Book an award ticket for travel on British Airways across the Pond, and you’re going to pay pretty hefty fuel surcharges.

But use your American AAdvantage or Alaska Airlines miles to fly on American transatlantic, even without fuel surcharges the taxes and fees are still pretty high.

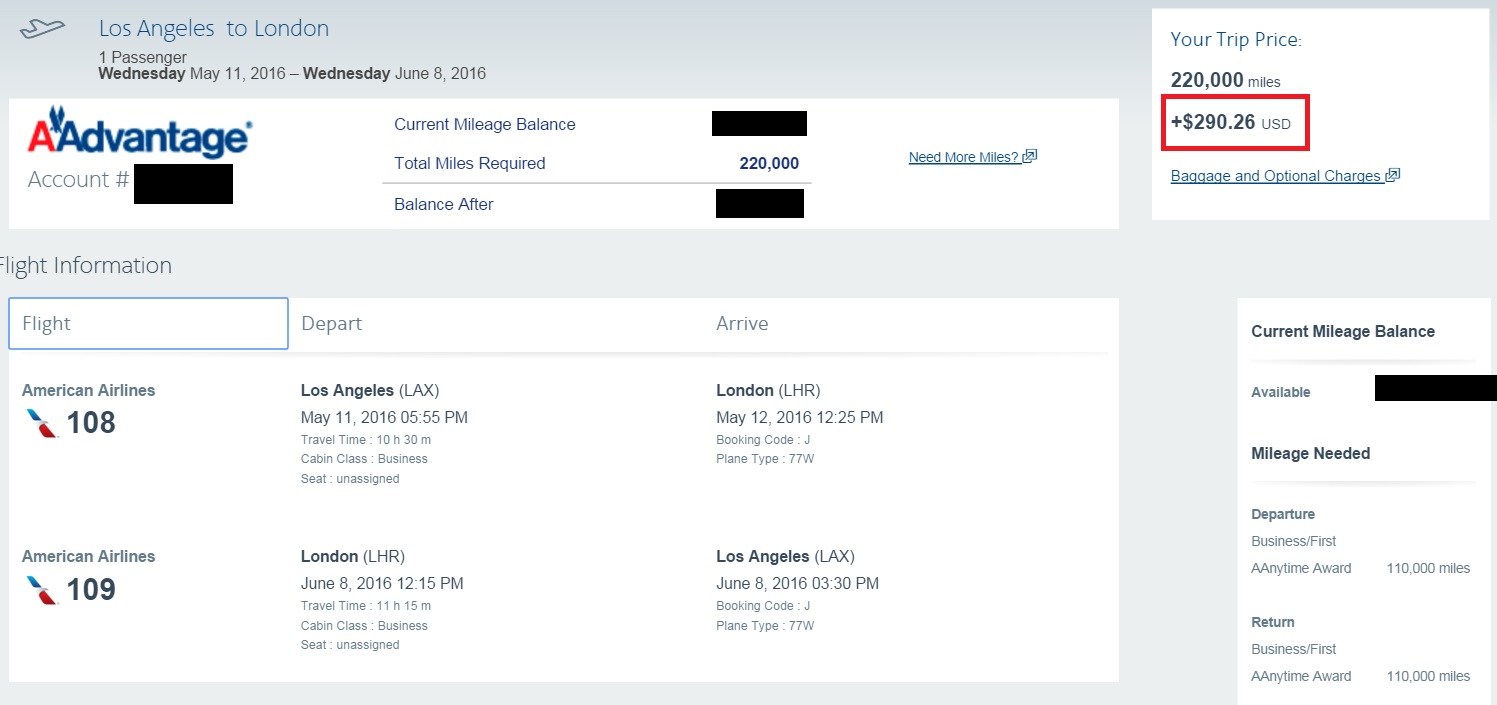

I picked random dates for Los Angeles – London non-stop in business class. It’s an AAnytime award (so lots of miles), but what’s relevant here is the taxes. There are no fuel surcharges and yet you’re still coming out of pocket nearly $300 for one person.

The same holds true for using Delta miles on an itinerary originating in North America (remember: Europe-originating SkyMiles awards incur fuel surcharges, which in my view is tantamount to theft). And the same holds true of United MileagePlus awards — there are never fuel surcharges on United-issued awards, but UK taxes are still high.

That’s because of the UK’s Air Passenger Duty (APD) also referred to as the UK luxury tax or premium cabin departure tax, even though it applies to coach tickets as well.

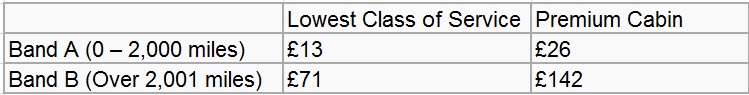

The amount of this tax is based on distance and class of service. And it applies to all departures originating in the UK.

On a paid business class ticket London – Los Angeles you’re paying US$209 in APD.

It’s half that on a coach ticket.

Here are the amounts (in British pounds) and distances:

The fee was sold as an environmental measure but the UK now admits it’s primarily a revenue generator. There are exceptions to the fee — for instance certain Northern Ireland flights were exempted when Continental threatened to cancel Belfast-Newark non-stops (a route United flies to this day), and children up to age 12 flying economy are now exempted.

And since the UK government didn’t want to disadvantage British Airways from competing in connecting markets, it only applies to UK departures and not to UK connections. Fly Paris – London – Los Angeles and there’s no UK APD to pay. Similarly, fly through London to get where you’re going outside the UK, be it Paris or Brussels or Munich or Amsterdam, and you won’t pay this fee. That’s why some people originate their travel outside the UK, and connect through London, instead of starting in London.

That’s all by way of background. Reader L.B. taught me something about the UK APD that I didn’t know.

- I always thought that to avoid the APD, your travel originating or terminating beyond the UK had to be on the same ticket.

- So if you only found award availability to London, and had to buy your connection to Rome on a separate ticket, you were stuck paying the tax.

- Or if you bought a ticket from London (or other UK city) to the US, and later decided that you’d begin your trip home from another country buying a ticket on a low cost carrier to London the night before (but within 24 hours of your departure) you were out of luck. You had already paid the tax. And since your travel originated outside the UK on a separate ticket you were stuck anyway.

In fact, while the APD is collected when you buy your ticket the airline doesn’t actually remit it until you fly.

- If you wind up not taking the trip, you can claim the tax back from the airline.

- If you travel on a separate ticket to the UK within 24 hours of your UK departure, even if it’s on another airline, you can claim the tax back from the airline you paid it to.

L.B. points me to this illustration,

Earlier this year I flew U[nited] from [London Heathrow] to the USA on a ticket whose price correctly (at the time of purchase) included the APD.

As events turned out, I arrived in the UK on a [British Airways] flight less that 24 hours before my departure from [London]. I requested a refund of the APD by email to [United] (with both boarding passes and the original eTicket attached) and was paid by a refund to the card used to purchase the UA ticket within a few weeks.

Perhaps others knew this, but I didn’t realize it, and am kicking myself because I’ve paid UK taxes that weren’t due!

I did a quick turn mileage run, LAX-LHR-LAX, with only a 6 hour layover at Heathrow. Would I qualify for the tax refund as well?

You can also avoid the UK APD if on separate tickets but connecting itineraries with up to 24 hours in the UK by having “Conjunction Tickets”.

Even on different ticketing carriers.- this is a little complicated (more to do with the airlines either not paying or refunding the APD) and may be easier with a TA but the amount saved can make it very worthwhile.

There’s some of this on the major forums – search for “Conjunction” and “AP”.

Wow, this on top of the original research on overseas credit card fees. Really appreciate bloggers that add something. I just filed a claim with SAS for a separate-tickets connection through LHR last summer.

Always good to know these things, but still a pretty limited set of circumstances that once doesn’t have to pay this outrageously high tax.

Gary, FlyerTalk has known about this for months if not years. Thanks for posting about it, but this is not earth shattering info…

I booked a AA saver award in business JFK-LHR on AA metal last week and the total charges were only $11.20, just like a domestic flight.

@Scott but that’s not a departure from the UK

Gary, thanks for posting.

So would this apply to award travel? For example, Dallas-London-Madrid via British Airways, using American miles? (Assuming the layover in London was less than 24 hours.)

Normally (I think) you’d have a big tax bill to go along with the miles needed for the award.

On Virgin Atlantic we know the surcharges are hi flying out of UK but I noticed that transiting LHR en route US-JNB also carried fees that were high. Almost as if UK tax was being applied in both directions. Wonder if this is the case and whether should be challenged if so?

@daniel – the circumstances are limited to any time you fly into the UK and depart the UK on another flight where there is not more than 24 hours between the scheduled arrival of the first flight and the scheduled departure of the second.

These can be on separate tickets as long as there is a conjunction document linking them – which is rather simple.

Interesting — there’s always some new trick to learn.

I do wonder whether more people travel transatlantic eastbound TO the UK than travel westbound. It’s kind of a no-brainer to visit the UK FIRST, then travel to the Continent, and return transatlantic from there. I’m sure most people are clueless about this tax, but since frequent flyers buy a good percentage of tickets, I can’t be the only person deploying this tax-avoidance strategy.

You mention a conjunction document linking the two flights. How do I get that? I’m flying a couple of times into and out of London with under 24 hour stays, so this could save me a lot of money. Thanks!

Hoping someone can help me… we booked some rather inexpensive flights from IAD to LHR in March (~$410 per person round trip in coach). Problem is the fares were only available through Orbitz, but the charge showed up on our card as Iberia. We’ll be in London for half the trip, then going to Italy for the second half and flying back to London for our return flight the day before our flight home from London (within 24 hours). It sounds to me like we should be able to get the APD refunded, but I’m not sure who to go to in this case — Orbitz? Iberia? Any advice would be greatly appreciated — this would be an additional savings over $200+ overall.

@ Gary — Very sweet. We have to go to DUB for an event, and ended up booking separate awards BA DUB-LHR and DL DL LHR-ATL. We willl certainly applying for our refund!

I understand that VAT paid on the continent or the UK for hotel and car rentals are refundable if they incurred during business trips. My question is simple – how does one go about filing for the rebate?

I’m flying IAD-LHR-TLV and then back on BA, but with two tickets (IAD-LHR-IAD and LHR-TLV-LHR). After reading this post, I called BA to request a refund of the 71 pounds charged for the APD on the LHR-TLV flight, since I’m in London for under 2 hours. The agent told me I can’t get a refund. Any suggestions? Any website to which I can refer the agent?

Dear Mrs

Thanks for your call regarding a refund request on 29 February.

We’ve looked into your request and I’m afraid we’re unable to refund any Air Passenger Duty charges as your flights were on separate bookings. I understand this wasn’t the answer you were looking for, I’m sorry to disappoint you.

Best regards

G.T

British Airways Customer Relations Executive

Judging from the questions, this seems like a either a mistake or a really big deal.

Too bad we couldn’t get more details on this.

If it’s not a mistake, I’m sure someone else will write up the details.

This does not seem to be the case for BA: http://www.flyertalk.com/forum/british-airways-executive-club/1620173-apd-refund-possible.html

interesting that different airlines appear to read the rules differently