A couple of years ago government taxes ostensibly for security were increased from $2.50 each way not to exceed $5 per roundtrip to $5.60 each way.

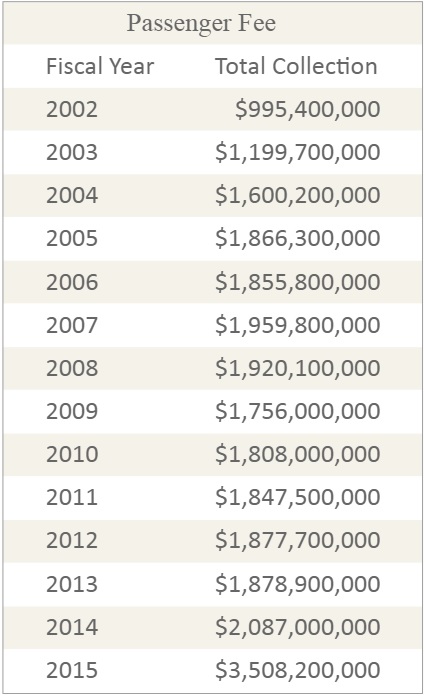

The $2.50 per direction fee had been constant since the February 2002, until it went up in 2014, though revenue has consistently grown:

The Obama administration is proposing to raise the fee from $5.60 per direction to:

- $6.60 in 2017

- $7 in 2018

- $7.25 in 2020

Department of Homeland Security Secretary Jeh Johnson says we need this because security.

Right now I believe aviation security is critical, given the world situation. We need help to pay for that. Those who use the system, as opposed to taxpayers generally, should help a little more in paying for those things. If these are not increased, we’re going to have a real problem finding where to pay for aviation security.

(Emphasis mine.)

Transportation research Robert Poole, in Airport Policy News notes though that the money from this proposed increase isn’t actually going to security.

[D]ue to planned shifts in where the revenue would go, over the 10-year period through FY 2026, the proposal would generate $6.9 billion for TSA’s budget and $5.4 billion for general fund deficit reduction.

It was “consistent” grown if it went down from 2008 to 2009.

Confused. I thought Barry’s position was that terrorism is a non-issue?

Hopefully some of the new fee increases will go to hiring more people, having more scanners and newer equipment and generally speeding things up and improving security.

@Donna. LOL, that’s what they say after every tax increase. Instead of doing more with less, its easier to do less with more.

Daniel – the word used is “consistent” not constant — troll much

seems to me with the ticket fees TSA should be operating at a profit,

where is the money really going ?

The fact that ~40% of this goes to “general revenue” is ridiculous and for that reason I’m against this proposal. At the same time, TSA either needs to become more efficient or needs more money (most likely it’s both).

I’m pretty sure the last increase went towards the general fund as well.

You should do more posts about how heavily travel is taxed. Rental cars and hotels are even worse.

If this goes into the general fund then good, it goes some way to making up for the tax that airlines are dodging by shifting revenue from fares to fees and from the general subsidy air travel gets through infrastructure funding.

Compared to fuel surcharges (still in place even if oil is at record lows), ticket cancellation fees, and bag fees, this tax looks like a bargain and its increase very modest.

If airlines don’t like it, all they have to do is pull out a mirror while eating some of their own medicine.

@Ed – couldn’t agree with you mode!

@Donna, lol are you serious?

When has more money for government led to more efficient operation? That people think like this in 2016 is scary, what world are they living in?

As for the TSA, yet another report came out 2 days ago showing what a fraud of a ” security” department it is: http://www.washingtontimes.com/news/2016/apr/27/tsa-employees-tell-house-panel-poor-leadership-ret/

Like I said in your other post, this is what governments do. They get bigger, and they do so by taxing citizens more and more. It’s the only thing they do well.

the more they take, the more they waste

That’s like saying Social Security is broke when the reality is it would be solvent but for the fact the the government has been stealing from it for the general fund for years. Bernie is right. We do need a revolution, but a real one.

@blacksheep – since the ‘trust fund’ is invested in government funds, it’s simply a claim on future taxpayer dollars. In any case, social security spends more than it takes in and the ‘trust fund’ is expected to run out in ~ 2035. It’s inexcusable that social security is paid out to millionaires. There are going to have to be changes to the program, including means testing.