A few commenters have argued that Visa charges more for foreign currency conversion than MasterCard — that a Visa with ‘no foreign currency conversion fees’ isn’t really because Visa marks up their exchange rate by 1%.

Traditionally credit cards have earned money on foreign purchases in two ways:

- Exchange rate. They may not give you as favorable a rate as they’re getting, so they profit on the exchange.

- Surcharge. This is what’s referred to as the foreign transaction fee, whether an additional (often 3%) change is assessed after the exchange rate is calculate.

It’s worth noting that a credit card with foreign transaction fees will add the surcharge onto purchases made outside the US that are in US dollars.

Some card issuers stopped charging surcharges because:

- They wanted to appeal to high spend cardholders who travel abroad

- They found that the fees often lose money — such cardholders put the cards at the back of their wallet when they travel and don’t put them front of wallet again when they come back to the U.S.

When banks say their cards have no foreign transaction fee, they mean there is no surcharge. But that doesn’t mean any card with no foreign transaction fees is as good as any other — you still want to get the best exchange rate.

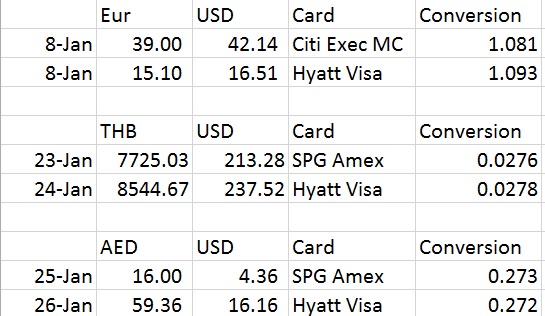

I’m testing this out on a few trips. I mentioned in the comments that I’m experimenting with comparisons, and I’ve had a couple of folks ask about the status of this in the comments and also by email, so I thought I’d provide an update.

I’m waiting for some card statements to close. I don’t want to go off of interim information, and Chase’s website doesn’t show me the original foreign charge or the conversion rate (only the US dollar equivalent) as far as I can tell outside of a card’s monthly statement.

In the meantime, a few data points suggest:

Visa vs. American Express: No difference.

- I received the same rates with a Chase Visa as American Express in Thailand.

- I received the same rates with a Chase Visa as American Express in the UAE.

Visa vs. MasterCard: Visa gave a less favorable exchange rate.

- I paid 1% more in Paris to use a Chase Visa compared to a Citi MasterCard.

I’ll be back from the UAE and also Asia shortly and will continue the comparison. I want to see whether this pattern holds, and whether or not it’s country-dependent. I should have a couple more countries over the next week.

I just got back from Malaysia. Same observation i had between my Citi Master and CSP Visa. On the same day i had 2 transactions on both cards, Citi gave me an exchange rate 4.21 vs Chase 4.16, USD-MYR (the higher the better). Also found out that Chase gives a flat 1% rebate for overseas spend, even though its in a bonus category like dining and gas.

More reasons why Citi premier/prestige rules for travelers.

Hey Gary,

January 25th and January 26th were both business days, wouldn’t it be better to compare transactions made on the same day or transactions made on consecutive non-business days (i.e. Saturday and Sunday)?

Since the Forex markets are closed on Saturday and Sunday.

All the credit cards disclose that the rate they exchange at is not the wholesale rate applicable at the time. That this is the case is not easy to find and even if you do tells you virtually nothing because they do do not disclose what rate they do use. In fact the agreements say that the rate varies and by what or how much they say nothing.

The best one can say is that in most countries the spread is less than most travels would pay if they exchanged money or used a debit card at a cash machine and paying in cash would mean giving up any points you would have earned.

However since you are doing a test keep in mind that there is what is happening at the Visa/MC/Amex level and what is happening at the level of the issuing bank (not applicable to all but a few Amex cards). It is not clear who sets the exchange rate that is used. If it’s at that Visa/MC level than the rate should be identical regardless of the bank, but if it’s at the bank level then there could be a variance not only across cards but within cards but across the issuing institution. So if you really want to dig down try some back to back Visa or MC charges with across a couple of banks and see how closely they match.

I’ve done this test in the past when travelling for business. Unfortunately I don’t recall my results. That said, the Exchange Rate can differ day-to-day so if you can make purchases with each card each day over the course of multiple days, you’ll get a better understanding. I’ve purchased items on the same day but they posted on different days (merchant delay??) and I got a different rate because of that. (Nothing to scream about.)

Hint: Try Visa vs. Amex in Europe.

EOM

There is a great app for this: Mercez.

I’d be curious to know the conclusion of this experiment(?).

This is very interesting info, thanks Gary.

i used a debit card product, straight from USD check account, at same time as purchases on CSP Visa product in Ireland, and the net variation was in fact 2.5%.

i suspect they pick it up on their margin on the Interbank FX rates.

so technically, no fees, just pathetic exchange rates.

Fascinating stuff. Thanks for doing the experiment. If you don’t get enough data points, hopefully others can weigh in. I’ll be overseas late next month and could also try to vary my purchases from MC to Visa to see what the exchange rate is.

From a personal standpoint, I’d obviously choose to use the card that gives me the best exchange rate — assuming it’s meaningful, and 1 percent would be enough to earn my business. Like most of your readers, I have no-foreign-transaction reward cards with AMEX, MC and Visa.

Is there any chance that the exchange rate could also vary based on your bank?

Finally, for the litigious set, I see the possibility of a class action here. If “no foreign transaction fees” don’t mean what it sounds like, I’m pretty sure the lawyers will get interested.

Was about to say what IAHPHX did. If indeed it is true that Visa consistently builds a 1% premium into their exchange rate over Amex and MC without disclosing it, that is outrageous and I hope they do get into hot water because of it. I regularly use both MC and Visa “no-fee” cards abroad thinking I am getting the best possible rate and it would burn me up to no end to know I had been paying a hidden surcharge every time I reach for my Visa.

larry – warning – you are about to get burned up.

If I remember correctly the last time I looked at least one of them either Visa or MC did disclose that the bank would use an undisclosed rate to which 1% would be added. I thought both did but it may have only been one of them.

But be clear there are three things going on. The currency conversion fee, which we are assuming is zero for the cards being tested, the exchange rate itself, which is somehow related to the wholesale rate, but isn’t the wholesale rate, isn’t the rate the bank actually traded at (if they even traded at all), and for therefore about which we know nothing and finally any fee that Visa, MC may have added independent of what the bank is doing.

The last of these can easily be checked as it is clearly disclosed in ones agreement. If Visa has a fee and MC doesn’t well then there you have it.

Keep in mind that the bank can make money on the spread without actually changing your currency. They are handling enormous number of currency transactions. If a billion dollar goes one way and a billion goes the other then they make the spread without having actually converted anything. Of course it never matches up so neatly so then the bank is either taking a currency risk or hedges its risks in any number of way. It gets very complex but this is how a bank can make pretty good money even if they are only charging a very small spread. If you had a billion dollar going both ways every day and were charge .1% for matching these transactions up with each other you’d be taking in $1 million a day without no currency risk.

The short answer is most definitely. There are a number of threads on FT that discuss this. Visa’s rates are generally more expensive than MC by 1% or more.

One explanation for the difference is the way MC and Visa set their rates. MC use market rates on the day the transactions post (normally T+2). So at the time of purchase, the customer is not guaranteed a rate. This is why when you look at your online statement, the USD amount normally changes between transaction date and posting date.

Visa, on the other hand, guarantees you a rate on the day of your transaction. So you know right away how much you are going to pay in your base currency. They publish their rates daily on their website. But because this transaction does not actually post for 2 days, Visa is taking a bit of market risk. If the exchange rate moves in an unfavorable direction during these 2 days, Visa could lose money. So, they charge customers a bit of premium to protect themselves against FX rate movement. So essentially, we as consumers are paying extra for this 2 day protection. (We are buying an option). It is a fair question to ask whether 1% is an appropriate premium especially for highly liquid currencies that don’t vary much from day to day.

For me, the bottom line is I avoid using Visa overseas unless the card gives bonus miles/points that offset the exchange rate premium I have to pay.

Btw, Gary, I think the fairest comparison you can make is to make 2 back-to-back transactions using different cards. Some of your data use transactions from different dates.

I’m pretty sure that the rate is the one of the day the transaction clears (I.e. is submitted by the merchant or merchant’s bank), not the one of the day when the transaction is made (authorized). There is typically a lag between the two, and it varies by merchant / clearing bank, so when dealing with very volatile currencies you could see wide variations.

Please keep digging I to this by adding data points, but I suggest you also track the clearing date, not just the date of purchase / authorization

@PrivU — I either missed your post or we posted at the same time. Your explanation is more complete and most likely accurate. Thanks. If that’s the case then all my Visa cards will be ejected from my wallet.

@PrivU — your info does not match what’s on Visa USA website at https://usa.visa.com/support/consumer/travel-support/exchange-rate-calculator.html/

It reads “Rates apply to the date the transaction was processed by Visa; this may differ from the actual date of the transaction” and the rate is only an “indication”. I stand behind my previous comment.

I don’t think that the two are contradicting. There could be 3 different dates here: the date of the transaction (1), the date that the merchant submits the transaction (2), and the date the transaction posts (3). Most of the time, (1) and (2) would be the same, but there could be some (off-line?) merchants that don’t capture transactions on the same date. Visa is just saying that the rates apply on (2) and not on (1).

I’ve noticed the exchange rates that vary each day when using my British Airways Chase Visa card but I haven’t compared it with other cards since I was happy with using the BA Visa.

I did however notice that a purchase I made in South Africa, and then had to return and get a refund for – on the same day, only hours apart – that I lost a few pennies between the amount the purchase posted at and the amount that the refund posted at. Maybe 13 cents on a $15 transaction. Minor difference, but interesting. Possibly due to the charge being pre-auth and recorded at the exchange rate at the time, whereas a refund isn’t notified to the issuing bank at point of sale/return but only when it settles a few days later?

I’m returning to this post to whine.

It bothers me that you were so unscientific and non-rigorous in your tests. You sell credit cards for a LIVING. Would it have been so hard to go to a Starbucks in four different countries amidst your myriad travels and put $10 on your Starbucks card using three different payment methods?

You have to do:

-same day

-same merchant

-same amount

-different cards

To achieve this, you can:

-split hotel bills between cards

-split restaurant bills between cards

-buy train tickets on separate cards

I’ve run these experiments time and again and Visa has come up short by 1%. If you spent $12,500 abroad on a Visa, yes, you’d have earned a one-way plane ticket with 12,500 miles, but you also would have spent $125 for this privilege!

To claim yourself as a thought leader and to spend so little time thinking about this… It really gives me pause.

@stvr I know you seem to have a vested interest in the argument, and I shared a few examples that support your contention and mentioned in this post that i was going to be conducting experiments in my travels abroad. I’m not sure why you have a problem highlighting an issue tentatively and then collecting data.

Someone took the time to do a very thorough analysis and the result was…

“On average, from the euro and dollar data sets we looked at, Mastercard’s exchange rates were 0.6% higher than Visa’s. While we haven’t checked every day and every currency, it’s likely that the data we do have shows a pattern that would be replicated.”

http://www.moneysavingexpert.com/news/cards/2015/05/mastercard-vs-visa-for-using-abroad-which-wins

This image says it all:

http://images.moneysavingexpert.com/images/chart-mcard-vs-visa-1.jpg

My own experience using a Chase Visa, Citi MC and Chase MC for purchases in Euros back in March and April of this year showed that MasterCard was better than Visa on 4 of the 6 days that multiple cards were used, but most of the time the difference was negligible:

When Visa was on top, it was only an average of 0.267% better than MasterCard.

When MasterCard was on top it was only an average of 0.117% better than Visa, although there was a single day where a single MC charge did win by a full percent. Compared to the rest of the days, that appears to be more of an outlier than a rule so I have excluded it from the average.

So we are talking a difference of 12-27 cents for every hundred you spend in either direction. Not enough to stress about.

One thing to note, on the 2 days that I used both the Citi MC and the Chase MC, the Chase MC beat the Citi MC by an average of 0.24%. Unfortunately, we all know that the Chase MC gets you IHG points which are not worth as much, so realistically the Citi MC still wins.

All of the above was calculated using the transaction date. Citi statements list the transaction date and posting date as the same date. Chase statements list the posting date as a date 2-3 days after the transaction date (and in one case 5 days!),