Alaska Airlines and Virgin America held an investor call this morning to walk through the deal that came together over the weekend.

Regarding the Virgin America brand, Alaska “want[s] to learn more about it.” You ‘d think they’d have some idea the value of the brand and how (if) to deploy it before spending $2.5 billion — $600 million in cash and taking on $2 billion in debt (while picking up half a billion in cash from Virgin America). Currently Virgin America pays 0.7% of revenue off the top to Virgin for the brand.

Alaska claims they initiated the deal, and JetBlue got into the bidding after they started negotiating.

They’re going to slow down share repurchases (but not to zero this year or next year) in order to pay down some of the debt over the next couple of years. I think they weren’t sticking to their talking points though concluding, “We don’t destroy our balance sheet.”

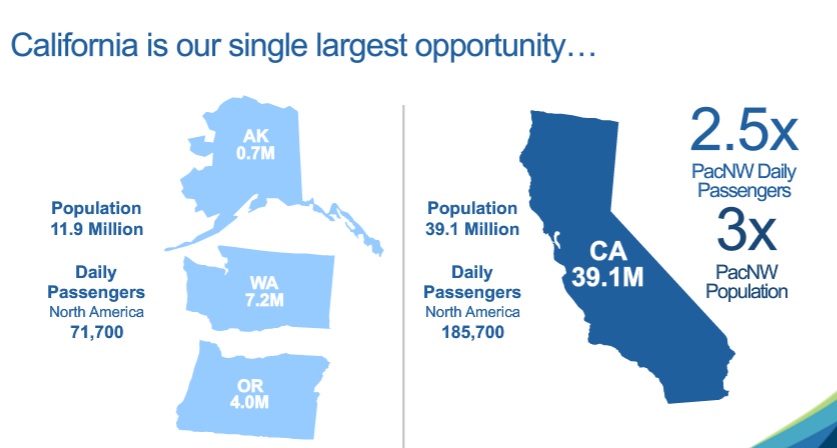

The case that Alaska made for the deal on the investor call is strength in California.

Alaska views upside of the deal being more on the revenue side than the expense side, though they noted over and over that they wouldn’t provide any breakdown of the magnitude of how the revenue synergies break down though they specifically noted a driver on revenue being greater penetration of the Alaska Airlines co-brand credit card in the Bay Area especially. They came back to this point in the Q&A.

They talk about synergies driven by the loyalty program, and member base in California, rather than reducing overlapping routes.

Of course the Virgin America co-brand card contract will take time to wind down, and there’s some tradeoff that reduces synergies when you lose the Virgin America card from Comenity Bank. (The next year could be a good time to pick up that card, since it’s expected to go away.)

They haven’t decided what to do with the Airbus fleet since Alaska mainline is all-Boeing. They’ll operate it in the near-term and decide in the future. Alaska joked, “We’re such a big fan of a single fleet that we bought another single fleet.” That of course underscores the problem or challenge they face.

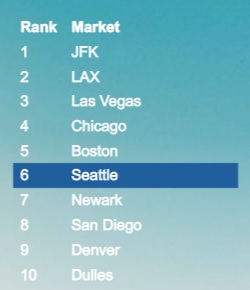

They grow in Los Angeles but mostly San Francisco. They currently serve only one of the 10 largest markets from San Francisco, but after the merger will serve all 10. Virgin’s and Alaska’s operations at those two airports will be tough to consolidate.

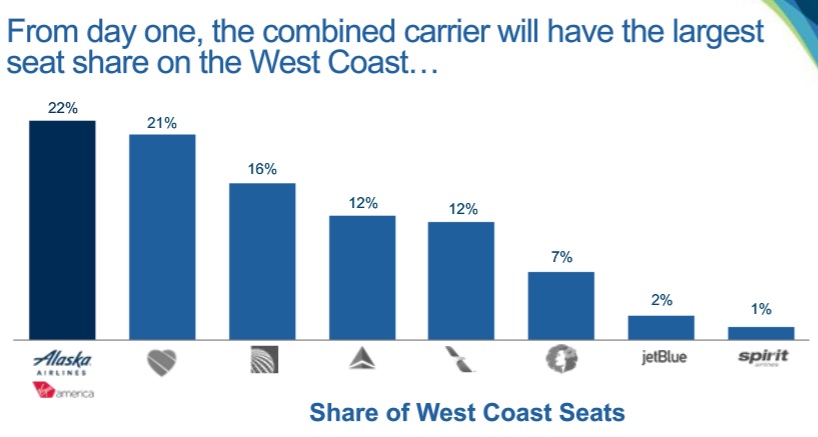

In claiming to really grow, they conflate California with ‘West Coast’ where they’ll have the most seats within the state. They become the second largest carrier in San Francisco and ‘relevant’ in Los Angeles.

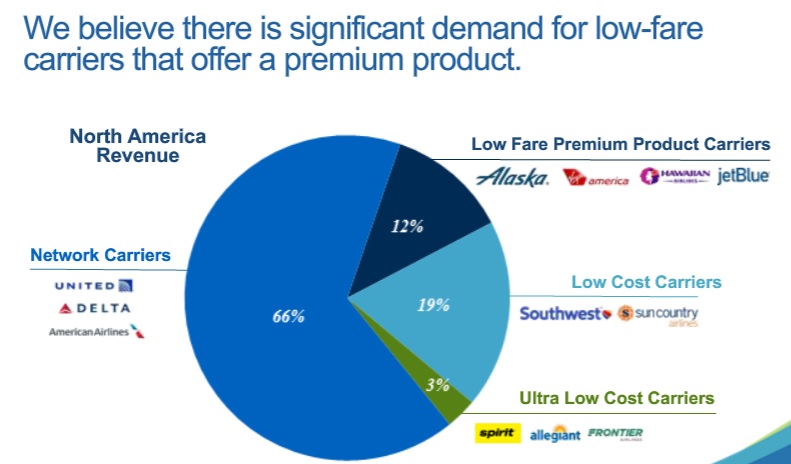

They see themselves as a low fare, premium airline — along with JetBlue. In fact, having beaten out JetBlue for Virgin America (a match that I believe would have made more sense), one could imagine Alaska and JetBlue merging to be strong both on the West and East Coasts although the tremendous expense of this deal makes that so much the harder, given the additional debt that would require (having spoken to the ratings agencies, ‘wherever it winds up will be a good result’).

Alaska talked on the call about the importance of getting into constrained airports, that it took 5 years to get a redeye flight into JFK. A deal with JetBlue would change that dynamic.

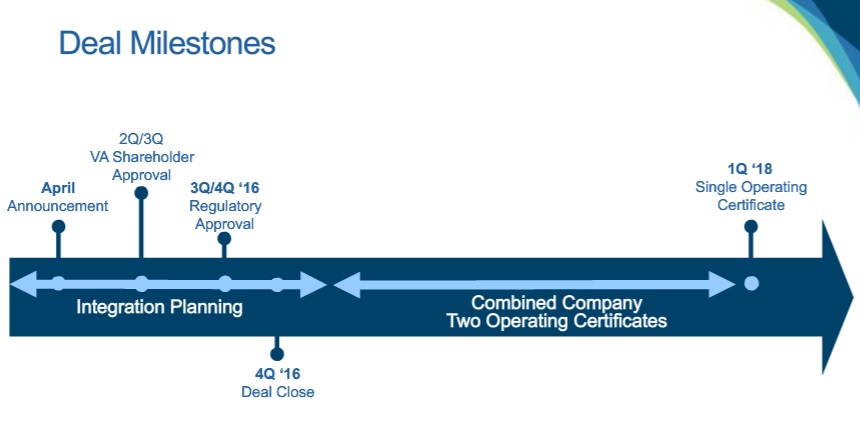

The deal won’t close until at least the end of 2016, and they do not expect a single operating certificate until the beginning of 2018. So Virgin America is going to remain a separate airline for nearly two years.

Ultimately Alaska gets some value from Virgin America’s San Francisco, Los Angeles, and constrained airport operations in New York and DC. (Dallas Love Field didn’t get focus until the question period and is just something Alaska ‘will be taking a look at’). That’s never been in question. The real challenge here is the price Alaska is paying — $2.6 billion is a 90% premium over Virgin America’s market cap just two weeks ago.

Alaska describes the price as ‘easily digestible’ — which means they’re able to pay — but they do less to demonstrate why that price was worth paying. It was competitive bidding, which drove up the price. They prefer to focus on ‘value’ not ‘price’ which I take to be a deflection from their having overpaid.

While the deal may be easily digestible, the airline operations will present challenges. When US Airways and American held an investor call when their deal finally got government approval American’s CEO Doug Parker specifically talked about the reservation system — something that tripped up other mergers (United, cough, United) and that American ultimately managed exceptionally well. Alaska didn’t focus on operational specifics, and deflected questions that drove down to operational questions like reservation system except when pressed late in the Q&A — although at least both airlines use Sabre.

Alaska sees the American relationship getting stronger. No question that’s the case in San Francisco. Virgin America shares a terminal with American there already. Of course they start competing on the Los Angeles and San Francisco – New York routes. In contrast, Alaska and Delta while partners have been staunch competitors in Seattle. Delta is a joint venture partner of Virgin Australia and 49% owner of Virgin Atlantic. This deal may benefit Delta by leaving them – effectively – as Virgin America, or rather Virgin’s America partner.

Awfully overpaid for VA, for the price they could have just piecemealed together something that would be much easier for them to consolidate and have synergies with. But good news for stockholders of Virgin (alas I sold too early)

Something tells me Alaska will regret this rushed purchase. What surprises me is that their shareholders approved this. Well, if this proves to be a disaster their CEO and CFO will leave with their pockets full. Who cares, right? 🙁

Way overpaying and not clear that they have thought things through as to why VA is worth the money. I could see a couple of years where they struggle until eventually B6 swoops in and buys the combined entity for less than the sum of the pre-merger individual parts.

I notice that Tilden is CEO, President and Chairman of the Board, which for me is a bit of a flashing light given ego can be a major driver for overpaying in M&A

I think any potential future merger between B6 and the combined AS/VX entity should take on Emirates as a minority stakeholder to help fund the purchase

It seems the intent here was more to keep VA out of the hands of JetBlue, which would have ended up with strong operations on both coasts. Right now the only real effect is to reduce competition on the West Coast. Wonder if the DOJ will see it that way too.

I actually see the reticence to talk about the VA brand a good thing.

My (smaller) company had made three acquisitions in as many years. Until you have control and look under the hood, there are things you don’t know:

1) How the brand is going to fit in with yours. Our last acquisition could have been total conversion to our brand, total conversion to theirs or run two distinct brands focused at different segments. We went with the first, but not until getting everyone in a conf room for a week and hashing it out with the combined team.

2) Talent – It’s hard to judge talent below the senior team at the VP/Sr. Director level prior to getting in there and working with them. This is the level that’s actually, tactically making a business run. You know the senior guys, but they’re strategically focused and expendable (synergies!). Those at the next level are of vital import to the revenue and expense synergies that ware going to drive growth and efficiency.

I think they paid too much, and I think now they have to think about a JetBlue merger to make the debt load work (yes, I know about B6’s debt load). That said, it gets them out of the Seattle or die spot that they are in, which is good long term strategy.

With looming regulatory approvals and shareholder votes on a deal that will make or break the company, it is surprising that Alaska would pull a stunt like the whole Emirates awards saga. If ever there was a time when Alaska needed to avoid alienating customers and destroying its credibility, it would be now.

Alaska seems to be paying to much for Virgin America, but it must grow. This deal is probably Alaska’s best opportunity to do that. It doesn’t solve all of Alaska’s problems, and it creates some new ones. Still, growth must be its top priority. Maybe Alaska also has its sights on Jet Blue in the future.

They will have a strong competitive advantage if they keep giving full miles, but wonder if they can now with that debt pressure. Suddenly they take in all of my markets so I could use them exclusively and would if they give full mileage credit.

But isn’t the name too disjointed to keep now? It’s like another major carrier being named Arizona because it has a hub there.

@john the people responsible for the Emirates devaluation likely were completely unaware of the looking Virgin America deal

@Greg – unclear what taking on debt, which isn’t out of whack for an airline really and which they intend to pay down a bit over the next two years by reducing share buybacks, will have to do in terms of reducing marketing spend. if anything the deal could cause them to limit major changes to the program while they focus on the merger. not saying that’s definitely what will happen, but for the most part it’s what’s happened in other deals.

One, the Alaska shareholders did not have a say, the Board approved the purchase. Two, I don’t think piecing together an expansion is possible as you need the gates at several different high volume airports. The price does look high at the moment but if (a BIG if) fuel prices stay low then Alaska will be judged to have done the responsible thing in purchasing VA.

The devil’s in the details but if they can work with Virgin Australia then they will be a good feeder into LAX for them. The synergies with AA could work out as well. If this is a huge success I see Alaska taking a run at JetBlue in 24 to 36 months. If not that then they might possibly seek routes to Asia and acquire some long haul jets. In any event I think Boeing is happy with this and Delta probably not so much.

Gary, I’m interested in your further thoughts on this part of your post:

“Alaska views upside of the deal being more on the revenue side than the expense side, though they noted over and over that they wouldn’t provide any breakdown of the magnitude of how the revenue synergies break down though they specifically noted a driver on revenue being greater penetration of the Alaska Airlines co-brand credit card in the Bay Area especially. They came back to this point in the Q&A.”

So does this mean Alaska management sees selling many more miles to Bank of American due to many more folks signing up for the Alaska B of A credit card as a result of this deal, to the point that it’s a significant benefit of the deal? Is that the reasoning here? And if so, does it make sense to you?

@Steve that’s one of the points that was made during the investor call, yes.

@Russell I think Delta is probably OK with this. A competitor is off the board, another is distracted, and they should be able to better leverage their ownership interest interest in VS with VX out of the picture. Also, long term, can you see AS trying to compete with the products the other airlines offer on SF/LA-NYC? That has not been their style in the past.