if one knows that the Sierra Club needs a WSJ subscription for its library , a donation is legit. But dumping 1000 People Magazine subscriptions on the Red Cross is bogus and, at a minimum, abusive of the tax code.

Pay your taxes with the Amex Bus Plat card. You get a 50% bonus on purchases above $5,000. The site Payusatax charges a 1.99% card surcharge. Thus, you are getting pts for 1.33 cents. Or better yet the next time AA sells miles at 1.7 cents or Life Miles at 1.5 cents use the Amex Bus. Plat card for purchases above $5,000. (Thus you earn AA or Life Miles, plus bonus Amex Membership Rewards pts.)

@Mike D- that was good times…

Gary is the next Donald Trump – Oh wait, Donald’s deductions may have actually been legitimate. Dumping copies of magazines on organizations that likely don’t want or need them solely to obtain airline miles at a lower rate is literally comical. If the organization actually needs the magazines to support their non-profit then that is one thing, even though I still think it is a total waste of time given the marginal benefit. The sad part is that someone actually (1) thought this scheme up and (2) spent time developing an argument to support their perverted view of the US tax code.

This post would be perfectly fine without the focus on dumping these magazines on nonprofits to obtain a tax benefit. I’m sure that Goodwill has use for 500 copies of Gun World. Have some class.

We’re hijacking the thread with the tax talk – I use the UA Club card to pay my taxes, essentially buying UA miles for about 1.3 cents each. Chase doesn’t let you pre-fund payment, so if your taxes exceed your credit limit, it will take a few cycles, which take about 5 days each in case you’re paying on the due date. Then the providers only allow 2 payments per tax type. Check Flyertalk for more info.

Gary – I agree though, some more tax posts would be helpful.

John–Thanks for that! I hadn’t yet made the connection (between AmEx’s new 50% bonus on the Business Platinum and online tax payment).

Several times a year I pay estimated taxes online–your strategy sounds good, and I’ll try it this month.

I think that, if you contact your local library and ask them to select the magazines based on what subscriptions they currently buy or would be next on their list to buy, then donating those subscriptions would be almost as good as cash to them. Maybe you could scale it up by contacting a library system or school district, especially poorer areas, where I suspect you might find bigger wish lists.

After reading this post, I called a local shelter / safe house for battered women and asked them about donating magazines. They were enthusiastic and gave me several suggestions for magazines related to women and children. Next I’ll go and order some. You probably have a similar place in your community.