I’ve signed up for scores of cards over many years and I still have an excellent credit score, it was nearly 800 FICO on the three major credit bureaus when I went to get my mortgage. In part because of signing up for more cards, rather than in spite of it.

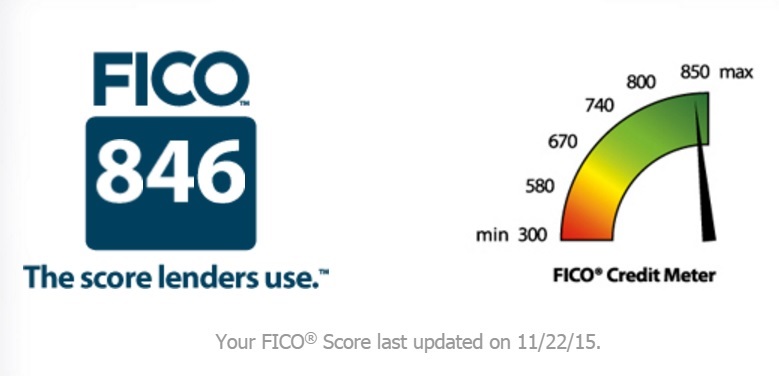

In fact, here’s the latest Barclays-provided free FICO score I pulled:

I first discovered rewards credit cards in 1997. I signed up for a US Airways card, enticed by the bonus. I decided I didn’t want to pay an annual fee for a credit card back then. My income – and thus my spending – wasn’t very high. So I cancelled the card right away. They still let me keep the bonus, though, which I thought was really nice of them.

When I finally did the math and realized it made sense to earn rewards even with an annual fee I applied for that same card again, and they gave me the bonus again. I thought that was really nice of them. And I learned that if a bank liked me once they were quite likely to keep liking me.

The Key to a Understanding Your Credit Score and Improving It — and When it Matters Most

I didn’t know much about credit scores back then, I just knew that I was earning lots of miles for things other than flying. I paid my bills on time, and I wasn’t in search of tons of credit. And that meant I pretty much always got approved, and having requests for credit never hurt me.

The first two lessons.

- The most important thing for a good credit score is paying your bills on time.

- You care most about your credit score when seeking significant credit for things like a residential mortgage.

Avoid Credit Cards If You They Cause You to Spend More Money Than You Otherwise Would

For the most part the availability of credit cards hasn’t increased consumer spending — it’s shifted how that spending is financed. We don’t use layaway or store credit very much, for instance. And high interest (even higher than credit cards!) personal loans are far less common than they used to be.

But there are certainly folks who will spend more because they can. Or because it’s somehow deemed worth it to meet a card’s spending requirement. I want you to understand if you’re one of those people.

If you don’t pay your bills in full and on time, or if you’ll spend more just because you have a credit card, then you should stay away from rewards credit cards.

The key is to be honest and reflective with yourself. You need to be meta-rational. The most important question isn’t whether your credit score is high enough to get credit, but how you’ll behave once you get it.

As I wrote in “This Game is Not For You If..” the most important consideration when playing the miles and points game with financial products is:

- Do you pay off your bills in full each month?

- You must not spend more than you otherwise would because you’re using a credit card or justify extra spending “because you need it to get a signup bonus”

If you don’t or can’t pay your credit cards in full, then interest rates are far more important than the points or rebates you’ll earn. If you spend more when you get more credit you’ll be giving up more than you get.

So if your score goes up, you find yourself better-positioned to sign up for credit cards, focus on these two issues when deciding whether you should get cards even if you can.

Avoid Card Signups – And Other Requests for Credit – in Advance of Major Purchases

My general view is that if you satisfy these conditions, you still want to avoid cards if you plan to be in the mortgage market over the coming 1-2 years. In any case, a score of 760 or higher will generally qualify you for the best lending rates. Scores over 760 don’t make you meaningfully better off.

In fact, some would argue that if your score is over 760 you’re ‘wasting’ your credit…

Requesting Credit Reduces Your Score.. Usually a Little Bit, and Just Temporarily

Getting a new card, or generally requesting credit (causing a ‘hard pull’ on your credit) will reduce your credit temporarily by a few points. If you are asking for credit, perhaps you need credit and aren’t such a great risk.

Getting Approved for Credit Can Improve Your Score

Having more available credit can improve your credit. It pushes down your utilization ratio — the amount of total available credit you’re using in a given month.

If you spend $3000 on cards (even if you pay off the cards in full) in a month and have $5000 in credit, you’re using 60% of your available credit. If you spend the same amount but have $30,000 in available credit your utilization rate is just 10%. You have credit, don’t use it, and show how responsible you are with credit. That’s far more significant than how many cards you request.

I Try to Keep My Credit, Even When I Cancel Cards

When I cancel cards, I often try to retain the credit. Chase frequently lets you move your available credit from one card (the one you’re going to get rid of before a fee hits) onto another card (that you’re keeping). American Express has offered the ability to move around your credit between cards as well.

Cancelling a Card Can Reduce Your Score.. in the Future

I keep my oldest cards, and no fee cards generally, but even when you cancel a card it stays on your report until it ages off after a decade — so cancelled cards can increase the average age of your accounts, one factor in your credit score. The more responsible with credit you are over long periods of time improves your score.

Note that this is true for traditional FICO scores but the less-used Vantage scores do not continue to use cancelled accounts in calculating average age.

We Can Easily Become Too Obsessed With Scores and Inquiries

I admit I don’t even bother checking my credit anymore before I sign up for cards. I’m not pushing the frontier in obtaining new credit. I’m not balancing my inquiries across the credit bureaus. So I’m just balancing my card applications across banks. I don’t want to apply for more than one card from each of the co-branded issuing banks at a time, subject to attractive offers being available.

If you’re truly at a margin where an inquiry will trade off with another one you might make, if you’re signing up for literally scores of cards each year, then you may want to be more vigilant than I am. I’m often surprised by some of the credit scores that get approved for top end credit cards.

The real hardcore folks will manage the inquiries on each credit bureau, there are forums over at Credit Boards where people list which bank runs credit through which bureau in each state. So if you have too many inquiries on one bureau you can apply only to banks that will pull your credit from another one.

I don’t really get rejected from cards, my credit is good, and I don’t have a major purchase like a house (or a refinance) on the horizon. So I don’t even monitor my credit score closely, I just do irregular housekeeping to make sure nothing is on my credit report that shouldn’t be by mistake.

The Most Important Thing to Worry About Is…

Pay your bills on time and don’t max out your credit and your credit score will generally reflect that, and you’ll be deemed a good enough credit risk to be able to get more credit. Because what financial institutions are most concerned with is whether they’ll get their money back.

Just getting ready to start building a home, working with the bankers (one for construction loan, the other for mortgage when built) I had mentioned that we took our entire family on a trip last year on points. They asked about it and I told them I used our good credit to get big signup bonuses but that since we were aiming at building a home I had eased off card applications. They both told me that I was good to start back up, that they wouldn’t even do a credit pull for either loan. So happy days, I’m back in the game. I’ll probably keep it under control until we finally close on the mortgage but at least now I can grab one if the deal is too good to pass up.

Gary, you are missing an important point. You need installment debt to get a score over about 780. Many high credit line, never use more than 5% of available credit that and have paid their bills on time for 30 plus years still have average scores. Without car payments, mortgage payments or any other installment debt other than credit card monthly payments places a cap on the calculation. It’s common for zero risk clients to have crappy FICO scores and they do pay more for homeowners insurance and car insurance as both use the erroneously calculated FICO scores to rate risk when in fact it’s not even close to a good risk indicator but it is non discriminatory which is why insurance companies started using it. This is a case of poor math skills leading to a perpetual mistake.

What happens when you cancel a charge card? Can you retain the “credit” of the charge card even after you cancel it?

Hi @Gary,

Quick question / observation. “My wife” just applied and was approved for the Citi AA card because she was targeted for a 60K bonus mile promo (sadly, I was not). After approval, when Citi was summarizing her Experian credit report, I noticed that it said she was an ~830 out of 900…

I thought it might have just been some odd website thing, but later that week we received the printed acceptance letter, and it again showed her score out of a possible 900.

Since I always thought credit, from any of the big three agencies, was maxed out at 850, where did this 900 value come from? Any insight?

Thx,

theBOAT

@theBOAT – i assume they’re reporting a FICO 8 credit card score http://www.myfico.com/crediteducation/fico-score-8.aspx

Very cool, I seemingly learn something from you every day!

Thanks again

Just a quick question: I’m getting different credit scores from the credit cards freebie FICO score “benefit”: AMEX, Barclays, and Citibank. Variable scores that are not even close to each other. Which credit card offers the most accurate score?

I live in California

Thank you!

@Kalboz you need to know which score from which credit agency your bank is pulling info. Remember that your TransUnion, Experian, and Equifax reports will vary and thus your score. And as I mention above they could be showing a FICO 8. all are accurate just different if a real fico

My FICO has been as high as 823, despite no installment credit and no mortgage payment. It usually hovers just below 800, despite about 22 new credit cards a year.

Because I invest in rental properties and we put mortgages on them after rehab, I time my app party inquiries to immediately (like the day after) my mortgage is closed. Even then, I still get a little attitude with the next property with the bank asking what all of the inquiries are for. They ask me to fill out a form clarifying the inquiry and whether or not new credit was issued. Since I’m usually closing one account to open another and transferring the credit limit, my answer is “no new credit, closed one account to open another”. So far, aside form having to complete an extra form, I’ve always been approved for my mortgages!

I am very careful now that my family is growing. I have to improve my credit score by paying for my bills on time. I had to set my due date on my phone calendar to notify me. Rebuilding our credit will make our life a little easier.