Goldman Sachs downgraded their recommendation on Hyatt’s stock to sell.

But they’re really making a broader point about the economy, and the toll it will take on the lodging industry.

Hyatt just bears the brunt of the recommendation because they do better in good times and worse in bad times than their major competitors because they still own a good portion of their hotels, or rather a larger portion than the industry at large. So they aren’t just earning revenue from fees.

We are in the downward leg of the hotel cycle, which will be characterized by rising supply, weakening demand, downward estimate revisions, and multiple contraction. So while the stocks have underperformed, we expect another leg down. We are most negative on hotel stocks with high operating leverage (high ownership) and little to no corporate finance levers.

…Only 21% of H’s 2016 revenues will be from fees, meaningfully lower than CHH (100%), IHG (90%), and MAR (67%).

Room Rates May Be Under Pressure, but the Park Hyatt New York Did Just Get its AAA Fifth Diamond

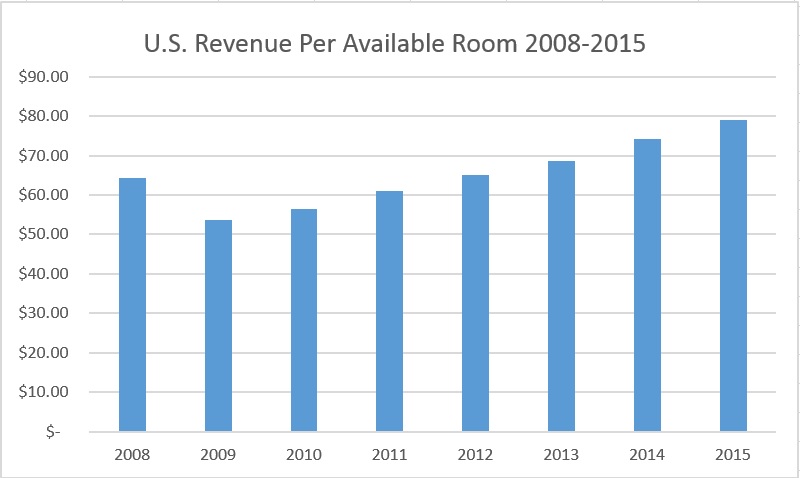

The hotel business has been on the upswing since the depths of the Great Recession.

Much of the growth in the business has come in markets that are struggling especially China which is cratering. South America is weak — especially Venezuela, Argentina, and even Brazil ended 2015 with negative GDP growth. The Eurozone is increasingly fragmented, and is hardly out of the woods after deferring the Greek crisis.

With cheap credit over the past several years hotels have been on a building boom. More rooms, without concomitant increases in demand, mean lower prices. And demand may indeed be lower in the face of economic weakness.

That’s bad news for the hotel industry as a whole, although mergers (IHG/Kimpton, Marriott/Starwood, and Accor/Fairmont with perhaps more to come) may help them weather a slowdown.

Slow times in the industry could translate to good news for consumers, however.

- Lower occupancy and thus lower rates across the board

- Flash sales and deals

- More hotel loyalty program promotions to put heads in beds

- Slowing of the trend towards devaluation —

- Hilton was the only chain to devalue during the Great Recession and IHG Rewards Club (née Priority Club) mocked them mercilessly for it.

- Programs that base redemption rates on anticipated average room rates certainly shouldn’t be raising points prices.

Hotel program devaluations in the current environment would be cheeky to say the least.

Its sad that it may take a serious cooling of the economy to get

Hyatt to do something promotional

I’ve canceled most of my stays with them this year as I jump onto promotions with

Hilton IHG and some Starwood

Time for them yo get their thumb out of their ### and do something

Are they comatose in marketing or did everyone get fired just before the new year ?

What’s up with Hyatt’s lack of winter promo as it seems like a logical response in a downturn? It seems odd that they’re just keeping silent while all sorts of bad stuff is happening eg. website down for multiple days(still buggy), Hyatt GCs being drained, pissed off DIA members about twitter matches, credit card breach etc.

When will airfares finally follow fuel prices down?

Hyatt has not yet decided on a winter promotion since they are enjoying a surge in room reservations from the many thousands of newly minted Diamonds. They are steeling sales from hotels like Hilton that have no confirmable upgrades. Once the reservation surge subsides, Hyatt should resume promotions.

This has already started. I got a suite at the doubletree Times Square for $134+ last fall. That is wildly lower than anything I have ever seen there

I second the question from nsx – will airlines be in the same boat and why or why not?

@CW Presumably at least to some extent. All that China expansion should lead to empty flights. Economic slowdown would mean less discretionary travel and empty seats. Airlines though have gotten better at capacity discipline, they don’t have as many net new seats coming on (proportionally speaking) as there are new hotels in the pipeline.

Hyatt has never really been big on promotions. That’s just not their thing. They maybe do a spring/summer/fall promotion sometimes. The surge of DIA doesn’t help that (grumble).

@TravelTex .. never? #FasterFreeNights 😀