I receive compensation for content and many links on this blog. Citibank is an advertising partner of this site, as is American Express, Chase, Barclays and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

Key Links:

With loyalty programs regularly offering less value for their points, I’m putting together this series with background, tips, and tricks for frequent flyer programs programs whose points:

- can be very useful to you

- that you can earn easily by transferring in from bank rewards currencies.

I love flexible points far more than earning points in a single frequent flyer or frequent guest program. That helps me to diversify so I don’t get hurt as badly when one program devalues and that gives me the points I need, when I need them with the program that has availability for the award that I want.

Here’s my tips for the Marriott Rewards program.

My Biggest Flexible Points Balance is With Chase Ultimate Rewards

A real go-to for the past 5 years has been the Chase Sapphire Preferred Card. It’s been reliably the most rewarding card for spend.

There’s a 50,000 point signup bonus (after $4000 spend within 3 months). The card earns double points on travel and dining. So they start you off quickly with points, and you accumulate points quickly for your spending.

Chase points transfer to:

- Airlines: United, Korean, Singapore, Air France KLM, Southwest, Virgin Atlantic, British Airways

- Hotels: Hyatt, Marriott, IHG, Ritz-Carlton

Important Tips, Tricks, and Cautions Using Marriott Rewards

Here are 19 things a US-based frequent flyer should know about the Marriott program:

- If you aren’t already a member get referred by a friend. Both you and your friend will earn bonus points for your first stays with the program: 2000 bonus points for each of your first 5 stays apiece.

Hong Kong SkyCity Marriott - Or as a new member you can earn a complimentary night instead. If you are already a Marriott member and have cookies on your computer the link will return an error, so open in incognito mode to see the page. Two stays within 120 days will earn a free night at any Marriott property up to category 5.

- Get cash back on your bookings. Start at sites like ebates and TopCashBack will give you rebates for the reservations you make through Marriott. The sites send you to Marriott to make your reservation so you get the savings as well as the benefits from booking directly. That’s better than going directly to Marriott’s site first.

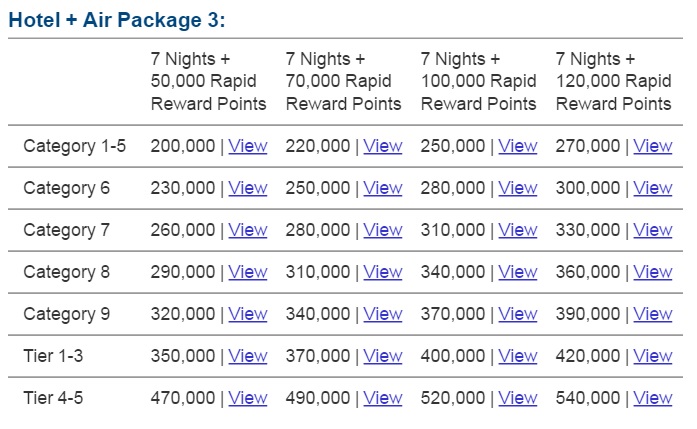

Battle House Renaissance Mobile, Alabama - Marriott Rewards offers hotel and miles package redemptions that are probably the highest value use of their points.

- There are secret travel packages. They also have 5 night travel packages which were originally introduced for timeshare owners, aren’t publicized on the Marriott Rewards website, can but can booked by phone.

- Marriott travel packages can earn you a Southwest Airlines companion pass. 235,000 Marriott Rewards points for 5 nights at a category 1-5 hotel and 120,000 Southwest points which is more than enough for a companion pass which requires earning 110,000 in a year.

A Southwest Companion Pass lets a companion fly with you when you travel on Southwest — even when you are flying on a Rapid Rewards award ticket.

You choose the person you want as your companion. You pay for your ticket, the companion flies for just the cost of security taxes. You can use the Southwest companion pass as many times as you’d like, and you can change your designated companion three times during its validity.

- Marriott points expire after 24 months of inactivity. The key thing to know here is that not all points extend expiration — social media points won’t, you can’t just follow Marriott on Instagram to extend your points. But transfers to Marriott from a Chase Sapphire Preferred Card will.

Marriott Seattle Airport Atrium - The Ritz-Carlton Rewards program is nearly identical to Marriott Rewards. The basic differences come from offering different promotions. I’ve seen more nights for Ritz-Carlton stays and double elite qualifying night promotions from Ritz-Carlton. But elite status is reciprocal — you get the same benefits at Marriott hotels as a Ritz-Carlton elites as you do as a Marriott elite.

Ritz-Carlton Grand Cayman - The Ritz-Carlton Rewards® Credit Card

doesn’t just let you earn 3 complimentary Ritz-Carlton nights as a signup bonus, you get Gold status your first year automatically and then each year you spend $10,000 or more on the card. That’s great for Marriott stays because it gets you club lounge access, late checkout, and breakfast on the same terms offered to Marriott Golds. $75,000 in spend in a year on the card earns top tier Platinum status. - Marriott Platinums get United Silver. In my opinion that’s the best benefit of Platinum over Gold, since United Silver gets access to economy plus extra legroom seats free at check-in and priority boarding so you don’t wind up having to gate check your bags.

- United Golds and above get Marriott Gold. United elites should make Marriott their ‘backup program’ because of free status.

- Marriott will let current elites challenge to a higher status level. Call up Marriott Rewards and ask for the ‘Taste of Gold’ or ‘Taste of Platinum’ offer. A silver can challenge to Gold, and a Gold can challenge to Platinum. You are given the higher status for 90 days, and if you complete 6 stays (Gold) or 9 stays (Platinum) in that time you keep the higher status level. This is a targeted promotion, but if you hang up and call back enough you may be successful in getting it. You can do this every 15 months (you can sign up again one year after the end of your 90 days of status).

- Marriott will give you 10 elite nights for booking a meeting and this is on top of any elite nights you earn for sleeping nights at the hotel. And that’s a straight 10 nights for any contracted meeting, even for use of a single conference room at a cheaper hotel in an inexpensive location such as in Southeast Asia. You can earn top tier status booking 8 conference rooms on 8 separate dates.

- Golds and Platinums can transfer points to friends for free up to 50,000 points per year.

- You don’t need to requalify to keep your status. Marriott consistently lets you spend points to keep your status when you don’t requalify.

- You can book reward stays without having the points in your account. This is useful for high demand properties, or high demand dates. You can book your stay whenever you wish and then just ensure you have the necessary points for the redemption at least 14 days prior to check-in. Chase points transfer to Marriott instantly of course, so this isn’t a case where you need to put a reservation ‘on hold’ poending a transfer. But you may need to earn more points and Marriott will let you do that as long as you’re more than two weeks out from your stay.

- Some hotels seem like they cost too many points or too few for a unique reason. Normally hotel chains assign individual properties to reward categories based on the average rate for the hotel throughout the year. But Marriott pays hotels more the most award nights get booked there in a given year. This incentivizes hotels to make award space available, but also means that popular hotels cost Marriott more. So lesser properties in prime locations will often cost more points than you’d expect — but off the beaten path hotels may be cheap.

- Some of the best value redemptions are in Eastern Europe and Southeast Asia. The JW Marriott in Bucharest, for instance, is just a category 3 hotel so only 15,000 points per night (10,000 if/when discounted on PointSavers) with fifth night free. The JW Marriott Shenzen near Hong Kong is just a category 4.

- Your Marriott points will soon be useful at even more hotels, especially high end luxury properties because Marriott’s acquisition of Starwood will mean that you’ll be able to use Marriott Rewards points at current Starwood properties soon.

St. Regis Bali

Chase Sapphire Preferred Card

Ritz-Carlton Rewards® Credit Card

Curious about #4: “Get cash back on your redemptions. Start at sites like ebates and TopCashBack” Do you really mean to say that you can get cashback on redemptions?? That doesn’t make sense to me unless possibly if it is a cash and points redemption– or did you mean to say “Get cash back on your bookings” (cash bookings)?

Can you please clarify something I do not understand about Marriott-Ritz. I think I read that you can’t have both a Marriott membership and a Ritz membership. Can you have both credit cards?

I am trying to understand this in advance of the merger (I’m a longtime Starwood loyalist)

A warning about buying status back – the miles you spend will be deducted from your lifetime points total. So it makes lifetime status harder to get.

Gary, can you clarify number 7. “Marriott travel packages can earn you a Southwest Airlines companion pass.” Are you saying if you use 235,000 Marriott rewards points for a 5 night stay package, you can earn 120,000 SWA points at the same time by booking the package through Marriott Vacations? Thanks for the help.

Are there any recent datapoints on the 5-night air+hotel packages? For a while, people were being told that those were only for timeshare owners.

My datapoints on this write up:

1. 5-night air+hotel packages are for timeshare owners only

2 Most times using Topcashback will result in the Marriott website showing a higher room rate vs going direct. Test it for yourself and see.

thks Gary,

i had 35K in my wife’s account expiring, and the 1K transfer from CSP saved the day

The 5 night air/hotel packages were introduced for timeshare owners but plenty of folks have booked them without a timeshare.

@Bob B – Marriott Vacations aren’t involved, you book a hotel stay with points and also get airline miles

Southwest companion pass can be changed three times per year

Is Hong Kong in Southeast Asia?

Don’t forget that BUYING points will also reset the expiration timer another 2 years as well. The last time I checked you could buy points for ~$12 USD

Gary, this blog and the recent one on the Ritz-Carlton Visa were very helpful – thanks. Couple of questions:

1) In R-C blog you said Marriott points can be moved into the R-C Rewards account. If in a year or two I decide Marriott program is better for me, can R-C points be transferred back into Marriott program?

2) Can R-C program points be used to “pay” for free stays at Marriott brands’ hotels, or only at R-C hotels?

3) On your recommendation I took advantage of the high bonus to get the Chase Marriott Visa. If I get R-C Visa, is there any reason to keep the Marriott card? Or, more specifically, wouldn’t it make sense NOT to renew/pay annual fee for the Marriott card on its next anniversary?

Thanks very much,

ScottB

have you EVER transferred UR to Marriott? Isn’t it usually cheaper to pay cash for Marriott and take the UR as a statement credit

How long do you have to use the free night earned through trick #2?

And can you use the trick if you already have an online account? (When I try, the incognito window tells me the information I have entered doesn’t match what’s in my account.)

Very nice tips, very helpful and this is really helpful for an upcoming trip

It seems like “taste of Platinum” is only available if you’ve been invited by corporate. I tried calling multiple times last night, and i got the same response multiple times. They will give you a platinum challenge, where you stay gold but can earn platinum faster, but not the taste of platinum challenge which gives you platinum while you do the challenge.

when was the last time someone confirmed they were able to book the 5 night stays + miles? Bc I’ve called and been flat out denied saying they don’t exist.

I called up Marriott Rewards and asked for the ‘Taste of Platinum’ offer.

Your blog stated that ‘a Gold can challenge to Platinum. You are given the higher status for 90 days, and if you complete 6 stays (Gold) or 9 stays (Platinum) in that time you keep the higher status level.” The rep at Marriott told me that Platinum status is given AFTER completing 9 stays,similar to the response given to TE in his comment to you on Aug.10,2016.

Is the response I received ‘correct’ or should I call back + see if a different agent would give the platinum status during the challenge period?

Didn’t know #16 (ability to book stays without the points in your account) and it came in handy! We had just been bemoaning that an appealing looking hotel wasn’t available for my wife’s birthday trip to Europe, but re-searched for the heck of it. Lo and behold, there it was, and even though we were short on points, we snapped it up! Now we just need to find some backdoor way into getting Marriott Gold for the free breakfast and room upgrades– if only Amex were offering a competitive signup bonus on the Platinum!

Do you recommend opening a new Marriott account when getting a second credit card for bonus points ??? ( In canada)