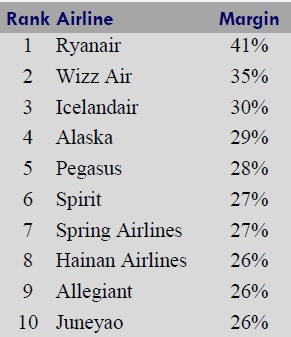

Last week’s Airline Weekly included third quarter profit margins from 48 airlines that had reported thus far. Here’s the top 10:

Delta reported a 21% margin (16th), Southwest and American 20% margins (19th and 21st respectively), and United a 19% margin (22nd). A 10% operating margin only placed an airline (Finnair) 34th out of 48 reporting airlines.

Unsurprisingly ultra low cost carriers like Ryanair, Spirit, and Allegiant do exceptionally well.

I remain skeptical of financial reports coming from Chinese companies at a time that the government there is pressuring firms to report profits and drive up share prices to support the nations stock exchanges.

What may be a surprise is that Alaska Airlines not only maintains one of the absolute best on time operations in the world, but also one of the most profitable (4th, with a 29% margin) despite the onslaught of competition from Delta at their Seattle hub.

It seems that the attack on Alaska by Delta has only made Alaska stronger. Sort of like Luke striking down the Emporer in Return of the Jedi. The only question remains is whether or not having done so turned Luke to the Dark Side of the force which we’ll learn with the debut of the new film. And of course whether Delta having attacked Alaska explains their own place on the Dark Side.

The Chinese operators structure themselves very opaquely with layers upon layers of cross ownership. I don’t doubt that one of the subsidiaries is able to show strong profits through accounting trickery, but I can assure you that the parent company of at least one of the entities on the list is nowhere near as profitable as that list makes them out to be.

High profit margin is good, but the question from an investor’s perspective is always “can it scale?” For the RyanAirs of the world, as they add to their route network, can they continue to maintain low cost as itineraries get more complex and passengers demand more expensive airports.

I always wonder what is being eliminated in order to increase profits, and “maintenance” is not the answer I want to hear.

Two questions :

-so, why has Spirit’s stock tanked?

-Wizz air? Really? Where on earth is that? I don’t think I have their credit card.

Delta – the Dark Side ha ha ha : Delta just can’t get a break , can they ? Maybe they deserve that description , hopefully they will ‘ move toward the light ‘ someday .

Have a good December everybody !

Maybe I’m mis-remembering, but doesn’t Darth Vader throw down the emperor, not luke? Luke just gets fried. https://www.youtube.com/watch?v=4BOQI-LAEzM

Yes, Luke refuses to fight… That analogy didn’t make any sense to me…

Everyone thinks that these airlines are making money. Spirt stock in 2012 was $26 now $36 Yes there was a bubble there but the Dow, S&P and Nasdaq did not have it. So it was speculation there.

Everyone thinks that the Airlines are making a fortune off these prices and fees. Well then buy their stock and see what your return on investment will be. Remember American, Delta, and United have all gone into bankruptcy. Also where is TWA? Pan Am? Braniff? Eastern? Ask the shareholders who got money and they will tell you no ONE!

This is the only industry where there has been almost 100% bankruptcy of every major player. Southwest bought the assets of bankrupt ATA Airlines, – just the gates NO employees, so don’t give them credit

You’re looking at the WRONG numbers.

Let me explain. Investors put $x of money (capital) in a company, which uses it to generate $y of revenues, returning $z in earnings. The relevant profit ratio is simply how much earning per unit of capital the business generates, or return on invested capital (ROIC). That’s $z/$x. It is, if you will, the equivalent of the interest rate you’d get from a CD.

This is important because companies have different business models of what they do with your money. One could have a model of low revenues and high “profit margin” (i.e. take your $100 of capital, generate $20 of revenues with it, and earn $10 for a profit margin of 50%). Another is a high revenue, premium model but with lower “profit margin” (i.e. take your $100 of capital, generate $40 of revenues with it, and earn $15 for a profit margin of “only” 38%). And in this example, you’re much better off investing in the lower margin company because they make $15 for your $100, while the high margin one only makes you $10 for the same amount of money.

What you have compiled here is mostly a list low service / low price carriers. They’re the ones that generally make lower revenues based on the capital they have and therefore must have higher margin. They may or may not also be the most profitable (highest return on invested capital) but the two are not linked.

But it is NOT a list of the most PROFITABLE airlines.

I don’t know, I’m no economist but I think a company’s profit margin is a pretty indicative of how profitable they are.

As an investor, I’d prefer to invest in a more, rather than less, profitable company.

Of course, I’m batting 50%–I bought DL at $8 and Spirit at $74.

MBH : ALK at $10. 57 but then , there was PBR , oops .

Operating margin and P&L profit are different metrics, so while op margin is a good performance indicator, it’s not sufficient to make your investment decision!

WizzAir is a low cost carriers based in Budapest, Hungary – no credit card for you!

Thanks, rupert.

Any stock tips, dalo?

Hmmm, I wonder what wizz’s stock symbol is . . . (Kidding)

mbh ; ALK , KR , AMT , BAC , BA have been good for me . Have they plateaued ? Don’t know but they may gain more slowly . I think LNG will be pretty good but , you may have to wait years (minimum two years ) . Disclaimer : I don’t know anything about the future , in fact I’m not smart either but , occasionally fortunate . Keep Smiling , D.

I know that people tend to worry about Alaska Airlines because it offers a lot of really great redemptions for miles & points people.

As a life-long Seattle resident, I can tell you that a big part of their success is a general loyalty that people in Seattle feel towards Alaska Air. This comes from them being a regional carrier, and from their insistence on just being better a lot of things across the board.

Given that Alaska Air is also profitable while maintaining this high standards, I really doubt they are going to do much to rock the boat. It would only risk alienating their fiercely loyal, local fanbase in Seattle. I realize that they span the entire West Coast, but they have this market completely won and I think they realize the only way they’d lose that is to start messing with their program in big ways.

There might be tweaks to the partner redemptions since the vast majority of people don’t utilize those, but also that’s another big part of their value. Without their network of partnerships, people wouldn’t be able to travel anywhere in the world with their Alaska miles, and I think they want to maintain that value.